The Beginner's Guide to Crypto: Your First Steps into the Exciting World of Digital Assets

By Dirk Dupon

Introduction

How Is Crypto Created?

The Start Of Crypto

How To Buy Your First Crypto Asset

How To Buy Crypto On Binance

Navigating The Crypto Ecosystem

Risks And Rewards

Blockchain Technology

How To Protect Your Tokens

Get Started With Crypto Trading

Basic Trading Advice

Which Trader Are You?

Pump-And-Dump Scams Explained

Using Crypto Trading Platforms

How To Practice With Paper Trading

Diversifying Your Portfolio

Technical Analysis

Recap

Conclusion

Introduction

Welcome to the exciting world of cryptocurrencies!

In recent years, cryptocurrencies have captured the imagination of millions around the globe, revolutionizing the way we think about money, finance, and technology.

Whether you're a seasoned investor or a curious newcomer, this book is your comprehensive guide to understanding and navigating the dynamic landscape of digital currency.

We'll explore the origins of cryptocurrency, the principles of blockchain technology, and the transformative potential of decentralized finance.

We'll delve into the fundamental concepts and terminology that underpin the world of cryptocurrency, providing you with a solid foundation to build upon as you progress through the book.

But first, let's take a step back and consider how we got here.

The concept of digital currency dates back to the early days of the internet, with early pioneers envisioning a future where money could be transmitted instantly and securely over the web.

However, it wasn't until the emergence of Bitcoin in 2009 that this vision began to take shape.

Bitcoin, the world's first decentralized cryptocurrency, was created by an enigmatic figure known as Satoshi Nakamoto.

Built on the principles of blockchain technology, Bitcoin offered a revolutionary new way to transact and store value, free from the control of centralized authorities such as banks and governments.

Since then, thousands of cryptocurrencies have been launched, each with its unique features, use cases, and communities.

In the following pages, we'll explore the key concepts and principles that define the world of cryptocurrency.

We'll learn how cryptocurrencies are created, how transactions are verified and recorded on the blockchain, and how we can buy, trade, and safely store and secure our tokens.

But cryptocurrency is about more than just technology –it's also about empowerment, innovation, and the democratization of finance.

Cryptocurrency has the potential to level the playing field, giving individuals around the world access to financial services and opportunities previously unavailable to them.

It's a disruptive force that's reshaping industries, challenging traditional power structures, and paving the way for a more inclusive and equitable future.

Whether you're looking to invest in cryptocurrencies, explore blockchain technology, or simply understand the basics, this book is your guide to unlocking the potential of digital currency.

So, let’s dive into this journey together and discover the exciting possibilities that await in the world of cryptocurrency.

How Is Crypto Created?

Cryptocurrencies are generated through a process called mining, which involves using computer hardware to solve complex mathematical puzzles.

The specific method of generating crypto tokens varies depending on the consensus mechanism used by each cryptocurrency network.

The most common method used for generating crypto tokens like Bitcoin is called Proof of Work (PoW).

Here's how it works:

1. Proof of Work (PoW): In a Proof of Work system, miners compete to solve complex mathematical puzzles to validate and confirm transactions on the blockchain. These puzzles require significant computational power to solve, and miners must expend energy (in the form of electricity) to participate in the mining process.

2. Mining Nodes: Miners use specialized hardware, known as mining rigs or mining nodes, to perform the computational calculations required to solve the puzzles. These mining nodes are connected to the cryptocurrency network and work together to validate and add new blocks of transactions to the blockchain.

3. Block Rewards: When a miner successfully solves a puzzle and adds a new block to the blockchain, they are rewarded with newly created cryptocurrency coins. This reward, known as the block reward, serves as an incentive for miners to participate in the mining process and secure the network.

4. Difficulty Adjustment: The difficulty of the mathematical puzzles is adjusted periodically to ensure that new blocks are added to the blockchain at a relatively constant rate, typically every 10 minutes for Bitcoin. As more

miners join the network and compete for block rewards, the difficulty of the puzzles increases to maintain the desired block time.

5. Halving Events: In some Proof of Work cryptocurrencies, such as Bitcoin, the block reward is periodically reduced through a process called halving.

