There are two accounting methods:

Accrual accounting

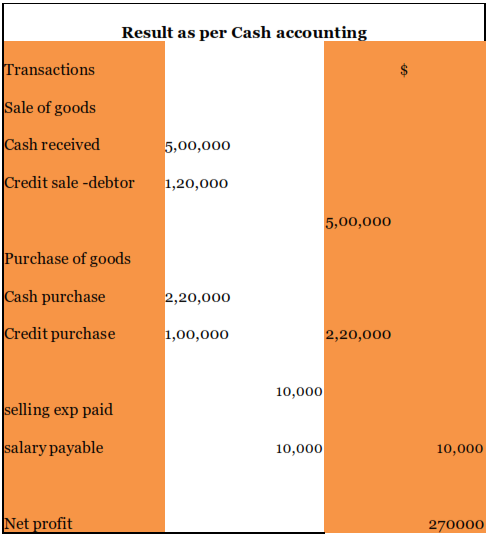

Cash accounting

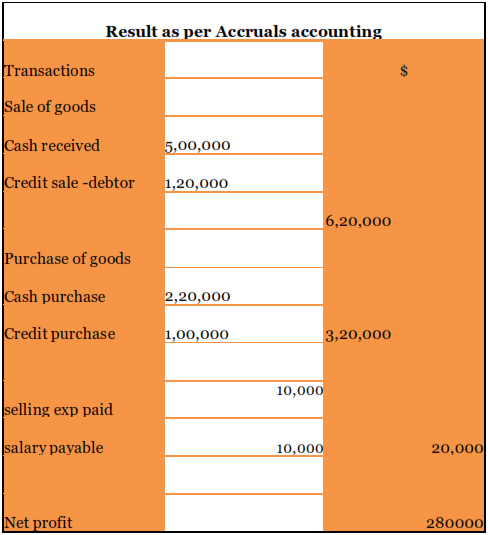

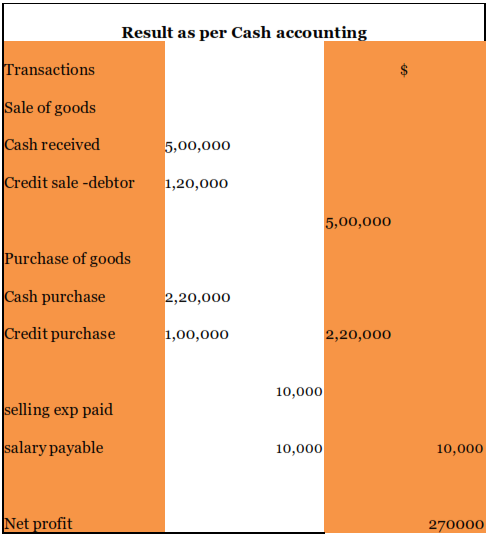

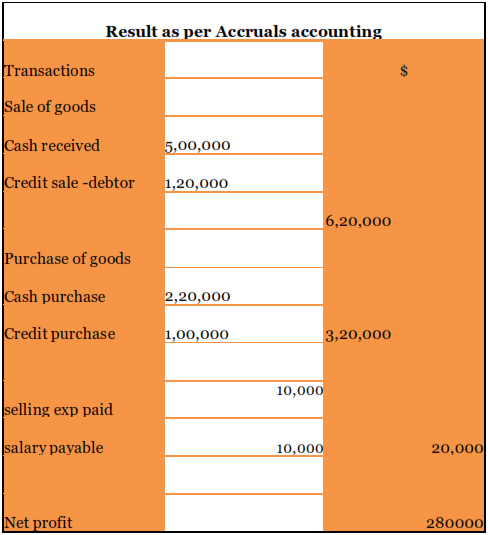

In cash accounting, transactions are recorded when cash changes hand means when cash income or cash expenses are done. Other side, in accrual accounting, transactions are recorded when they incurred, no matter the transactions are cash transactions or credit transactions.

Cash accounting is used in rare case but accrual accounting is popular because it is showing actual result of business.

Due to accrual accounting, concept of prepayment, accruals are needed to be understood.

Prepayment :

Prepayment means when we pay someone money in advance and we do not receive goods or service yet. Example: prepaid expenses.

Prepayments are shown on asset side of balance sheet.

Accruals:

Accrued expenses: Sometimes expenses are due but we have not paid them yet. They are our liability and should be considered in current financial year as expenses.

Accrued income:

Accrued income means we have provide service or sold goods but have not received money for it yet. They are our accruals. They are also need to be recorded in financial statements as current income.