Market Cycles

What we will talk about more than any other single thing in this book are market cycles. Allow me to simply introduce you to the term and what it means in the

broadest sense.

One goal of national news organizations is to learn about the general characteristics of the people or situations in the United States and then tell their viewers or readers what the latest trends are. The temptation is to make the conclusion that the general trends presented in the news apply to specific situations in your life. So in the world of real estate, you might hear from time to time that the national market is not good. That’s the news being given as of this writing. Don’t believe it. Or, at least don’t make the conclusion that the generalization holds true across the country.

The same is true for positive trends when talking heads on the news are shouting at you, “Buy, buy, buy!” On the contrary, different markets exist in different locations simultaneously. One market may be on the downswing, with another market being hot, as you will learn. I discovered this quite by accident and learned to identify these markets and predict them. This discovery is the keystone of my system, and the vast majority of real estate guides don’t discuss it.

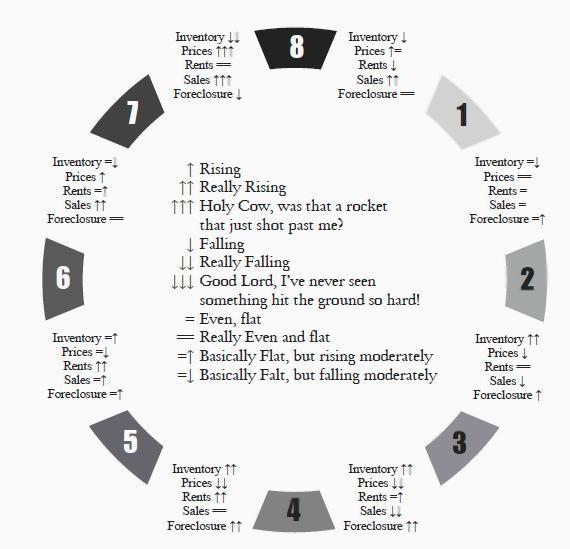

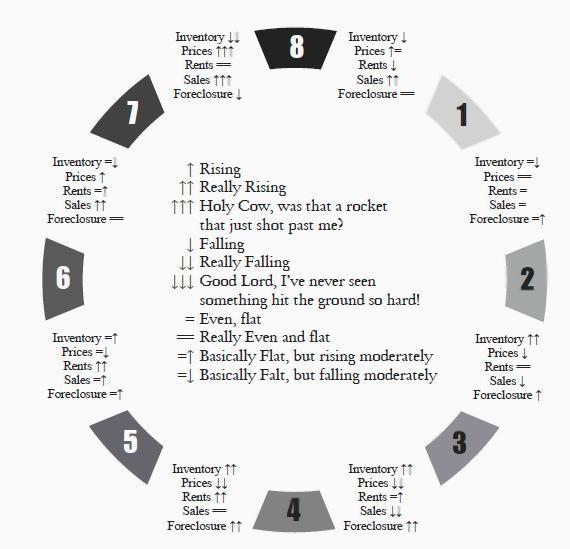

The real estate market is cyclical. Most experts believe the full cycle is approximately twelve to fourteen years. While I agree with this, I break it down into eight steps, each step lasting, perhaps, in excess of one year. The reason for this is that everything in life does not work on a three hundred sixty-five-day calendar. On a practical scale, I am looking at economic indicators, or economical stages, not calendars.

The economic indicators I am tracking are:

• Housing Inventory

• Housing Prices

• Rents

• Real Estate Sales

• Foreclosures

These indicators can be affected by increased job losses, natural disasters, etc., that can change the path of the market.

Everything I teach is based on the fact that we must accept that markets are always moving, always cycling. Look around you: Nothing ever stays the same. The hot music group from five years ago is now on the oldies circuit. Fashions change. New types of restaurants open and close. We live in a trendy society. So yes, even something as basic as real estate land moves and changes in cycles.