This means that over time, the rate at which new coins are generated decreases, leading to a finite and predictable supply of coins. Halving events occur approximately every four years and serve to control inflation and maintain scarcity in the cryptocurrency ecosystem.

Each method has its advantages and trade-offs in terms of security, energy efficiency, and decentralization.

The Start Of Crypto

In today's digital age, innovation is everywhere, and one of the most groundbreaking ideas shaking up the financial landscape is cryptocurrency.

It's like money, but it's digital, decentralized, and completely different from what you're used to.

Think of Bitcoin as the cool kid who started it all.

Back in 2008, someone (or maybe a group of someones) named Satoshi Nakamoto introduced Bitcoin to the world. It was a complete game changer, based on blockchain technology.

Suddenly, there was a new way to think about money -one that didn't rely on banks or governments.

But Bitcoin was just the beginning. Since its release, tons of other cryptocurrencies, or altcoins, have popped up, each with its unique features and purposes.

From Ethereum, which brought us smart contracts and decentralized apps, to Ripple, which wants to revolutionize how we send money across borders, there's a whole universe of digital currencies out there waiting to be explored.

Now, if you're feeling a bit overwhelmed or confused, don't worry.

That's where this book comes in. I’m here to be your guide, to break down the complex stuff into easy-to-understand chunks, and to help you navigate this wild and wonderful world of cryptocurrency.

Whether you're brand new to all of this or you've dabbled a bit and want to learn more, you're in the right place. So, grab a comfy seat, buckle up, and get ready for an adventure.

Cryptocurrencies have evolved into a diverse ecosystem with numerous digital assets serving various purposes and catering to different niches.

Let’s delve into some of the most prominent cryptocurrencies, exploring their origins, key features, and potential use cases.

Bitcoin: The OG Cryptocurrency

Bitcoin is the original cryptocurrency, introduced in 2008 by an anonymous entity known as Satoshi Nakamoto. Its creation marked a paradigm shift in how we perceive and use money.

With a finite supply capped at 21 million coins, Bitcoin operates on a decentralized network of computers, known as nodes, that validate and record transactions on the blockchain.

Bitcoin's primary use cases include serving as a decentralized digital currency for peer-to-peer transactions, a store of value akin to digital gold, and a hedge against inflation and economic uncertainty.

Ethereum, launched in 2015 by Vitalik Buterin and others, introduced groundbreaking features that expanded the capabilities of blockchain technology beyond simple transactions.

At the heart of Ethereum is its ability to execute smart contracts, self-executing agreements coded onto the blockchain, enabling the creation of decentralized applications (DApps) and decentralized finance (DeFi) protocols.

Ethereum's native cryptocurrency, Ether (ETH), serves as the fuel for executing smart contracts and powering transactions on the Ethereum network, making it a crucial component of the ecosystem.

Beyond Bitcoin and Ethereum, there exists a plethora of alternative cryptocurrencies, often referred to as altcoins, each with its own unique features and use cases.

Ripple (XRP) stands out for its focus on facilitating fast and low-cost cross-border payments for financial institutions. At the same time, Litecoin (LTC) aims to be a faster and more scalable alternative to Bitcoin for everyday transactions.

Other notable altcoins include Cardano (ADA), which prioritizes security and scalability, and Polkadot (DOT), which aims to enable interoperability between different blockchains.

Stablecoins are a special category of cryptocurrencies designed to maintain a stable value by pegging their price to a fiat currency like the US

dollar or a commodity like gold.

Tether (USDT), FDUSD, USDC, and DAI are a few examples of stablecoins commonly used for trading, remittances, and accessing decentralized finance (DeFi) protocols.

These stablecoins offer the benefits of cryptocurrency, such as fast and low-cost transactions, without the price volatility typically associated with other digital assets.

How To Buy Your First Crypto Asset Buying your first cryptocurrency asset can be a daunting experience, but don’t worry, here's the general step-by-step process to help you.

Step 1. Research and select a reputable cryptocurrency exchange platform that supports the cryptocurrency you want to buy. Some popular exchanges include Coinbase, Binance, Kraken, and Gemini.

