How to Guarantee Profits on Profitable LEAPs

Look at the above LEAP (spreadsheet will be on the page before this in the Adobe Acrobat version) and you will see it has been very successful and profitable. The LEAP has gone from $3.12 on November 15, 2006 to its current price of $6.90, more than double. And you will see that you have started with 35 contracts (3,500 LEAP shares) and now own only 17 contracts, or 1,700 LEAP shares left. AIM is doing what it's supposed to – selling profitable shares for you.

And we still have until January 2009 before this LEAP expires. How can we guarantee that we keep these (paper) profits on the remaining 17 contracts without selling now? How can we hold on and see if we will get even more profits in the future, to protect ourselves if AT&T has a sudden downturn? This simple answer and it's called a "stop loss".

Below I will give you the formal definitions of several types of orders and stop losses and explain how we can use them to protect earned profits and let us still strive for higher future profits.

Market Order

A market order is a buy or sell order to be executed by the broker immediately at current market prices. As long as there are willing sellers and buyers, a market order will be filled.

A market order is the simplest of the order types. Once the order is placed, the customer has no control over the price at which the transaction is executed. The broker is merely supposed to find the best price available at that time. In fast-moving markets, the price paid or received maybe quite different from the last price quoted before the order was entered. And you can't place a market order after the market is closed the night before. I favor only using limit orders when you're dealing with LEAPs.

Limit Order

A limit order is an order to buy a security at no more (or sell at no less) than a specific price. This gives the customer some control over the price at which the trade is executed, but may prevent the order from being executed (filled).

A buy limit order can only be executed by the broker at the limit price or lower. For example, if an investor wants to buy a LEAP but doesn't want to end up paying more than $4 for the LEAP, the investor can place a limit order to buy the LEAP at any price up to $4. By entering a limit order rather than a market order, the investor will not be caught buying the LEAP at $4 or higher if the price rises sharply.

A sell limit order can only be executed at the limit price or higher.

A limit ordered to buy may never be executed if the market price surpasses the limits before the order can be filled. Because of the added complexity, some brokerages will charge more for executing a limit order than they would for a market order. I haven't found that to be true nowadays. And you can execute limit orders that are "good till canceled" which means the broker will keep the limit order open for three months automatically so you don't have to worry about missing a limit order buy or sell because you were watching the ticker every minute.

Stop Order

A stop order (also stop loss order) is an order to buy (or sell) a security once the price of the security climbed above (or dropped below) a specified stock price. When the specified stock prices reached, the stop order is entered as a market order (no limit).

With a stop order, the customer does not have to actively monitor how we stock is performing. However because the order is triggered automatically when the LEAP price is reached, the LEAP price could be activated by a short-term fluctuation in a security’s price. Once the stop price is reached, the stop order becomes a market order. In a fast-moving market, the price at which the trade is executed maybe much different than the stop price. The use of stop orders is more frequent for stocks, and futures, that trade on an exchange rather than in the NASDAQ stock market.

A sell stop order is an instruction to sell at the best available price after the price goes down below the stop price. A sell stop price is always below the current market price. For example, if an investor holds the stock currently valued at $50 and is worried that the value may drop, he/she can place a sell stop order at $40. If the share price drops to $40 for whatever reason, the broker will sell the stock at the next available price. This can limit the investor’s losses (if the stock price is at or below the purchase price) or lock in at least some of the investors profits (if the value of the security has risen between when the security was originally purchased and the stop order placed).

A buy stop order is typically used to limit the loss (or to protect an existing profit) on a sale. A buy stop price is always above the current market price. For example, if an investor sells a stock short (selling short) hoping the stock price goes down in order to give the borrower shares back at a lower price (covering), the investor may use a buy stop order to protect himself against losses if the price goes too high.

Stop orders are the complement of limit orders. In a stop order, a desired selling price (ask price) is always below and a desired buying price (bid price) is always above the current price. In limit orders it is the other way around; the desired selling prices above and the desired buying price is below the current price.

Stop-Limit Order

A stop limit order combines the features of a stop order and a limit order. Once the stop price is reached, the stop–limit order becomes a limit order to buy (or to sell) at no more (or less) than a specified price.

As with all limit orders, stop–limit order may never get filled if the security's price never reaches the specified limit price.

A trailing stop loss is a slightly more complicated version of the stop loss order in which the stop loss prices set at a fixed percentage or value below the market price. If the market price rises, the stop loss price rises proportionately, but if the share price falls, the stop loss price doesn't change. That method allows the investor to set a limit on the maximum possible loss without setting a limit on the maximum possible gain, and without requiring paying attention to their investment on an ongoing basis.

A trailing stop order is similar, but based upon the stop limit order. With a trailing stop limit, once the price drops below the stop, a limit order is executed with the limit price equal to the final stock price.

The difference between the two is that the order executed with the trailing stop loss is a market order. If the share price continues to fall after the stop price is reached, but before the shares are sold, they can be sold at a lower price than the stop price. With a trailing stop limit, the shares will not be sold at less than the stop price (but with any limit order, it is possible that the limit price will never be reached).

Trailing-Stop Order

A trailing-stop order is an order entered with the stop perimeter that creates a moving or trailing activation price, hence the name. This parameter is entered as a percentage change or actual specific amount of rise (or fall) in the security price.

Here's the example explaining how trailing-stop limit losses work:

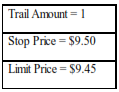

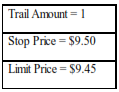

Example: You’re long 100 shares of XYZ with the current market price of $10.00. You set up trailing stop limit sell order with these perimeters:

Your trailing stop order calculates a limit price "Delta" using:

Stop Price – Limit Price = .05

The market price rises to $12.00; now your trailing stop price has risen to $11.00, and your limit price is at $10.95. The price drops to $11, and your limit order for $10.95 is submitted.

I hope that wasn't too technical for you. Basically what we did to keep it simple for AT&T is to put in the "stop loss" at $6.00 when the price was $6.90. That stop-loss order is only good for 60 or 90 days (brokers don't like keeping long–term stop or limit orders on the books – too complicated). What our stop loss order means is that our broker will sell those 17 contracts at $600 a contract or 17 X $600 equals $10,200. We have protected our profits. And we can copy the trailing stop loss. Say AT&T goes to $10.00 on April 5, 2007 – we can cancel our stop loss at $6.00 a share and put in the new one at $9.00 a share. Then if AT&T slips from $10.00 to $9.00, the broker will sell our LEAPs contracts at $900 a contract or 17 contracts X $900 equals $15,300. Pretty neat way to protect profits!