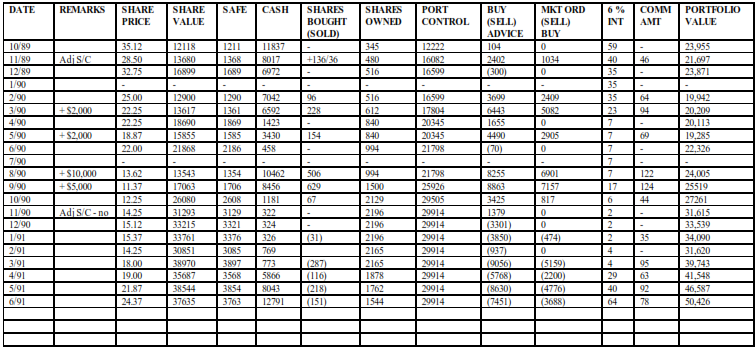

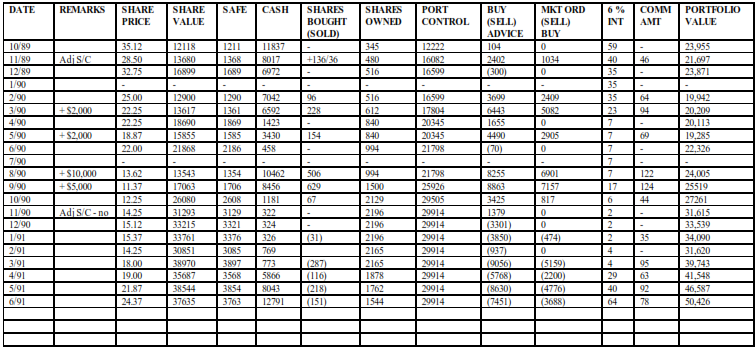

STANDARD 10% SAFE CAESAR’S

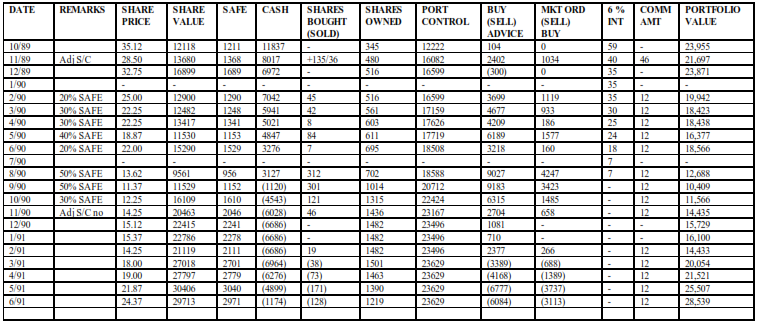

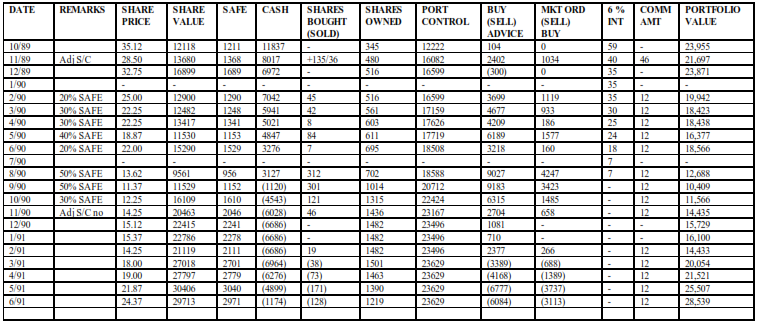

Adjustable SAFE CAESAR’S

Note: this note from Ron inspired me to add my thoughts on how much to adjust AIM for the different kinds of stocks. See my thoughts below Ron’s insightful note.

Hello Fellow AIMers: Readers of my notes know by now that I don’t pretend to be an expert. The other ladies and gentlemen who contribute to this great newsletter really know their stuff. They have refined Mr. Lichello’s original formula to peak performance. I’m just another small investor like many of you out there who read this and was impressed by the system and continue to marvel at how good it works. I am honored that they let me throw in a few thoughts. When I send in my notes every month I have no idea what will accompany me in this newsletter. Last month I posed the question, what do we do in a bear market when prices get so low we run out of cash. Well apparently this has been on many peoples minds, and it sure has been on Jeff’s.

He added a great new chapter in his book where he has increased his SAFE from 10% to possibly 50%. I urge you all to read it here, it’s great! Just when you think these guys can’t refine AIM any more they do it again. I am 40 years old and like many of you most of my investing life has been in a bull market. So this extended bear market is both new and hard for me. Now when I first read about the split SAFE, another great refinement that swayed towards ELIMINATING the buy SAFE for bull markets, especially mutual funds which tend to always go higher eventually, this really makes sense to me. So what does this tell us? How do we know how much or which way to adjust this SAFE figure. To me it seems we have to adjust it to the market and each individual equities personality. Look at each stocks' 52-week high and low and get the feel of it. There is no set way of determining this. Perhaps we all should learn a little technical analysis and look at a few chart patterns. AIM is a great tool, but remember no tool is any good unless you make it work. So friends this bear market isn’t all bad. It taught us AIMers a great refinement. Change the SAFE to fit your needs.

