ETF‘S

Exchange-Traded Funds (ETFs) are basically securities that closely resemble index funds, but can be bought and sold during the day just like common stocks.

They offer the simplicity of a stock trading along with the diversification of a mutual fund, giving us the ability to trade broad groupings such as, whole market indices, industry sectors, international stocks, bonds, currencies, and even commodities, thereby minimizing risk by not being directly subject to the whims of some specific companies‘ CEO, CFO, market makers, and analysts who are all pumping (or dumping) their respective firms for their own selfish reasons.

You are probably already familiar with the most popular ETFs such as the S&P 500 SPDR (SPY) or Nasdaq 100 Index Tracking Stock (QQQQ), or the Dow Jones Industrial Average (DIA)

Additional Benefits Of ETF’s

Reduced risk of substantial loss - Do you ever wonder if you are going to wake up in the morning and find out your stock dropped 50% because the CEO was caught with his hands in the cookie jar? ETFs are automatically diversified equities, which greatly reduces this risk because there is minimal exposure to any one individual stock. In the iShares Semiconductor Index (IGW), for example, the biggest holding is Texas Instruments, which only has an approximate 8% weighting in that ETF. By trading ETFs, you can greatly reduce the risk of a trading catastrophe.

Access to more markets - With ETFs, you now have access to markets that were previously difficult and expensive for retail investors to participate in. Government T-bonds, international markets, commodities, and even a currency ETF can all be traded with the same ease and commission cost of an individual stock. With new ETFs being created every month, the realm of trading opportunities keeps growing.

Liquidity is never an issue - Unlike individual stocks, in which liquidity can greatly affect how a stock trades, all exchange traded funds are synthetic instruments. As such, the amount of average daily volume that an ETF trades is, for the most part, irrelevant. Even if a particular ETF had no buyers or sellers for several hours, the bid and ask prices would continue to move in correlation with the market value of the ETF that is derived from the prices of the underlying stocks. An ETF with a low average daily volume may sometimes have slightly wider spreads between the bid and ask prices, but you can simply use limit orders if this is the case. We trade for points, not pennies, so paying a few cents more on occasion is not a big deal.

Lower trading commissions - Prior to the inception of ETFs, if you wanted to buy a basket of stocks within a particular industry sector, you had to pay a separate commission for each stock you wanted to buy. However, through trading in the sector-specific ETFs, you now only pay one commission to buy or sell short an entire group of stocks within an industry.

Better odds of follow-through - You have identified a particular sector you would like to be in, place the trade, then watch every single stock in that sector go in the right direction EXCEPT the one you are in!

Has this ever happened to you? With ETFs, you are at less risk of buying or selling short the wrong stock because you are buying or selling short an entire group of stocks within the sector or index. If you buy the Biotech HOLDR (BBH), it does not matter much if Morgan Stanley has a big sell order on Amgen because you also have exposure to many other stocks within the Biotech Index.

No uptick rule - Unlike individual stocks, ETFs are not subject to the uptick rule that prevents the short sale of stocks on a downtick. This makes selling short an ETF much easier and quicker than with an individual stock.

At this point I will say that you have learned a good deal about some of the realities of trading in today‘s markets…

Are you now ready to see what we can do for you?

If so, please read on… If not…I hope you learned something new about How The Market Really Works and use that knowledge to your benefit somehow…. The rest of this ebook will probably not be useful to you.

I wish you success! Robert Dorfman

Ok..for those of you who have made the intelligent choice to continue learning more, I will show you how our service works

THE ALERTS

So if you are considering trying us out, you should be wondering how we share the trades with you.

Well real simple….. We use a very efficient multi-national SMS text message system which sends the alerts to our subscribers instantaneously direct to your phone …. almost anywhere in the world.

This is an example what they look like when received on your cell phone……. ..

(New Trades)

ALERT… buy DIA @ 85….

(note….because of our usually minimum 3 to 1 reward to risk ratio, you can enter the trade anywhere within $1.00 of the alert price and still benefit)…..

Or…..ALERT… sell short XBI at 45.00….

