Chapter 7: Community, Politics, and Regulation

In this chapter we'll look at about all the ways that the world of Bitcoin and cryptocurrency technology touches the world of people. We'll discuss the community, politics within Bitcoin and the way that Bitcoin interacts with politics, and law enforcement and regulation issues.

7.1 : Consensus in Bitcoin

First let’s look at consensus in Bitcoin, that is, the way that the operation of Bitcoin relies on the formation of consensus amongst people. There are three kinds of consensus that have to operate for Bitcoin to be successful.

1. Consensus about rules. By rules we mean things like what makes a transaction valid, what makes a block valid, and how the nodes in the peer-to-peer network should behave — how they should interact with each other, the communication protocol they should use, and more generally all the protocols and data formats that are involved in making Bitcoin work.

You need to have a consensus about these things so that all the different participants in the system can talk to each other and agree on what's happening.

2. Consensus about history. That is, consensus about what's in and what isn’t in the block chain, and therefore a consensus about which transactions have occurred. Once you have that, what follows is a consensus about which coins — which unspent outputs — exist and who owns them.

This consensus results from the processes we’ve looked at in earlier chapters from which the block chain is built and by which nodes come to consensus about the contents of the block chain. This is the most familiar and most technically intricate kind of consensus in Bitcoin.

3. Consensus that coins are valuable. The third form of consensus is the general agreement that bitcoins are valuable, that bitcoins are a good thing to have, and in particular the consensus that if someone gives you a bitcoin today, then tomorrow you will be able to redeem or trade that for something of value.

Any currency needs this — whether it's a fiat currency like the dollar or cryptocurrency like Bitcoin, you need a consensus that the thing has value. That is, you need people to generally accept that it's exchangeable for something of value, now and in the future. In a fiat currency, this is the only kind of consensus, whereas in cryptocurrencies we additionally have the first two.

In Bitcoin, this form of consensus, unlike the others, is a bit circular. In other words, my belief that the bitcoins I'm receiving today are of value depends on my expectation that tomorrow other people will believe the same thing. So consensus on value relies on believing that consensus on value will continue. This is sometimes called the Tinkerbell effect by analogy to Peter Pan where it's said that Tinker Bell exists because you believe in her.

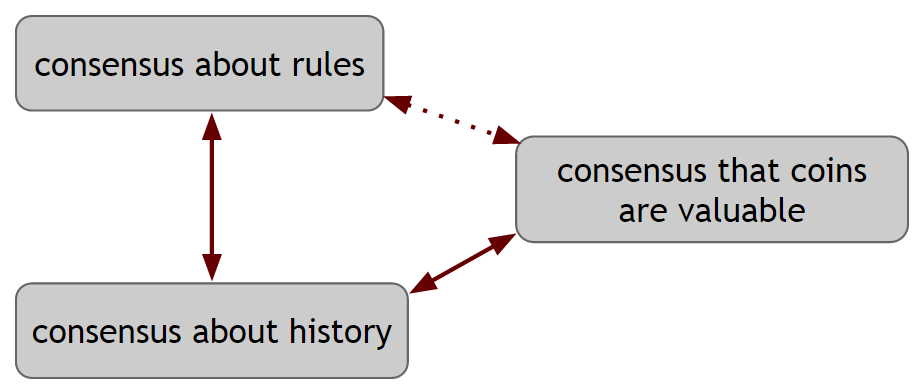

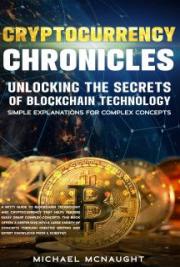

Whether it's circular or not, it seems to exist and it's important for Bitcoin to operate. Now, what's important about all three forms of consensus is that they're intertwined with each other, as Figure 7.1 shows.

Figure 7.1: Relationships between the three forms of consensus in Bitcoin

First of all, consensus about rules and consensus about history go together. Without knowing which blocks are valid you can’t have consensus about the block chain. And without consensus about which blocks are in the block chain, you can’t know if a transaction is valid or if it’s trying to spend an already-spent output.

