Introduction

It has been found that R&D does not provide a true picture of innovation in SMEs since smaller

enterprises will not have a specialist R&D department (Crespi et al, 2003). Further to this it appears that most innovations originate in certain sectors (Robson et al, 1988) as likewise most R&D (Scherer, 1982).

In relation to these aspects this review considers R&D activities in small businesses according to demand, organisation, innovation, imitation and diffusion, complementary assets, networking and government

influence on small business R&D.

Demand

With regard to demand it is apparent that the motivation to undertake R&D has involved variables representing market demand conditions which present demand as a major influence on such decisions

(Crespi et al, 2003). Unfortunately, as noted by Mowery and Rosenberg (1979) this does not convey much since managers or entrepreneurs will consider the demand outcome before undertaking the development process which is likely to be expensive.

Organisation

According to the Schumpeterian perspective innovation and R&D activities in modern times have required large firms or concentrated industries (Crespi et al, 2003). Consequently, there will be sectors where the spend on R&D will be determined by the minimum operation scale but there will be other sectors where concentration will be in small and medium sized enterprises (SMEs) (Acs and Audretsch (1990) and

Audretsch (1995) explain this according to different technological régimes across the different sectors and firm size). Acs and Audretsch (1990) further describe the differences in innovative activity between small and large firms according to the R&D intensities gap. Cohen (1995) notes that the scale economies in R&D may be a possible explanation for the impact of large sized firms. Contrary to this there may be diseconomies with larger firms and as a result government focus in many economies has changed to

considering SMEs (Crespi et al, 2003). Further, data on small businesses has tended to underestimate their R&D effort (Tidd et al, 2001). According to von Tunzelmann (1995) all productive units involve the four functions of administration and finance, products, production processes and technology (with

augmentation by R&D). In the literature on scale economies in R&D there is justification for merging large high technology firms (Fisher and Temin, 1973; Kohn and Scott, 1982) and in a literature survey by Martin et al (2003) it is shown that for scale economies in university research at team level scale economies are usually obtained by teams of between five and nine people in a subject. Economies in R&D

will involve merging diverse technological fields for production and cost advantages (Crespi et al, 2003).

Contrary to examples of fusion that are successful there will also be cases where fusion has not been successful in a company (Kodama, 1991). The cycle time is the speed for R&D to be turned into new products and in order to be first to market there will be pressure for small businesses to shorten the time (Crespi et al, 2003). Taking aside increase in complexity a faster cycle time has its own costs (Scherer and Ross, 1990).

Download free eBooks at bookboon.com

34

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Innovation, imitation and diffusion

Ownership of innovation and intellectual property rights (IPRs) will be fundamental to determine the attractiveness to carry out R&D. Recent studies, however, have suggested that R&D is often undertaken in ways that appear more like imitation than innovation (Crespi et al, 2003). Indeed, the work of Cohen and Levinthal (1989, 1990) highlight absorptive capacity which they describe as the capacity to absorb

technologies which are generated elsewhere. They contend that R&D increases absorption even if the R&D is not innovative but rather duplicative.

Complementary assets

Within enterprises there is a danger that there will be too narrow focus on innovation and R&D since as well as the ability to create new products and processes absorptive capacity will depend on the other resources and functions within and outside the organisation (Crespi et al, 2003). Teece (1986) has called these other resources complementary assets. In relation to this Dodgson and Rothwell (1994) have

purported that SMEs will be likely to encounter difficulties translating external opportunities due to limited internal capabilities. According to many studies a significant determinant of R&D in SMEs appears to be financing of innovation and the role of cash flow (Crespi et al, 2003). In the literature on appropriate methods for the evaluation of the financing of R&D Myers (1984) has suggested options valuations instead of payback procedures or conventional discounted cash flow (DCF). A problem is that if a company leaves an R&D project it may be far more expensive to return at a later date (Mitchell and Hamilton, 1988). Marketing functions also need to be taken into account since there may be a

considerable gulf between marketing and R&D (Crespi et al, 2003). Most studies have found a positive connection between R&D intensity and diversification and recent research shows that when the share of external contracted out R&D rises this leads to higher returns (Bönte, 2003).