Ensure that the exchange operates legally in your country and complies with relevant regulations.

Step 2. Sign up for an account on your chosen platform. You'll typically need to provide an email address, create a password, and complete identity verification procedures, which may include providing personal information and documentation.

Step 3. Once your account is verified, deposit funds into your exchange account using a bank transfer, credit/debit card, or other accepted payment methods supported by the exchange.

Be aware of any deposit fees and processing times associated with your chosen payment method.

Step 4. Navigate to the trading section of the platform and search for the cryptocurrency you want to buy. Bitcoin (BTC) and Ethereum (ETH) are popular choices for beginners, but there are thousands of other cryptocurrencies to choose from.

Select the cryptocurrency pair you wish to trade, such as BTC/USD or ETH/EUR.

5. Decide whether you want to buy cryptocurrency at the current market price (market order) or set a specific price at which you're willing to buy

(limit order). Enter the amount of cryptocurrency you want to buy and review the transaction details, including the total cost and any associated fees.

6. Once you're satisfied with the transaction, confirm and execute the trade.

Your crypto purchase will be processed, and the funds will be credited to your exchange account.

Double-check that you've received the correct amount of cryptocurrency in your account after the transaction is completed.

7. If you don’t plan to trade, you can transfer your purchased crypto asset from the exchange to a secure decentralized crypto wallet like Metamask or Rabby on your computer.

Or you can send the tokens to a hardware wallet, such as a Ledger Nano

or Trezor, which offers the highest level of security by storing your private keys offline.

Secure your crypto holdings by enabling two-factor authentication (2FA) on your account and use a strong, unique password.

Congratulations!

You've successfully bought your first cryptocurrency and stored it in your wallet.

In the next chapter, I will show you how to buy crypto on the crypto exchange Binance.

How To Buy Crypto On Binance

Binance is one of the largest cryptocurrency exchanges in the world. It was founded in 2017 by Changpeng Zhao, commonly known as CZ. Binance offers a platform for trading various crypto tokens, providing traders with access to a diverse selection of digital assets.

Binance offers a user-friendly interface and employs robust security measures to protect users' funds and information. These include two-factor authentication (2FA), cold storage for the majority of funds, and regular security audits.

Binance provides high liquidity, allowing traders to execute trades quickly and efficiently, even for large orders. There is a mobile app for iOS and Android devices, so you can trade crypto on the go.

In addition to crypto-to-crypto trading, Binance also offers fiat-to-crypto trading pairs, allowing users to buy cryptocurrencies using traditional fiat currencies like USD, EUR, and others.

The platform also offers services like staking and futures trading and has a decentralized exchange (Binance DEX).

Here's how to buy your first crypto asset on Binance.

TIP: If you sign up for Binance and register an account using my link, you will get a $100 cashback voucher.

1. Visit www.binance.com and click on the "Register" button. Enter your email address and create a secure password for your account. Complete the captcha verification and agree to the terms of use. Verify your email address by clicking on the confirmation link sent to your email inbox.

2. Log in to your account and navigate to the "Account" section. Click on

"Verify" and follow the instructions to complete the Know Your Customer (KYC) verification process.

Provide the required personal information and upload a photo of your government-issued ID (e.g., passport or driver's license) for identity verification.

