Refractory Industries In India

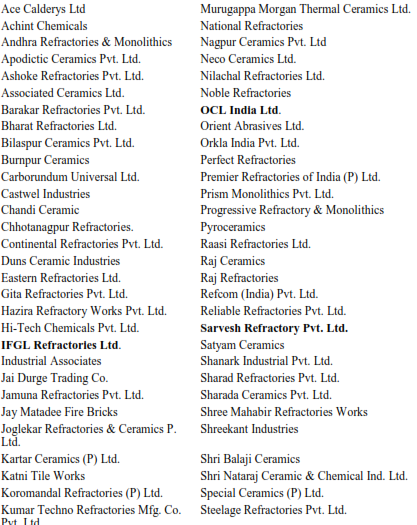

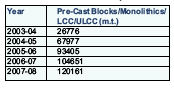

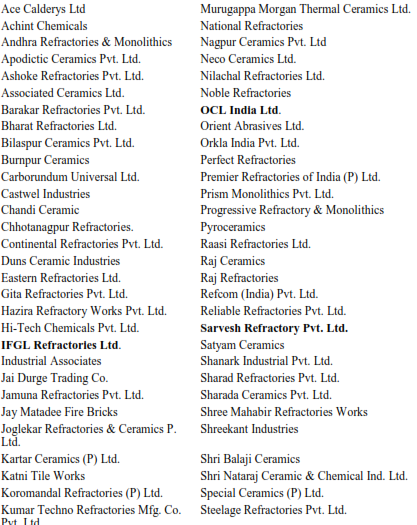

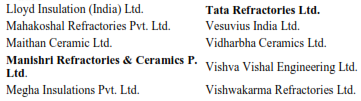

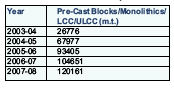

Presence of Top Refractories in India(Performance wise 2007-2008):

Government Protection for Indian Refractory Industry

S.G. Rajgarhia, Managing Director, Orient Abrasives, said in an interview, “If steel industry continues to do well as it is doing now in India, the industry in general and the company in particular will perform better. The current year is expected to remain better than the last year. The company supplied refractories to steel producers. We are also a supplier of refractory raw materials to the other large refractory manufacturers in the country,” he said.

The refractory industry is feeding the steel industry in two ways i.e. refractories to steel producers and refractory raw materials to other large refractory manufacturers. So, if the steel industry continues to do well as it is doing now in India, we’ll have good business for our refractory industry as well as for the raw materials industry, Rajgarhia said.The fused alumina business is currently very good and it is expected to continue to be very good because in the earlier years the main competitor that the country had was that imports from China and fortunately the situation in China changed last year. So all fused alumina local users which are refractory and abrasives producers have decided to source their raw material requirement within India being reliable and giving better service. Therefore, the demand for fused alumina business will continue to be there. It is there now and it has been there in the past also. But in the past the imports was taking the large share and now we have the major share of the raw material requirement.

As far as bauxite business is concerned, ‘Orient Abrasives’ bauxite in Gujarat is very unique and there is a large requirement of bauxite for export also from China and from the Middle East countries for cement application and as well as for the metal application. So we expect both metals - bauxite and fused alumina - business to do well in the current year, he added.

The industry is currently passing through volatile, uncertain, complex and ambiguous phase. However, the economic growth of the country will determine the growth of refractory industry as well. During early 2008, the Indian economy was anticipated to growth by 10 percent. However, with the massive financial troubles which began towards the end of 2008, the growth prospects of 2009 looks uncertain.

The Asian Development Bank (ADB) has projected growth of a mere 6.5 percent. Previously, it had forecast 7 percent, down from another earlier estimate of 7.4 percent. Later, several forecasts indicated, India’s economy to grow between 4 - 4.5 percent during the current financial year.

The RBI Governor has also cautioned that 2009 could turn out to be the worse performer. However, Indian economy has its fundamentals all intact to stage a bounce back with economy may look between 6.5 - 7 percent towards the end of the current financial year.

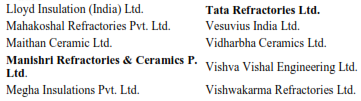

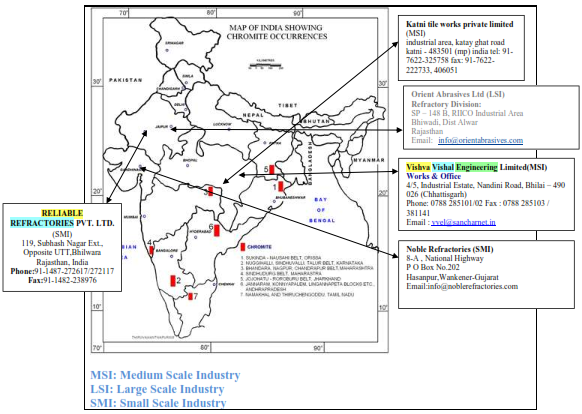

Refractories have always played a critical role in the development of Indian economy but sadly it has never received its due recognition because of its insignificant size compared to its key user industries like steel, cement and aluminium.(see Table 7)

