Lesson XIII Fiscal Policy

Reading Objectives:

The purpose of introducing this part in the managerial economics is to familiarize the candidate about the role played by the Government of the country in fulfilling certain objectives like, economic stability, price stability, achieving full employment, promoting exports and achieving balanced regional growth through the tools like taxation, public barrowing and deficit financing. These tools are mostly used only in its budget proposals it may make clear the minds of the reader that the objectives of the monetary policy and the fiscal policy are more or less the same. Therefore to achieve the goals most often these two are used in combination. The managerial economist while taking their managerial decisions will have to keep in their mind these policies to take wise decisions.

Lesson Outline:

-

Fiscal policy

-

Objectives of fiscal policy of India

-

Key features of Budget 2012-13

-

Tax proposals

-

Receipts and expenditure of the government of India

-

Review questions

Introduction:

Fiscal policy is defined as the conscious attempt of the government to achieve certain macro economic goals of policy by altering the volume and pattern of its revenue and expenditures and the balance between them. The major economic goals of fiscal policy are to maintain a high average level of employment and business activity, to minimize fluctuations in employment activity, prevent inflation and to produce and promote economic growth.

The fiscal policy is used to control inflation through making deliberate changes in government revenue and expenditure to influence the level of output and prices. It is a budgetary policy. Fiscal policy is the use of government taxes and spending to alter macroeconomic outcomes of the country. During the great depression of the 1930s people were out of work, they were unable to buy goods and services therefore government had to increase, to regulate macroeconomic values and money supply.

The use of government spending and taxes to adjust aggregate demand is the essence of fiscal policy. The simplest solution to the demand shortfall would be to increase government spending. The government increases it’s spending through construction of tanks, schools, highways. This increased spending is a fiscal stimulus. Economic stability is a macro goal of the fiscal policy of a country whether developed or developing. By economic stabilization it means; controlling recession or depression and price stability.

Objectives Of Fiscal Policy:

-

To maintain economic stability in the country

-

To bring Price stability

-

To achieve full employment

-

To provide social justice

-

To promote export and introduce import substitution

-

To mobilize more public revenue

-

To reallocate available resources

-

To achieve balanced regional growth.

Instruments:

The major instruments to be used to control inflation and to achieve the above said objectives are (i) Taxation (ii) Public borrowings (iii) Deficit financing.

Fiscal policy deals with the government expenditure and its composition. Government expenditures are classified into two categories as capital expenditure and consumption expenditure. The spending on construction of road, dams and others are called as capital expenditure. Government expenditure on consumption of goods and services are called as consumption expenditure. The interest paid by the government against the borrowings or national debt is called as interest payment. Governments’ transfer of money from one sector to other is called Transfer of payments.

Key Features Of Budget 2012-2013

For Indian economy, recovery was interrupted this year due to intensification of debt crises in Euro zone, political turmoil in Middle East, rise in crude oil price and earthquake in Japan. GDP is estimated to grow by 6.9 per cent in 2011-12, after having grown at 8.4 per cent in preceding two years. Growth moderated and fiscal balance deteriorated due to tight monetary policy and expanded outlays. Manufacturing sectors are under recovery period. The 12th five year plan is to be launched with the aim of “faster, sustainable and more inclusive growth”.

Budget Estimates 2012-13

The major estimates are:

-

Gross Tax Receipts estimated at `10,77,612 crore.

-

Net Tax to Centre estimated at `7,71,071 crore.

-

Non-tax Revenue Receipts estimated at `1,64,614 crore.

-

Non-debt Capital Receipts estimated at `41,650 crore.

Temporary arrangement to use disinvestment proceeds for capital expenditure in social sector schemes extended for one more year. Total expenditure for 2012-13 budgeted at 14,90,925 crores. Plan expenditure for 2012-13 at 5,21,025 crore is 18 per cent higher than Budget Expenditure of 2011-12. This is higher than 15 per cent projected in Approach to the Twelfth Plan. Non-plan expenditure estimated at 9,69,900 crore. 3,65,216 crore estimated to be transferred to States including direct transfers to States and district level implementing agencies. Entire amount of subsidy is given in cash and not as bonds in lieu of subsidies. Fiscal deficit has reduced from 5.9 to 5.1 per cent of GDP in 2012-13. Net market borrowing required to finance the deficit to be 4.79 lakh crore in 2012-13. Central Government debt is 45.5 per cent of GDP in 2012-13 as compared to Thirteenth Finance Commission target of 50.5 per cent. Effective Revenue Deficit to be 1.8 per cent of GDP in 2012-13.

Tax Proposals On Direct Taxes:

-

Exemption limit for the general category of individual taxpayers proposed to be enhanced from 1,80,000 to 2,00,000 giving tax relief of 2,000.

-

The upper limit of 20 per cent tax slab proposed to be raised from `8 lakh tò10 lakh.