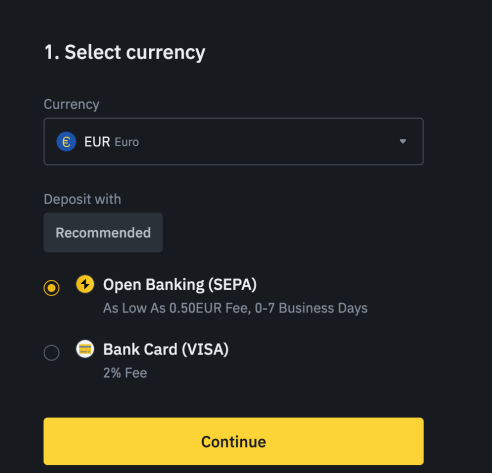

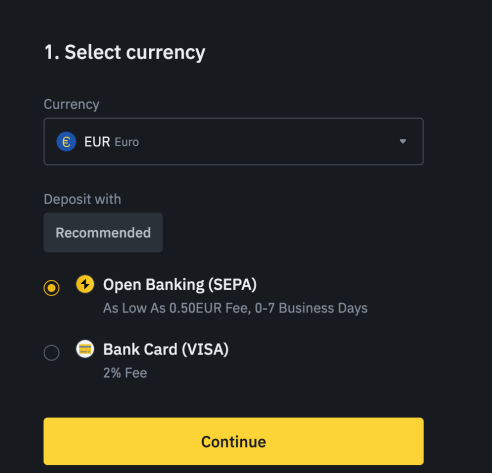

3. Once your account is verified, you can deposit “fiat” funds into your account. Pick your currency and deposit with your preferred bank or credit card, as shown in the screenshot below:

- If you already have some crypto in a waller, or on another platform, navigate to the "Wallet" section and select "Deposit." Choose the cryptocurrency you want to deposit and copy the deposit address provided.

Transfer the crypto funds from your external wallet or exchange to the Binance deposit address. Always double-check the deposit address to avoid errors, or make a small deposit to see if the funds arrive.

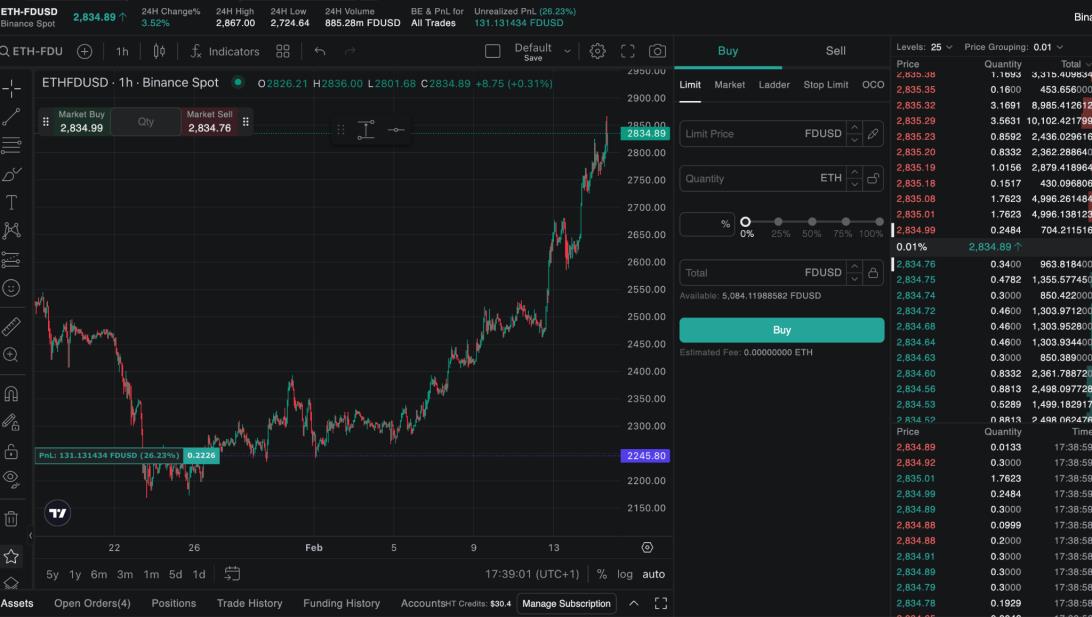

4. After your deposit is confirmed and reflected in your account, you can proceed to trade -or buy more- crypto. Go to the "Trade" section and select

"Classic" or "Advanced" trading interface based on your preference.

Choose the trading pair you want to trade (e.g., BTC/USD, ETH/BTC) and locate the "Buy" section of the trading interface.

Enter the amount of cryptocurrency you want to buy or the amount of fiat currency you want to spend. Review the order details, including the current market price and any applicable fees, then click on the "Buy" button to execute the trade.

5. After purchasing cryptocurrency on Binance, consider transferring your assets to a secure wallet for long-term storage. Binance offers a built-in wallet, but for added security, you may prefer using a hardware wallet.

