CHAPTER 3: THE 941 PAYROLL TAX FILING

Now that we have gone through some basics of employer taxes, let us build on Chapter 2 by going through Form 941. Most of you are going to fall into the group that is required to file quarterly, and I think it is important to make sure you are filing accurately.

Correcting past filings can always be done, but part of your resolution process should be putting in good habits regarding how you file and having a clean slate moving forward with the IRS.

*Special Note: This book was published using the Employer’s Quarterly Federal Tax Return (Form 941) from 2020. The form may change its format over time, but concepts will remain the same.

Gather Form 941 Information

Before you can begin filling out Form 941, you must collect some information. Gather the following to fill out Form 941:

- Basic business information, such as your business’s name, address, and Employer Identification Number (EIN)

- Number of employees you compensated during the quarter

- Total wages you paid to employees in the quarter

- Taxable social security and Medicare wages for the quarter

- Total federal income, social security, and Medicare taxes withheld from employees’ wages during the quarter

- Employment tax deposits you have already made for the quarter

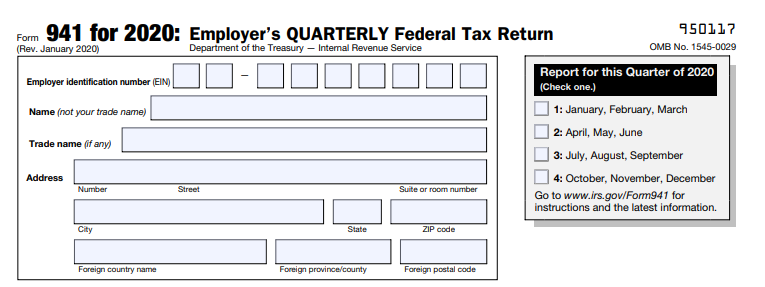

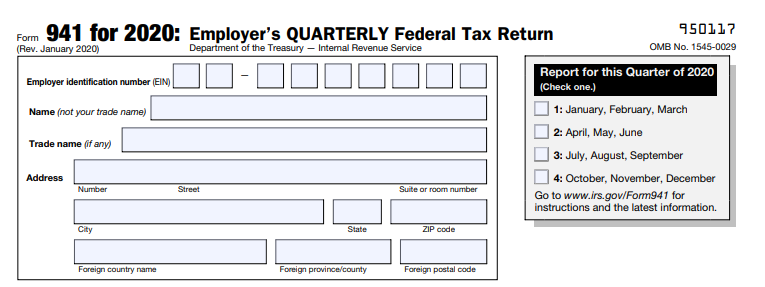

Fill out Business Information

Fill in all applicable areas, the EIN, the business name and address and so forth.

Off to the right side, mark which quarter the information is for. For example, if the form is for the first quarter, put an “X” in the box next to “January, February, March.”

Fill in Necessary Sections in the Form

Now we are going to go step by step through the form, starting at the top and working all the way down.

Form 941 is broken into five parts with their own questions and sections. We will go through the sections that you should be filling out as a sub-contractor, and which sections you can disregard.

Part 1: Questions for the Quarter

Part 1 has many different lines. Here are details about each of those lines and what information you must provide:

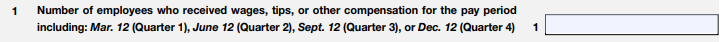

Line 1

Line 1

List the number of employees you paid during the quarter. This includes any employee who received wages, tips, and other compensation.

According to the IRS, you only need to include the total number of employees that who worked on a specific date within each quarter, or the number of employees that worked during the pay period that includes these dates:

- Quarter 1 – March 12

- Quarter 2 – June 12

- Quarter 3 – September 12

- Quarter 4 – December 12

For example, say you have 14 employees work during September. Only 12 of the employees work during the pay period of 9/1 – 9/13. Because only 12 employees worked on or through September 12, you would only report “12” on Line 1.