(this means that you can enter the trade anywhere between $44-46.00 if you missed the exact price)

ALERT…buy INTC @ 12.35….

Some alerts will give a specific price range ……

ALERT..buy DIA @ 85-86. …(so you should not enter below or above those prices)…

We are not too concerned with exact entry prices since we are not scalping. Our profits are usually in the 2-10 point range.

You should however enter the trade as soon as the alert is received to maximize your potential gains…which is why you should act in real time.

Also note … due to our sub-market buying and selling tracking which may not be reflected in what the market is doing on a given day, we will at times have draw- downs.

Professional traders always expect and have them. It is how you handle them that counts.

It is this underlying buying or selling that drives our alerts, NOT what is happening in the markets on a daily basis, so it may take a few days to see our trades turn profitable as the market tries to shake out the weak hands of those who are just luckily tagging along just as you have learned.

Remember…. we are trading with the “smart money” crowd. …where

NOTHING is obvious.

Is it fool-proof? ….Absolutely not …,sometimes the bigger institutions will turn us into the weak hands and force us into closing our positions… probably with just a small loss…and then we watch the trade immediately turn back around on us.

It WILL happen… There is nothing we can do about it…. Has that happened to you before?

But….to give you an idea of our success rate, in Feb 2009 we had 18 trades and only one lost an insignificant amount of money…….. 17-1 not bad….. MAY 2009 generated 80 points!! June, 6+ , and July, 22+ ….

CY Young numbers…..

But again it is not foolproof . …..Big unexpected market news always trumps algorithms no matter what the smart money is doing…..

Also realize that not every alert will pertain to you…You will probably not be in every position we broadcast possibly due to limited available trading capital.

….Nothing we can do about that either. Just delete them.

You can expect an average of 5-7 new trades per week….and since we are not specifically day trading, you can easily enter the trade with your broker via phone or by internet at or near the price we recommend… even if the alert is a few hours old

Later on I will show how what an alert looks like when we take profits or close a position..

You should keep track of your positions in your notebook if you do not have your computer handy during trading hours.

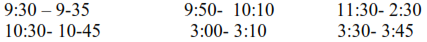

Note… very rarely do we send any alerts between 11:30 AM – 2:30 EST.

This is actually a reversal time in the markets due to some program trading, market makers taking lunch, market review etc.....so this is a great time for you to take care of your other personal or business related projects and not worry about missing too much here.

FYI…..Some other key market reversal times are as follows:

RISK/MONEY MANANGEMENT

Now that you understand the alerts themselves, you must then determine how many shares you are to buy when entering a trade…… This is crucial to your long term trading success!!!!!

The answer is not however many you can afford!

We HIGHLY recommend that you follow this money management guideline which will teach you how to keep your risk to a minimum whether you utilize our service or not.

This is part of the trading process where you will need to do some math… simple math…. but math none the less/// but let me start by saying that proper risk control is the foundation of long term survival for all traders… …..no matter how much you have to trade with.

Because of our track record, I do not want you to have unreasonable expectations by taking huge positions on our alerts because you are anxious/excited to start making big money.

Large trading profits are gained and compounded over time by winning consistently and conserving capital in the short term..

Trading in positions that are too large for your specific risk parameters result in larger than average losses and is the #1 reason many new traders quickly go broke.

The urge to make more money more quickly will always be a battle you will be fighting.

You must resist those urges and just accept the fact that as a professional trader your #1 priority is capital preservation and taking home numerous small to medium size gains of 2-10% within a 2-10 day time frame…but extrapolating a

5% gain in 10 days equates to 180% annual return …….

multiply that by the number of trades you enter in a year and you will have enormous realized returns…just like our other clients do

So contrary to popular belief, trading is not about trying to hit home runs with big positions and taking substantial risk…. unless you are a true gambler …..then by all means go for it……but don‘t blame me for your large losses…..

Consistently hitting singles and doubles and of course the occasional triple and home run is how pros build their bank account with dynamic results…

No matter what stories you hear about from some people who say they doubled or tripled their money in a short time.. (yes it does happen), but I can guarantee you that luck probably played a significant role…and like playing in a casino, luck soon runs out….

