FEBRUARY 1995

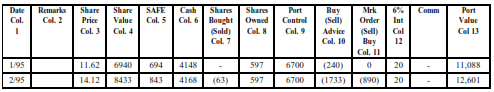

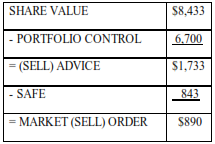

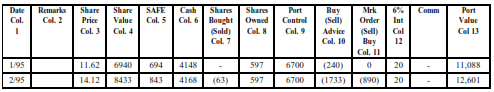

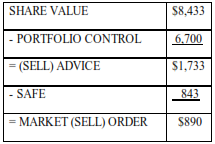

Now February 95. SHARE PRICE has risen and is now $14.12, write that in column 3. Now go back to columns 8 and 9. Since you didn't buy or sell any stock last month, these amounts don't change. So write in 597 for number of SHARES OWNED and 6,700 and for PORTFOLIO CONTROL. Then figure out your SHARE VALUE (it's 597 X $14.12 = $8, 433). Write it in column 4. Again SAFE is 10% of column 4, so write in 843 in column 5. CASH is simple since you did no buying or selling; just add the INTEREST earned $20 to last month's total and write in your new total of $4,168. Again compare PORTFOLIO CONTROL to SHARE VALUE. By now your brain should be telling you that since the SHARE PRICE rose, you probably have a sell. Again as you always do, put the largest amount on top:

Remember to write all the above amounts in their proper columns. Every column either has a number or a –; never will a column be blank. Meanwhile back at the spreadsheet.

Now you have a MARKET ORDER (SELL) for $890. All you have to do is divide $890 by the SHARE PRICE $14.12 and you find out you SOLD 63 shares. Put (63) shares in column 7 for February 95. Again finish off your month by figuring your PORTFOLIO VALUE. It's SHARE VALUE of $8,433 + CASH of $4,168 = $12,601.

Now try to imagine this for real. It's one thing to play quite another when it's for keeps, when it's your money. You got to work at being mentally tough when it comes to the hard, lean times of investing. For every peak you'll also find some valleys; always think for the long term. Study the history of the stock (Claire’s Stores) and you see those peaks and valleys. Look where you stand at the end and you'll have a grand view of those valleys from your peak.