Figure 8-1

I don't know what a subscription costs now but I have one so I should know that but whatever it is it's well worth the cost because you get lots of good ideas on potential stocks that might work well with the AIM system. Again the spreadsheet with the information will be found in the Adobe Acrobat version.

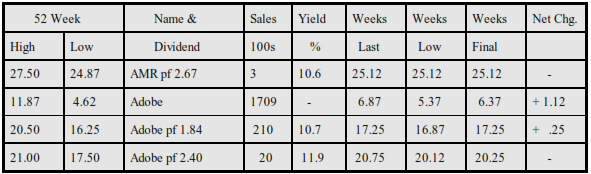

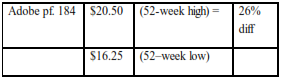

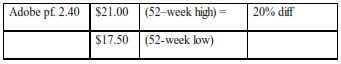

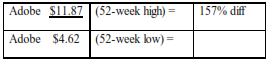

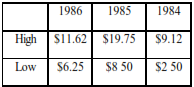

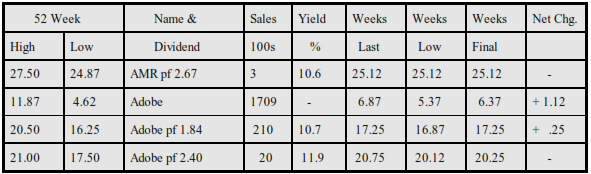

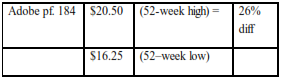

As you can see, preferred's list a guaranteed dividend (they get paid before any dividends are paid on the common stock). Also they list the yield amount which is merely what percent the dividend is of the share price. If the stock is $20 and the dividend is $2, then the stock yields 10%. When you look at the key component for the system, which is the percent difference for the 52-week high and low prices, you will see that usually, preferred stocks fail miserably. Let's look at the Adobe trio of stocks and you can see the difference between good and bad 52 – week high and low percents.

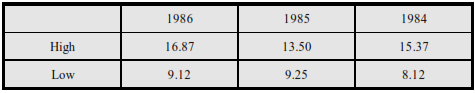

Now compare this with Adobe common stock with no dividend. This is the stock we used to originally explain the system in chapter 2 (changed stock to Claire’s Stores). One factor I recommend is to look for a stock that pays no dividend or a very small one. We want companies that reinvest their earnings (profits) back into the company and not pay them out to stockholders.

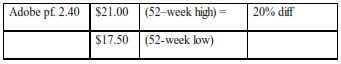

You’ll see why when you read the chapter on semi-aggressive investing and see that you average a 29% return a year (first three years) on stocks that pay no or small dividends. Wouldn’t you like to make 29% return than a steady 5-10% from a preferred stock? Look at Adobe’s common stock high and low for the year:

That's a little better. The stock would get further consideration. For now though were only looking for reasons not to buy.

Learning what to buy and not buy is going to take time and a little effort on your part. It's really not very difficult and I believe you'll find it fun and interesting. Again I highly recommend that you get a subscription to Barron’s. Buy a copy at your favorite newsstand and decide for yourself. You'll find many articles by stock pickers that talk about exactly the type of stocks we are interested in. Within a short time you’ll see how your knowledge and skills of picking out the type of stocks, ETFs, LEAPs you like will grow.

Remember it's not a case of there being only one stock that you have to find to make the system work. There are many, many stocks, ETFs, LEAPs that will work. Nobody can always pick all the best ones; the more you study, learn, and do, the better you'll get. You'll only get better by actually doing. I offer a monthly printed e-mail newsletter with my picks of stocks, ETF's, LEAPs that work well with AIM. And remember you get a free one-year subscription to my newsletter when you buy my e-book. Let me show you how I picked the stocks in my portfolio. It will give you an idea of what to look for in stock.