But you only hear about the big win… not the previous or subsequent bigger losses…

I can absolutely assure you that there is a direct correlation between correct position size and higher profitability.

Some losses are inevitable even with our service, but correct position size results in smaller insignificant ones. …..But sometimes we all get greedy… especially when our alerts are so accurate …giving even us a false sense of security….. So it is inevitable that whenever we disregard our own position size rules hoping to make a quick big kill…..we get smacked back to reality…. Almost as if the market knew we went against our plan and we are stuck with a sizable loss…..

Don’t make those mistakes.

Some of the best traders in the world earn 80% of their profits from only 20% of their trades (the "80/20 rule") because they strictly control their losses….. But if the stock doesn‘t do what they expect it to do—they quickly close it out and move on to the next trade. No big deal.

Those small losses can be considered your trader club dues. We all pay them

It is therefore imperative to stay in control of your emotions, the greed factor, and these position allocation rules….

Now I am going to assume that you already have an online or standard brokerage account and have set it up with margin trading ability… If not, I suggest you contact your broker immediately and tell them you want to open a margin account.

If you are not familiar with margin, it is basically a low cost loan from your broker who matches the amount of funds you have on deposit with them in order to give you more buying power….. or leverage….This margin will give you 2 to 1 leverage on your money and also allows you to sell short.

While there are some inherent risks when trading on margin, we have built in margin related risk controls in our service which you will discover more about shortly…….. so do not fear leverage. But it is your choice to use it.

Now let‘s learn how to determine what your proper maximum position size should be…..These steps should be taken methodically whenever entering a new trade to properly protect your trading capital.

But the first risk management myth I want to dispel is the balanced position size myth…which says you should enter every trade with the same 100, 500, 1000 or 2000 share allotment size for no real reason except…it‘s easy.

While it seems like the proper thing to do because it is easy,…. it isn’t proper………

For example, taking just a 2% loss trading 1000 shares of a $50 stock will have way more impact on your account than a 2% loss on 1000 shares of a $10 stock if not calculated correctly….. a 2% loss on the 1000 share $10 stock position, the loss is only be $200, but the same 2% loss on the 1000 shares of the $50 stock, the loss is $1000…. 5X greater!.. Think of the negative impact a loss like that would have on your account.

A $200 dollar loss is certainly manageable for most people but a $1000 loss would probably cause some pain for their account..….

Without proper risk management and discipline you will be trading in the dark regardless of how many winning trades you enter and subjecting your account to undue risk.

You will learn to correctly calculate the 2% risk amount in a moment.

Since we do not know is how much you are trading with to correctly calculate your true exact risk amount, I am presenting to you a somewhat generic risk management method that will still properly teach you how many shares to enter for each trade based on your available buying power.

This is the only part of our service which you need to do on your own…

“Do not risk thy whole wad” is the first rule of trading. Dr. Alexander Elder

The 2% Risk Management Rule

Basically what the 2% risk management rule says is that no one position should represent more than 2% risk to your entire portfolio.

Calculating this strategy starts before, not after the trade.

All too often we hear our clients say that they loaded up on one of our alerts to maximize their gains. However, That is NOT what we teach..... .

When I or my traders look at a potential trade, a large portion of our time is immediately spent identifying the risk/reward ratio to validate the trade.

We need to know at what point that if a trade does goes against us exceeding our risk/reward analysis, that we are going to cave in and say this trade just did not go as we or marketlogicdata predicted.

Our traders further know that if a trade does not offer at least a 3-1 risk/reward ratio, they cannot send it out to our trade signal clients.

So don't view an alert in terms of how much more you can gain by maxing out your account to make more money, you must look at it in terms of how much of your account you are willing to risk on one trade.

This starts with knowing your available buying power and how to properly calculate this rule

The 2% figure does not mean you can only use 2% of your account balance for each position…… or that your entire risk is 2%,…no …..

Here is what it means….

Example: (for non-margin accounts) If you have a $10k portfolio ready to trade with, multiply that amount by 2% which gives you your portfolio risk amount which in this case = $200 … …($10,000 x 2%)

This $200 represents how much you can afford to lose on at least your initial trades

As a trade signal client client, you can assume that we will usually not ever lose more than $2 per share on any one trade... (position risk)

So for your calculations in determining the correct amount of shares to buy, you could use the $2 figure and be well within an acceptable risk level.

