Chapter 11—Apply cost containment discipline

Design teams not used to commitments to low cost design frequently have a lot of trouble achieving them. A good corrective is to create and enforce an effective form of cost containment discipline in the design effort.

Proof that this subject is of compelling interest is that since the early 1970s several well publicized forms of cost discipline have appeared and have been enforced by various government and corporate directives. Designers and others with design related responsibilities have been subjected to many hours of training and cajoling aimed at keeping costs under control.

Some readers will have heard of several or all of these disciplines, but for those who may not have we recap them here. However, hearing of a method does not assure an understanding of how to execute it, so we will explain each method sufficiently to give readers at least the gist of it. Suggestions for implementation can be found in Appendix B.

These are the cost reduction disciplines we will discuss in this chapter:

-

Design-to-cost.

-

Life-cycle cost.

-

Cost as independent variable.

-

Target cost.

-

Value engineering.

-

Design for manufacturability.

-

Low cost labor.

However hard you work to achieve cost reduction discipline, all your effort will be to no avail if your organization suffers from conditions that prevent good estimating practices. This chapter concludes with a discussion of this common malady, and what might be done about it. See also Appendix D.

Design-to-cost

In the early 1970’s the U.S. Department of Defense (DoD) found that it was unable to fund all of the projects it thought it needed in order to do its job. It had been subjected by Congress to declining budgets, and its costs of maintaining and operating the resources it had were squeezing out new developments it felt it sorely needed.

As a way of getting more for its development and production money, DoD produced a requirement for “design-to-cost.” The gist of the idea was that challenging but presumably doable goals would be set for product costs (usually measured by average recurring unit production cost) and the design team would have to design the product to be produced for that cost or less.

A few project teams took this very seriously and there were some early and notable success stories. Other teams took it much less seriously, and business as usual continued. When it was taken seriously, it was generally because the customer forced the issue. When it was not taken seriously it was generally because the customer only paid lip service to the idea, and the contractor naturally followed the customer’s lead as being the path of least resistance.

The idea of designing to a predetermined cost has several implications that are worth noting. The first is that it partially reverses the notion prevalent in many design shops (especially aerospace and defense design shops) that product performance is king. In principle, under the DTC discipline the designers are required to make cost calculations at every step of the design process. But many designers are notoriously poor at such calculations. They have no training or experience in it. Moreover, the estimates must be done quickly and concurrently with the design. If they are not, the pressure to release drawings for prototyping or for production will overwhelm the estimating effort. This implies that highly qualified estimators must work closely with the designers on a day to day basis. In addition, the estimators must have tools capable of providing reasonably accurate estimates with minimum effort, even for subcontracted and purchased items!

A second implication is that the preset cost target must somehow be estimated without prior knowledge of the details of product design, and yet the goal must meet the standard of being challenging but doable. This implies a rather prescient estimating capability that did not exist in many customer or contractor shops. The challenge of doing such “should cost” estimates in advance of knowledge of product architecture or sometimes even knowledge of who the contractor will be is substantial. The temptation is to set the goal based not on product knowledge but on knowledge of available funding, often with strong political considerations. If the goal is based on past experience, that experience may contain wastes and inefficiencies that should be purged from the goal, but a difficult issue is how much to purge. If these costs that don’t belong are not purged, the goal tends to simply reflect past inefficient experience and no real savings are realized.

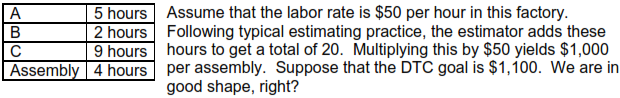

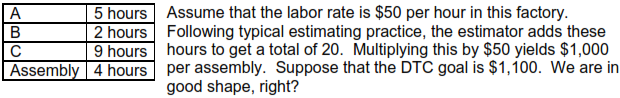

A third implication is that cost uncertainty (risk) must be taken into account continuously. Consider a simple device that comprises only three parts, A, B, and C. A qualified estimator makes the following estimates of factory labor hours to fabricate the parts and create the assembly, including inspection and test. (We ignore the material cost for the sake of simplicity.)

Not necessarily. A deeper inquiry reveals that the estimator believes that the estimate for A may be off by as much as 20%, for B by a like percentage, for C by as much as 30%, and assembly by as much as 50%. All of these uncertainties reflect the fact that the item is merely a concept at the time of estimating.