*Special Note: If you enter more than 250 employees on line 1, you must file Form 941 electronically.

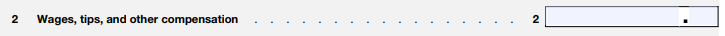

Line 2

Now report the total compensation that you paid to the applicable employees during the quarter. Include all wages and other compensation.

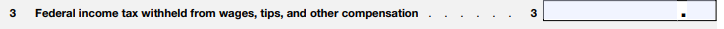

Line 3

Add up the federal income tax withheld from employee compensation during the quarter. Do not include any income tax withheld by a third-party sick payer, if applicable.

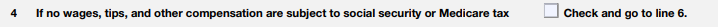

Line 4

If no employee compensation is subject to social security and Medicare taxes, mark an “X” next to “Check and go to line 6” on line 4. If you mark that box, you can skip lines 5a, 5b, 5c, and 5d.

If employees do have compensation subject to social security and Medicare taxes, let us go through lines 5a-d together next.

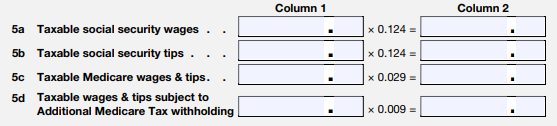

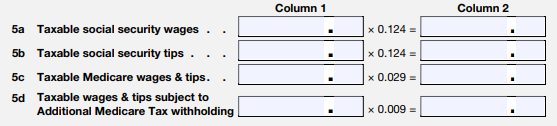

Line 5

These are by far the most confusing areas on the 941. To calculate the totals for these lines correctly, you need to break up the wages based on their type (e.g., regular wages or tips).

Lines 5a-5d are the totals for both the employee and employer portions of social security and Medicare taxes withheld from an employee’s wages.

Lines 5a-5b

Unless you have tips (highly unusual in a sub-construction environment), you only need to completed line 5a.

The decimal represented on the form is the total social security tax rate (Employee = 6.2%, Employer = 6.2%, Total = 12.4%). Combined, you and your employee contributions and multiply by 12.4%. That is the amount you put on line 5a.

For 2020, the social security wage base is $137,700. This means only the first $137,700 of an employee’s annual income is subject to social security tax. If an employee hits this number during the year, any future quarters can be represented by a $0, since you do not need to include any wages above $137,700 on lines 5a-5d.

Lines 5c-5d

On line 5c, multiply taxable Medicare wages and tips by 0.029 (Employee = 1.45%, Employer = 1.45%, Total = 2.9%).

Medicare tax does not have a wage base. However, you must withhold an additional 0.9% for Medicare tax once an employee meets one of the following thresholds:

- Single with an annual income of $200,000 or more

- Married filing jointly with an annual income of $250,000 or more

- Married filing separately with an annual income of $125,000 or more

If applicable, account for the additional 0.9% on line 5d by multiplying taxable wages and tips subject to additional Medicare tax withholding by 0.009.

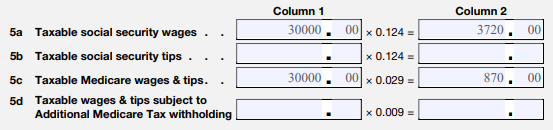

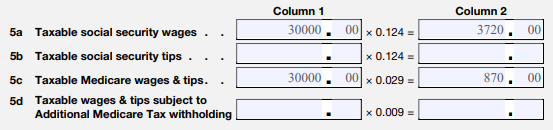

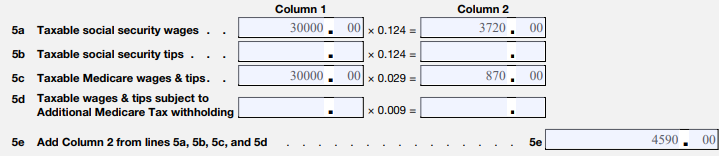

Let us look at a quick example of calculating totals for lines 5a-5d for an employee.