Example: ALERT... buy DELL @ $11 ......Now take your $200.00 portfolio risk amount and divide it by the $2.00 position risk and you come out with 100.....

This means, that as long as you have the available buying power, you can safely purchase a maximum of 100 shares of DELL @ $11

If our stop loss exit gets hit at or near the $2.00 risk per share figure, which in this example, DELL would have to trade down to $9, your loss would only be $200… (100 shares x $2 loss per share= $200) )

Another Example/..

Let‘s assume that you still have the $10,000 balance and the next alert comes……ALERT.... Buy IYG @ 55.5 ... ..

Now take your same $200 portfolio risk and divide it by $2.00 same position risk and once again, you come out with 100 of course.

So you could continue buying 100 shares of a new trade as long as your portfolio maintains the $10,000 balance and you have the available buying power to enter new trades.

Now as your trades move in real time, your portfolio balance will fluctuate. So when you want to enter a new trade, you will use your updated portfolio balance to see if it is possible to do so.

So let‘s assume your account goes to $10,950 after those two trades close out. Let‘s see what happens next when we adhere to our 2% risk parameter calculation before entering a new trade…

ALERT ... Sell Short GLD @ 95.25...

So you now know that your new portfolio balance is $10,950 , x 2% portfolio risk now = $219 ….. Divided by your position risk of $2.00 which equals 109.5 ... obviously you would round up and you could safely sell short 110 shares of GLD

However in this case, you would be maxing out your account on this one trade.

(110 x 95.25 = $10,477 of your $10,959) which I don‘t recommend.

You may want to skip this alert and wait for another lower priced one to maintain a proper risk reward balance for your account.

Ok one more.. ... ALERT… buy FLEX @ 7.35

For this one, lets‘ say your portfolio balance is $57,500... x 2% portfolio risk= $1150 divided by your position risk of $2.... you could therefore buy 575 shares... ………………………..Did you understand that?

Now .. If this 2% figure seems like too small amount for you to risk because you have mucho dinero or risk capital to play with and don‘t mind taking higher risk....you can raise your portfolio risk to 3%.... some successful traders even use 5%...... I don‘t recommend it .. but that is up to you.

Now that you hopefully have that down,

I am going to present you with our proprietary 2% Rule calculation used for margin accounts

OK….Let‘s add the fact that you are trading on margin into the equation and that your broker calculates your Available Buying Power (ABP) (usually twice your cash balance) in real time for you, then this is how you would calculate the 2% risk management formula

Let‘s say you are starting out with the same $10,000 trading capital but now it is in a margin account… which means your Available Buying Power is actually $20,000...(2X)

The first thing you need to do before you enter any trades is multiply the 20k by 30%....... which is your "set aside" % amount....This is the amount of your actual buying power that you “set aside" and do not use for trading purposes…

This capital cushion serves as an additional protection layer to absorb draw-downs to ensure against receiving margin calls.

In the example above, you would be setting aside $6000 of your account balance that will not be used to calculate buying power when entering new trades......which in this case, would leave you with $14,000 Usable Buying Power (UBP) to actually trade with.

Using the same formula you learned earlier, you would still multiply the $14,000 x the 2% portfolio risk figure …..this gives you $280 risk per trade.

Now just as before, divide that $280 by your same assumed $2.00 position risk amount giving you 140 shares to enter new trades (280/2) ... this gives you a little higher risk level based on your actual portfolio cash balance, but it is still within acceptable risk limits.

The key to this formula is to always calculate your UBP after the set aside amount has been deducted from the ABP for new trades.

So now you want to enter a new trade………

Let‘s say your initial $10,000 has grown to $15,760 which means you have $31,520 actual buying power..... deduct the 30% "set aside" amount ($9456) which leaves you with $22,064 UBP x 2% portfolio risk = $441 risk for this trade..

Again now divide the risk per trade by your $2.00 position risk which = 220 which is how many you should purchase for this trade.