Enable two-factor authentication (2FA) on your Binance account to enhance security and protect against unauthorized access.

That's it!

You've successfully bought your first cryptocurrency on Binance.

Navigating The Crypto Ecosystem

Cryptocurrency is more than just digital money -it's a dynamic ecosystem that encompasses a wide range of applications and innovations.

In this chapter, we'll talk about the various components of crypto, from decentralized finance to token sales and non-fungible tokens.

Decentralized Finance (DeFi)

Decentralized finance represents a revolutionary shift in the traditional financial system.

Instead of relying on centralized intermediaries like banks, DeFi leverages blockchain technology to create open and permissionless financial services accessible to anyone with an internet connection.

PancakeSwap is a popular decentralized exchange (DEX) and automated market maker (AMM) protocol built on the Binance Smart Chain (BSC).

It allows users to swap various cryptocurrencies, provide liquidity to liquidity pools, and earn rewards in the form of trading fees and governance tokens.

Here's an overview of how PancakeSwap works:

1. PancakeSwap operates as a decentralized exchange, meaning it allows users to trade cryptocurrencies directly with one another without the need for a centralized intermediary.

Users can swap Binance Smart Chain-based tokens (BEP-20 tokens) in a peer-to-peer manner, similar to other decentralized exchanges like Uniswap on the Ethereum blockchain.

2. Instead of relying on traditional order books and liquidity providers, PancakeSwap uses liquidity pools and automated trading algorithms to determine token prices and execute trades. Liquidity providers contribute assets to these pools and earn rewards in the form of trading fees.

3. Users can contribute pairs of tokens to liquidity pools, providing liquidity for trading pairs. In return, liquidity providers receive liquidity provider (LP) tokens representing their share of the pool. These LP tokens can be staked to earn rewards in the form of trading fees and PancakeSwap's native governance token, CAKE.

4. PancakeSwap also offers yield farming opportunities, allowing users to stake LP tokens or other tokens in designated farms to earn additional rewards. Yield farmers can earn CAKE tokens and other rewards by providing liquidity to specific pools or participating in liquidity mining programs.

5. CAKE is the native utility and governance token of the PancakeSwap platform. Holders of CAKE tokens can participate in governance decisions by voting on proposals and changes to the protocol. Additionally, CAKE

tokens are used to incentivize liquidity providers and yield farmers through reward distributions.

PancakeSwap has gained popularity for its low fees, fast transaction speeds, and integration with the Binance Smart Chain ecosystem.

However, you should always be aware of the risks associated with decentralized finance (DeFi) protocols, including impermanent loss, smart contract vulnerabilities, and market volatility.

Uniswap is another DEX but this one is built on the Ethereum blockchain.

By participating in DeFi, you can earn interest on YOUr cryptocurrency holdings, access liquidity for trading, and engage in complex financial transactions -all without relying on traditional financial institutions.

Initial Coin Offerings (ICOs) and Token Sales

Initial coin offerings and token sales have played a significant role in the growth and development of the cryptocurrency ecosystem.

These fundraising mechanisms allow projects to raise capital by selling digital tokens to investors in exchange for cryptocurrency or fiat currency.

The process of launching an ICO typically involves several stages:

- White paper creation: Projects publish a detailed document outlining their vision, technology, and tokenomics to attract potential investors.

- Token issuance: Projects create and distribute digital tokens to investors through a public sale or private allocation process.

- Marketing and distribution: Projects promote their ICO to attract investors, often through social media, forums, and industry events.

While ICOs have enabled many innovative projects to raise funds and build communities, they also come with regulatory challenges and risks, including potential fraud and investor loss.

Non-Fungible Tokens (NFTs)

Non-fungible tokens have surged in popularity, offering a new way to represent ownership and scarcity in the digital world.

Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and interchangeable, NFTs are unique digital assets on the blockchain.

They can represent virtual trading cards to virtual real estate, with each NFT having unique properties and characteristics.

NFTs have found applications in various industries, including:

- Art: Artists can tokenize their digital creations as NFTs, allowing collectors to purchase and own digital artwork with provable ownership and authenticity.