A statistician working with the estimator calculates that there is a 30% chance that the ultimate cost of the assembly will exceed the DTC goal. Is this acceptable? Someone has to decide. If it is not, additional work is needed to cut costs, remove uncertainty, or both. If no attention at all is paid to the accuracy of the estimates, a probable result is not meeting the DTC goal.

Keep in mind that the estimates of product cost must be made concurrently with the design activity, before actual production costs are known. Estimates always have error until actual costs are known.

The implications mentioned above are probably at least part of the reason DTC had few early successes. It imposed unaccustomed requirements that many teams had neither the training nor the tools to fulfill. Many struggled with it the best they could and often failed. As time went on, performance did improve in some design teams, but in others business as usual prevailed with DTC often getting little more than lip service. Today, the practice of DTC and related disciplines such as life-cycle cost, cost as independent variable, and target cost is more routine as processes have matured and design teams have become more accustomed to working with cost analysts. Still, however, cost overruns are quite common.

Appendix B contains many suggested implementation ideas for the DTC discipline. Much of what is said there applies also to most of the other disciplines discussed in this chapter. There is considerable similarity in activities related to cost discipline.

The notions behind DTC did spread to the private sector in the 1970s, probably because at that time the U.S. was lagging in international competition. Today, many private sector companies use DTC principles. It may be no accident that as this is written the U.S. is the most competitive nation on earth.

Life-cycle cost

While the DTC discipline is typically concerned with average unit production cost, the life-cycle cost (LCC—also called Total Ownership Cost or TOC) discipline concerns the total cost of a system from its earliest development through its ultimate retirement.

Usually the discipline involves either 1) minimizing LCC or 2) creating the system such that a target value of LCC is not exceeded.

LCC is generally an appropriate view when dealing with major systems that have long lives and particularly those that require considerable tending after they have moved from implementation to an operational state. LCC is especially appropriate for systems that do not “die” readily, such as nuclear power plants, large buildings, ships, aircraft, and certain kinds of factories that may leave significant toxic residue, such as paint shops and metal plating facilities.

Customers often have LCC goals because they are concerned about their long term liabilities for the system. This concern can exist even though the customer knows that the system ownership may change one or more times in its lifetime, because the residual LCC obligation at all times affects the value of the system. Customers who own many long life assets they intend to keep must be concerned about LCC to assure that the funds and other support resources will be there in the out years.

Here are some typical uses of LCC estimates:

-

Long range planning and budgeting.

-

Comparison of competing projects.

-

Timing of replacement of old or obsolete systems.

-

Selection among competing bidders.

-

Trading off initial investment in development and implementation against the often much larger costs of operations and support and retirement of a system (this may be the most important use of LCC estimates).

In one sense LCC estimating can be a guessing game. The reason is that certain assumptions must be made that may turn out to be untrue. A major assumption among these is the useful life of the system. It matters a lot to LCC whether we assume that a ship will be in naval service 30 years or 50 years. This particular difficulty is often overcome by using “standard” lifetime assumptions, e.g., all ships of a certain class shall be assumed to remain in service 30 years. Everyone using the estimate is informed of this and makes decisions accordingly. Another way of handling this problem is to state an average annual cost once the system has been deployed.

Another key assumption is the rate of use of the system, also sometimes referred to as the duty cycle. For example, if we assume that an aircraft will fly 1,500 hours a year, the cost of operating and maintaining it will be considerably more than if we assume it will be flown 750 hours a year.

Because they have so many long life systems, many LCC estimates are made for the U.S. military. The military customer frequently specifies what assumptions should be made for lifetime and for duty cycle. They may also specify other things, such as pay rates for military and civilian personnel that will be involved in operations and maintenance. Also, to avoid unnecessarily complicating the estimating process, the military generally requires that only peacetime operations be considered, and that certain higher level labor costs (e.g., officers or civil servants above a certain rank) not be factored in. Other estimating ground rules may also be specified.

Another major consumer of LCC estimates is the construction industry, especially that part that works major projects such as office buildings, freeways, industrial plants, etc. Many systems built by the construction industry have long lives, and significant out year costs. For example, a large office building of conventional design in a city like Houston requires substantial costs in operating and maintaining its air conditioning system. What if a more environmentally “green” but initially more expensive construction techniques were used, but savings in air conditioning over out years resulted? That might be a tradeoff worth examining.

LCC is also of concern for many software systems. There can be significant LCC tradeoffs in software, for example between costs of developing a system and maintaining it over the years. Typically, the more effort put into development, the fewer defects (“bugs”) and the less the out year maintenance costs.