Consensus about history and consensus that coins are valuable are also tied together. Consensus about history means that we agree on who owns which coins, and that’s a prerequisite for believing that the coins have value — without a consensus that I own a particular coin I can’t have any expectation that people will accept that coin from me as payment in the future. It’s true in reverse as well — as we saw in Chapter 2, consensus about value is what incentivizes miners to maintain the security of the block chain, which gets us consensus about history.

The genius in Bitcoin’s original design was in recognizing that it would be very difficult to get any one of these types of consensus by itself. Consensus about the rules in a worldwide decentralized environment where there's no notion of identity isn’t the kind of thing that's likely to happen.

Consensus about a history, similarly, is a very difficult distributed data structure problem which is not likely to be solvable on it's own. And a consensus that some kind of cryptocurrency has value is also very difficult to achieve. What the design of Bitcoin and the continued operation of Bitcoin shows is that even if you can't build any one of these forms of consensus by itself you can somehow stand up all three of them together, and get them to operate in an interdependent way. So when we talk about how things operate in the Bitcoin community we have to bear in mind that Bitcoin relies on agreement by the participants, and that consensus is a fragile and interdependent thing.

7.2 : Bitcoin Core Software

The Bitcoin Core software is a piece of open-source software which is a focal point for discussion and debate about Bitcoin’s rules.

Bitcoin Core is licensed under the MIT license which is a very permissive open-source license. It allows the software to be used for almost any purpose as long as the source is attributed and the MIT license is not stripped out. Bitcoin Core is the most widely used Bitcoin software, and even those who don't use it tend to look to it to define what the rules are. That is, people building alternative Bitcoin software typically try to mimic the rule-defining parts of the Bitcoin Core software, the parts that check validity of transactions and blocks.

|

Bitcoin Core is the de-facto rulebook of Bitcoin. If you want to know what’s valid in Bitcoin, the Bitcoin Core software — or explanations of it — is where to look.

|

Bitcoin Improvement Proposals. Anyone can contribute technical improvements via “pull requests” to Bitcoin Core, a familiar process in the world of open-source software. For more substantial changes, especially protocol modifications, there is a process called Bitcoin Improvement Proposals or BIPs. These are formal proposals for changes to Bitcoin. Typically a BIP will include a technical specification for a proposed change as well as a rationale for it. So if you have an idea for how to improve Bitcoin by making some technical change, you're encouraged to write up one of these documents and to publish it as part of the Bitcoin Improvement Proposal series, and that will then kick off a discussion in the community about what to do. While the formal process is open to anyone, there’s a learning curve for participation like any open-source project.

BIPs are published in a numbered series. Each one has a champion, that is, an author who evangelizes in favor of it, coordinates discussion and tries to build a consensus within the community in favor of going forward with or implementing a particular proposal.

What we said above applies to proposals to change the technology. There are also some BIPs that are purely informational and exist just to tell people things that they might not otherwise know, or that are process oriented, that talk about how things should be decided in the Bitcoin community.

In summary, Bitcoin has a rulebook as well as a process for proposing, specifying, and discussing rule changes, namely BIPs.

Bitcoin Core developers. To understand the role of the Bitcoin Core software we also have to understand the role of Bitcoin Core developers. The original code was written by Satoshi Nakamoto, who we’ll return to later in the chapter. Nakamoto is no longer active, but instead there are a group of developers who maintain Bitcoin Core. As of early 2015 there are five: Gavin Andresen, Jeff Garzik, Gregory Maxwell, Wladimir J. van der Laan, and Pieter Wuille. The Core developers lead the effort to continue development of the software and are in charge of which code gets pushed into new versions of Bitcoin Core.

How powerful are these people? In one sense they’re very powerful, because you could argue that any the rule changes to the code that they make will get shipped in Bitcoin Core and will be followed by default. These are the people who hold the pen that can write things into the de-facto rulebook of Bitcoin. In another sense, they’re not powerful at all. Because it's open-source software, anyone can copy it and modify it, in other words, fork the software at any time, and so if the lead developers start behaving in a way that the community doesn't like, and strongly rejects, the community can go in a different direction.

