Chapter 3:

Cashing In On Precious Metals

Synopsis

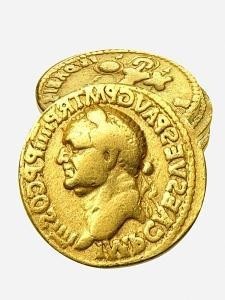

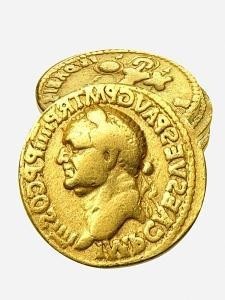

There is much talk of investment in precious metals and investors might question why there is a move to this area of the markets. Precious metals are used to manufacture such every day commodities as coins and jewelry to name just two.

Gold And Such

With the increase in world population the demand for these items increases and the consumption of precious metals is so high that the high demand exceeds the supply and the price of the metals goes up. Investors who have investments in precious metals can see their investments go up too.

Although an investor could purchase precious metals in the form of jewelry and coins, the metal contained in those items is not always pure and sentiment may make it hard to dispose of a jewelry item.

Bullion purchase could be seen as a sound and conservative investment to make but there is the problem of storing it safely and it can be costly to do so.

Investing in a properly researched precious metals mutual fund can be the least risky way to invest and can yield good rates. Such funds can manage a variety of precious metals. They can also contain stock in mining and so offer diversification.

In unstable markets diversification is the key to stability and mutual funds can do that.

Precious metal prices are very volatile so most experts recommend investing only between two and ten percent. Of all the precious metal mutual funds gold funds are by far the most popular as gold has risen more than 200% since 2001. Gold’s high performance as other stocks and bonds fall should make it appealing to all investors concerned about their investment portfolios.

There are risks and rewards with all investments but the current market and economy could make the investment in gold or silver mutual funds a very satisfactory addition to any investment portfolio.