The first stock I picked was Alaska Airlines. The way I picked it will give you a good idea on how to get started picking stocks. I got a copy of the Wall Street Journal and looked at the New York Stock Exchange listings that included the 52–week high and low prices. I highlighted all stocks that were low-priced (currently less than $15 a share) and had 52–week high/low differences of 100% or more.

To the local library I took my highlighted stocks and looked up all the highlighted stocks in Standard & Poor's Reports. How much easier you have it today when with most online brokers you can get free Standard & Poor's Reports that will always be current and accurate. Standard & Poor's Reports cover virtually any good stock on the New York, American and NASDAQ stock markets. The big three should be the only stock markets that you look at for buy candidates - don't go to any these flimsy weird little exchanges that might be trying to con you with some penny stock. I then read all the reports on the stocks I picked and tried to pick the best one.

Now like I said earlier, I didn't agonize over it. I like Alaska Airlines for several reasons. First of all the system wants to own the stock for a year or two and then sell out at or near the high for the year. Alaska Airlines immediate future looks good. Alaska Airlines was the leading airline between Alaska and the lower 48 states. We all know about the oil exploration and other commercialization of Alaska. It's only going to get bigger and bigger. Also the population of Alaska was growing faster than any other state.

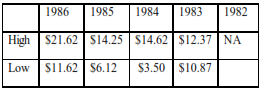

The stock was paying a small dividend of 1.2%. I liked the increases in revenues I saw in Standard & Poor's that shows the last 10 years of revenues for stock. Another plus was the fact that 44% of the stock is owned by institutions (pension funds, mutual funds etc.). Institutions tend to move together (look at the stock market crash of October 1987.) They all sell or buy about the same time based on short-term reason; drop in the last quarter earnings, price of gas goes up, trade deficit, interest rates go higher. These big price swings caused by institutions will help give us the big 52–week high and low differences we want. I bought Alaska Airlines in August 1986. At the time the high for the prior year had been $26.12 and the low was $14.25. Alaska Airlines was then selling at $16 a share.

It's very different actually putting your money where your mouth is. I went with a fairly conservative first stock because I didn't want to get burned right out of the gate. Nothing wrong with that. Alaska Airlines was also more per-share than I would have liked. I felt it was a good stock, with a good future and have no regrets. I made money on the first year and feel that would continue to pay off - (update – it has!)

Also, in August 1986 I bought Compaq Computer. I was already familiar with Compaq. Right after I had finished my original research on stocks up but before I learned about the system, and was itching to buy, I came into some money (won $750 at a craps table in Atlantic City).

I came back to Frederick, Maryland and looked for a stock to buy. I chose Compaq for several reasons. First I thought computers were going to be a tremendous growth industry. But IBM, the leader didn't appeal to me. The stock was priced too high and didn't have the high/low yearly swings I like. I felt much better taking a chance on a new company in a growing field and felt I could make more money before everybody discovered Compaq. Wouldn't you like to buy McDonald's when there were only a few stores out there?

I went to the local broker. I picked a Merrill Lynch office I found in Frederick. They get excited when you walk in off the street to open an account. So I opened my account and bought 100 shares of Compaq at $6.75 a share. At this time I knew nothing about the AIM system but another book I had read, The Hidden Stock Market, How to Pick $5 Dollar Stocks that Can Double in 6 –12 Months, made an impression on me.

I was buying a stock I felt would double in 6 – 12 months. Well I bought this stock in August 1984 and naturally started to follow it closely. By October or so, the stock had sunk to $3 dollars a share. I had no money, naturally, and I just knew the stock would zoom upward. Within a couple of months, the stock was up to $10 a share. I knew then I wanted a way to profit from stock fluctuations. When he finally found one, I remembered good old Compaq.