-

Proposal to allow individual tax payers, a deduction of uptò10,000 for interest from Savings bank accounts and upto 5,000 for preventive health check up.

-

Senior citizens not having income from business, proposed to be exempted from payment of advance tax.

-

Restriction on Venture Capital Funds to invest only in 9 specified sectors proposed to be removed.

-

Proposal to continue to allow repatriation of dividends from foreign subsidiaries of Indian companies at a lower tax rate of 15 per cent upto 31.3.2013.

-

Investment link deduction of capital expenditure for certain businesses proposed to be provided at the enhanced rate of 150 per cent.

-

New sectors to be added for the purposes of investment linked deduction.

-

Proposal to extend weighted deduction of 200 per cent for R&D expenditure in an in house facility for a further period of 5 years beyond March 31, 2012.

-

Proposal to provide weighted deduction of 150 per cent on expenditure incurred for Agri-extension services.

-

Proposal to extend the sunset date for setting up power sector undertakings by one year for claiming 100 per cent deduction of profits for 10 years.

-

Turnover limit for compulsory tax audit of account and presumptive taxation of SMEs to be raised from `60 lakhs tò1 crore.

-

Exemption from Capital Gains tax on sale of residential property, if sale consideration is used for subscription in equity of a manufacturing SME for purchase of new plant and machinery.

-

Proposal to provide weighted deduction at 150 per cent of expenditure incurred on skill development in manufacturing sector.

-

Reduction in securities transaction tax by 20 per cent on cash delivery transactions.

-

Proposal to extend the levy of Alternate Minimum Tax to all persons, other than Companies, claiming profit linked deductions.

-

Proposal to introduce General Anti Avoidance Rule to counter aggressive tax avoidance scheme.

-

Measures proposed to deter the generation and use of unaccounted money.

-

A net revenue loss of `4,500 crore estimated as a result of Direct Tax proposals.

Indirect Taxes

Service Tax

Service tax confronts challenges of its share being below its potential, complexity in tax law, and need to bring it closer to Central Excise Law for eventual transition to GST. Overwhelming response to the new concept of taxing services based on negative list.

1. Proposal to tax all services except those in the negative list comprising of 17 heads.

2. Exemption from service tax is proposed for some sectors.

3. Service tax law to be shorter by nearly 40 per cent.

4. Number of alignment made to harmonize Central Excise and Service Tax. A common simplified registration form and a common return comprising of one page are steps in this direction.

5. Revision Application Authority and Settlement Commission being introduced in

Service Tax for dispute resolution.

6. Utilization of input tax credit permitted in number of services to reduce cascading of taxes.

7. Place of Supply Rules for determining the location of service to be put in public domain for stakeholders’ comments.

8. Study team to examine the possibility of common tax code for Central Excise and Service Tax.

9. New scheme announced for simplification of refunds.

10. Rules pertaining to point of taxation are being rationalized.

11. To maintain a healthy fiscal situation proposal to raise service tax rate from 10 per cent to 12 per cent, with corresponding changes in rates for individual services.

12. Proposals from service tax expected to yield additional revenue of `18,660 crore.

Other Proposals For Indirect Taxes

13. Excise duty on large cars also proposed to be enhanced. No change proposed in the peak rate of customs duty of 10 per cent on nonagricultural goods.

14. To stimulate investment relief proposals for specific sectors - especially those under stress.

Agriculture and Related Sectors: Basic customs duty reduced for certain agricultural equipment and their parts; Full exemption from basic customs duty for import of equipment for expansion or setting up of fertilizer projects up to March 31, 2015.

Infrastructure: Proposal for full exemption from basic customs duty and a concessional CVD of 1 per cent to steam coal till 31st March, 2014. Full exemption from basic duty provided to certain fuels for power generation.

Mining: Full exemption from basic customs duty to coal mining project imports. Basic custom duty proposed to be reduced for machinery and instruments needed for surveying and prospecting for minerals.

Railways: Basic custom duty proposed to be reduced for equipments required for installation of train protection and warning system and upgradation of track structure for high speed trains.

Roads: Full exemption from import duty on certain categories of specified equipment needed for road construction, tunnel boring machines and parts of their assembly.

Civil Aviation: Tax concessions proposed for parts of aircraft and testing equipment for third party maintenance, repair and overhaul of civilian aircraft.

Manufacturing: Relief proposed to be extended to sectors such as steel, textiles, branded readymade garments, low-cost medical devices, labour-intensive sectors producing items of mass consumption and matches produced by semi-mechanized units.

Health and Nutrition: Proposal to extend concessional basic customs duty of 5 per cent with full exemption from excise duty/CVD to 6 specified life saving drugs/vaccines. Basic customs duty and excise duty reduced on Soya products to address protein deficiency among women and children. Basic customs duty and excise duty reduced on Iodine. Basic customs duty reduced on Probiotics.

