Chapter 2 A

Mechanics of Buying and Selling

Part II – Bear Market

In the last chapter you learned the basics of buying and selling. I kept it simple because it's important to learn the system before we go to some advanced technique to improve our profit-making ability. Now I'm going to teach you a simple adjustment to the basic buy and sell system you learned in the previous chapter. This adjustment is needed because of the nature of the stock market.

When I first wrote this book, the stock market hadn't had a sustained bear market in quite a while. It was just recently that I saw the need for this adjustment of the basic buy and sell technique shown in Chapter 2 (I added this chapter right after the last great bear market of 2000, 2001, 2002 - you remember the great dot.com bust. You'll see that this is a very simple refinement and it will protect your CASH during a steep bear downturn.

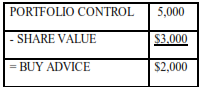

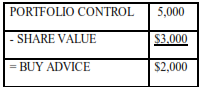

Okay, what is the change? Well, in the last chapter you learn that every month when you compared PORTFOLIO CONTROL and SHARE VALUE, you take the one with the highest value and subtract the other one:

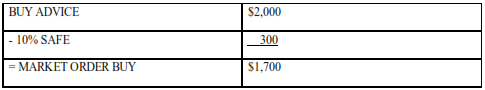

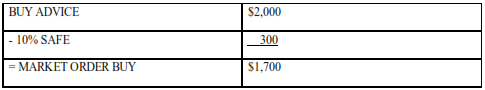

In the last chapter, I taught you then that you look at the SAFE, which is always 10% of share value. Thus based on Chapter 2, you would finish off your calculation like this:

So the system would have you buy $1,700 worth of stock. Well, the basic 10% rule for SAFE for both buys and sells works fine in regular markets. BUT it won't work in an extended bear market because the extended bear market will take all your CASH quickly and you find yourself out of CASH and your stock is still dropping in price. This recently happened to some mighty fine tech stocks and non-techs in early in 2001. (Note: when I used 10% SAFE, 20% SAFE etc., in reality I am actually referring to 10% of SHARE VALUE, 20% of SHARE VALUE etc.)

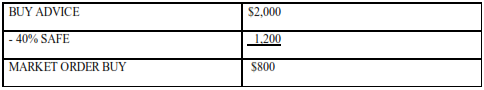

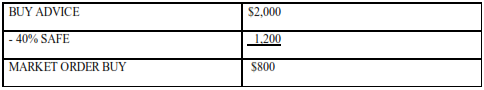

These stocks will come back in price but what can we do to save CASH, buy the most possible shares at the lowest prices, and gain the maximum advantage? Well I'll tell you! All we have to do is make a simple little adjustment to the SAFE % on buys. Instead of arbitrarily using 10% SAFE for buys, we use an adjustable SAFE percentage for buys in a bear market. Thus compare the example below to our regular 10% SAFE shown above:

Thus we have reduced the buy amount from $1,700 to $800 and conserved our cash. If we had used 50% SAFE then 2,000 – 1,500 = MARKET ORDER BUY of $500. I'm going to leave it up to you to decide what percent to use in any given situation. Of course if I'm helping you manage your portfolio I will be glad to give you my advice on what percent you should increase SAFE based on your particular investment. I think my examples in this chapter will help you with the decision.

Below you will see a stock – Caesar's Palace – using both the standard 10% SAFE and using the adjustable SAFE. In this example I'm arbitrarily picking an increased SAFE percentage based on the sharpness of the price drop – I'm trying to conserve CASH so I can use my last dollar at the lowest price.

In this example, I will also do a little borrowing from other stocks if my CASH does actually run out. I would recommend borrowing as little as possible as I have taught elsewhere in this book. I’m more conservative now and I want to keep borrowing to a minimum. Take a look at Campbell Resources in Chapter 12 and you'll see a borrowing pattern that I don't want to repeat.

Now I'm going to give you a quickie version of what I did with SAFE each month that was not the ordinary 10% SAFE for buys. Remember we did not change the SAFE percent for sells – we kept it at 10%.

After this explanation are two spreadsheets showing Caesar's using the 10% SAFE and Caesars using an adjustable SAFE amount. Notice the final totals using both amounts.

10% SAFE – PORTFOLIO VALUE = $50,426 - $19,000 added = $31,426

Adjustable SAFE – PORTFOLIO VALUE = $28,539

So for a lot less risk, you made about the same profits – also with 10% SAFE in reality your CASH amount is $12,791 - $19,000 borrowed or you have a negative cash balance of minus $6,209). With adjustable SAFE, we have recovered all the "negative cash" and are now in the black.

(- $1,174) + $3,113 from the last months sell = + $1,939

Here are the months with SAFE greater than 10%:

February 90 – used 20% SAFE; price drop from $32.75 to $25.00

March 90 – used 30% SAFE; price dropped from $25.00 to $22.25

April 90 – used 30% SAFE; price stayed the same $22.25; didn't want to buy a lot at the same price, wanted to see if price would continue to drop

May 90 – used 40% SAFE; price did drop sharply again, from $20.25 to $18.87

June 90 – used 20% SAFE; price rose from $18.87 to $22.00, just bought a few shares

August 90 – used 50% SAFE; share price had severe drop from $22.00 to $13.62; still bought $4,247 (312 shares) worth, cash went negative, hoping this is near bottom so wanted to "buy low".

September 90 – used 50% safe; price continued to drop to $11.37; still bought $3,423 (301 shares) worth, wanted to get cheap shares and hope slide is over.

October 90 – used 30% SAFE; price rose slightly to $12.25, still bought a few shares – $1,485 or (121 shares) cause this is still a great price to be buying shares – we are negative in cash to (- $6,028).

Now looking at the spreadsheet you'll see the "bear market for Caesar's" ended here and we could go back to normal. You see by June 91, we have recovered all our cash and you'll see we have made a profit, going from $23,955 in October 89 (top of the spreadsheet) to $28,539 in June 91. This despite the fact that the price of Caesars stock was $35.12 in October 89 and in June 91 is only $24.37, a 31% drop in price.

Again you see the beauty of the system. But because of "bear markets" we need to add another tool to our AIM arsenal in our war with the stock market. Also note in old days paid much higher commissions – thus for adjustable AIM spreadsheet, I used newer lower commission rate of $12 – flat rate for up to 5,000 shares.

Please read my new material at the back of this Chapter. Notice Caesars stock prices were taken in the early 1990s – all we had then was a very brief bear drop. But in the last years – 2000 – 2003 we had a severe bear market, very severe and the AIM bear adjustment had to be modified so AIM could even handle a severe bear market! These adjustments are not necessary IF you have a lot of spare cash lying around and don't mind adding it until the bear stops growling... But you better have very deep pockets – see Allis Chalmers in Chapter 7!! And see Campbell Resources in Chapter 12.

Here in the Adobe Acrobat free book you will find a spreadsheet showing Caesar’s using 10% SAFE & a second spreadsheet using an adjustable SAFE.