SECTION 2

“Knowing when to walk away is wisdom. Being able is courage. Walking away, with your head held high is dignity.” Unknown”

Deciding when you want to retire, helps you set a time bound goal.

It gives you more focus to understand where you are and where you want to be in a certain number of years.

Be practical, when deciding when you want to retire, do not set a goal too difficult to achieve nor set a goal to retire too late.

This is the step 2 in the retirement planning process.

As a financial adviser, I have asked this question to every client I have met, and the following are some of the answers I typically get;

- The usual retirement age, I think it is 60 or 65...

- Haven’t thought of it yet...

- I don’t know

- It is too early to think about retirement..

Some of them knew exactly when they wanted to retire.

They had in fact started visualizing how and when their retirement would be.

For most, the decision of when to retire is not so easy, because it could involve complex financial, emotional, social and family considerations.

What about you?

Have you decided?

Do you know when you can practically retire? If not; the following can help you in deciding;

If you want to retire early remember that retiring early means fewer earning years and therefore a smaller retirement kitty.

Also consider that the earlier you retire, the more number of years you will spend in retirement, if you do not have adequate savings, it could be a challenge then.

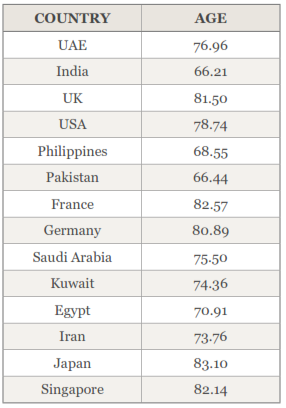

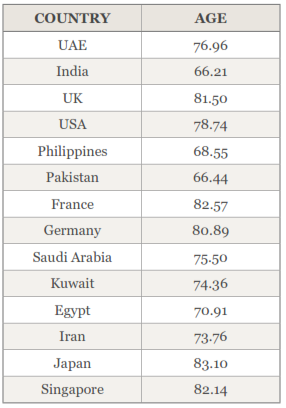

Consider the increasing life expectancy. The average life expectancy in UAE as of 2012 is 76.96 years. The following table provides you the average life expectancy in some of the countries as of 2012;

“If your country is not listed here, ask google..

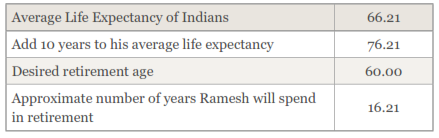

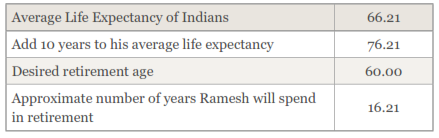

Now that you know your average life expectancy add 10 years to it, to approximately predict how many years you would be in retirement, before you kick the bucket...

The following example will show you how?

Ramesh is an Indian National, desiring to retire at age 60

Bear in mind, that the average life expectancy around the world is increasing thanks to medical advancements and health awareness, so you may end-up spending more time in retirement than you actually planned for.

Delaying retirement provides you with more time to build your nest egg;

For example, if you decide to retire at age 60 instead of age 50, and you manage to save AED20,000 per year, growing at 8% rate of return during the additional 10 years, you can approximately add an AED 312,909 to your retirement fund.

While delaying retirement may give you more time to save, it also may lead to procrastination.

Do consider health implications; while deciding when to retire, as health plays an important role in determining how many years you can actively work.

We will discuss in detail about aspects which can affect your retirement, like Inflation, Rate of return on your investment etc.,in the forthcoming chapters.