Financial statements consists three statements:

Income statement

Balance sheet

Cash flow statement (Not mandatory for all organization).

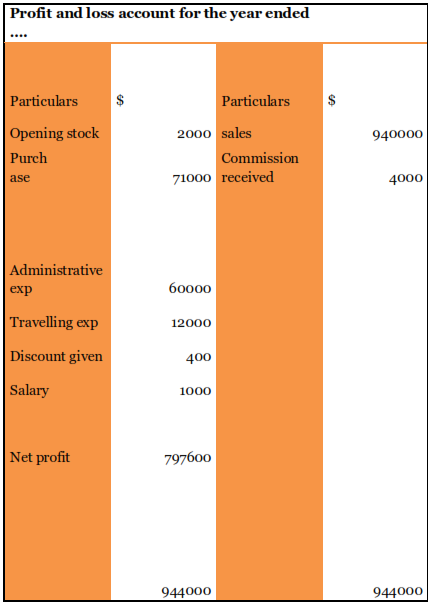

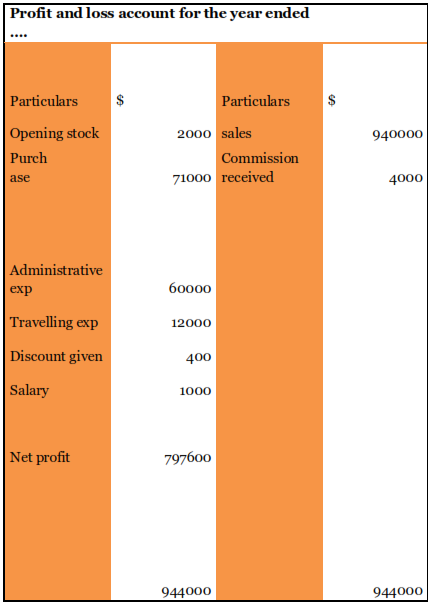

Income statement: Income statement is summary of all income and gains during the year and all expenses and losses during the year. If the company is manufacturing or dealing in purchase and sale of goods, trading account is also prepared. From income statement, we can find actual net profit of business.

We record all the income and expenses as per accrued accounting. So record current years income (Received or not) and matching expenses (Paid or payable) to prepare financial statements.

In next page, you can get access of income statement.

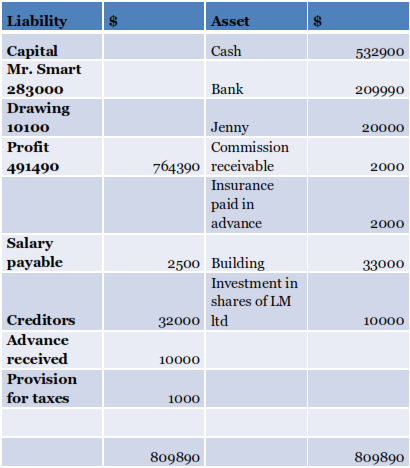

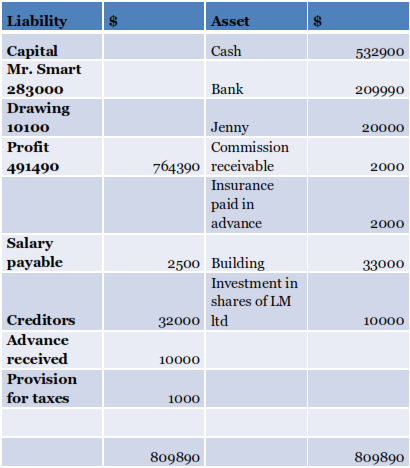

Balance sheet: Balance sheet is statement showing assets and liability position of business. It is prepared for last day of the year. Balance sheet is useful to know about credit worthiness of business.

Assets and liabilities are current and long term. Like current assets, fixed assets, Long term loan.

Here is the balance sheet of XYZ ltd.

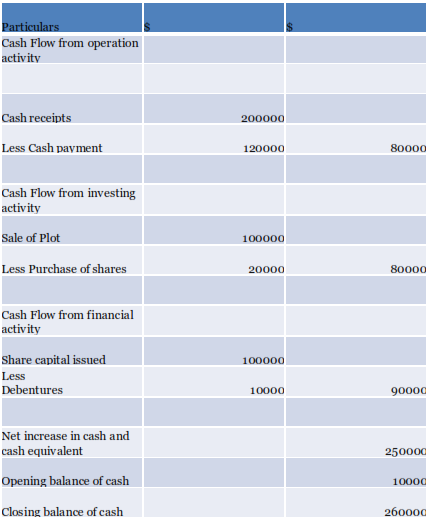

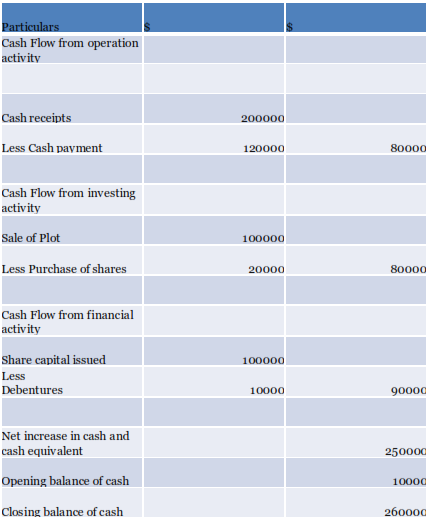

There is no mandatory requirement to prepare cash flow statements for all enterprise. Cash flow statement represents cash inflow and outflow during the year.

It represents cash movement of three activities:

Operational activities

Investing activities Financial activities

here is cash flow statement of xyz ltd.