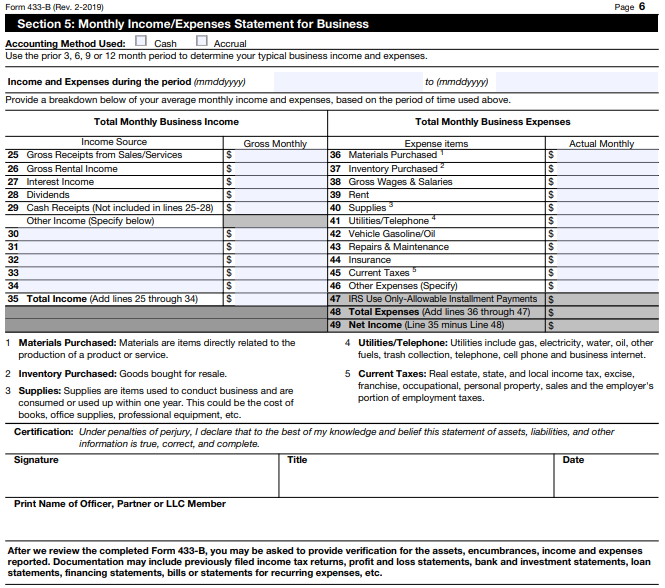

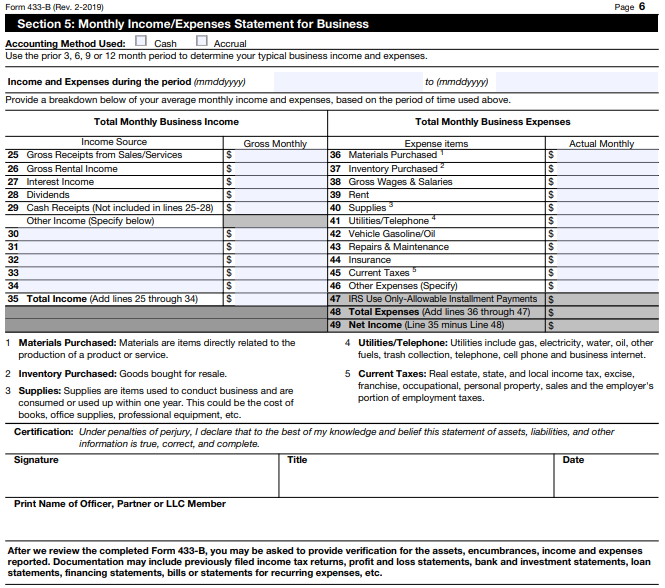

Section 5 – Monthly Income/Expenses Statement

If you remember, I mentioned that you can provide a P&L and balance sheet to the IRS in lieu of this section. I highly recommend that you do that. Again, it makes you look like you have your crap together.

If you must fill out this section, be prudent to only use the cash method and only include reasonable and ordinary business expenses.

Then make sure you sign and send it in.

Summary

I know this chapter was exhaustive and quite long; however, it is the most vital piece to the puzzle regarding your resolution outcome.

To recap:

- Adjust your reasonable expenses (thereby lowing net income)

- Be honest and transparent where you need to be because the IRS will find out anyways

- Understand that the IRS will be stopping by for a business visit

- And do everything from the eyes of scrutiny!

Now that we have gone through the Financial Analysis, the next section we are going to talk through the resolution options that the IRS will request based on your final and approved analysis.