As your account grows, you will be trading with more shares...same risk… Now lets‘ say your cash deposit to your account is $125,000.....great.... your broker has now given you $250,000 actual buying power ... so deduct your 30% set aside amount of $75,000 leaving you with $175,000 UBP..... at least for your first trades..

Note.. there will be some trades you will have to pass because you do not have enough buying power to buy higher priced stocks because doing so it would exceed your UBP...Simply wait for a lower priced stock alert signal, or just buy a lesser amount of shares if you want to be in that particular...(suggested min 100)

Ok…..ALERT…buy AMGN @ 55.15... so...$175,000 x 2% = $3500 position risk....... divided by $2.00 risk per trade = 1750 shares… MAX.. .... so in this case you would be buying a max 1750 shares at 55.15 using $96,512 of your $175,000 UBP, leaving you with $78,488 buying power for additional trades.

This strategy allows you to have a few consecutive losing trades, and still stay alive till you hit the big winners and still grow your account.

Note... sometimes things may happen like price gaps that'll exceed the intended 2% portfolio risk... but we will be doing additional analysis to determine whether to stay in the position or not............... We Never Panic.... Nor Should You

ALSO…..another good rule to sound money management is that you should never have more than 10% exposure of your UBP on at any one time. …So this effectively means that you may have up to 5 trades on with the 2% risk factor, or 3 at 3% so you can sleep even better..

Remember This Formula.....

Portfolio Balance (including margin) = your Actual Buying Power (ABP) x

30% set aside = Usable Buying Power (UBP) x Portfolio Risk amount (2%)

divided by Position Risk ($2) equals the number of shares to purchase or short

Remember to always verify your UBP to ensure that you can enter a new trade with a minimum of 100 shares.

You do not have to use the maximum number of purchasable shares. You may reduce the amount to buy to 1000 if the max allowed was, say 1200 or whatever which will leave you with more buying power for additional trades.

This risk management process may seem odd, unusual and maybe even uncomfortable, especially if you have OCD like me and like round numbers, or are just too lazy to want to calculate it before entering a trade…. I understand….but it truly is the only sure fire method of proper risk control.

It is not trading equal share amounts because you like it that way…… sorry to tell ya ……

TEST……Ok...for 1 million dollars .....tell me how many shares you would buy if you started with a $35,000 deposit in a margin account using our formula.... The answer is below

Additionally…..

Now that you are making money consistently, you may want to take out some of your profits to enjoy the fruits of your labor.

Many of our clients take out half their profits every month to use as they wish and leave the rest in the account to trade with.

This is a good idea because it simultaneously builds your trading account and gives you the additional spending money to use for whatever you need or want.

Test Answer... 490 ($35,000 x 2 (margin) = $70,000 ABP x 30% set aside = $49,000 UBP...x 2% portfolio risk = $980 / $2.00 position risk = 490 max shares.. Did you get it correct? Great!!! Guess what????? only joking about the million dollars………..but you could earn that much using this risk management process!

Selling Portions Of, and Closing Out A Position

Now that you have properly bought the correct amount of shares using the above rules, you will now be advised via text alert when we are selling a portion of or closing out a position.

Here is how this part goes.. (note….. you should have always have your notebook or a piece of paper handy to keep track of your current positions and balances so you Always know where you stand with your open positions,, especially if you are on the go)

All alerts which go out regarding selling an open position will specify the portion or "lot" size. This is because we are always taking profits when they are presented by selling in1/2 lots as the stock is moving up .

So….. let‘s say you bought 900 shares of SSO….

Then the next day an alert comes…ALERT.. .sell ½ lot SSO @ 25.35…. now obviously we do not know how many shares you bought, so it is up to you to figure out what half your position is…..so with this trade you should know to sell 450 shares.. (1/2 of 900)

This obviously leaves you with 450 shares still trading… Now let‘s say a day or so later we send this alert ALERT…. sell ½ lot SSO @ 29.00…..

This means that you are to sell 225 shares.. (half of your remaining 450)

This will leave you with 225 shares still working for you … It is not imperative in all cases to sell exactly half…you may