Chapter 5

Seven Rules for Success in the Stock Market

I saw an ad in Barron’s listing seven rules for success in the stock market. I'm going to show you how the system incorporates these rules for success.

1. Know What to Buy – When

The system incorporates the right type of stocks for us small investors (see Chapter 8 on how to pick stocks). Also the system has flexibility on when to buy. I personally like the idea of buying a stock initially when the stock is at or near its 52-week low because it should greatly increase profits. Also closed-end funds, ETFs and LEAPs work well in the AIM system.

2. Know What Not to Buy

The system shows you what not to buy. Normally don't want to buy stocks that don't fluctuate, (show a wide range between the year’s high and low price), stocks with large dividends, (a big exception to that is when you buy closed-end funds that are income oriented and pay high dividends), and regular mutual funds.

3. Know When to Sell and Buy

The system shows you exactly when to buy and sell and how much to buy and sell. The system also shows you when you should do nothing.

4. Know How to Measure Risk

The system works well at all risk levels. You can choose the type of stocks, ETF's, LEAPs in your system to suit any risk level you feel comfortable with.

5. Know How to Diversify

I'll show you how to select the rounded 10 investment portfolio that will make allowances for individual fluctuations and will give you profits year after year.

6. Know which Industry Sectors to Select

I will show you a couple of industry sectors I like and will work well with the system. Three I liked many years ago and still like are gambling, high tech, and biotech. Also for conservative investors, blue-chip stocks have a lot to offer. You basically want industries that are viable for the long term and sometimes you can take a risk with a new technology that will pay off someday like solar power. Very recently most solar companies crashed and their stocks are at very low prices. If you're patient and waited out they could give you a handsome reward in 5 or 10 years playing AIM.

7. Reap the Rewards of Compounded Appreciation

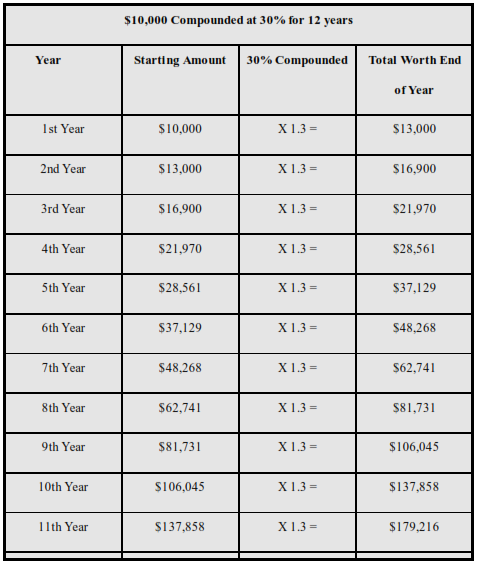

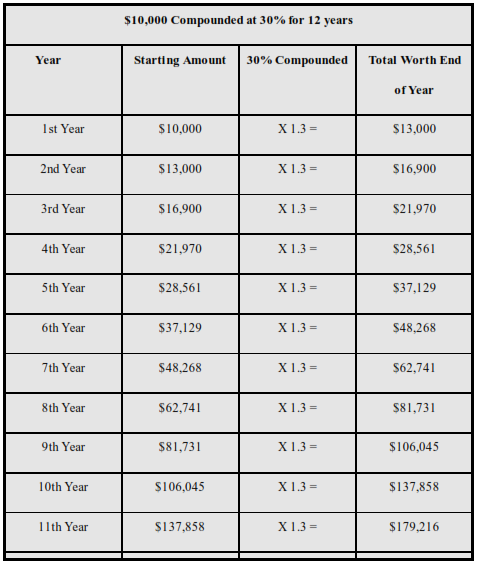

This is the best part of the system. You'll get good returns in both dollars and percent in the early years. But after a few years, you get unbelievable benefits from compounded interest. You want to see the benefits of compounded appreciation, take the 30% average return and extended out 12 years and see how much money you have. Here is $10,000 compounded at 30% for 12 years: again you will need to look in your Adobe Acrobat version and you will find a very nice spreadsheet showing compound interest for 12 years. I’ll break the suspense and let you know if you compound $10,000 for 12 years at 30% you have $232,981!

And it will keep growing. This is a realistic estimate of the gains you can make under the system if you faithfully follow the system and work at picking the best stocks, ETF's, closed-end funds and LEAPs for the AIM system.

Think of compounding this way: in the above example, we started with $10,000 and at the end of 12 years accrued to $232,981 or your money grew 23.3 times the starting amount of $10,000.

This means that every dollar you invested 12 years ago is now worth $23.30. So spend that dollar now and you throw away $23.30 of your future 12 years later. Now you see the value of compounding. Use it for your future too.

And it will keep growing. This is a realistic estimate of the gains you can make under the system if you faithfully follow the system and work at picking the best stocks and close-end funds for the system. You have to hang in there in the early years and keep reinvesting profits back into the system (always pay yourself first and don't touch that money).