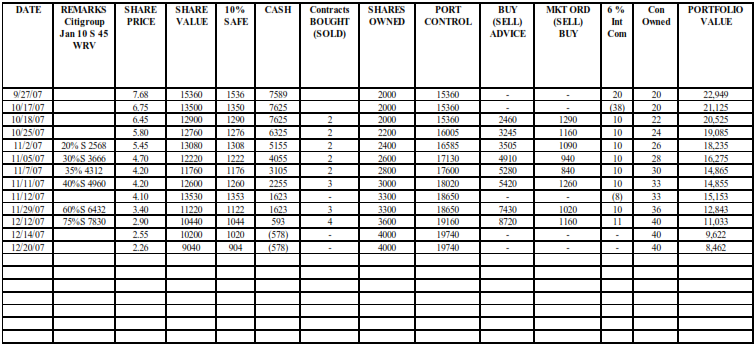

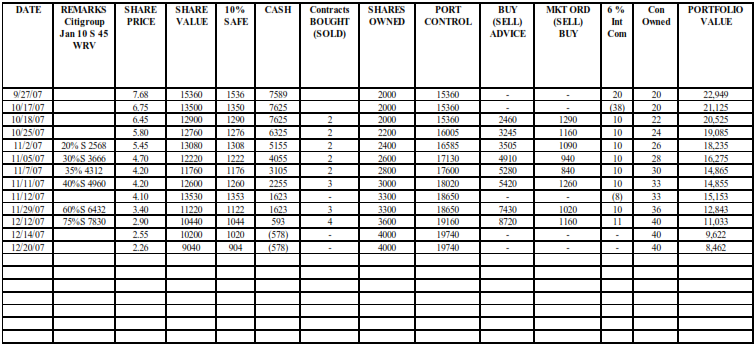

Remember my cardinal rule for investing – buy at or near the 52-week low. But even with that strategy, you can't guarantee that you will buy at the absolute bottom. So even with the "conservative" LEAPs, you run the chance of a sharp drop before the LEAP recovers. Again be cautious on when to make the buys and be cautious on how much you buy. When you see that 75% S above in the REMARKS column, it means that instead of a 10% SAFE (or 10% of the SHARE VALUE) I used a 75% S (or I used 7.5 times the amount of the 10% SAFE or I used 75% of the SHARE VALUE price for the SAFE amount.

Thus in the example above which you'll find somewhere in that spreadsheet PORTFOLIO CONTROL $19,160 – SHARE VALUE $10,440 = $8,720 - 75% SAFE $7,830 = about $1,000 worth of new LEAPs to buy. Thus I only bought $1,160 worth of new LEAPs at $2.90 a LEAP or bought 4 more contracts. I wanted to be very cautious in case Citigroup went down further. As you can see from the spreadsheet Citigroup did go down further. But I feel a small buy at $2.90 was still warranted because we don't know what the bottom will be and $2.90 to me is still a good price to buy some more Citigroup LEAPs at.

I am also changing the initial CASH/LEAP ratio I recommended for LEAPs. Let's be conservative in the future and go 50% CASH and 50% LEAPs instead of 2/3 LEAPs and 1/3 CASH. It will be better to have that extra cash to make buys with.

So let's summarize the advice I'm giving you for LEAPs in bear markets:

1. Analyze the parent stock very closely before buying the LEAP. Have a look at historical prices in Yahoo Finance. Stick with more conservative, blue-chip stocks in the beginning until you get experienced with LEAPS. They can still be risky but will offer greater upside potentials when the market goes back to the bull.

2. Don't make the first buy until the LEAP price has dropped 50% from what you initially bought it at. Make future buys using high bear SAFE amounts like I talked about above. Try to keep your actual buys around $1,000 saving your CASH for future buys if the LEAP goes lower.

3. Start with 50% CASH, 50% LEAP ratio. Better to be more conservative and have more CASH for buys.

4. Ignore small changes both up and down. When we buy a LEAP in a bear market, we are expecting a big decrease sometime in the short-term, two years until the LEAP expires. Thus we don't want to buy or sell too quickly but rather get more LEAPs as cheaply as possible and sell those LEAPs for good profits from the parent stock recovers from whatever drove down. We must be patient.

5. It's best to start with say 10 LEAPs (if you're a big risk taker type of investor) so we can have a variety. But in a bear market, most if not all of your LEAPs could go down from your initial purchase price even though you bought them thinking all the bad news was out. A way to prevent is to mix call LEAPs with put LEAPs – then some will go up and some will go down. Look at how Citibank sank after its initial bad news. It still had more bad news and the market reacted to that bad news and drove the stock and LEAP even lower. That's why the 50% initial CASH is a good idea – use that extra cash and maximize our bear strategy for buys will leave us with the best chance of maximizing our cash to make cheap buys. Remember at some point the stock and LEAP will start going up and staying up. But not for all stocks and LEAPs.

6. Here's another trick I learned since I originally wrote this. Remember how I said that it LEAP will expire like it will expire in January of any given year. But really any LEAP you own never has to expire because you can always roll it over to the LEAP in the following year so for example if you own a January 13 LEAP, you can always roll it over to a January 14 LEAP and buy an extra year of time.

7. Another great idea as I edit this. You are not limited to only buying call LEAPs (make money when stock goes up). You can also buy put LEAPs (make money when stock goes down.) I have come up with a great way of implementing both a call/put strategy using LEAPs on ETFs. You’ll get a free bonus explaining that strategy when you buy my e-book

This is not the perfect answer to LEAPs in a severe bear market but it offers you good ideas to increase profits with LEAPs in a bear market. If you have any other good ideas for improving this chapter I'd love to hear them. E-mail your ideas to me at jeffee13@hotmail.com