SECTION 4

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair. Sam Ewing”

Now that you know what you want to do during retirement, when you want to retire and where you want to retire, the next logical step is to understand how much you would need to lead the retired life you desire?

The general thumb rule is that you will need at-least 60-70% of your current income in future money.

Future money is the value of today’s money after taking into account the inflation.

For Eg : John is 35 years old and his current income is AED 20,000. He expects to retire in UAE, when he reaches age 60.

John would need at least 60-70 % of his current income to retire in UAE today, which would be AED 12,000 to AED 14,000, depending on the lifestyle he wants to lead during retirement.

The projected inflation for UAE is about 5.00%, hence we will assume that John’s retirement expenses will increase at a rate of 5.00% every year.

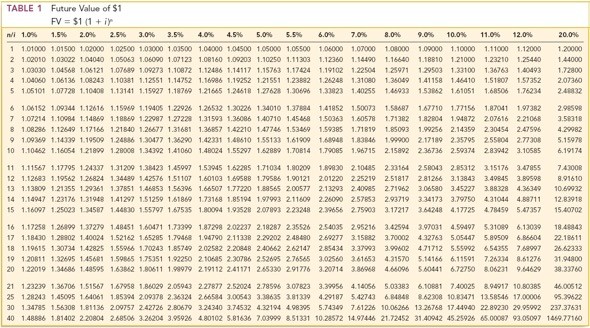

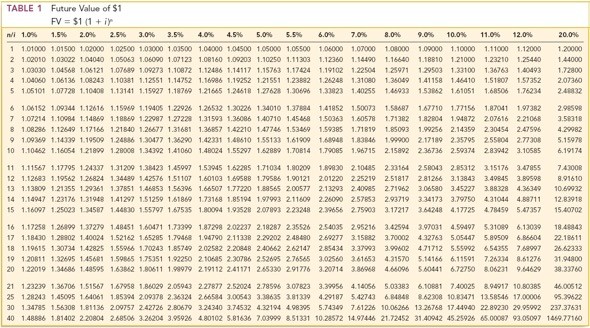

Hence he would need AED12,000 multiplied by 3.386( refer next page for the table showing future value of money) at age 60 for his retirement expenses.

Chart showing future value of one unit of currency (Dollar, AED, Rupee, etc..)

UAE is predominantly an expat oriented country, hence many would prefer in their home countries or other countries where the cost of living is lesser in comparison.

It would be wise to estimate the current cost of living in the particular country you want to settle down during retirement, and use the above table to ascertain the future value of money to figure out how much you would need.

Also consider the following factors; while ascertaining how much you would need for retirement if you prefer to retire outside UAE.

Factors to be considered when ascertaining retirement costs outside UAE

Basic cost of housing Include cost of housing; according to the country you intend to retire. Ideally you should have invested in a house in your retirement destination and paid off the mortgage, before you actually retired, if not please include the rent you will pay as of today and other maintenance charges you may have to pay.

When investing in a home for retirement, please keep in mind about safety and availability of quality health care, clean air, water and activities which would keep you engaged during retirement.

Utilities Most of us expect the utilities to be far less than today, please remember; that you would have got accustomed to a comfortable lifestyle in UAE, which you may find difficult to compromise, hence be generous when budgeting for utilities in retirement.

Food Expenses Include food expenses for you and your partner, a domestic help and occasional friends and guests in today’s money.

Medical Expenses Unplanned Medical expenses can drain out retirement savings very quickly, hence it is important to plan and allocate funds for medical expenses.

If medical insurance is easily available and affordable in the country you intend to retire, include medical insurance premiums in your retirement budget. International medical insurance providers like Aetna, Bupa, AXA, Now Health, Neuron etc, provide global and reliable medical coverage.

“While you are working in UAE, you can consider buying Whole of Life Insurance with a critical illness rider, to help you pay for major medical expenses and other bills, after retirement.

These plans will pay out an agreed sum of money on diagnosis of one of 30-36 critical illnesses, so that you do not have to withdraw money from your retirement savings for your treatment.

Zurich International Life, Metlife and Salama Islamic Insurance, offer globally portable Whole of Life insurance with optional critical illness rider.

Subscribing to such insurance from one of these companies will help you protect your hard earned retirement savings from being spent on unexpected medical expenses of major illness like Cancer, Health Attack, Stroke, Kidney Failure, Liver Failure etc.,

Life and critical illness insurance is discussed in detail in the earlier chapters in detail.

Transportation Budget for a fully paid car, and for fuel expenses to help you move around during retirement, also include car maintenance expenses.

If your retirement destination offers comfortable and reliable public transportation you can budget the expenses in today’s money in lieu of a car.

Travel Depending on how much you would want to travel during your retirement, allocate funds for travel expenses for you and your spouse. Even if you are not a big fan of traveling, please provide for occasional traveling to meet family and friends.

Entertainment During our working lives, we are expected to at-least work for 8 hours a day if not more, while most of us endup workin more than 8 hours a day

Ideally we should be sleeping 8 hours a day, and the balance 6 8 hours is what we get to spend for traveling, grooming, eating, exercise, entertainment and all other activities on which spend the money we earned during the 8 hours of work.

When retired; assuming you would sleep for 8 hours in a day, you would have twice the time you now have at your disposal. If you do not plan to keep yourself engaged with activities, retirement could be a nightmare.

Budget a certain amount of money for entertainment or social activities to keep yourself engaged in retirement.

Miscellaneous Allocate 10% of your budget towards miscellaneous expenses, which you might have during retirement.

The world is rapidly changing, what was luxury ( Car, Smart Phone etc...) few years back, now is a necessity, similarly what you consider as luxury now could be a need in future!