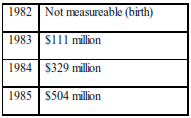

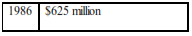

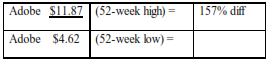

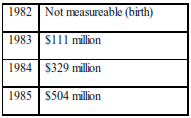

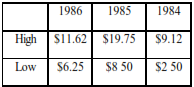

By the time I got around to the system in August 1986, Compaq, bigger and better than ever was now listed on the New York Stock Exchange (used to be a NASDAQ stock). I read some very positive things on Compaq in Barron’s and found many things to like about the company. The young dynamic management, the quality of their computers, and the tremendous acceptance of their products impressed me. A quick glance at just one financial statistic will prove that just look at the revenue since complex birth:

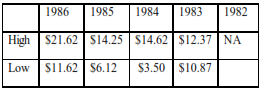

Also impressive was the fact that management held 10% of the stock. Also, Compaq had good high low differences:

As you read from 1987 when I owned the stock, it did even better. Believe me once you start learning about investing, good stocks will appear to you also. The best thing to do is read investment publications such as Money Magazine and Barron’s and others that give out investment information (of course I wrote this before I ever started my monthly newsletter which again should be one of your favorite spots to find good stocks for the AIM system.) If you see a stock that looks appealing, get the Standard & Poor’s Report and start checking it out.

That's what I did when I bought Claire’s Stores. Here’s just how simple my selection was. I was reading the August 3, 1987 issue of Barron’s and came across a typical type of article that Barron’s has frequently, an interview with a stock analyst to talk about several stocks he liked. This article was titled Cherry Picking in Florida, in which Richard Lilly trains his sights on companies in the Sunshine State.

Mr. Lilly mentioned several Florida companies he liked. His quotation on Claire’s Stores was, "back on track is one of the highest profit margin and fastest-growing specialty retailers. 70% + gross margins". Well, that got my attention. Mr. Lilly also said he had been a long-term bull on Claire's which operates boutiques selling costume jewelry, handbags, and other items. He said he recommended it when it was selling around $2 a share in the early 80s and it climbed to $20 a share in 1985. Then it sank again as low as $6.25 and currently (August 1987) was selling at $9.50 – $10 a share.

Mr. Lilly felt most of Claire's problems were behind them, that the number of stores was growing, an upscale subsidiary was off to a good start, and that management was getting better. He felt Claire's best days were ahead. Well I filed this information away, literally. Anytime you see an article like this in Barron’s, you should clip them out and save them for future reference. Well I finally had enough money to buy another stock in December 1987 and I thought of Claire’s Stores. I already owned three stocks – Alaska Airlines, Compaq Computer, and Golden Nugget (next).

All three of these I regarded as conservative as all three were over $10 share when I first bought them. This time I truly wanted an under $5 stock. I wanted to own at least 100 shares of something. Moreover, I felt that percentagewise, a low stock under $5 has the best chance for large profits.

So I did exactly what I told you to do – I checked out Claire’s Stores in the Standard & Poor's Report. I was excited to check it out because I had already looked up Claire’s Stores in the newspaper. Thanks largely to the great October 1987 crash, Claire’s was selling near its 52-week low. A check of Barron’s in early December 1987 showed Claire’s Stores was selling at $3.50 a share, the 52-week low was $3 and the 52-week high was $13 – just the high/low ratio range I like. A review of the Standard & Poor's showed additional things to like.

Claire’s showed good high/low ranges for the last several years. This isn't mandatory but I regard it as a good sign. See the summary sheet of Claire’s Stores in the Adobe Acrobat version of the free book you will be receiving

Also I liked what I read about the company; the number of stores had grown from 155 in 1981 to 439 stores in 1987. Revenues had grown from $36 million to $74.5 million in 1986. Also, Claire’s had no long-term debt and expected to finance store growth from internally generated funds. Also one family controls 26% of the stock and institutions hold about 25%. Net income had doubled in the past couple of years. All this was enough to get me to take a chance. Claire's paid a very small dividend, not enough to matter. I like the price range I found. I felt much of the reason for the low price was outside factors like the stock market crash or general dislike for retail stocks. All this will let us buy low and sell high.

