LONG-TERM DEBT-PAYING ABILITY AND DEBT

RATIO ANALYSIS

For a firm being financially sustainable means being able to carry its debt. Usually, the debt ratio analysis is being applied to a company by potential creditors to see, how creditworthy it is and analyze its willingness and ability to pay the debt. Generally, greater amount of company’s debt means greater financial risk of its bankruptcy. Long-term debt paying ability of a firm can be viewed as indicated by the income statement and by the balance sheet.

Debt Ratio Calculation and Analysis

Times Interest Earned

The indicator of the firm’s long-term debt paying ability from the income statement view is the times interest earned ratio. Having normal times interest earned ratio means lesser risk for a firm not to meet its interest obligation. If this ratio is being relatively high and stable over the years, a company is financially sustainable, while relatively low and fluctuating ratio would mean potential problems with paying the long-term obligations.

Times Interest Earned = Recurring Earnings, Excluding Interest Expense, Tax Expense, Equity Earnings, and Noncontrolling Interest ÷ Interest Expense, Including Capitalized Interest

As seen from the formula, times interest earned ratio measures the amount of income that can be used to cover interest expenses in the future. In opposition to percentage this ratio is expressed in numbers, and it measures how many times a firm could cover the interest expense with its income, so larger ratios are considered more desirable than smaller ones.

Another formula for times interest earned calculation is as follows:

Times Interest Earned = EBIT ÷ Interest Expense

Earnings Before Interest and Taxes (EBIT) is also referred as operating profit and it measures firm's profit that excludes interest and income tax expenses. Considering this, times interest earned ratio can also be calculated as follows:

Times Interest Earned = Operating profit ÷ Interest expense

Debt Ratio

The debt ratio is an indicator of firm’s long-term debt-paying ability. It is a ratio of firm’s total liabilities to its total assets. Use the following formula to calculate the debt ratio:

Debt Ratio = (Total Liabilities ÷ Total Assets) = (Total Assets - Total Equity) ÷ Total Assets

The debt ratio shows how well creditors are protected in case of company’s insolvency by indicating the percentage of firm’s assets financed by creditors. Issuing the additional long-term debt is inappropriate for a company if its already existing creditors are not well protected. In terms of financial sustainability of a business lower ratios are more favorable. Another ratio that allows to measure firm’s long-term debt paying ability is long-term debt ratio:

Long-Term Debt Ratio = Long-Term Debt ÷ Total Assets

As seen from the formula, this ratio measures the percentage of a company’s total assets financed with long-term debt, including loans and financial obligations that last more than one year. This ratio comparison made for different periods of time would show whether a company is becoming more or less dependent on debt to run a business.

The Long-Term Debt to Total Capitalization Ratio

The long-term debt to total capitalization ratio is a ratio showing the financial leverage of a firm by dividing the long-term debt by the amount of capital available:

The Long-Term Debt to Total Capitalization Ratio = Long-Term Debt ÷ (Long-Term Debt + Preferred Equity + Common Equity)

This ratio is fully comparable between different companies. That’s why it is useful for investors, who can measure their risks with different firms by comparing their long-term debt to total capitalization ratios and identifying the amount of financial leverage, utilized by these firms. The decrease of the long-term debt to total capitalization ratio over time would indicate the lessening long-term debt load of the company as compared to the total capitalization, leaving a larger percentage of the total capitalization to the total stockholder’s equity, and vice versa.

Debt to Equity Ratio

Another ratio helping the creditors understand how well they are protected in case of firm’s insolvency is the debt to equity ratio. It’s a ratio that compares the total debt with the total shareholders’ equity:

Debt to Equity Ratio = Total Liabilities ÷ Shareholders’ Equity

If a company’s debt to equity ratio is high, it has been financing its growth with debt.

This is being done to generate more earnings than it would have been without this outside financing. In terms of long-term debt-paying ability the lower this ratio is, the better. Normal values for the debt to equity ratio are different for different industries. Close to this indicator is long-term debt to equity, comparing only long-term debt with the stockholders’ equity:

Long-Term Debt to Equity = The Long-Term Debt ÷ (Preferred Equity + Common Equity)

The higher the long-term debt to equity ratio is, the greater a company’s leverage is.

Most commonly higher long-term debt to equity ratio of a firm would mean more risk for the investor.

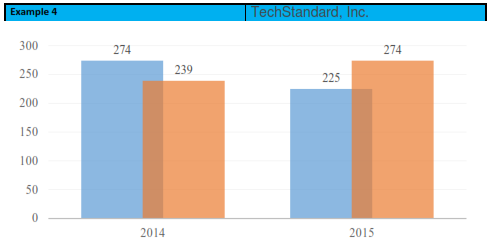

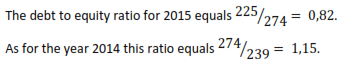

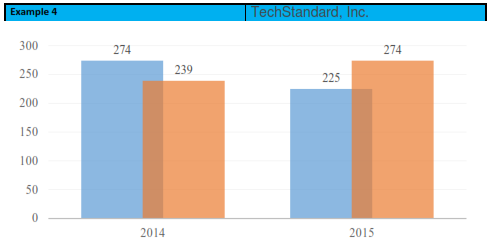

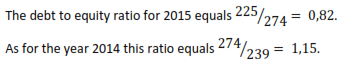

Chart 5. Financial data

Current Debt to Equity Ratio shows that creditors are protected in case of firm’s insolvency. For every 82 cents of creditors’ money there is one dollar of shareholders’ equity.

Debt to Tangible Net Worth Ratio

More conservative measure for a firm’s long-term debt-paying ability is the debt to tangible net worth ratio. It indicates creditors’ protection level in case of firm’s insolvency by comparing its total liabilities with shareholders’ equity excluding intangible assets, such as trademarks, patents, copyrights, etc.:

Debt to Tangible Net Worth Ratio = Total Liabilities ÷ (Shareholders’ Equity - Intangible Assets)

Debt to tangible net worth ratio is a measure of the physical worth of a firm, not including any value derived from intangible assets. As with the debt ratio and the debt to equity ratio, from the perspective of long-term debt-paying ability having lower ratio is preferable for a firm.

Overall, applying the debt ratio analysis to the company’s financial statement is a good way for an investor to estimate firm’s performance and measure the risk. Calculation of debt ratios would clarify the ability of a firm to carry its debt in the long run.