CHAPTER 10: TRUST FUND RECOVERY PENALTY PROCESS

As mentioned throughout the book, in most 941 cases someone is going to be on the hook for the Trust Fund Recovery Penalty. The process and concepts revolving this penalty are extensive, so I wanted to dedicate an entire chapter on it.

Personal Assessment Overview

The employee portion of withheld social security, Medicare, and income taxes is the Trust Fund. The employer portion is what stays with the business. If the business goes out of business, that liability disappears, but the employee portion becomes an ongoing liability.

Responsible and Willful

The key to whether you will be assessed this penalty comes down to whether you were responsible and willful. Let us talk about both concepts:

Responsible – This could be an officer of a corporation, a partner or employee of a partnership, an accountant or payroll professional, a specific check signer, or any other person or entity that is responsible for collecting, accounting for, and paying trust fund taxes to the Treasury.

It really comes down to who controls the money, specifically in relation to payroll. Hiring a payroll company does not absolve that person of the responsibility; delegation does not remove responsibility.

Willful – This means voluntarily, consciously, and intentionally. Did they do it on purpose? A person that is willful is someone that knows the required actions of collecting, accounting for, and paying trust fund taxes to the Treasury.

Common mistakes from those willful are based around deciding which bills get paid. They may also be trying to save their job by not telling the business owner and stressing them out about the issues.

*Special Note: If a responsible person finds out about the willful persons actions and do not take immediate action, then they will become part of the willful category.

Both - For those responsible and willful persons, the Trust Fund Recovery Penalty will be imposed. If this is imposed upon you, the full weight of the IRS can pierce the corporate veil and touch you personally.

Form 4180 Interview

For those that are possibly responsible or willful, there will be a personal interview by the IRS. This interview is required by the IRM to determine who is going to be liable for this penalty.

The interview can occur over the phone or in person. Do not be afraid to request the interview over the phone since the Revenue Officer will likely prefer that option anyways.

I would recommend going through the entire Form 4180 ahead of the call. Think of it as an interview prep. Go through the questions and make sure you have your answers down pat. In fact, I would recommend filling out the form, so you have the answers to share on the phone. It will keep your information on point and will prevent you from rambling.

*Special Note: Do not answer any questions about roles and responsibilities when the revenue officer shows up in person.

*Special Note: You can refuse a non-scheduled site visit. You can ask for a proper site schedule.

*Special Note: Never sign Form 2751 accepting the assessment without a good reason. You are not required to and nor should you.

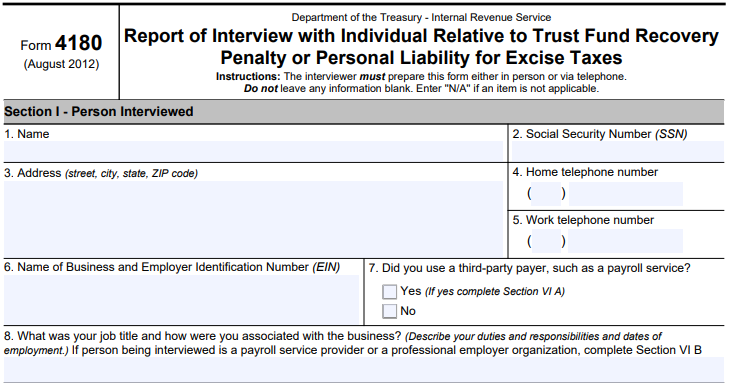

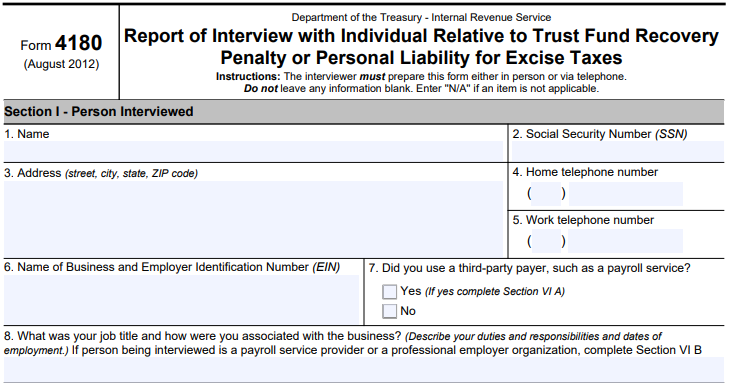

FORM 4180 – Section 1

Any open-ended questions on this form are traps; be careful. Be as brief as possible. Be truthful but be concise and do not leave room for them to ask follow-up questions.

There is a difference between telling them about your role, versus basically handing them a resume with a bullet point for every little detail and thing you touched there at the office.