Environment: Concessions and exemptions proposed for encouraging the consumption of energy-saving devices, plant and equipment needed for solar thermal projects. Concession from basic customs duty and special CVD being extended to certain items imported for manufacture for hybrid or electric vehicle and battery packs for such vehicles. There is a proposal to increase basic customs duty on imports of gold and other precious metals.

Additional Resource Mobilization

Proposals to increase excise duty on ‘demerit’ goods such as certain cigarettes, hand-rolled bidis, Pan Masala, Gutkha, chewing tobacco, unmanufactured tobacco and zarda scented tobacco. Cess on crude petroleum oil produced in India revised tò4,500 per metric tonne. Basic customs duty proposed to be enhanced for certain categories of completely built units of large cars/MUVs/SUVs.

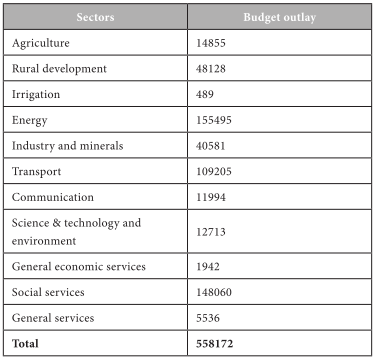

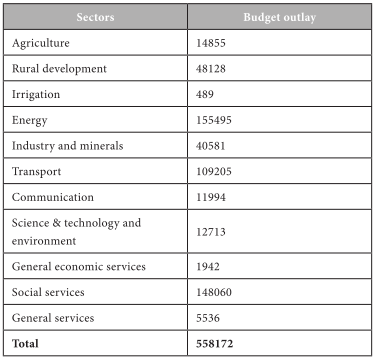

Central Outlay By Sectors (In Crores)

The above table indicates that the central outlay for year 2012-13. It is clear that the highest amount spent on energy which is the need of the hour followed by social services and transportation. But in other hand the amount spent on irrigation is very low.

Receipts And Expenditure Of The Government Of India

The Receipts And Expenditure Of The Central Government

The table shows the various receipts and expenditure of the government which implies that the revenue earned through tax or non tax sources are growing year after year. It is estimated to have more revenue deficit. The revenue deficits are lesser than the fiscal deficit of the country. The detailed schedule with the percentage change is discussed in the table.

It is concluded that both monetary and fiscal policies are complementary. The monetary policy influences the money supply, currency and deposits in banks and the cost of borrowing it. Fiscal policy is concerned with money which flows in and out of the treasury by means of taxation, public borrowings, government expenditures and management of public debt. There fore without coordination of both the policies, in developing economy the desired objectives cannot be realized.

Review Questions

-

What do you mean by fiscal policy?

-

Briefly explain the instruments of fiscal policy.

-

Give the highlights of the current budget 2012-13.

-

Discuss the central outlay by major sectors.

-

Describe the current receipts and expenditure of central government of India.

Exercises:

(a) Suppose that you are a member of the Board of Governors of the RBI. The economy is experiencing a sharp and prolonged inflationary trend. What changes in

-

Reserve Ratio

-

The discount rate and

-

Open market operations

Would you recommend? Explain in each case as to how the changes you advocate would affect commercial bank reserves, the money supply, interest rates and aggregate demand.

(b) Suppose that you are a member of the Board of Governors of the RBI. The economy is experiencing a sharp and prolonged inflationary trend. What changes in a) reserve ratio b) the discount rate and c) open market operation would you recommend? Explain in each case how the change you advocate would affect commercial bank reserves, the money supply, interest rates and aggregate demand.

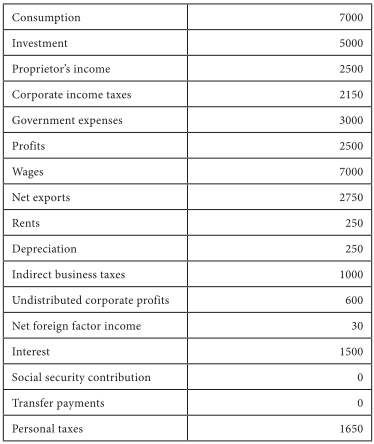

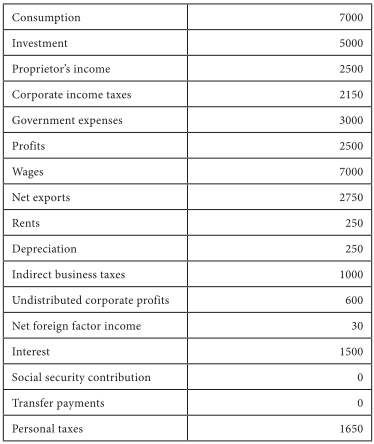

(c) Given the following data about the economy:

-

Calculate GDP and GNP with both the expenditure and income approach

-

Calculate NDP, NNP,NI and Domestic income

-

Calculate Personal income.

-

Calculate Disposable Personal income.

*****