In September 1987 I bought Golden Nugget stock. I lived in Las Vegas for four years and visited it many other times. Millions of other people like to gamble and I feel the gaming industry will always do well. People love to gamble and there aren't that many convenient places (written years ago, that's changing) they can gamble. The management of the Golden Nugget and the hotel/casino itself impresses me. It is one of the finest places you'll ever see.

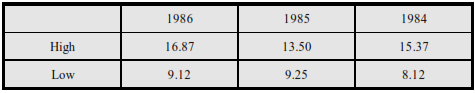

What got me excited to buy Golden Nugget was the fact that they were building a brand new casino with over 3,000 rooms next to Caesar's Palace. Their current revenues showed a drop because they sold their Atlantic City operations. The new hotel/casino will open sometime in 1991. So I "gambling" on the success of the new hotel/casino. I think it's a good bet. The stock shows good but not great high/low swings:

I just felt comfortable with this stock and know that I can visit my investment and stay in my investment anytime I'm in Las Vegas. It's my faith in Steven Wynn and the rest of management that caused me to buy the stock. I have great faith that the new hotel/casino will be very successful. I'm willing to bet on the future of the Golden Nugget.

You should always buy stocks that you ultimately feel will be successful. They will always have ups and downs (very profitable ups and downs) but you want them to be rising to higher plateaus of highs and lows. Look at Alaska Airlines - how it shows this - in 1980 the high was 5 and the low was 3; in 1982 the high was 14.37 and the low was 4.62; in 1984 the high was 17.25 and the low was 9.25, and in 1986 the high was 22.75 and the low 14.25. No stock will ever be perfect but look for steady upward progress. It's easy to tell by checking the Standard & Poor's Stock Reports; which shows the high and low prices for the last ten years if the company has been traded that long.

I've given you a chance to crawl around in my brain for the stocks I have bought. I found many others that I like but don't have the money yet to buy. If you like and buy my book, then I will be buying a lot more. I'm now going to give you some other stocks I like (circa 1987 or so) and a brief explanation of why I like them. These stocks may no longer be good buys at the time you read this years later. However, the principles and reasons for liking the stock are timeless and there will always be current stocks to like for the same type of reasons.

Born to be Wild? I like Harley-Davidson. They make the unique American product, Harley-Davidson motorcycles, the only American motorcycle. They just recently bought Holiday Rambler, a manufacturer of recreational and commercial vehicles. Harley just shifted from the American to the New York Exchange. Since the stock started trading, price fluctuations have been good.

Another I like is Advanced Micro Devices (listed as AMD on the New York Stock Exchange). Again with all stocks, the basics apply, - good high/low fluctuations, low per share price, and continued good prospects. Also you're always much better off buying the stock at or near its 52-week low. This is extremely easy to tell by checking the stock in the stock tables of any good financial newspaper.

If you love investing get a good daily financial newspaper like the Wall Street Journal or Daily Investor. But you don't need to. If you are only going to buy one financial newspaper, I recommend Barron's. It has taught me a tremendous amount about stocks and investing. Besides, I find it highly entertaining, honest, funny, informative and very concerned about the small investor. If you get a subscription, you'll still need to buy a daily paper the beginning of the month to find out the current prices so you can do the system.

Meanwhile back at Advanced Micro Devices. I saw AMD recommended by one brokerage house in Barron's. I found AMD was selling was selling near the year’s low (high was 33.50, the low was 12.87). Standard & Poor's had some good comments and predicted a strong rebound and expected earnings increases in 1988. Also felt long term prospects were good based on aggressive research and increased emphasis of proprietary (moneymaker) items. Sounds good to me.

Remember Adobe, the common stock? They got a good review from an oil analyst. I feel oil stocks are a good play in any balanced portfolio. Adobe is low priced (high was 12.62 and the low was 5.25) in 1986. Adobe and the other oil stocks are still depressed and you can get them at a bargain at this time. I'm sure they'll be at bargain prices occasionally in the future too.