Jeff’s thoughts on stock’s personalities

Ron came up with a great way of viewing stocks I hadn’t thought of. Yes, I feel stocks do have “personalities” just like people. And we need to view these personalities to figure out how these stocks are going to behave in a bear market. In reality it’s the “personality” of investors holding the stocks that decides whether we have a wild one or a mild one.

Here are my quick thoughts on the different stock personalities and how to handle them in a Bear Market:

The Conservative Personality:

The conservative ones are the Blue Chips of the world – these are the Dow Jones Industrial Average Stocks. These stocks have been around forever, these stocks made it through the Great Depression of the 1930s. You’ve probably heard of some of these: IBM, DuPont, American Express, CitiGroup, Coca-Cola etc.

These stocks will not show such drastic plunges – a good example is my Dow Jones Model Portfolio – never had to increase SAFE % with those stocks – while had great increases with the Techs in the “Conservative” portfolio. These stocks normally do not even show highs and lows greater than 100% in a year. Thus tocks with the conservative personality will not require very radical changes in AIM during a Bear Market. You might wind up upping your SAFE amount to 20% instead of the normal 10% of share value. Again like Ron says, it helps to do a little work yourself. One reason I post the highs and lows for stocks for a stock for the prior few years is to give you an idea of the personality of the stock. I feel most of these stocks will not require radical AIM surgery during a Bear Market.

The Radical Personality:

I feel I should apologize to you for calling my Conservative Portfolio my Conservative Portfolio. It has been anything but conservative in this bear market. I originally felt it was conservative compared to other high techs – primarily the content high techs like iVillage, Dr. Koop, eToys etc. I felt content providers would come and go (I did recommend ones I thought had a chance to succeed). I felt the hardware providers – the Ciscos, Sun Microsystems, Lucent Technologies would always succeed. And they probably will – but they will give you a heck of a ride. Based on my experience with Cisco & Sun – I will give you new “fight the bear” info 0r “Son of Bear Market” – how to Turbo-Proof AIM when the unthinkable like the tragic World Trade Center Terrorist Attack occurs. At the end of the chapter, I will show you Cisco & Sun through this disaster and how I tried to “Bear-Proof” what was left of them. Again like Ron, I was a little late to catch on but like he said, learn from your mistakes and be ready for the next unspeakable horror – I’ll show you what I did.

I knew these “Radicals” did have bigger swings in high/low prices but I underestimated investor’s foolishness in dumping these stocks for huge losses – again I fell victim to underestimating the stupidity of investors. I won’t do that again.

Now I have a better grasp on how these “high techs” will handle in a Bear Market. So here are my new thoughts on how AIM should handle these stocks.

The one way to easily distinguish conservative and radical personality stocks is the high/low differences they have. As I said above, conservative/Blue Chip/Dow Jones stocks rarely have high/low differences greater than 100%. But our radicals, even the radicals I thought were conservative – that’s why I called the portfolio conservative – exhibit high/low differences significantly higher. Cisco’s high was 82.00; low was 20.31 for a 304% difference; Sun’s high was 64.66; it’ low 17.00 for 280% difference; and Lucent’s high was 66.62; it’s low 9.81 for a 579% difference.

It’s these differences that require adjusting AIM so as to not exhaust our cash too soon. remember by going 2/3 stock, 1/3 cash we don’t have a lot of leeway and we want to make the most of buying as low as possible. So in addition to the advice earlier in this chapter, here are some additional ideas for radical stocks:

Rules # 1 – use a 20% SAFE (20% of Share Value) for all buys right from the start.

I am saying do this from day one when you own a “high tech”/radical-type stock. You don’t change the SAFE 10% Sell amount. Also during sells let the cash build up.

Rule # 2 – when you adjust Stock/Cash amount on radical stocks, only use half the amount the calculations say:

For ex: If Stock Value is 3,000 and cash is 3,000:

Normally your calculations are 6,000 X 1/3 = 2000 cash and you have 1,000 extra cash and buy 1,000 worth of stock. For radical stocks, just buy 500 more and leave that extra 500 in the cash account as a cushion.

Rule # 3 – keep extra cash in your money market for outstanding buy opportunities

Let’s say you are going to start with $15,000: $10,000 in stock and $5,000 in cash. If you have an extra $5,000 to put in your Money Market Account – do it!

Rule # 4 – you can always follow Robert Lichello’s original investing strategy – 50% Stock, 50% Cash...for Radical Stocks

I want to emphasize I still think high techs and others on the NASDAQ are good stocks and are our future for America. What we are experiencing now is just a typical Bear Market affecting both good and bad stocks. Again remember the words of J. Paul Getty: “buy when the news is bad.”

The real world is the best lab so below I’ll show you what the Bear did to Cisco and Sun. It’s not pretty, but both as well as many other “techs” have recovered significantly from the tragic events of September 11. Check the two spreadsheets for Turbo-SAFE – I had to stop the bleeding so I took radical action on radical stocks.