Networking

Industries have always depended on sources external to the company for technologies for R&D and some of those that have had in-house R&D in recent times have externalised part of the function (Crespi et al, 2003). The performance of R&D in the UK by higher education institutions (HEIs) has increased from a figure below similar countries in 1980 to the same as similar nations (von Tunzelmann, 2004). It is thought that this has arisen due to the triple helix of activities between government, industry and universities (Etzkowitz and Leydesdorff, 2002). It appears that the interrelationship between HEIs and industry is a significant driver regarding the intensity of R&D (Crespi et al, 2003).

Download free eBooks at bookboon.com

35

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Government influence on business R&D

There are a number of ways government activities can influence business R&D and these include basic research funding, industrial R&D finance (by the tax system indirectly or directly) and through IPR. Gains in technological achievements through more R&D and patents can be caused by rising Gross Domestic Product (GDP) and other macroeconomic forces (von Tunzelmann and Efendioglu, 2001). Indeed, surveys of business R&D have revealed that a strong incentive is a macro economy in a buoyant situation (von Tunzelmann, 2003). Furthermore, governments see their contribution to technology from pump priming

basic research funding with an emphasis on basic research arising from market failure (funding will contribute to business R&D through the subsidisation of private sector laboratories and spillovers complementing private R&D) (Crespi et al, 2003). There has also been concern since the 1980s over private sector R&D being crowded out by government R&D (Kealey, 1996; David et al, 2000). Other studies in the UK have suggested that increases in government R&D in defence activities resulted in skilled researchers being drawn away from commercialisable and private R&D (Walker, 1980). A study by von Tunzelmann and Efendioglu (2001) of the cross country effects of interest rates on R&D since the 1960s provided a positive long term correlation.

Download free eBooks at bookboon.com

36

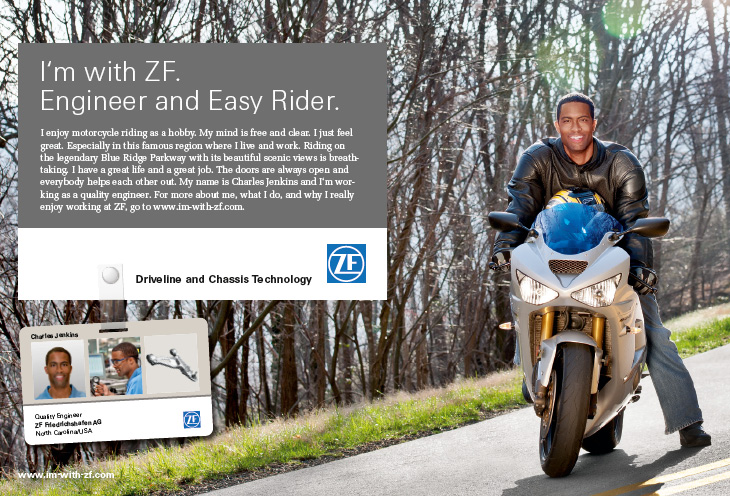

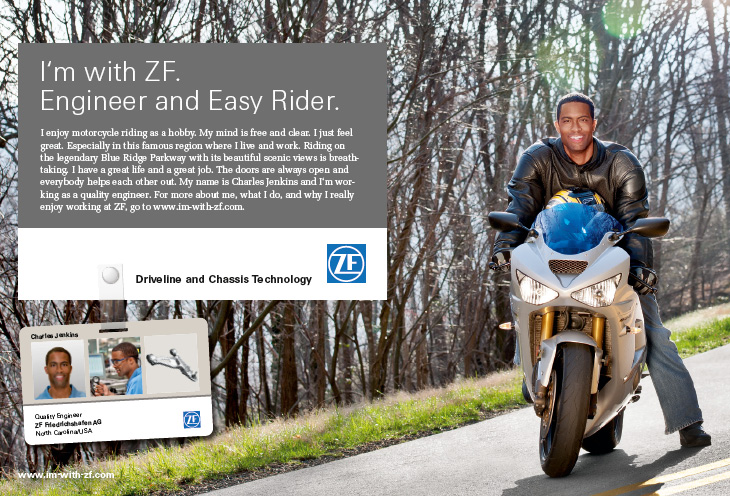

Click on the ad to read more

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Governments can influence the level of R&D expenditures by small firms in two principal ways and these are by offering fiscal incentives or by directly subsidising such expenditures (an OECD survey in 2002

