3. Proof: 22 Trades in 22 Days

Time for the proof, but before I do I want to make the point that during the 22 day period that is being analysed, I always aimed to make at least the amount of my risk back on each trade, and more if possible. The risk/reward of a system is very important and it would have been vastly easier to create the winning streak with a system that risked more than it stood to gain on a trade, than one like mine - which always aimed to make at least my risk back on each trade.

If you don’t know the ins and outs of risk/reward ratio in trading and are fairly new to this stuff, I recommend you first spend some time completing some of the beginner lessons at babypips.com.

This ebook doesn’t provide many trading basics, but there are plenty of great cheap and free resources around the internet that can get you started in the world of forex.

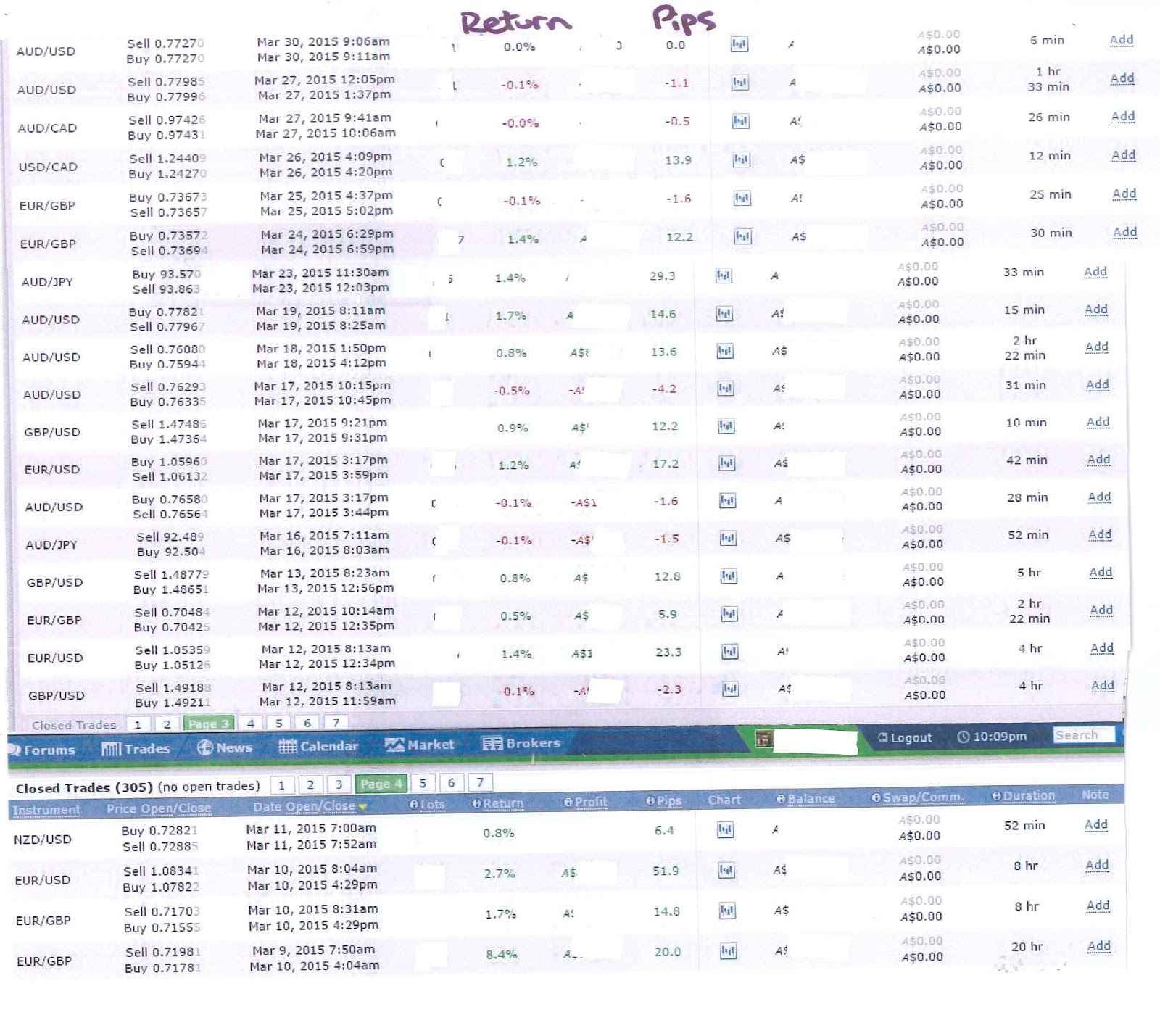

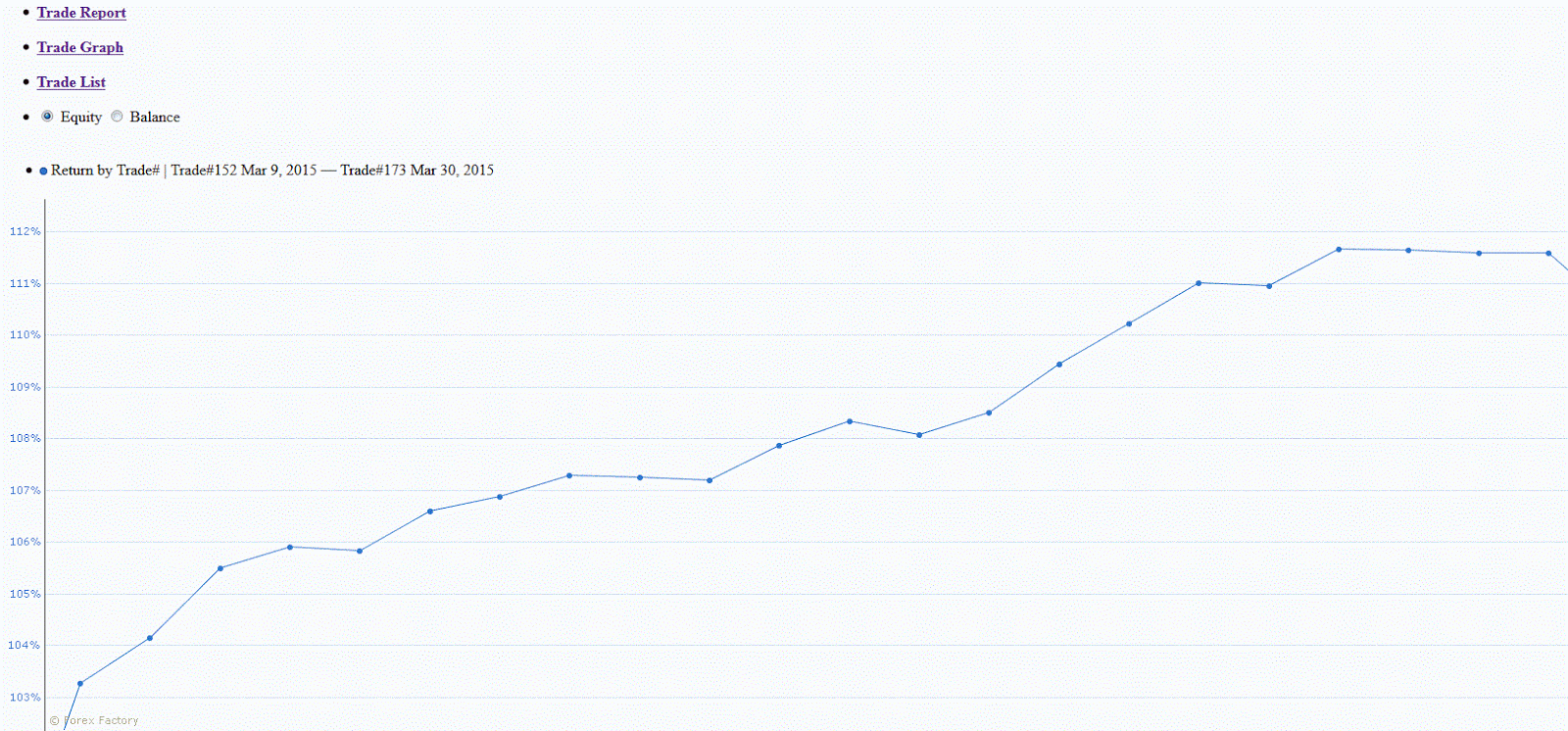

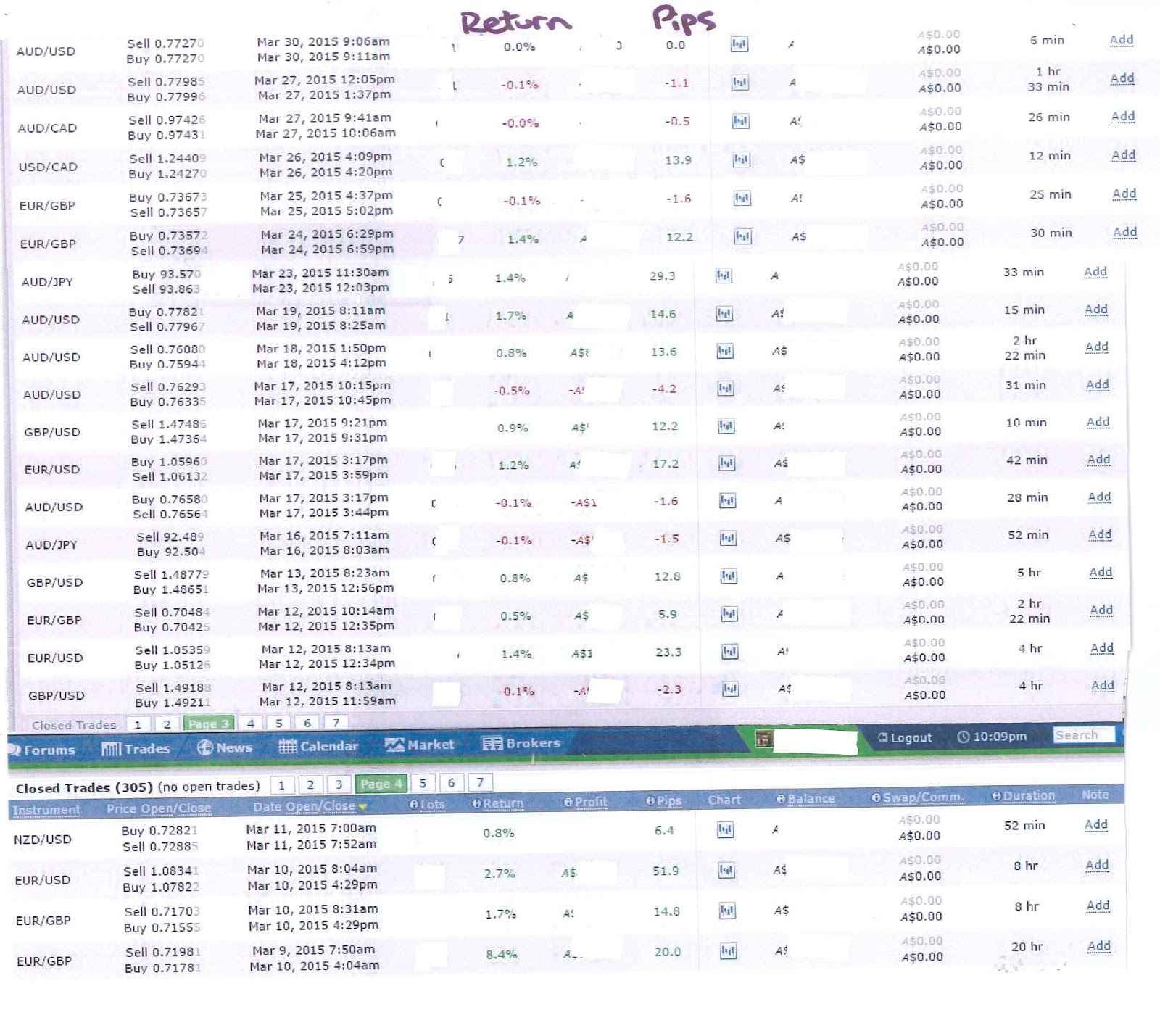

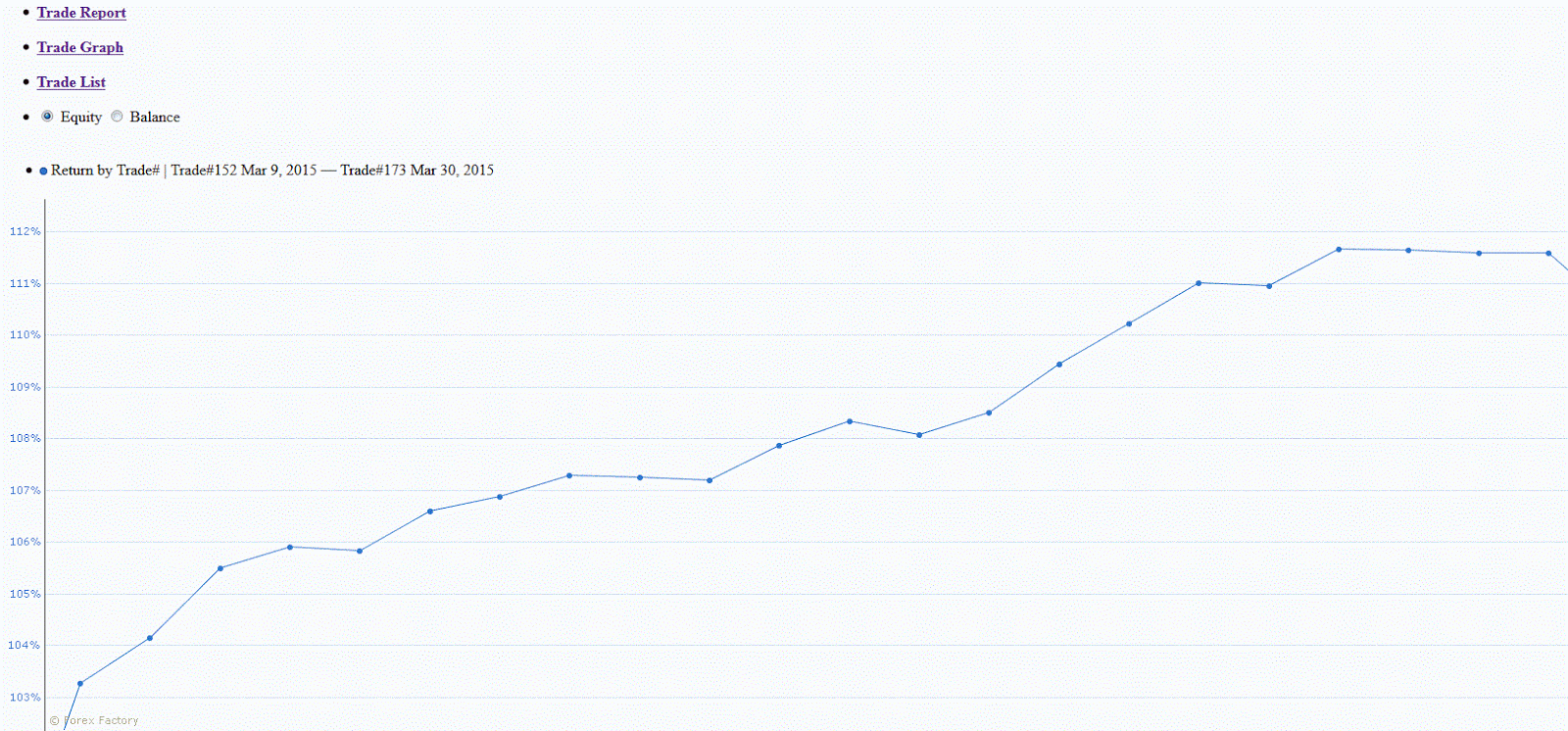

The following is my equity curve for the trading period, so you can be sure the list of trades for the trading period were sequential.

All losses in the sample that were equal or less than the spread I have not labelled as a loss. These trades were closed at break even, but given the volatility of the forex market, the spread and/or slippage, around a pip loss occurred in a few cases. This loss was not significant in the context of the risk taken on each trade.