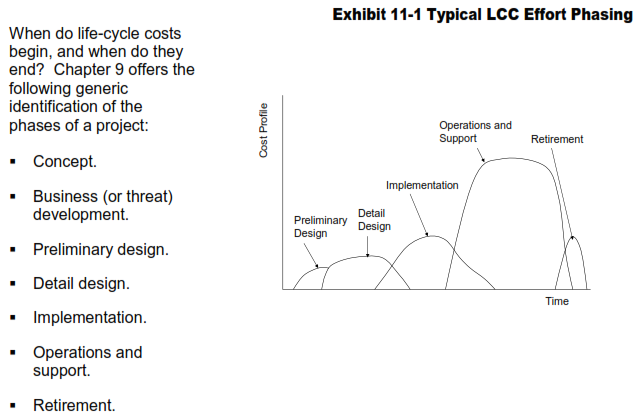

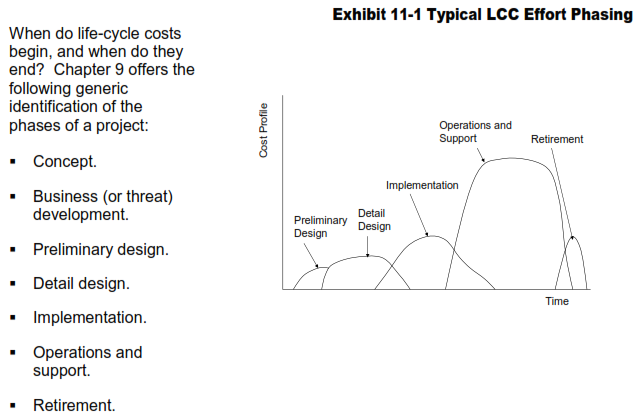

Of these, all but the first two are generally included in an LCC estimate. The first two are usually regarded as overhead costs related to the development of new business. But bear in mind that various practitioners do not necessarily have the same view of the world, and may use different ways of organizing and naming phases.

Exhibit 11-1 illustrates a typical time phasing of LCC effort. The time scale might be anything from a few years to 50 years or more.

Cost as independent variable

In the 1980’s the U.S. Department of Defense apparently decided that it needed a more powerful tool for cost control than DTC, and “Cost As Independent Variable” (CAIV) was born. Understanding of this new approach was probably not helped by its rather odd name, but through aggressive marketing in the military and contractor cost communities the idea spread and eventually became fairly routine. Practice is not perfectly uniform, but here is the general idea.

-

Strong affordability goals (limits, actually) are set by the customer at the beginning of the project.

-

The goal may be for total LCC , or sub-goals may be set for one or more components of life-cycle cost. The contractor is expected to not only live within the goals but also to make a best effort through extensive trade studies to try to do better than the goals. The extra trade studies generally add to the cost of development, perhaps as much as 20% or so, but the DoD apparently believes that extensive trade studies (also called “trade space exploration”) save it money in the long run, especially on major projects.

-

Aggressive cost risk management is expected during development.

-

If it develops that the goals are such that the cost target cannot be reached, a relaxation of the goals may be considered. This option was generally not allowed under the DTC discipline, and is not always allowed under the CAIV discipline.

CAIV generally is not applied to smaller projects. The extra trade studies generally do not make economic sense for them.

Target cost

What if you developed a totally new product that fills a new role never filled by any previous product? Your cost analysts say they can’t find a similar product to compare it to. A product like this that comes to mind is the Segway battery powered “Human Transport System.” We have no idea how much the Segway people are charging for their HTS, or what it costs to manufacture it. But if we were made responsible with trying to figure out what the cost to develop and produce it should be, based on a conceptual design, we would first conduct focus groups to find out what likely customers would be willing to pay.

And if we were rational members of such a focus group, how would we come up with a reasonable number? We would likely proceed to figure how many labor hours we could save by using the machine in our business. We would estimate how many hours per day certain highly ambulatory employees are on their feet walking around, and would take cognizance of the fact that the Segway can move them about three times faster than they can walk.

How much time would they save? What does their time cost per hour, not just salary but also fringe and allocated overhead? Would idle time be reduced anywhere in the organization because people would not have to wait (or wait as long) for parts, authorizations, etc.? Then we might want to consider tradeoffs. What are the alternatives to the Segway? Maybe some of those ambulatory employees could be replaced with e-mail, or a system of pneumatic conveyor messaging tubes. When we got through with our analysis, we would have a pretty good idea what we would be willing to pay for a Segway, and how many we would want to buy. It might be zero if we thought we could get the same or better results by doing something different. Or, it might be millions of dollars if we found that using the Segway could result in substantial savings.