Example

An employee earns $30,000 in regular wages during the quarter. This is what the 5a-5d section would look like:

Fill out Columns 1 and 2 with the correct totals based on your wages and calculations. Be sure to separate the dollar and cents on the form.

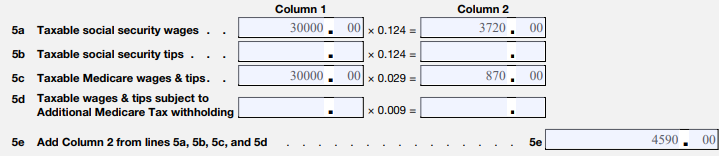

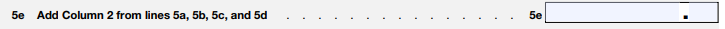

Line 5e

Add the totals from Column 2 for 5a, 5b, 5c, and 5d together to fill in the total on line 5e. Using the example data from above, you would input $4,590.00 on line 5e ($3,720 + $928).

Line 5f

Line 5f is specifically for documenting tax due on unreported tips. Since tips are not common in construction, you can skip this line.

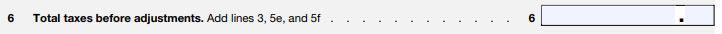

Line 6

To get your total for line 6, add together totals from lines 3, 5e, and 5f (should not be applicable). Line 6 is the total amount of taxes you owe before any adjustments.

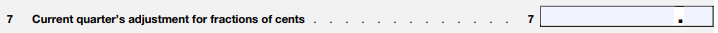

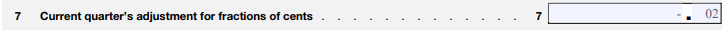

Line 7

Fill out line 7 to adjust fractions of cents from lines 5a-5d. At some point, you will probably have a fraction of a penny when you complete your calculations. The fraction adjustments relate to the employee share of social security and Medicare taxes withheld.

The employee portion of social security and Medicare taxes from lines 5a-5d may differ from the amounts you withheld from employees’ wages due to rounding.

For example, say your employee had a tax liability of $2,237.212. You cannot send 21.2 pennies to the IRS. Instead, you round the penny amount down to 21 cents.

Line 7 is for you to report these types of penny discrepancies. Say you paid $4,474.14. Your form states you should have paid $4,474.16. You would put -.02 on line 7 to show the penny discrepancy.

The fractions of cents adjustment can be either a positive or negative amount. Be sure to use the negative sign (not parentheses) to show a decrease.

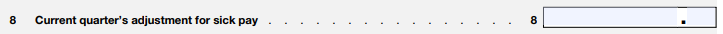

Line 8

Fill out line 8 if you have a third-party sick payer, such as an insurance company. Calculate third-party sick pay for the quarter and enter the total on line 8 as a negative (e.g., -$120).

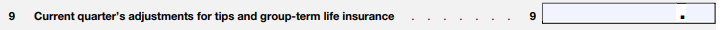

Line 9

If you do not have employees that get tips or offer a group-term life insurance plan, you can skip this line. However, if you offer a group-term life insurance plan, you can enter a negative amount for the uncollected employee share of social security and Medicare taxes on group-term life insurance premiums paid for former employees.

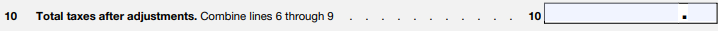

Line 10

On line 10, fill in the total taxes after your adjustments (if applicable) from lines 6-9. Add the totals from lines 6-9 and fill in the sum on line 10.

Line 11

Line 11 will not apply to your business. Leave blank.

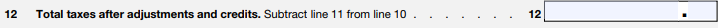

Line 12

Record your total taxes after adjustments and credits on line 12. Because you skipped line 11, just put what you had in line 10 here.

