Chapter 10

Semi – Aggressive Investing

I'm especially happy with this chapter because these are the type of stocks I pick for myself. Alaska Airlines, Compaq, and Golden Nugget are three stocks I've owned. These types of stocks are little bit from the wrong side of the tracks to blue-chip bluebloods. As such the investing world deems them riskier and thus to my mind increases my profits. As such can see by comparing your yearly profits under semi – aggressive to conservative stocks, your profits were over twice as high – 139% versus 59%. By taking a slightly bigger risk, you will be greatly rewarded.

This illustrates the system at its best – big profits from dynamic young growing companies. Again study the charts. For the stocks that started later than October 1984, I just used the profits as of September or October 1985 when the other stocks had completed a full year.

Don't let the $10,000 per stock discourage you; you could have turned $15,000 ($1,500 per stock) into $38,850. Always do the best you can with what you got. Not only will the money come in handy someday, but the self-respect and pride in yourself coming from doing something for yourself will yield an inestimable, immeasurable boost to your self-confidence and your life. Remember every day in every way you're getting better and now richer. You made 132% in three years, more than doubling your money. This illustrates the system at its best. It will do the same for you.

Also you'll notice I do something very different with the 10 stocks here and the 10 in the conservative strategy. I re-adjusted the stock/cash balance back to the 2/3 stock, 1/3 ratio. I did not do this in chapter 2 as I was trying to keep learning the system easy.

I took the excess cash over 1/3 and bought more stock. Again I haven't used the system to the max. I took the money out once a year and bought the same stock regardless of price. I ignored with the stock was at or near its year’s low. When you do this for real, here are the best ways to maximize profits:

1 - Look more often for excess cash.

2 - Either buy one of your existing stocks that is at or near its year’s low or buy a new stock that is at or near its year’s low. Here's an explanation to show you what I did. Look at Alaska Airlines. I readjusted cash and stock in November 1985 (11/85). Here's what I did:

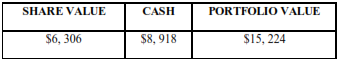

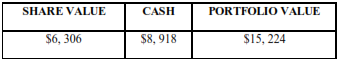

I looked at 10/85 and found the following:

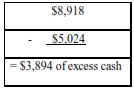

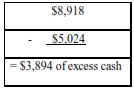

I multiplied $15, 224 X .33 = $5,024. Thus $5,024 is 1/3 of my PORTFOLIO VALUE. So I subtracted the cash balance:

I took the $3,894 of excess cash and bought an additional 193 shares of stock - $3,894 divided by $20.12 = 193 shares. Then I put “+ 193 shares” in the shares bought column in November 1985 (295 + 193 = 488 shares owned). Also, I added 3,894 to PORTFOLIO CONTROL. Remember when you first buy stock or buy additional shares with excess CASH, you increase PORTFOLIO CONTROL by 100% of the amount bought. Again it’s simple and will become second nature with a little practice. I omitted the rest of the spreadsheets from Chapter 10. If you would like to see all the spreadsheets, please go to: http://www.jjjinvesting.com, then click on Book by Chapters, Chapter 10.

The three spreadsheets used in Chapter 10 will be found in your free Adobe Acrobat version.