SECTION 7

Every retirement plan portfolio should have real estate investment, and the following are the 5 reasons why...

Inflation Proof Asset: Real estate investment is an ideal hedge against inflation, because its value appreciates with inflation.

Tax Efficient: Many countries across the globe offer attractive tax benefits for property investment

Cash cow: Real estate investment, particularly commercial can fetch a regular and dependable income during retirement, and the best part is that the income from the property also increases along with inflation.

Asset Appreciation: Mark Twain once said; “Buy land. They’re not making it anymore.”, and it is still valid today.

Globally the demand for land is increasing day by day thanks to the growing population and the supply cannot be increased without causing huge damage to the environment.

Leverage: Property investment is one such asset class which allows you to leverage your capital to buy an assets worth 3 to 10 times its value.

For example if you want to buy a villa in the springs for AED 2,000,000; banks would happily lend you 80% of the property cost; so you would only need AED 500,000 for downpayment and other expenses to buy the property.

In this real example you can buy an asset 4 times your capital through leveraging.

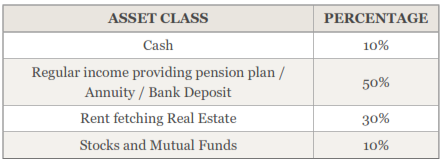

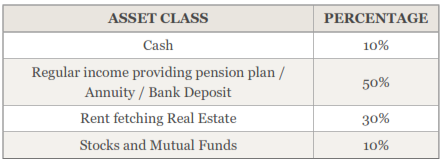

While it is advisable to have a certain portion of your retirement savings in real estate, it is not without liquidity, legal and other risks, hence it is important to diversify your retirement portfolio in 4 to 5 asset classes

An ideal retirement portfolio can be as follows;