showed that in order to encourage business R&D countries have used fiscal incentives and these have involved tax deferrals, allowances and credits) (Crespi et al, 2003). Bloom et al (2001) in a study of the effect of fiscal incentives on R&D spending used an econometric model of R&D investment for nine countries from 1979 to 1997 to investigate the relationship between the level of R&D expenditure and tax changes (a ten per cent decrease in the cost of R&D via tax incentives caused a one per cent increase in the short term level of R&D and ten per cent in the longer term). Similar results have been found for US

and Canadian studies (Hall and van Reenan, 2000). Furthermore, there is little evidence as to whether non-R&D performing companies can be influenced by tax incentives (Crespi et al, 2003). Governmental considerations over the contribution to R&D are still influenced by supply push and market failure models and the case for market failure is affected by high private and social returns for R&D (Steinmueller, 1994).

Conclusions

It has been recognised that the technological development of small firms is influenced by various sources of know-how including R&D, industry contacts, learning, ICT and publications. R&D is therefore a major source for technological progress in the modern economy. A principal justification for support of R&D

policy activities will rest upon the positive spillovers which are the positive externalities from R&D

(Revesz and Boldeman, 2006). The studies undertaken in the literature have revealed the major concepts involved in the study of R&D in industrial sectors. In particular the importance of R&D in enhancing technology absorption is considered important for small firms. The approach to the assessment of R&D

activity in this chapter has therefore been to focus down from the national (macro) level of policy making to consider the sectoral regional level (meso) and the individual small business level (micro).

Recommended Reading

Acs, Z. and Audretsch, D. (1990) Innovation and Small Firms, MIT Press, Cambridge, MA.

References

Acs, Z.J., Audretsch, D.B. and Feldman, M.P. (1994) R&D Spillovers and Innovative Activity,

Managerial and Decision Economics, 15(2), March, pp. 131-138.

Adams, J.D. (1990) Fundamental Stocks of Knowledge and Productivity Growth, Journal of Political Economy, 98(4), pp. 673-703.

Adams, J.D. (1993) Science R&D and Invention Potential Recharge: U.S. Evidence, American Economic Review, 83(2), pp. 458-462.

Allen Consulting (2005) The Economic Impact of Co-operative Research Centres in Australia –

Delivering benefits for Australia, Report for the Co-operative Research Centres Association.

Download free eBooks at bookboon.com

37

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Arrow, K.J. (1962) Economic Welfare and the Allocation of Resources for Invention, The Rate and Direction of Inventive Activity, Princeton University, National Bureau of Economic Research.

Arundel, A. (2001) The relative effectiveness of patents and secrecy for appropriation, Research Policy, 30, pp. 611-624.

Audretsch, D. (1995) Innovation and Industry Evolution, MIT Press, Cambridge, MA.

Audretsch, D.B. and Vivarelli, M. (1996) Firm’s Size and R&D Spillovers: Evidence from Italy, Small Business Economics, 8(3), June, pp. 249-258.

Bloom, N. et al (2001) Issues in the design and implementation of an R&D tax credit for UK firms, IFS

Briefing Note, No. 15, January.

Bönte, W. (2003) R&D and productivity: internal versus external R&D – evidence from West German manufacturing firms, Economics of Innovation and New Technology, 12, pp. 343-360.

Bresnahan, T.F. (1986) Measuring the spillovers from technical advance: mainframe computers in

financial services, American Economic Review, 76(4).

Caballero, R.J. and Jaffe, A.B. (1993) How high are the giants’ shoulders: An empirical assessment of knowledge spillovers and creative destruction in a model of economic growth, National Bureau of Economic Research, Working Paper No. 4370, Cambridge, Massachusetts.

Coe, D. and Helpman, E. (1995) International R&D Spillovers, European Economic Review, 39(5), pp.

859-887.

Cohen, W.M. (1995) Empirical studies of innovative activity, in P.Stoneman (ed.) Handbook of the Economics of Innovation and Technical Change, Blackwell, Oxford.

Cohen, W.M. and Levinthal, D.A. (1989) Innovation and learning: the two faces of R&D, Economic Journal, 99, pp. 569-596.

Cohen, W.M. and Levinthal, D.A. (1990) Absorptive capacity: a new perspective on learning and

innovation, Administrative Science Quarterly, 35, pp. 128-153.