One way of thinking about this is to say that the lead developers are leading the parade. They’re out in front of the parade marching and the parade will generally follow them when they turn a corner, but if they try to lead the parade into an action that disastrous, then the parade members marching behind them might decide to go in a different direction. They can urge people on, and as long as they seem to be behaving reasonably, the group will probably follow them, but they don't have formal power to force people to follow them if they take the system in a technical direction that the community doesn't like.

Let’s think about what you as a user of a system can do if you don't like the way the rules are going or the way it's being run, and compare it to a centralized currency like a fiat currency. In a centralized currency if you don't like what's going on you have a right to exit, that is, you can stop using it. First you’d have to try and sell any currency you hold. Just like almost any business that you deal with, you have the ability to just stop dealing with them if you don't like what they're doing. On the other hand, if it's a currency and you've got a lot of business, you've got a lot of assets tied up in it and it might be expensive or difficult to actually exit. Whether or not it’s easy, with a centralized currency that's really your only option.

With Bitcoin, while you certainly have the right to exit, because it operates in an open-source way, you additionally have the right to fork the rules. That means you, and some of your friends and colleagues can decide that you would rather live under a different rule set, and you can fork the rules and go a different direction from the lead developers. The right to fork this is more empowering for users than the right to exit, and therefore the community has more power in a system like Bitcoin which is open source than it would in a purely centralized system. So although the lead developers might look like a centralized entity controlling things, in fact they don't have the power that a purely centralized manager or software owner would have.

Forks in the rules. One way to fork the software and the rules is to start a new block chain with a new genesis block. This is popular option for creating altcoins, and we’ll discuss altcoins in Chapter 10. But for now let’s consider a different type of fork in the rules, one in which those who fork decide to fork the block chain as well.