Different members of the focus groups would arrive at different conclusions. But if a sufficient number of people were willing to pay enough money to make it worthwhile to develop and produce the product, we might be willing to proceed.

Once we determine what people are willing to pay, we decide how much profit we need to make to satisfy our investors. Subtracting the desired profit from what people are willing to pay results in a target cost. If we can figure out how to build the product for the target cost or less, we proceed. If we can’t, we pass up this product opportunity.

The process we have just described is called target costing. It had its origins in Japan; then it spread to Germany, and is now widely used in the U.S. For information on implementing target costing, see Appendix B.

Value engineering

Value engineering (VE), also known as value management or value methodology, is a technique for obtaining maximum value from a product or service. Value, for this purpose, is defined as the “ratio” of function to cost. “Ratio” is in quotes because in value engineering “function” is not a number. Rather, it is two word expression comprising an active verb followed by a noun. When necessary and appropriate, an adjective can be inserted between the verb and the noun, or sometimes an adverb after the noun.

Suppose, for example, that you have been given the task of developing and providing some means of stirring paint that is sold in cans. You might consider the function to be well defined by the expression “stir paint.” More generally, you might define it as “blend liquid.” However you define it, the goal is to define a design solution that minimizes the cost for satisfying this function. We will return to that goal shortly and have more to say about it.

Value engineering began at General Electric Company in World War II as a response to shortages of skilled labor, raw materials, and component parts. It was quickly recognized that VE also reduces costs, and that is its main use today. Typically, a VE effort involves a job plan with steps along these lines:

-

Gather information. What are the requirements for the object? What does it do? What must it do? What could it do? What must it not do?

-

Generate alternatives. What are the alternatives?

-

Evaluation. How well do the alternatives meet the requirements? What do they cost?

-

Choose. Select the best alternative and present it for decision.

Recall now the goal previously stated: Define a design solution that minimizes the cost for satisfying this function. There has been some criticism of VE practitioners in that they tend to focus exclusively on the lowest cost alternative without regard for how well it satisfies the function. For that and other reasons, when taking a VE approach to a problem, it is wise to be sure you have included all valid and necessary secondary functions. For example, does “stir paint” tell you everything you need to know about that function? Perhaps “open can” is a secondary requirement. Maybe “fit hand comfortably” is another. If you don’t include them all, you could wind up with a product that makes nobody happy.

Design for manufacturability

Design for manufacturability (DFM) is an idea that became prominent in U.S. industry and elsewhere in the late 1980s and early 1990s. It has saved hundreds of millions of dollars in design and manufacturing costs.

The focus of DFM is to reduce product costs (including design costs) and speed up time to market through design simplification. An enormous lore of DFM has accumulated, and is available in numerous texts and courses. Here we can only provide a flavor of what it is about. Here are some specific DFM techniques that are widely used.

-

Minimize parts count: A lower parts count results in fewer parts to design and fabricate, and reduced assembly time. It also reduces inventory costs, and could reduce requirements for factory capacity. Procurement lead times are often shortened. The main tools for minimizing parts count are elimination of unnecessary parts, combination of two or more parts into a single part, and finding simpler ways to perform necessary functions.

-

Use standard parts. If off the shelf parts are available to perform a needed function, it is almost always cheaper to use them than to design from scratch. Benefits include reduction of engineering design hours, reduction of the amount and diversity of inventories, and reductions in manufacturing tooling. Higher quality could also result. Manufacturing learning curve costs, which can be huge, are usually reduced or even eliminated.

-

Use castings, forgings, and extrusions to eliminate machining for high volume parts.

-

Design items for ease of assembly. This includes providing features for automatic alignment, reduction in the number of fasteners, and use of methods that eliminate fasteners, such as fast setting adhesives. Consider human factors such as the difficulty an operator has in reaching and tightening a nut. Avoid forcing operators to look up into overhead work.

-

Avoid using thin members that easily distort during assembly, slowing down the assembly process.

-

Avoid all processes that require special operations and tools.

-

Avoid small or weak features that can be easily damaged in fabrication and assembly, resulting in scrap and rework.

-

Use through holes instead of blind holes wherever possible.