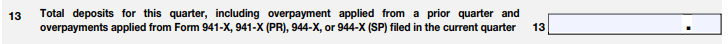

Line 13

List your total deposits for the quarter on line 13. If you had any overpayments from previous quarters that you are applying to your return, include the overpayment amount with your total on line 13.

Also, include any overpayment you applied from filing Form 941-X or 944-X in the current quarter.

Line 14

If line 12 is more than line 13, enter the difference on line 14. You do not have to pay if your line 14 total is under one dollar.

Do not fill out line 14 if line 12 is less than line 13. Move on to line 15.

Line 15

If line 13 is more than line 12, enter the difference on line 15.

Do not fill in both lines 14 and 15. Only fill out one of these lines.

If line 15 is under one dollar, the IRS will send a refund. Or, the IRS can apply it to your next return if you ask them to do so in writing.

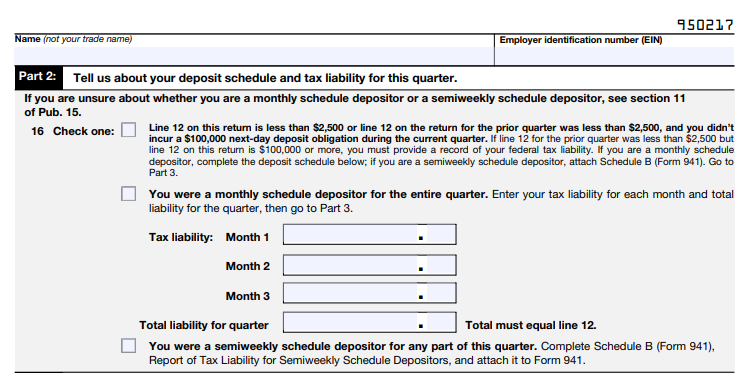

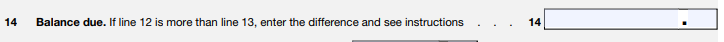

Part 2: Tell us About Your Deposit Schedule and Tax Liability for this Quarter

Above the section for Part 2, enter your business name and EIN one more time.

In Part 2, fill out information about whether you are a semiweekly or monthly depositor. If you are not sure which type of depositor you are, check IRS Publication 15, section 11.

Next to line 16, you will see three boxes. Mark an “X” next to the first box if:

- Line 12 on your Form 941 was less than $2,500

- Line 12 on your previous quarterly return was less than $2,500

- You did not incur a $100,000 next-day deposit obligation during the current quarter.

If you were a monthly depositor for the entire quarter, put an “X” next to the second box and fill out your tax liability for Months 1, 2, and 3. Your total liability for the quarter must equal line 12 on your form.

If you were a semiweekly depositor during any part of the quarter, mark an “X” next to the third box. You must also complete Schedule B, Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941 if you were a semiweekly depositor.

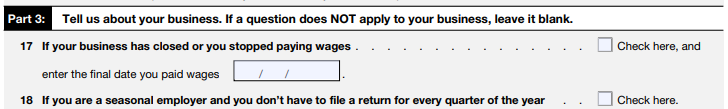

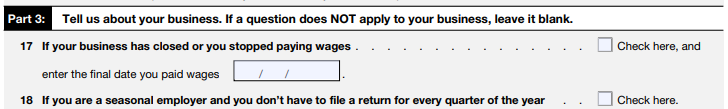

Part 3: About Your Business

Part 3, line 17 asks you whether your business closed or stopped paying wages during the quarter. If you did close your business or stopped paying wages in the quarter, place an “X” next to the box that says, “Check here.” Then, enter the final date you paid wages.

If lines 17 and 18 do not apply to your business, leave Part 3 blank and move on to Part 4.