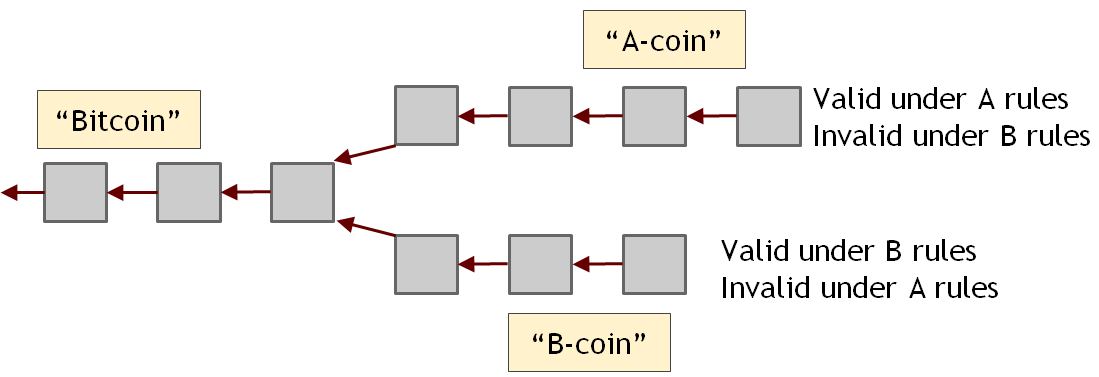

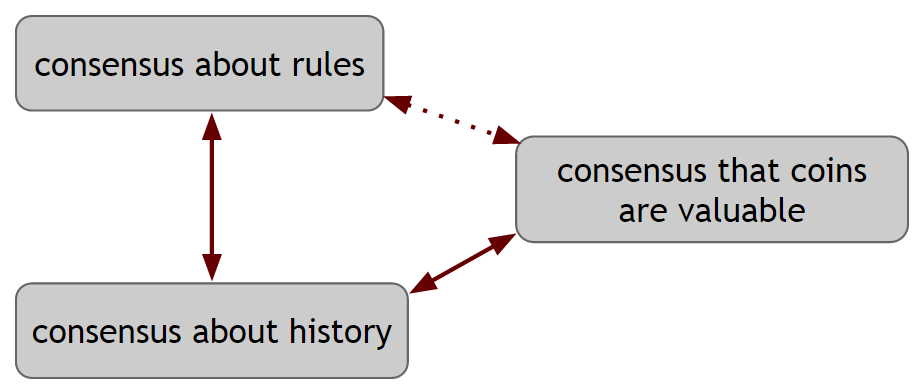

If you recall the distinction between a hard fork and a soft fork from Chapter 3, we’re talking about a hard fork here. At the point when there’s a disagreement about the rules, there will be a fork in the block chain, resulting in two branches. One branch is valid under rule set A but invalid under rule set B, and vice versa. Once the miners operating under the two rule sets separate they can’t come back together because each branch will contain transactions or blocks that’s invalid according to the other rule set.

Figure 7.2: A fork in the currency. If a fork in the rules leads to a hard fork in the block chain, the currency itself forks and two new currencies result.

We can think of the currency we had up until the fork as being Bitcoin — the big happy Bitcoin that everyone agreed on. After the fork it's as if there are two new currencies which we can think of as being A-coin corresponding rule set A and B-coin corresponding to rule set B. At the moment of the fork, it’s as if everyone who owned one Bitcoin receives one A-coin and one B-coin. From that point on, A-coin and B-coin will operate separately as if they were separate currencies, and they might operate independently. The two groups might continue to evolve their rules in different ways.

We should emphasize that it's not just the software, or the rules, or the software implementing the rules that forked — it's the currency itself that forked. This is an interesting thing that can happen in a cryptocurrency that couldn't happen in a traditional currency where the option of forking is not available to users. To our knowledge, neither Bitcoin nor any altcoin has ever forked in this way, but it’s a fascinating possibility.

How might people respond to a fork like this? It depends on why the fork happened. The first case is where the fork was not intended as a disagreement about the rules, but instead as a way of starting an altcoin. Someone might start an altcoin by forking Bitcoin’s block chain if they want to start with a ruleset that’s very close to Bitcoin’s. This doesn’t really pose a problem for the community — the altcoin goes its separate way, the branches coexist peacefully, and some people will prefer to use bitcoins while others will prefer the altcoin. But as we said earlier, as far as we know, no one’s ever started an altcoin by forking Bitcoin’s or another existing altcoin’s block chain. They’ve always started with a new genesis block.

The interesting case is if the fork reflected a fight between two groups about what the future of Bitcoin should be — in other words, a rebellion within the Bitcoin community where a sub-group decides to break off and decides they have a better idea about how the system should be run. In that case, the two branches are rivals and will fight for market share. A-coin and there's a B-coin will each try to get more merchants to accept it and more people to buy it. Each will want to be perceived as the “real Bitcoin.” There may be a public-relations fight where each claims legitimacy and portrays the other as a weird splinter group.

The probable outcome is that one branch will eventually win and the other will melt away. These sorts of competitions tend to tip in one direction. Once one of the two gets seen as more legitimate and obtains a bigger market share, the network effect will prevail and the other becomes a niche currency and will eventually fall away. The rule set and the governance structure of the winner will become the de-facto rule set and governance structure of Bitcoin.

7.3 : Stakeholders: Who's in Charge?

Who’re the stakeholders in Bitcoin, and who’s really in charge? We've seen how Bitcoin relies on consensus and how its rulebook is written in practice. We've analyzed the possibility of a fork or a fight about what the rules should be. Now let’s take up the question of who has the power to determine who might win a fight like that.

In other words, if there’s a discussion and negotiation in the community about rule-setting, and that negotiation fails, we want to know what will determine the outcome. Generally speaking, in any negotiation, the party that has the best alternative to a negotiated agreement has the advantage in a negotiation. So figuring out who might win a fight will tell us who has the upper hand in community discussions and negotiations about the future of Bitcoin.

We can make a bunch of different claims on behalf of different stakeholders.

- Core developers have the power — they write the rulebook and almost everybody uses their code.