Why? Think about anything that is “trendy.” Products, businesses. There are real estate ramifications to a lot of the trendiness around us. Rubik’s Cubes were really cool a number of years ago. If your town had a Rubik’s Cube factory, employment was high back then. But I’ll bet that factory is closed today. We are in the era of “Future Shock.” They say that fifteen years from now, most of us will be employed in industries that do not even exist today. How could that possibly not affect real estate markets? And it’s not just manufacturing. Big metal and glass office towers with white collar workers move around the country. Why? Management is always looking to improve the bottom line. If real estate costs and labor costs are too high where corporate headquarters are today, management thinks nothing of picking up and moving to a less expensive location several states away. Cycles. Lots and lots of cycles.

There is also a trendiness to homes themselves. Builders build what the market wants to buy at any point in time. Look at post World War II homes. Compare those to 1950s designs. 1960s, 1970s. Now compare all those to new construction today. In each era, things were different, often vastly different. Today, big kitchens are in, big master bedrooms, lots of closet space, vaulted ceilings and bay windows.

Years ago, other amenities were more desirable. So when new housing product comes on the market, that’s where people want to go. This means that something else, some other type or style of housing, gets left behind, vacant. What happens to it? Lots of things. Maybe poorer people move into it. Maybe no people move into it. That affects real estate markets. Areas go to seed and values diminish. Meanwhile, everyone has moved to new developments in another town. But then, the cycle turns around again. A developer gets incentives to come into the old market area and he knocks down those old homes and builds new ones, newer now than the ones in that other town. Suddenly, the area that once had those older homes is now the hot new place to live. Cycle, cycles, cycles.

While this concept has been widely accepted in the stock market, it has been strangely ignored in real estate investing. Perhaps this is based upon the fact that real estate will, given an infinite amount of time, always appreciate in value. Unfortunately, we, as mere mortals, do not have infinite time on this earth. A buyer of stocks knows to “buy low and sell high.” For the most successful investors, it is a bloodless business decision. They catch a hot tip and buy a “growth stock.” They watch it climb, rooting it on like a race horse they just bet on at the track. As it climbs and splits (the stock, not the race horse), exhilaration grows. But then, it reaches a point where nothing much seems to happen. An apex a plateau is reached. It’s still a good place to be; it’s a much higher place than where you started. But then it begins to drop a bit. Is this the “big drop?” Hard to say. This is where the consistent winners out-earn the other guys. The winners are the serious guys who investigate why the stock has plateaued and why it is beginning to drop. Is it something minor, like a temporary lack of confidence as the company gets ready to roll out a new product? Or is it that a competitor is hard on their heels with a new and improved better product? The smart guys know; the dumb guys guess. What’s more, if it is definitely a real, genuine downturn, the smart guys get out in a flash, while the dumb guys wait around, emotionally wrapped up in how good it felt to cheer that stock on when it was rising.

In real estate investing, way too many otherwise smart people act like the “dumb guys.” They are far more prone to getting sentimental and emotional about the properties they buy. And why? Because it’s real. They can see it, touch it, visit it on Sundays and eat an ice cream cone in front of it. You can’t do that with some tech stock.

Another reason we don’t give proper respect to real estate cycles is that we often focus on the wrong properties. Stable desirable areas rarely take a big hit, even when all the other local economic indicators race south. Think about it. Every place, no matter how depressed, has a couple of rich guys. It’s inevitable. And those guys need a place to live. And if they die or retire to Florida or move, there’s probably some new young rich guy who’s spent his whole life growing up wishing he could live in that old rich guy’s mansion. That young guy will pay whatever it takes to move in, no matter where the market cycle is. (Now obviously, the mortgage meltdown of 2008 has put this theory to the test, but you have to consider the stated income loans allowed people to purchase properties they couldn’t afford in the first place.)

Tracking the five major indicators, here is what a real estate life cycle looks like:

Notice that we have eight stages, and that each stage indicates what is happening regarding local real estate inventory, prices, rents, sales and foreclosures. Our key is that things are either: