SECTION 1

“ What gets measured gets managed” Peter Drucker.

A Budget is the most basic and important factor in helping an individual achieving financial success.

It helps you to make the best use of the money you earn; to meet the needs of today and goals of tomorrow.

It also allows you to manage your cashflows effectively while focusing on your long term financial goals.

How to Budget?

There are many budgeting tools like an excel templates, mobile applications and Desktop applications, which can help in setting up a personal budget and track expenses regularly.

The following are some of the excel templates available free to download for creating a personal budget;

Click on the following pictures, to view each budget template and choose the one, which suits you the best;

The following are mobile applications available on iTunes and Android, which can help you manage your money effectively.

HomeBudget

HomeBudget is a complete application, which can not only help you budget your income and expenses, it also helps you track expenses easily, as you can install it on your smartphone and record expenses as they happen.

HomeBudget is available for iPhone, Android and Windows based phones. It is also available for a windows pc and Mac

I use HomeBudget to manage my budget and cashflows, and I highly recommend it to anyone who wants to budget and track expenses.

Wally

Wally is a free personal finance application available on the iPhone and Android.

It helps you record your income and expenses to understand what happens to your money after you have earned it.

Wally lets you keep track of the details as you spend money: where, when, what, why, & how much.

8 steps to effective budgeting

Once you have decided which method to use, either a mobile application or an excel sheet, or you can also budget using a simple paper and pen, the following steps will help you create your budget…

Step 1 – Pay your self first: The biggest mistake most of us do, is that we pay bills, expenses, loans and everything else before we pay ourselves.

When all bills and expenses are paid, there is very little or nothing left to pay ourselves.

The most common advice shared in almost all financial self help books, like Rich Dad Poor Dad & The Richest Man in Babylon is to pay ourselves first.

George Clason, in his book “The Richest Man in Babylon states that this is the cure for a lean purse….

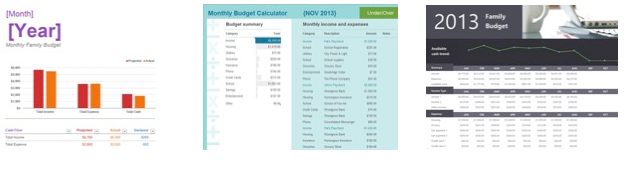

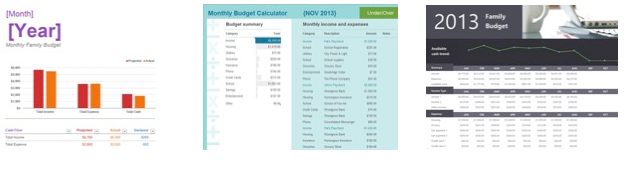

Determine a certain percentage of your income (10% of your income is highly recommended) and setup an auto debit into a savings plan.

I know that most of you might be thinking that it is impossible to set aside 10% of your income, given your current state of affairs.

Don’t be disheartened, start with a 10% provision, we are still in the planning stage, and you can always comeback to firm the percentages before your fix your budget…

Step 2 – Determine your monthly income When I say, monthly income, add only the regular and recurring income.

Only include actual income, do not consider income you are likely to receive or notional income.

For best results, add your last 12 months actual income from your bank account and take the average figure as your planned income.

Step 3 – Ascertain fixed expenses Fixed expenses are the ones which are regular and do not change in small intervals..

They are also usually the basic expenses like; Rent, School Fees, School transportation, Maid salary, Elife – Internet and TV bill, gym or club membership etc…

Step 4 – Ascertain Variable Expenses which are likely to change according to usage and other factors are called variable expenses..

Examples of variable expenses are; Food, Groceries, Utilities, Departmental, Personal Care, Laundry, Car fuel, repairs and maintenance etc…

Step 5 – List and organize debt: Make a list of all the debts like credit card(s), personal loan, car loan, mortgage, student loan and hand loans…

Organize the list in the order of highest interest to lowest interest…

For example: Credit cards always come first, as they are likely to charge the highest interest, followed by personal loan, mortgage, car loan and other loans…

Step 6 – List your Savings: Savings can be for short term or long term financial needs..

Short term needs could be an annual vacation, purchase of gadgets, saving for buying jewelry or buying a car..

Long term needs could be, saving to buy a property, saving for children’s education or for retirement…

Step 7 – Don’t forget Charity: Allocate at-least 1.00% of your income to your favorite charity. When you give without remorse, it creates a feeling of fulfillment, which is essential to lead a happy life..

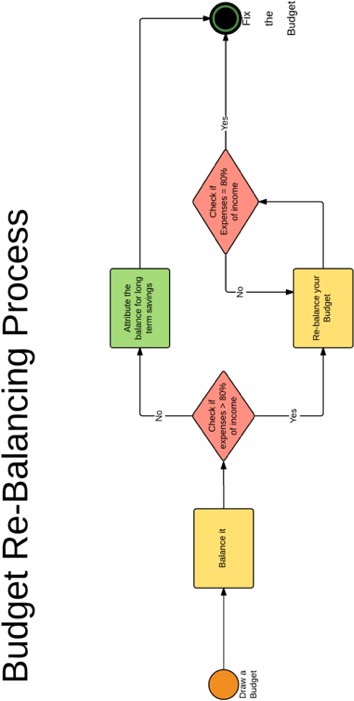

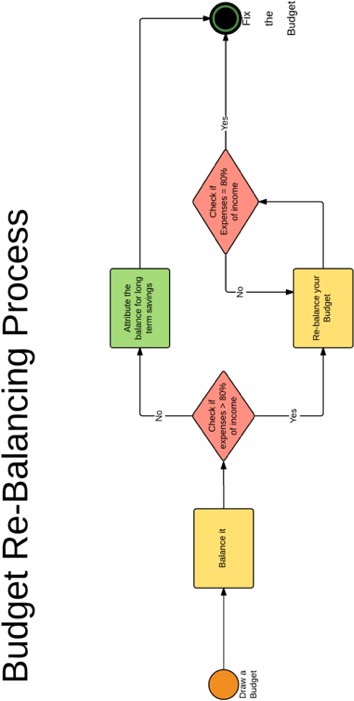

Step 8 – Balance Your Budget: An ideal budget should have the following ratios;

If your income is more than your expenses, then you are very fortunate and it would be very easy for you to create and maintain a budget.

If your expenses and loan repayments are more than 80% of your earnings, then you have a serious cost cutting exercise to undertake.

Revisit all your expenses, involve your family members and identify expenses, which can be avoided or trimmed.

Consider debt consolidation to make the repayments more affordable.

Banks like ADIB, NBAD and Mashreq are offering debt consolidation loans to residents of UAE to help them better manage cashflows and save on interest costs..

You can also consider refinancing your mortgage, to take advantage of the low rates currently prevailing.

Also check if you can get a lower premium on your mortgage insurance and property insurance, because banks usually charge a fixed percentage of premium, irrespective of the fact if your are a smoker, non smoker, healthy, unhealthy, young or old….

Talk to an independent financial adviser to ascertain how much premium you will have to pay to protect your mortgage, if the premiums are lower than what you are currently paying, consider switching…

Try and reduce 5% to 10% on all variable expenses like groceries, eating out, departmental, clothing, utilities and car expenses.

There is always scope to reduce these expenses..

The flowchart on the next page explains the Budget rebalancing process.

If your expenses are less than or equal to 80% of your income, fix your budget, to start implementing from the beginning of each month.