- Miners have the power — they write history and decide which transactions are valid. If miners decide to follow a certain set of rules, arguably everyone else has to follow it. The fork with more mining power behind it will build a stronger, more secure block chain and so has some ability to push the rules in a particular direction. Just how much power they have depends on whether it’s a hard fork or a soft fork, but either way they have some power.

- Investors have the power — they buy and hold bitcoins, so it's the investors who decide whether Bitcoin has any value. You could argue that if the developers control consensus about the rules and the miners control consensus about history, it's the investors who control consensus that Bitcoin has value. In the case of a hard fork, if investors mostly decide to put their money either A-coin or B-coin, that branch will be perceived as legitimate.

- Merchants and their customers have the power — they generate the primary demand for Bitcoin. While investors provide some of the demand that supports the price of the currency, the primary demand that drives the price of the currency, as we saw in Chapter 4, arises from a desire to mediate transactions using Bitcoin as a payment technology. Investors, according to this argument, are just guessing where the primary demand will be in the future.

- Payment services have the power — they’re the ones that handle transactions. A lot of merchants don't care which currency they follow and simply want to use a payment service that will give them dollars at the end of the day, allow their customers to pay using a cryptocurrency, and handle all the risk. So maybe payment services drive primary demand and merchants, customers, and investors will follow them.

As you may have guessed, there's some merit to all these arguments, and all of those entities have some power. In order to succeed, a coin needs all these forms of consensus — a stable rulebook written by developers, mining power, investment, participation by merchants and customers, and the payment services that support them. So all of these parties have some power in controlling the outcome about a fight over the future of Bitcoin, and there's no one that we can point to as being the definite winner. It's a big, ugly, messy consensus-building exercise.

The Bitcoin Foundation. There's one more player that’s relevant to the governance of Bitcoin and that's the Bitcoin Foundation. The Bitcoin Foundation was founded in 2012 as a nonprofit. It’s played two main roles. The first is funding some of the Core developers out of the foundation’s assets so that they can work full time on continuing to develop the software. The second is talking to government, especially the US government, as the “voice of Bitcoin.”

Now, some members of the Bitcoin community believe that Bitcoin should operate outside of and apart from traditional national governments. That believe Bitcoin should operate across borders and shouldn’t explain or justify itself to governments or negotiate with them. Others take a different view. They view regulation as inevitable, desirable, or both, and would like the interests of the Bitcoin community to be represented in government, and for the community’s arguments to be heard. The Foundation arose partly to fill this need, and it's fair to say that its dealings with government have done a lot to smooth the road for an understanding and acceptance of Bitcoin.

The Foundation has had quite a bit of controversy. Some board members have gotten into criminal or financial trouble, and there have been questions about the extent to which some of them represent the community. The Foundation has had to struggle with members of the board that become liabilities and have to be replaced on short notice. It’s been accused of lacking transparency and of being effectively bankrupt. As of early 2015, it’s at best unclear if the Bitcoin Foundation will have much of a role in Bitcoin’s future.

A different non-profit group, Coin Center, launched in September 2014 based in Washington, D.C., has taken on one of the roles the Bitcoin Foundation played, namely advocacy and talking to government. Coin Center acts as a “think tank.” It has operated without much controversy as of early 2015. Neither the Bitcoin Foundation nor Coin Center is in charge of Bitcoin anymore than any of the other stakeholders. The success and perceived legitimacy of any such representative entity will be driven by how much support — and funding — it can obtain from the community over time, like everything else in this kind of open source based ecosystem.

To summarize, there’s no one entity or group that is definitively in control of Bitcoin’s evolution. In another sense, everybody is in charge because it's the existence of consensus about how the system will operate — the three interlocking forms of consensus, on rules, on history, and on value — that governs Bitcoin. Any ruleset, group, or governance structure that can maintain that consensus over time will, in a very real sense, be in charge of Bitcoin.

7.4 : Roots of Bitcoin

Let’s look at the roots of Bitcoin — how it got started, what its precursors were, and what we know about its mysterious founder.

