Choosing Your Most Important Customers

How to Choose Which of your Customers Should be Included in your B2B Customer Satisfaction Survey

Best practice for obtaining feedback from your customers requires two parallel systems.

The first is a regular, event-based telephone call from your own people to the customers, at an appropriate time following the delivery of your products and services. This is to make sure that all went well and, if it didn’t, allows knowledgeable people to sort out any issues as quickly as possible. This is aimed at the recipients of your products and services who, by the way, are not necessarily the decision-makers.

The second is an occasional (every 12 – 24 months) in-depth survey of the decision-makers, looking at all your systems, disciplines and procedures, and looking for any “people” issues. It is this second, business process analysis review that I want to concentrate on.

The raison d’être for any B2B customer satisfaction survey should be “To increase profitable sales”. The increases will come from three routes.

Reduced customer churn

We need to identify individual dissatisfied customers, find out what has led to the dissatisfaction and do something about it.

Selling more to existing customers

Using “share of wallet” or “percentage penetration” figures will help identify key customers who could and should be buying more from you.

Increased prices

Customers that love you will, by definition, understand and value your company’s contribution to their success. If you go the extra mile, and your customer knows that (and values that) then that opportunity should be realised.

Statistical validity is not important for a typical B2B customer satisfaction (C-Sat) survey on the basis that a) the number of customers is not large when compared with B2C, b) the relationships are already being managed by key account managers and c) these customers are all different anyway. Remember, in an InfoQuest C-Sat survey we will be telling you exactly who said what, and InfoQuest has an average response rate of 70%. So it’s important that you choose the most important customers to be included in your survey.

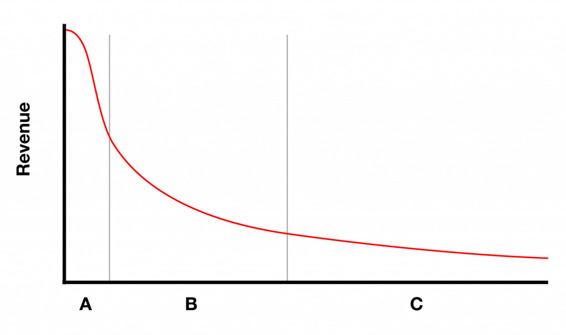

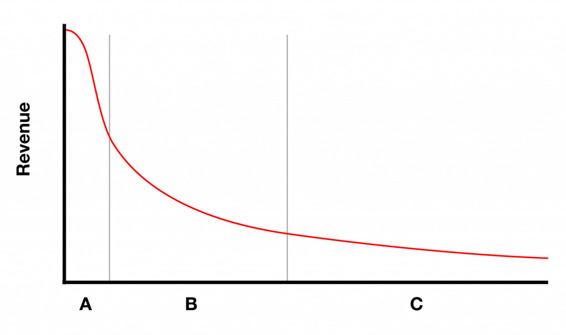

To this end we hope that you will find the following two diagrams helpful.

Most people will recognise the above diagram as being similar to their own circumstance. Parǽto’s 80:20 theory defines the curve – A’s being the major buyers of your goods or services and the C’s being the tail-end Charlies.

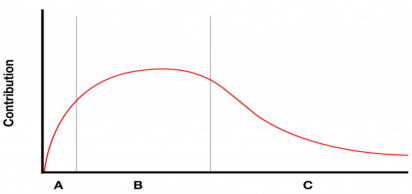

The second diagram highlights what often happens in terms of contribution.

The A customers know the power of their spending. They buy from you as though they are buying a commodity rather than a value-added item. The extra demands from large customers can include special packaging, special deliveries, stock-holding, extra-long credit terms, days out playing golf – all on top of extra-keen prices. These extra costs regularly turn A customers into marginal accounts.

But you need the A customers. They deliver the volumes that you need in order to gain the economies of scale – without which you couldn’t service the B customers.

My personal advice to clients is to carry out the C-Sat survey on the A’s and the B customers.

The survey needs to identify if any of the A customers are looking like they might take their business elsewhere, to the competition. If that happened, news of the migration might get out, leaked to the trade press, and some of your B customers might follow without knowing the full story. And that’s a bad thing.

And the B customers need to be surveyed so that more can be sold to them. This is where your profit comes from. This is where we’re looking for references, referrals, case-studies, cross-selling, up-selling and more business.

When it comes to the C customers, those tail-end Charlies, they won’t be left out; they’ll benefit from the generic improvements you’ll be making to your systems, disciplines and procedures for the A’s and B’s.

Deciding What to Ask

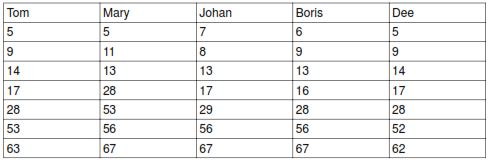

Choosing the 'right' questions for a customer satisfaction survey is easy if you get the heads of different disciplines to help you before you start. Print out enough copies of the question library and take them to the next Board meeting and ask each Board member to choose 8 question sets that they believe should be included in the survey. Explain to them that Question Set 1 (i.e. 1A, 1B. 1C and 1D) is included and that their choice of 8 is in addition to Question Set 1.

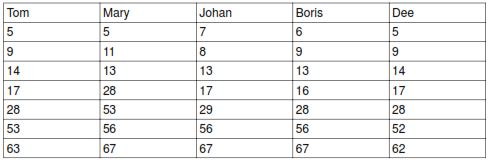

When they have each chosen, use a whiteboard or a flip-chart to write up their choices – writing the question numbers underneath their names: -

Several things happen as a result of this process.

Individual priorities are identified.

Discussions regarding individual's choices are focussed on the exceptions. Compromise and agreement usually follow quickly.

Questions can be compromised. For example, the Board may decide to use questions 14A, 13C, 14C and 13D as a compromise set.

Getting the Board involved in choosing the questions is an early step to getting them committed to gaining the feedback.