Crespi, G., Patel, P. and von Tunzelmann, N. (2003) Literature Survey on Business Attitudes to R&D, Science Policy Research Unit (SPRU), Brighton, University of Sussex.

David, P.A., Hall, B.H. and Toole, A.A. (2000) Is public R&D a complement or substitute for private R&D?: a review of the econometric evidence, Research Policy, 29, pp. 407-530.

Department of Communications, Information Technology and the Arts (DCITA) (2005) Productivity

Growth in Service Industries, Occasional Economic Paper, Canberra.

Download free eBooks at bookboon.com

38

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Dodgson, M. and Rothwell, R. (eds.) (1994) The Handbook of Industrial Innovation, Edward Elgar, Aldershot.

Eaton, J. and Kortum, S. (1996) Trade in ideas: patenting and productivity in the OECD, Journal of International Economics, 40, pp. 251-278.

Eaton, J. and Kortum, S. (1999) International technology diffusion: theory and evidence, International Economic Review, 40(3), pp.537-570.

Etzkowitz, H. and Leydesdorff, L. (eds.) (2002) The Triple Helix: special issue of Research Policy, 29(2).

Fisher, F.M. and Temin, P. (1973) Returns to scale in research and development: what does the

Schumpeterian hypothesis imply? Journal of Political Economy, 81, pp. 56-70.

Gittleman, M. and Wolff, E. (1998) R&D activity and cross country growth comparisons, in Archibugi, D.

and Michie, J. (eds.), Trade, Growth and Technical Change, Cambridge University Press.

Griffith, R., Redding, S. and Reenen van J. (2004) Mapping the two faces of R&D: productivity growth in a panel of OECD Industries, The Review of Economics and Statistics, 86(4), pp. 882-895.

Budget-Friendly. Knowledge-Rich.

The Agilent InfiniiVision X-Series and

1000 Series offer affordable oscilloscopes

for your labs. Plus resources such as

lab guides, experiments, and more,

to help enrich your curriculum

and make your job easier.

Scan for free

Agilent iPhone

Apps or visit

See what Agilent can do for you.

qrs.ly/po2Opli

www.agilent.com/find/EducationKit

© Agilent Technologies, Inc. 2012

u.s. 1-800-829-4444 canada: 1-877-894-4414

Download free eBooks at bookboon.com

39

Click on the ad to read more

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Griliches, Z. (1957) Hybrid corn: An exploration in the economics of technological change, Econometrica, 25(4).

Grilliches, Z. (1992) The search for R&D spillovers, The Scandinavian Journal of Economics, 94, pp. 29-47.

Hall, B. and van Reenan, J. (2000) How effective are fiscal incentives for R&D?: a review of the evidence, Research Policy, 29, pp. 449-470.

Hirsch-Kreinsen, H., Jacobson, D. and Robertson, P. (2005) ‘Low Tech’ Industries: Innovativeness and Development, Perspectives a Summary of a European Research Project, Pilot Project Consortium,

Dortmund, Germany.

Jaffe, A. and Tratjenberg, M. (1998) International knowledge flows: evidence form patent citations, NBER Working Paper No. 6507, USA.

Jaffe, A.B., Tratjenberg, M. and Henderson, R. (1993) Geographic localisation of knowledge spillovers as evidenced by patent citations, The Quarterly Journal of Economics.

Jaruzelski, B., Dehoff, K. and Bordia, R. (2005) The Booz Allen Hamilton global innovation 1000,

Strategy and Business, 41, Winter.

Kealey, T. (1996) Economic Laws of Scientific Research, Macmillan, London.

Kodama, F. (1991) Analysing Japanese High Technologies, Pinter, London.

Kohn, M. and Scott, T.J. (1982) Scale economies in research and development, Journal of Industrial Economics, 30, pp. 239-250.

Lederman, D. and Maloney, W.F. (2003) R&D and Development, World Bank Research Paper 3024.

Levin, R., Klevorick, A.K., Nelson, R. and Winter S.G. (1987) Appropriating the Returns from Industrial Research and Development, Brookings Papers on Economic Activity, 3, Washington D.C.

Maddock, R. (2002) Social costs and benefits from public investment in innovation, Business Council of Australia, paper No. 2, pp. 88-93.