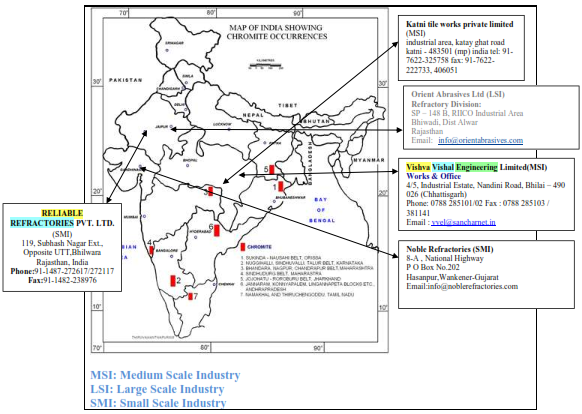

Table 6.1 Consumption of Refractories 2003-2008

Refractory makers seek price escalation clause: (http://www.mjunction.in/market_news/metals/refractory_makers_seek_price_e.php)

The Indian Refractory Makers' Association (IRMA), plagued by dipping profits, has requested for a price escalation clause from the steel industry, which is its major consuming sector.

IRMA has taken this step after refractory makers were struggling with soaring raw material costs as well as fuel prices. IRMA chairman Arup Kumar Chattopadhyay told Steel Insights that he has already met the Durgapur Steel Plant (DSP), as well as other SAIL- Steel Authority of India and RINL- Rashtriya Ispat Nigam Limited officials twice in this regard. It is the turn of the steel companies now to take a decision, he said.

Chattopadhyay said the price escalation clause will definitely benefit the industry and help them to get a justified price for their finished products. Fixing an appropriate price is impossible owing to the instability in raw material prices, he said. However, if the price variation clause is in place, it may be possible to adjust prices during the contract period, he added.

The formula suggested by IRMA looks like this:

RP = BP (1 + RM1b/RM1a + RM2b/RM2a + RM3b/RM3a + ......+ RMnb/RMna + + FP1b/FP1a + FP2b/FP2a + RBlb/RBla).

The different elements in the formula are:

RP - revised price, BP - base price, RMa - raw material base price, RMb - raw material incremental price, FPa - fuel and power base price, FPb - incremental change in fuel and power price, RBa - RBI whole index base, RBb - incremental change in RBI whole index.

Orient Abrasive managing director S.G. Rajgarhia told Steel Insights that refractory makers usually get into annual contracts, and thus, any price hike in raw materials during the contract period hampers the company.

Prices of raw materials imported from China are pegged on a shipment basis and are highly unstable. Thus, there is always a big difference between refractory prices when the company settles a contract and when the product is delivered. Refractory companies suffer because of this volatility. It is therefore believed that incorporation of such a clause is now a necessity. However, some industry experts are sceptical as they feel enforcing such a clause can be quite difficult.

It is not that prices of refractories have not moved up but the proportion is not very sound. According to Chattopadhyay, raw material prices have moved up 80 to 85 percent but prices of finished products have just appreciated 18 to 30 percent.

IFGL Refractories director & chief executive officer Pradeep Bajoria told Steel Insights that product prices have increased quite less compared to raw material prices. In some categories, they have increased 10 to 15 percent while in some they have moved up 30 to 40 percent.

Export opportunities

The industry maintained an annual turnover of Rs 3,000 crore in 2008-09 almost similar to the last year, and a sparkling growth from Rs 2,370 crore during 2006-07. Production slipped to 1 million tons in 2008-09 from 1.3 million tons (mt) in 2007-08 and 1.08 mt in 2006-07. Growth in sales was driven by growing demand from sectors like steel, cement, aluminium, sponge iron and others. However, the industry is looking for synthetic raw materials sources which are expected to help the industry reduce the tension of rising prices and expenditure due to soaring raw material costs. Exports during 2008-09 are estimated at Rs 400 crore, a fall from RS 452 crore during 2007-08 and up from Rs 314 crore in the previous fiscal.

Presently, India exports around 10 per cent of its production to the tune of 1 million tonnes primarily to European Union, West Asia, South Africa and Far East including Malaysia and Indonesia. However, Indian products are yet to enter the American markets in large volumes because of the un-competitive pricing owing to higher freight cost.

However, imports stood at a staggering high of Rs 818 crore, which industry experts found promising. A majority of these imports in 2007-08 came from China, an industry expert added, saying that this could pose a threat for the indigenous refractory industry. China has an advantage over India in terms of raw material availability. China had certain good quality raw materials. However, China continued to dump raw materials into India at very low prices two years ago. The refractory industry is small and fragmented, but is still very important. Taking all factors into consideration, it will be very interesting to watch the way this industry moves ahead.(www.Business-standard.com,2009)

http://www.business-standard.com/india/news/refractory-exports-to-come-down-by-25/352818/