FINANCIAL RATING ANALYSIS

Very often different users of the financial analysis of a company, such as creditors, investors, firm’s managers, regulatory organizations, are in need of getting a brief and clear summary of its financial condition. With numerous ratios calculation we can only get the understanding of some specific spheres of company’s activity and performance. Considering this we have developed a special rating system for the company’s financial condition estimation exclusively for finstanon.com. Its methodology includes calculation of the firm’s most important indicators, and depending on their values, definition of the summary financial rating of a company.

Financial Rating Estimation

The process of estimating the financial rating of a company includes calculation of ten important business ratios, also commonly used during the financial statement analysis performance. These indicators are:

1. Net Profit Margin. Key ratio of the profitability analysis of a firm, measuring the amount of net income, generated by 1 dollar of sales. Information, necessary for the calculation can be obtained from the profit and loss statement of a company.

2. Return on Assets. Ratio, measuring the efficiency of the company’s resources utilization process, comparing the amount of profit to total assets. Also a part of the profitability ratio analysis.

3. Debt to Equity Ratio. Being a part of the debt ratio analysis, this ratio indicates the level of protection of company’s creditors in case firm becomes insolvent. In other words, it indicates if the company has been financing its growth through increasing its debt.

4. Current Ratio. Being a part of the liquidity ratio analysis, this ratio measures the ability of a firm to pay its liabilities from its assets. Information for the calculation can be found in firm’s balance sheet.

5. Net Sales Change. A change in company’s net sales expressed as an absolute value.

6. Operating Income Margin. A part of the profitability ratio analysis measuring the operating income, generated by 1 dollar of sales.

7. Equity Change. An absolute value expression of a change in company’s equity.

8. Quick Ratio. Also referred as acid test ratio, it measures how well a company can meet its short-term obligations with its most liquid assets. An important part of the liquidity ratio analysis.

9. Debt Ratio. A ratio that indicates firm’s long-term debt-paying ability by comparing its total liabilities to total assets. It measures the protection level of company’s creditors in case of its insolvency.

10. Times Interest Earned. A ratio that measures the amount of income, available for covering interest expenses in the future.

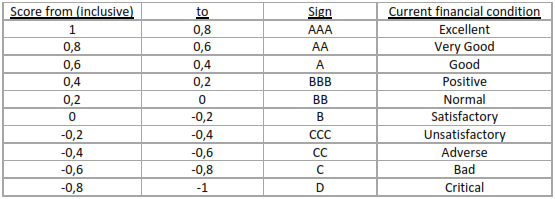

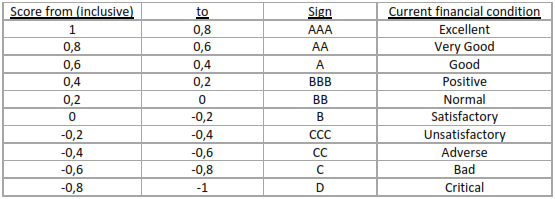

After all of these ratios calculations, they are being compared to the normative values. Depending on this comparison results, each of the ratios gets 1, 0 or -1 estimation. They are being weighted by coefficients, carefully selected for each ratio according to its importance and influence, and summed up. The final result of the calculation is the financial rating of a company. The final conclusion on company’s financial condition is being made depending on the value of this financial rating, and the estimation grade is as follows:

Table 3. Estimation grade for the financial condition of the company according to finstanon.com

The financial rating system is useful for all users of financial analysis, who are in need of brief and clear estimation of firm’s financial condition. Based on the most common and important business ratios, the calculation of the financial rating of a company is a process, giving us an opportunity to confirm good or bad financial condition of a firm by computing a weighted score and analyzing it.