I like various other stocks on the three exchanges. And remember I said I like them, I didn't say I'd buy all of them. Look at a stock’s current high, low, and actual price when you want to buy. You can gather from most of the graphs and charts in this book that I included stocks I like. A couple of bad ones were included as examples and aren't recommended. I have many others that have piqued my interest but I haven't had the time to make any detailed study on. One area I find especially interesting but haven't had the time to explore is closed-end mutual funds. Check out Barron's and you'll find Morningstar offers a closed-end mutual fund guide.

Remember that buying stocks is a lot like fishing, I can tell you where the big ones are but it's up to you to pick the right time, rod, bait, and method. I'm your guide. Besides the satisfaction and self-esteem will come from patting yourself on the back for doing it yourself. The money made will be nice but you'll have a bigger smile of satisfaction from doing something to benefit yourself, your family and ultimately America itself.

In the last few years I've picked up more ideas on how to pick the best stocks. Again I recommend Bill Mathews' book, Winning Big with Bargain Stocks. He offers many excellent tips on picking the best stocks.

Here is another factor worth looking at. It's the P/E ratio or price earnings ratio. Price earnings ratio is the previous closing price of the stock divided by the latest 12 months per share earnings. Companies only have P/E ratios if they are profitable. Check the stock tables in the paper and the P/E ratio is listed for profitable companies. A good basic rule is if the P/E is under 10, the stock is a good buy possibility.

If you look at the bottom of the Standard & Poor's 2-page reports, you'll see the P/E listed below the high/low yearly prices. However just because there isn't any P/E doesn't mean we aren't going to buy. One reason a good company might have low stock prices is that they lost money the previous quarter or year. If you see reasons why the company can reverse that and make a profit the following year, the stock is a good buy.

I also want to talk a little about stocks in bankruptcy and other low priced (under $2) stocks. These stocks are the riskiest and the most profitable of any in the system. All stocks in bankruptcy (Chapter 11, under court protection and given time to reorganize) are identified by "VJ" in front of the name "VJCirclek" for example. These stocks should be considered by investors willing to handle more risk. Same basic rules apply - at or near year's low, prospects for company turning things around in following year. Mr. Mathew’s book explains these types of stocks very well. With stocks this cheap, you don't need to put up $1,500 per stock. $750, $500 stock, $250 cash would be fine.

Later I explain that you should diversify and have 10 stocks in the system. I strongly think 2 or 3 of these risky stocks belong with 7 or 8 more conservative stocks. I want you to study the monthly price changes and you'll see that in some months prices double or triple. Great volatility. Of course timing is everything. You don't want to buy one of these just before bankruptcy or it could get expensive. Wait till the stock hits a low in bankruptcy. For example look at VJLOMASFNL. (Chart at end of chapter). If you had timed it right and bought in Jan 91 at $.28, in four months the stock was $1.12, not bad. Or look at VJCIRCLEK, you could have bought at $.37 a share in Jan 91 and it was $1.25 a share two months later.

Here are a few good tips for buying Chapter 11 bankruptcy stocks:

1 - Look in Barron’s for articles on the company - find a reason you think the company will continue,

2 - Monitor closely & get ready to sell all shares if total liquidation of the company seems imminent (for example Pan Am was in bankruptcy a long time & then liquidated. Barron's alerted investors that the company was doomed if financing wasn't found and you had a chance to get out.)

3 - Look for bankrupt companies with large sales and a well-known name. Look for increasing sales and reasons to like the company, like they're selling an unprofitable division, cutting costs. A reverse stock split is usually a bad sign - if you see a 1 - 4 reverse split about to happen, probably time to get out.

Look at the attached page at the end of this Chapter of low priced and bankrupt stocks and you'll see that great profit possibilities exist. Read Mr. Mathews book, he has good advice on bankrupt stocks.