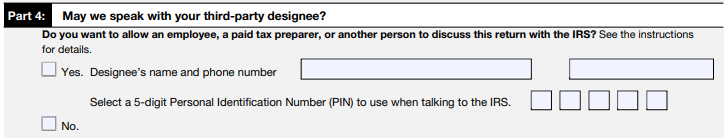

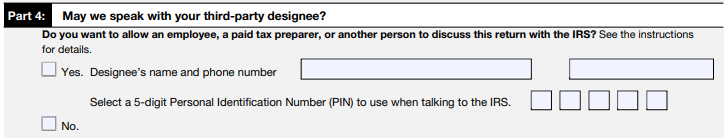

Part 4: Third-Party Designee

Part 4 asks permission for the IRS to speak with your third-party designee. Your third-party designee is the individual (e.g., employee or tax preparer) who prepared Form 941 and is typically responsible for payroll tax prep.

If you want your third-party designee to be able to discuss your return with the IRS, mark an “X” next to the “Yes” box. Then, fill in the designee’s name and phone number. You must also select a five-digit PIN to use when talking to the IRS (e.g., 12345).

If you do not want another person to be able to discuss the return with the IRS, check off the box next to “No” and move on to Part 5.

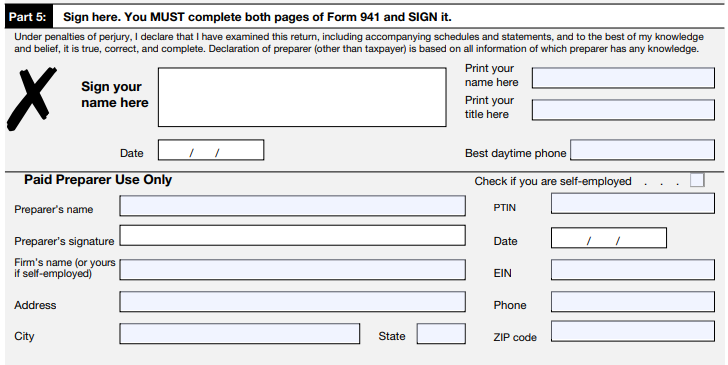

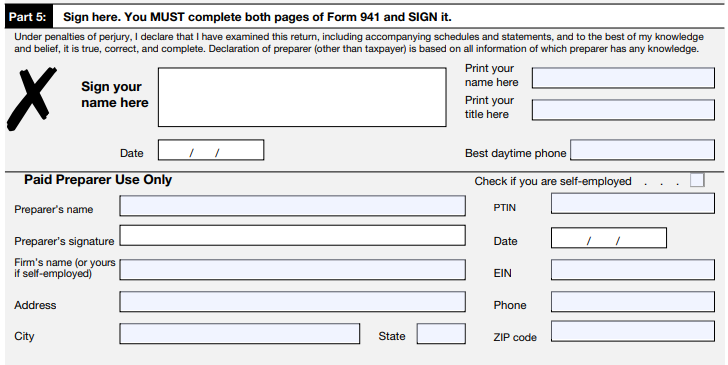

Part 5: Signature

After you complete all the above sections, sign your form under Part 5. The following people can sign Form 941:

- Sole proprietorship: Individual who owns the company

- Corporation or an LLC treated as a corporation: President, vice president, or another principal officer

- Partnership or an LLC treated as a partnership: Partner, member, or officer

- Single-member LLC: Owner of the LLC or a principal officer

- Trust or estate: The fiduciary

One of the authorized signers from above must sign Form 941 in the box next to “Sign your name here.” The signer must also print their name and title (e.g., president) and include the date and their phone number.

If you have someone else prepare Form 941 on your company’s behalf, the preparer must fill out the Paid Preparer Use Only section. This section includes the preparer’s name, signature, firm’s name, address, phone number, EIN, and date. Your preparer must also check off whether they are self-employed.

Submit Form 941

After you complete both pages of 941 and sign it, you are ready to submit your form to the IRS.

I recognize that was a lot of information, but hopefully it was helpful to walk through each section individually. Take it one-line item at a time and you will get through it simply fine.