50

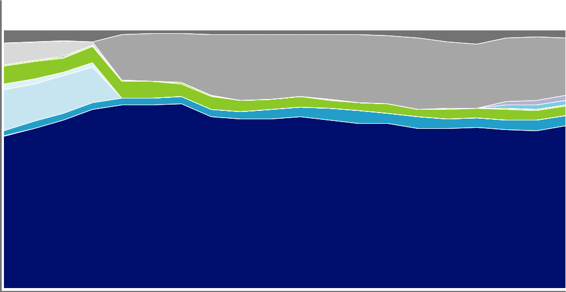

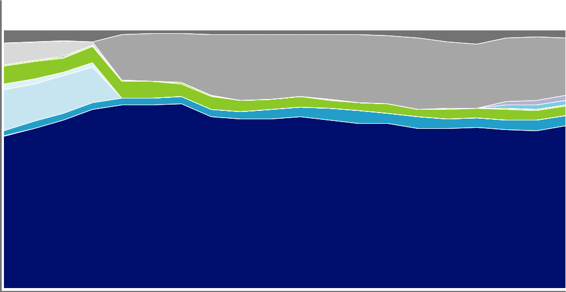

Figure 5: Composition of foreign exchange reserves

110.0

82.50

55.00

27.50

0.0

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

Shares of US dollars

Shares of Swiss francs

Shares of other currencies

Shares of Pound sterling

Shares of Japanese yen

Shares of Euros

Shares of Canadian dollars

Shares of Netherlands guilders

Shares of ECUs

Shares of Deutsche mark

Shares of French francs

Shares of Australian dollars

Source: IMF52

There has been talk of replacing the US dollar with special drawing rights (SDR) created by the International Monetary Fund (IMF) in 1969 to supplement its member countries’ official reserves. The SDR’s value is based on a basket of four international currencies – the US dollar, pound sterling, euro and yen – and can be exchanged for freely usable currencies. Typically, the funds the IMF lends to countries are denominated in SDRs. China, eager to take the yuan global, wants the IMF’s five-yearly review of the basket of currencies to include the yuan, which requires formal recognition of the yuan as a reserve currency. For many stakeholders, the SDR seems an ideal candidate for a global reserve, particularly once its basket of currencies contains the yuan53.

The Future of Exchanging Value Cryptocurrencies and the trust economy 51

The SDR was created to support the Bretton Woods fixed The trust dynamics that limit the adoption of

exchange rate system. Bretton Woods requires

cryptocurrencies within a closed community also limit

participants to hold official reserves to purchase their adoption across communities. Money is a technology for domestic currencies in foreign exchange markets to

resolving obligations between individuals who don’t know, maintain exchange rates. A new reserve asset was

or don’t trust, each other and for whom barter is too

required as the supply of two key reserve assets of the awkward. The strongest possible driver for national

time – gold and the US dollar – proved inadequate for

adoption of a cryptocurrency is for the national

supporting the expansion of world trade and financial

government to mandate that taxes be paid in the

development. One of the hopes for the SDR was that it

cryptocurrency. Similarly, the strongest possible driver for would function as a reserve currency, though the SDR is global adoption of a global reserve cryptocurrency would neither a currency nor a claim on the IMF. Instead, it is a be global institutions that can force their will on most potential claim on the freely usable currencies of the cross-border trade, mandating its use. Otherwise,

IMF’s member countries. One school of thought when the stateless cryptocurrencies will continue to play a niche IMF was established 70 years ago was that it would be

role in the global economy, just as they do in national the custodian of a global reserve currency. However,

economies. Individuals and institutions will still find it more SDR was overtaken by history when the Bretton Woods

convenient to conduct their business in one of the

system collapsed and the major currencies shifted to

currencies at either end of the transaction (which, as floating exchange rates, facilitated by the growth in

we’ve already stated, is most likely to be a national fiat international capital markets that simplified borrowing by currency), in a trusted third currency (which, by sheer creditworthy governments.

size, may be the global reserve currency) or in a weighted basket of currencies as a risk management strategy to

The opposite point of view is that adopting SDR as a

limit exposure to any single currency.

reserve currency would not change the fundamentals

of the current status quo as it is simply an aggregate of International inter-currency exchanges may travel over fiat currencies and would lose value like a fiat currency peer-to-peer technology platforms based on (or inspired if the nations in the basket print currency with

by) the technologies that underpin cryptocurrencies such abandon. It could also be considered a risk

as Bitcoin or XRP, but value will continue to be stored and management tool as it allows holders to spread their

exchanged in conventional sovereign currencies.

exposure across multiple reserve currencies,

something many organisations may choose to do

directly as it enables them to tune the weightings of the basket of currencies to more closely meet their needs.

If the global reserve currency is to be stateless, it

also needs to be independent. This means it would

need to be supported by enforceable taxation rights

across participating countries, or valued against a

single commodity (gold, for example) or a basket of

commodities such as gold, oil, grain, etc. owned by

an issuing entity. A third option, enabled by our

increasingly globalised and virtual world, is to adopt a stateless cryptocurrency.