Cypherpunk and digital cash. There are two precursors to Bitcoin worth discussing. One of these was cypherpunk, a movement that brought together two viewpoints. First was libertarianism and in particular the idea that society would be better off with either no government or very minimal government. Together with that strong libertarian notion or perhaps even anarchist notion, we had the idea of strong cryptography and in particular public-key cryptography which started in the late 1970s. The cypherpunk movement was a group of people who believed that with strong online privacy and strong cryptography you could re-architect the way that people interact with each other. In this world, cypherpunks believed, people could protect themselves and their interests more effectively and with much less activity (or, as they would say, interference) from government.

One of the challenges in the cypherpunk movement was how to deal with money in a future cypherpunk world where people were interacting online via strong technical and cryptographic measures. In response, a bunch of research came along, led especially by early digital cash work by David Chaum and others, that was designed to create new forms of digital value that functioned like money, specifically cash, in the sense of being anonymous and easily exchangeable. There’s a whole interesting story about how these technical ideas were developed and why early digital cash didn't sweep the world, but we won’t go into it here. In any event, early work in that area came together with cypherpunk beliefs and in particular the desire to have a strong currency that would be decentralized, online, and relatively private to sow the seeds from which Bitcoin would be born. It’s also the basis for the philosophy that many of Bitcoin’s supporters follow.

Satoshi Nakamoto. Bitcoin began in 2008 with the release of this white paper called Bitcoin: A Peer to Peer Electronic Cash System that was authored by Satoshi Nakamoto. This paper, which you can find online easily, is the initial description of what Bitcoin is, how it works, and the philosophy behind its design. It’s still a good resource to get a quick idea of how Bitcoin’s technical design and philosophy were specified. Open-source software implementing that specification was released soon after by the same Satoshi Nakamoto, and that’s where everything started. To this day, Satoshi is one of the central mysteries of Bitcoin.

We know that the name Satoshi Nakamoto is almost certainly a pseudonym. It’s a fake name that some person or people have adopted for the purpose of doing things related to Bitcoin. The identity of Satoshi is associated with certain public keys, certain accounts and certain systems. That means there are certain online activities or digital signatures that would convince the community that something was said by or issued by or created by the real Satoshi. So Satoshi, while being a pseudonym, is also a person (or people) who can speak, and who has spoken especially extensively in the early history of Bitcoin. Satoshi was fairly active in working on and writing about Bitcoin, and participating in online forums until around 2010, and since that time Satoshi has said almost nothing.

We know that Satoshi writes fairly well in English. Satoshi uses sometimes American and sometimes British spellings. There have been numerous attempts to look at Satoshi’s text, code, post times, machine identifiers, and so on to try to answer questions like: what is Satoshi's native language?

Where is Satoshi from? The real identity of Satoshi is still unknown, despite occasional confident pronouncements by individuals and, at least once, a news organization.

Satoshi owns a lot of bitcoins from early mining. In the beginning Satoshi was perhaps the only miner, or one of the only few people mining bitcoins. So until Bitcoin mining took off and the network’s hash rate started to increase from the influx of other miners, Satoshi was accumulating all or at least a significant portion of block rewards, which was 50 bitcoins every 10 minutes. As Bitcoin’s price appreciated, this turned into a large sum of wealth. We know that these bitcoins haven’t been cashed out. Everybody can see which Bitcoin addresses probably belong to Satoshi, and so if those coins were to be sold and the proceeds transferred into any particular bank account, it would be a very notable event and an important clue to Satoshi's identity. So, interestingly, even though Satoshi has on paper made a lot of profit from Bitcoin mining, Satoshi is unable to cash in that profit without identifying himself or herself, and that’s something that, for whatever reason, Satoshi doesn't want to do.

In an important sense it doesn't matter that we don’t know Satoshi’s identity because of the notable feature of Bitcoin that it is decentralized and with no single entity in charge. Satoshi's not in charge, and to some extent it doesn't really matter what Satoshi thinks anymore. Any special influence that Satoshi has is only because of respect that Satoshi would have in the Bitcoin community should Satoshi become active again.

Growth. Bitcoin has grown