DECEMBER 1994

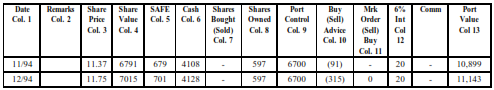

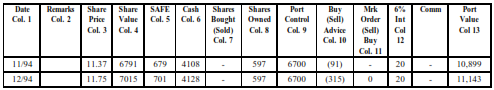

Now December 94. Again look up the SHARE PRICE (its $11.75). Write it in column 3. Now go to column 8, SHARES OWNED and column 9, PORTFOLIO CONTROL; since you did nothing last month both stayed the same. Now business as usual.

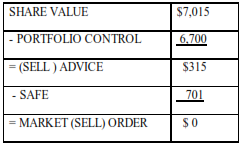

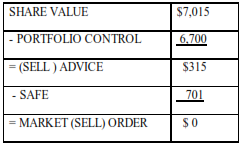

Multiply the number of shares (597 X SHARE PRICE $11.75) and your SHARE VALUE is $7,015 write it in column 4. CASH was only affected by INTEREST so add $20 to this month's total and write $20 in column 12, INTEREST. Now compare PORTFOLIO CONTROL to SHARE VALUE. SHARE VALUE is $7,015 and bigger than PORTFOLIO CONTROL so you place it on top. Again remember P for purchase if PORTFOLIO CONTROL is on top and S for sell if SHARE VALUE is on top. Very simple. So do your calculations:

You do nothing. Then you figure PORTFOLIO VALUE. Remember how? See this is easy. You added SHARE VALUE of $7,015 + CASH of $4,128 = $11,143. You’re ahead $1,143.