Mandeville, T.D., Lamberton, D.M. and Bishop, E.J. (1982) Economic Effects of the Australian patent system, AGPS, Canberra.

Mansfield, E. (1985) How rapidly does new industrial technology leak out?, The Journal of Industrial Economics, 34(2), December.

Download free eBooks at bookboon.com

40

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Mansfield, E., Rapoport, J. Romeo, A, Wagner, S. and Beardsley, G. (1977) Social and private rates of return from industrial innovations, Quarterly Journal of Economics, 71, pp. 221-240.

Mansfield, E., Schwartz, M. and Wagner, S. (1981) Imitation Costs and Patents: An Empirical Study, The Economic Journal, 91.

Martin, B., von Tunzelmann, N., Ranga, M. and Geuna, A. (2003) Review of the literature on the size and performance of research units: report for OST, SPRU, University of Sussex.

Mazzoleni, R. and Nelson, R.R. (1998) The benefits and costs of strong patent protection: a contribution to the current debate, Research Policy, 27, pp. 273-284.

Mitchell, G. and Hamilton, W. (1988) Managing R&D as a strategic option, Research Technology Management, 31(3), pp. 15-22.

Mohnen, P. (1996) R&D externalities and productivity growth, Science, Technology and Innovation, 18, pp. 39-66.

Mowery, D.C. and Rosenberg, N. (1979) The influence of market demand upon innovation: a critical

review of some recent empirical studies, Research Policy, 8, pp. 103-153.

Myers, S. (1984) Finance theory and finance strategy, Interfaces, 14, pp. 126-137.

Nadiri, M.I. and Theofanis, P.M. (1994) The Effects of Public Infrastructure and R&D Capital on the Cost Structure and Performance of U.S. Manufacturing Industries, Review of Economics and Statistics, 76(1), February, pp. 22-37.

Nelson, R.R. (1990) Capitalism as an engine of progress, Research Policy, 19.

OECD (2002) Tax Incentives for Research and Development, trends and issues, OECD, Paris.

Organisation for Economic Co-operation and Development (OECD) (2002) Frascati Manual, OECD

Publications, Paris.

Phillips, R. (1997) Innovation and Firm Performance in Australian manufacturing, Industry Commission Staff Research paper, AGPS, Canberra.

Polanyi, M. (1943) Patent Reform, Review of Economic Studies, 11(1).

Pottelsberghe de la Potterie van, B. and Lichtenberg, F. (2001) Does foreign direct investment transfer technology across borders?, The Review of Economics and Statistics, 83(3), pp. 490-497.

Quah, D. (2003) Digital goods and the new economy, in Jones, D.C. (ed.) New Economy Handbook, Elsevier Academic Press, USA, pp. 291-323.

Download free eBooks at bookboon.com

41

Innovation and Small Business: Volume I

Research and Development and the Small Firm

Revesz, J. (1999) Trade-Related Aspects of Intellectual Property Rights, Staff Research paper, Productivity Commission, Canberra.

Revesz, J. and Boldeman, L. (2006) The economic impact of ICT R&D: a literature review and some Australian Estimates, Occasional Economic Paper, Australian Government Department of

Communications, Information Technology and the Arts, Commonwealth of Australia, November, pp. 1-

140.

Revesz, J. and Lattimore, R. (2001) Statistical Analysis of the Use and Impact of Government Business Programmes, Staff Research Paper, Productivity Commission, Canberra.

Robson, M. Townsend, J. and Pavitt, K. (1988) Sectoral patterns of production and use of innovations in the UK: 1945-1983, Research Policy, 17, pp. 1-14.

Scherer, F.M. (1982) Inter-industry technology flows in the US, Research Policy, 11, pp. 227-246.

Scherer, F.M. and Ross, D. (1990) Industrial Market Structure and Economic Performance, Third edition, Houghton-Mifflin, Boston.

Schuchman, H. (1981) Information Transfer in Engineering, The Futures Group, Washington D.C.

Schumpeter, J. (1934) The Theory of Economic Development, Harvard University Press, Massachusetts, USA.

The financial industry needs

a strong software platform

That’s why we need you

Working at SimCorp means making a difference. At SimCorp, you help create the tools

“When I joined

that shape the global financial industry of tomorrow. SimCorp provides integrated

SimCorp, I was