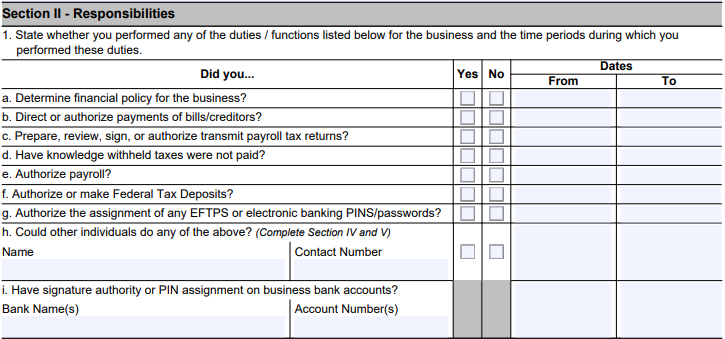

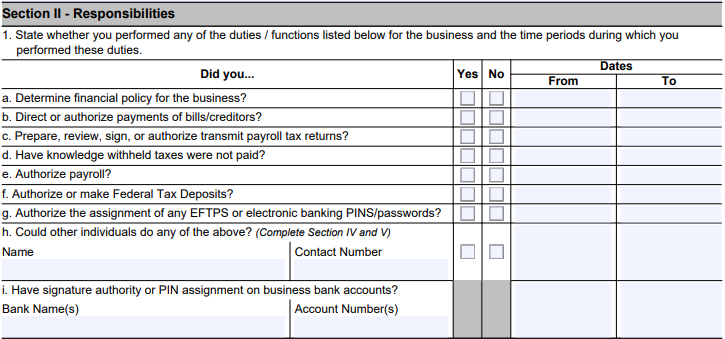

FORM 4180 – Section 2

If you are making a responsible defense, the dates that you held the responsibilities should before or after the quarters in question for the 941.

Be aware that Question H is specifically asking who else they can go after.

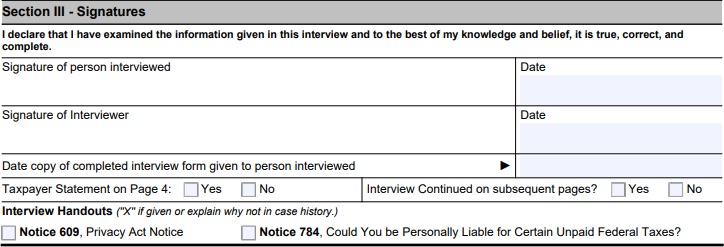

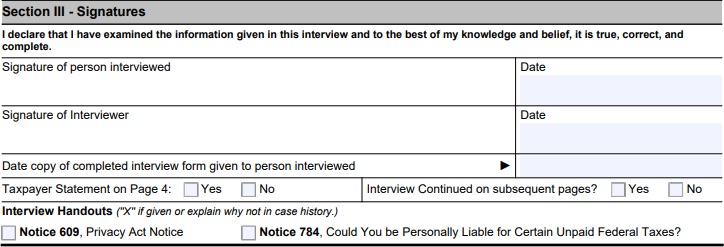

FORM 4180 – Section 3

This form you can sign, just do not ever sign Form 2751 (waiver of your rights).

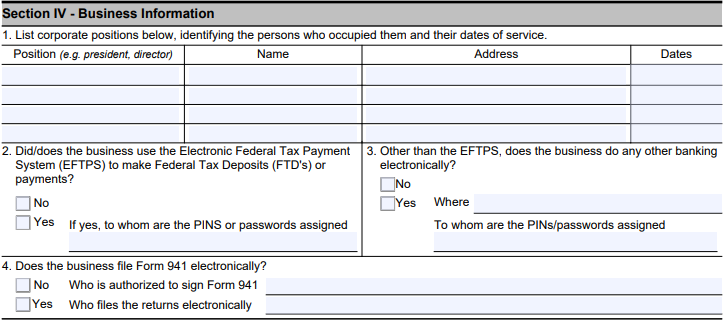

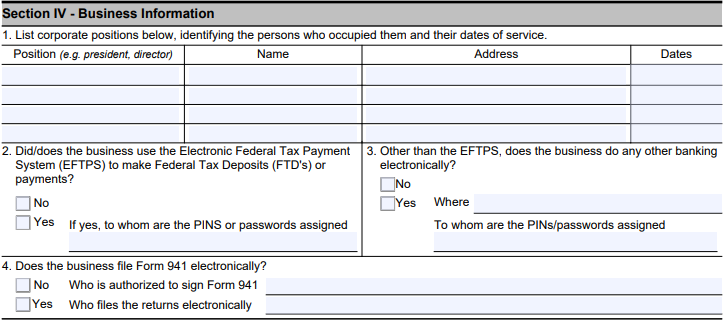

FORM 4180 – Section 4

This is another section where they are probing for people to throw under the bus. Please use caution with what you say here.