OCTOBER 1994

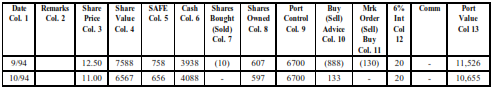

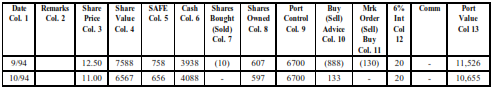

Now October 94. Stock price is $11.00 (stock prices to go down). Again write the SHARES OWNED and PORTFOLIO CONTROL numbers in columns 8 and 9. Column 9, PORTFOLIO CONTROL hasn't changed since no buying but SHARES OWNED did change since we sold 10 shares. So go to last month's column 8 total and subtract 10 (607-10 = 597) and write that number in column 8. Now figure SHARE VALUE and you see it's less than $6,700. It's $6,567 to be exact. SAFE is always 10% of SHARE VALUE so fill that in. CASH again was affected by selling. You started with $3,938 and added $130 + $20 INTEREST = $4,088.

Now look at PORTFOLIO CONTROL and it is higher than SHARE VALUE so put PORTFOLIO CONTROL on top, think P for purchase. You have BUY ADVICE of $133. Before you do anything, you still must compare BUY ADVICE to SAFE. SAFE is still going to cancel any market order. Did you remember not to put ( ) around zero in column 11? I don't bother putting ( ) around 0 in column 11, I just use a –. Again if you haven't given yourself $20 in INTEREST, add $20 to your CASH account and again add SHARE VALUE and CASH to obtain your PORTFOLIO VALUE. Your PORTFOLIO VALUE is $10,655.

Again all of this is going to see much easier when you're reading it while looking at the Adobe Acrobat version of my book which will show all of the Excel spreadsheet rows and columns that will make it much easier to follow what I am talking about.