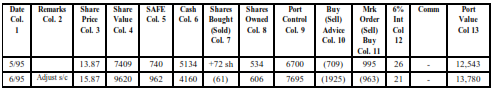

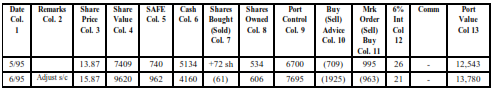

JUNE 1995

Onto June 95. The explanations are becoming shorter because you're getting smarter and seeing how easy this is. The SHARE PRICE rises to $15.87 a share. Write it down and then do columns 8 and 9. Column 8, SHARES OWNED, will increase by the 72 shares we bought last month with the excess cash (534 + 72 = 606). Column 9, PORTFOLIO CONTROL increases BY 100% of the MARKET ORDER BUY amount of $995. Whenever we first buy or add additional money to the system, we increase PORTFOLIO CONTROL by 100% – not the usual 50%. Thus column 9 is 6,700 + 995 = 7,695.

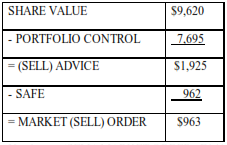

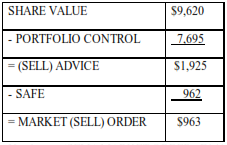

SHARE VALUE is 606 X $15.87 = $9,620. SAFE is always 10% of SHARE VALUE so SAFE is 962. CASH was affected by readjusting our stock/cache ratio. We started with $5,134 - $995 excess cash + INTEREST of $21 = $4,160. PORTFOLIO CONTROL is again smaller:

You have a (SELL) MARKET ORDER. Divide $963 by the SHARE PRICE of $15.87 and you find that you sold (61) shares. Write in column 7. Then end the month by figuring your PORTFOLIO VALUE. $9,620 + $4,160 equals $13,780.