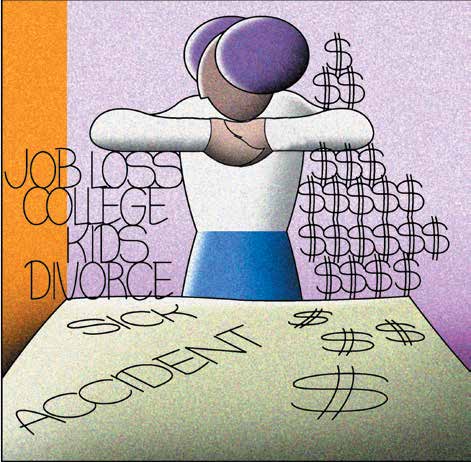

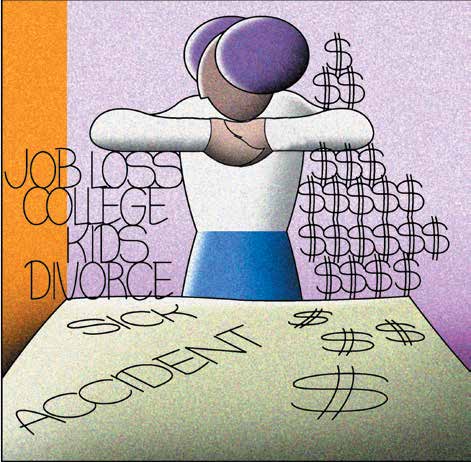

Financial Growth

worker changes jobs more than 10 times in a working

As mentioned earlier, you probably will experience

lifetime. Changing jobs often puts you at risk of not

several major events in your life that can make it more vesting in your current job, or a new job may not offer a difficult to start or keep saving toward retirement and

retirement plan. Consider keeping your money in your

other goals. The key is to have a clear plan, to stay

former employer’s retirement plan or rolling it into a

focused on your goals, and to manage your money so

new company plan or an individual retirement account

that life events don’t prevent you from keeping on

(IRA). Don’t cash out and spend the money, however

target.

small the amount.

Here are a few suggestions for saving for

Divorce. It’s important that you know the laws

retirement while financially managing some common

regarding your spousal rights to Social Security and

life events.

retirement benefits. Under current law, spouses

Marriage. Getting married creates new financial

and dependents have specific rights. Remember,

demands that compete for retirement dollars, such

retirement assets may well be the biggest financial

as changing life insurance needs and saving to buy a

asset in the marriage. Be sure to divide those assets

home. But it’s usually less expensive for two people

carefully. It’s also critical to review your overall

to live together, thus freeing up dollars. Also, you

financial situation before and after your divorce.

probably still have time on your side. A spending plan is Income typically drops for partners in the wake of a essential. Remember, every little bit helps.

divorce, particularly for women.

Raising children. The U.S. Department of Agriculture Disability. A severe or long-lasting disability can

estimates that it costs the average American middle-

undermine efforts to save for retirement. Although

income family approximately $295,560 to raise a child

Social Security Disability benefits can help sustain

to age 17. Furthermore, in some cases a spouse may

a family if severe disability strikes, you may wish to

stay out of the workforce to raise children, thus cutting explore the availability and cost of other forms of into income and the opportunity to fund retirement.

disability insurance.

Having a child may alter your major financial goals, but Death. The premature death of a spouse can should never eliminate them. Make the best effort you undermine efforts for the partner to save for can. Also, many financial planners stress that saving for retirement, particularly if there are dependent retirement should have priority over saving for a child’s children. That’s why it is important to check your college education. There are financial aid programs for Social Security statement to find out how much college-bound students but not for retirement.

children will receive if a parent dies. Maintaining

adequate life insurance is also important. Be sure that

you have properly named the beneficiaries for any

insurance policies, retirement plans, IRAs, and other

retirement vehicles.

24

A LIFETIME OF