-

Specify only the tolerances you really need. Fine tolerances are a major cost driver in fabrication. (See Appendix C for a discussion of this important area.) o Avoid specification of small internal radii. The larger the radius the easier it is to make.

-

Do not specify parts that can become entangled, wedged, or disoriented. For example, it should never be possible to mate two electrical connectors that do not belong together.

-

If assembly requires or tends to result in parts lying on the factory floor (such as electrical cables or connectors), damage is likely when workers step on them. This can result in scrap and rework, not to mention injury.

-

Use parts that are large enough to be easily handled. Tiny parts are easily lost or damaged.

-

Consider use of automation when it is cost effective.

Low cost labor (outsourcing)

An idea that has changed the distribution of manufacturing (and to a lesser extent design) activity worldwide is the use of low cost labor. In the past four decades much manufacturing activity has moved from countries with higher labor costs, such as the U.S., Germany, and Japan, to countries with lower labor costs, such as Mexico, Brazil, Taiwan, China, Malaysia, the Philippines, Costa Rica, and South Korea. As this is written, manufacturing direct labor costs in China are about 2% of costs experienced in the U.S., and costs in the Philippines are about 9%. Such low costs create a strong incentive to site production in these countries in order to be more competitive.

But before you take such a step, you need to consider factors other than just direct labor cost. In a typical manufacturing operation you also have freight costs, material costs, indirect labor costs, land costs, facility depreciation, equipment depreciation, utility costs, lease costs, legal costs, licensing and environmental costs, and taxes, as a minimum. Anyone considering establishing an operation in a foreign country needs to evaluate all of these factors, as well as issues of political stability and quality of life. There is also the question of training and productivity. Can the foreign labor force produce as effectively as its U.S. equivalent? How much training will they need?

Very often a tradeoff between manufacturing locally and manufacturing overseas will work out in favor of the overseas option. When it does, and especially when you suspect or know of competitors using overseas labor, you should strongly consider it, if your customer permits it.

Not all lower cost options involve going overseas. For example, your author once worked on a project where a high priced operation located in California structured its bid to take advantage of the fact that it had a division in Colorado where productivity was excellent but labor costs were about ten percent lower. Not all of the work could be done in Colorado because of physical limitations of the plant there, but the bid was reduced considerably by moving some of the work there.

Problems that prevent good estimating practices

Some organizations habitually underestimate their costs yet are seldom called to account for it. When this pattern is once established, it is difficult to break out of it.

In such an organization, costs are estimated not to determine what the true cost will be, to reasonable accuracy, but to determine a number that is politically acceptable. Such a number is often less than half of what the true cost turns out to be. Once the number is accepted, then overrun, the project is usually allowed to continue because it is deemed too important to fail, or perhaps it is too embarrassing to let it fail. Somehow, the money is found to let it continue.

In such an organization, cost discipline is essentially meaningless. It cannot be meaningfully exercised. The only remedy is a harsh awakening that may someday arrive.

Other organizations strive to achieve realism in their cost estimates, but are hampered by lack of historical precedent for what they are trying to do. Realistic, accurate cost estimates are always based on what something else once cost. One remedy for this situation is small pilot projects to explore options and gather information before proceeding with a full scale development. The cost of the pilot project is treated as a no fault investment. This is the approach which has been wisely taken in attempts to harness nuclear fusion energy for commercial purposes. There has been a succession of pilot projects in support of this goal, all of which have failed in achieving the main goal, but all of which have contributed to our general state of knowledge.

A solution that can sometimes be made to work in the event of no direct precedents is to look for indirect precedents. Sometimes a group of indirect precedents can be cobbled together and used to make an estimate based on rough similarity. This sometimes works very well for manufactured products if all required manufacturing processes exist and are proven.

Finally, there is the issue of estimating mistakes. These can creep in to the best managed estimates. We believe that the best safeguard is a good estimating checklist. If you don’t have one, we recommend the one in Appendix D.

Chapter 11 Review Questions

1. Have you worked on a project subject to rigorous cost discipline? Were the targets met? What problems were experienced and how were they resolved?

2. For many systems, operations and support costs over the system lifetime dwarf design and implementation costs. But this is not true in other systems. Can you think of the most likely reason for this? Can you think of such a system?

3. Some manufacturing companies in Asia have established manufacturing operations in the United States. This partially reverses the trend of moving them from the U.S. to Asia. What reasons do you think these companies have for doing this?