12

The use of electronic funds transfer is increasing at the expense of cash and cheques due to a number of factors.

Cards are being used in preference to cash and to buy more expensive things; transaction value and volume are increasing across all digital mechanisms. Point-of-sale technologies have streamlined the buying experience, the most recent of which is NFC-based contactless cards. The convenience of contactless cards is leading consumers to use them even for quite minor purchases and was one of the drivers of Apple Pay in the U.S. At the same time, the increasing importance of remote transactions (particularly to support online commerce) is moving many transactions from the physical to the digital world. The number of electronic transactions7 averaged about 353 per person per year in Australia in 2013, an increase of about 48 per cent from 2007.8 In 2013 cash payments accounted for only 18 per cent of the value and 47 per cent of the number of transactions.9

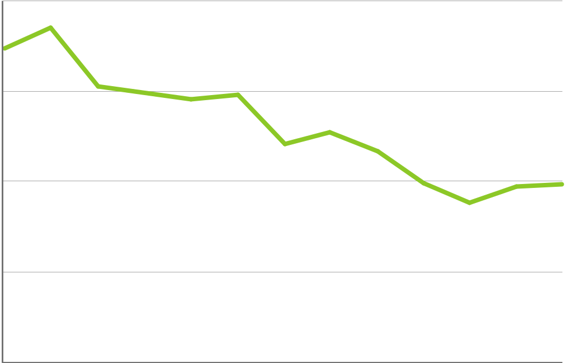

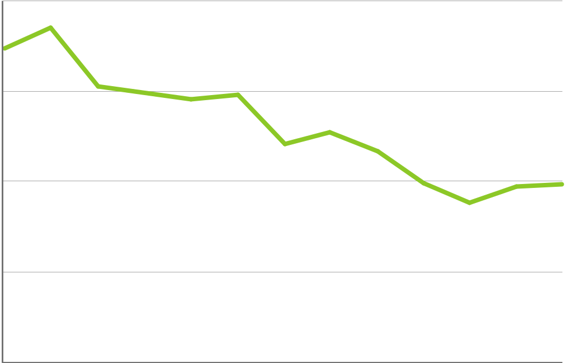

Despite all this technological innovation, and the fact that the use of cash is in decline, cash is still the most frequently used form of payment. Consumers use it for most of their low-value transactions – about two-thirds of all payments under $20. Cheques, in contrast, are retreating to the high ground. While their use is also in decline – with an average of eight cheques written per person in Australia in 2013–14, down from 28

cheques per person 10 years earlier – the average value of a cheque rose by 19 per cent to roughly $6,800

in 2013–14.10 Cheques are mostly used for high-value payments where there is currently no suitable digital alternative. This shift to digital payments suggests that the future of payments is online.

Figure 2: Cheques per capita

10.0

7.5

5.0

2.5

0.0

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Cheques per capita

Source: RBA11, ABS12

The Future of Exchanging Value Cryptocurrencies and the trust economy 13

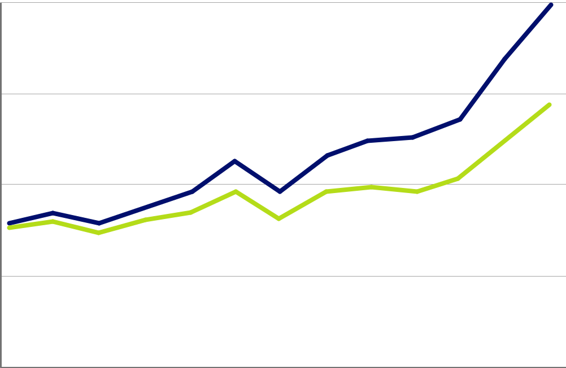

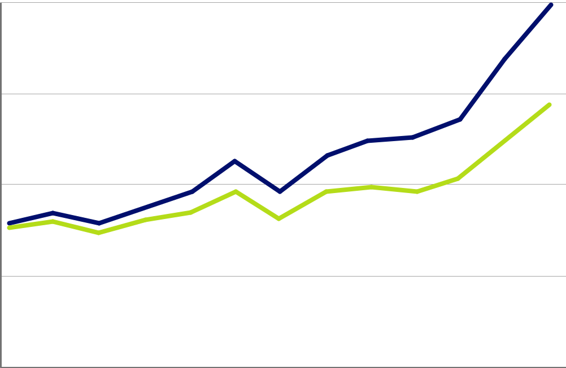

Figure 3: Average cheque value

$9000

$6750

$4500

$2250

0.0

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Average cheque value

CPI Adjusted

Source: RBA13, ABS14

As more payments move online, many are now being processed in real time. New platforms are being developed that enable instant transfers of value – of even quite low amounts – between institutions, between individuals and institutions, and even between individuals by supporting new ‘split the bil ’ functions. Start-ups such as Stripe15 and Square16 are the architects of some of these platforms, as are industry groups and government bodies such as the Australian Payments Clearing Association’s (APCA) with its New Payments Platform and the Property Exchange Australia, which has launched an electronic conveyancing platform.

Support is building to eliminate physical money. This would improve in-store security and reduce cash-handling costs for businesses. Many governments have a favourable view of a cashless society as it would reduce tax revenue leakage and remove an important tool from organised crime (which is why many governments have been retiring the highest denomination bank notes). Denmark has started down this road by proposing that by January 201617, selected retailers (such as clothing stores, restaurants and petrol stations) be no longer obliged to accept cash, though there are some fears this might increase the risk of fraud. Essential services – such as post offices, hospital cafeterias, dentists and chiropractors – would still have to accept Danish krone.