OpenSea is a popular website where you can sell and buy NFTs.

- Gaming: NFTs enable players to own in-game assets, such as characters, items, and land, which can be bought, sold, and traded on blockchain-based marketplaces.

An NFT game combines conventional gaming designs with unconventional game mechanisms to let users have more control over in-game assets like skins, characters, weapons, virtual lands, and much more.

This is made possible by launching games on blockchains and anchoring them with digital asset-powered economies. These digital assets are often NFTs so that they are distinguishable and tamper-proof.

The adoption of NFT token standards also allows developers to preserve the rarity and uniqueness of some of these in-game items. This is why some blockchain game assets are considered more expensive than others.

ChainPlay is a website with a list of the best blockchain games.

Risks And Rewards

Investing in crypto offers the potential for significant returns but also comes with inherent risks.

Here's a breakdown of the risks and rewards associated with crypto trading:

Risks:

1. Crypto markets are highly volatile, with prices subject to rapid and unpredictable fluctuations. This volatility can result in significant gains but also substantial losses, especially for traders who are not prepared to handle price swings.

2. The regulatory landscape surrounding cryptocurrencies is constantly evolving, with governments imposing new rules and restrictions. Regulatory uncertainty can impact market sentiment and potentially lead to adverse outcomes for traders.

3. Cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking, phishing attacks, and other security breaches. As a trader, you must take proactive measures to secure your funds, such as using reputable exchanges, implementing strong passwords, and enabling two-factor authentication.

4. Some crypto tokens have low liquidity, meaning there may not be enough buyers or sellers in the market to execute trades at desired prices.

Illiquid markets can lead to difficulties in entering or exiting positions, as well as wider spreads and slippage.

5. Crypto is susceptible to manipulation by whales, pump-and-dump schemes, and other fraudulent activities. Exercise caution and conduct thorough research to avoid falling victim to manipulation tactics.

Rewards:

1. Crypto has historically exhibited rapid price appreciation, with some assets experiencing exponential growth over relatively short periods.

2. Crypto offers diversification benefits for investors looking to hedge against traditional asset classes such as stocks, bonds, and commodities.

Adding cryptocurrencies to a diversified investment portfolio can reduce overall risk and potentially enhance returns.

3. Unlike traditional financial markets that operate during specific hours, crypto markets are open 24/7, allowing traders to execute trades at any time of day or night. This accessibility provides flexibility and convenience for traders in different time zones.

4. Crypto is at the forefront of technological innovation and has the potential to disrupt traditional financial systems. Trading crypto allows you to participate in the growth of groundbreaking technologies such as blockchain, decentralized finance (DeFi), and non-fungible tokens (NFTs).

5. Crypto assets offer financial freedom and autonomy by enabling people to transact and store value without reliance on centralized intermediaries such as banks or governments. Trading crypto empowers people to take control of their financial futures.

To mitigate risk and make informed investment decisions, you should take the following precautions:

Conduct thorough research before investing in any cryptocurrency or project. Research the technology, team, and market dynamics to assess its potential for long-term success.

By diversifying across different cryptocurrencies, sectors, and investment strategies, you spread risk and increase the likelihood of achieving positive returns.

Setting clear investment goals, establishing risk tolerance levels, and implementing stop-loss orders can help you manage risk and avoid significant losses.

Blockchain Technology

Let's start by demystifying blockchain. It's like a fancy digital ledger that records transactions in a way that's super secure and transparent.

Imagine a giant digital spreadsheet that's shared among a bunch of computers all over the world.

Every time a new transaction happens, it gets added to this spreadsheet, creating a chain of blocks -hence the name blockchain.

Now, let's get into the inner workings of blockchain. Each block contains a batch of transactions, like a page in a ledger, and these blocks are linked together in chronological order.

But here's the cool part: each block also contains a unique cryptographic hash -a digital fingerprint- that makes it virtually impossible to tamper with or alter any past transactions.

One of the most important aspects of blockchain is its decentralized nature.

Unlike traditional centralized systems where a single authority has control, blockchain is powered by a network of computers (or nodes) that work together to maintain the system.

This decentralization means that no single entity has control over the blockchain, making it more resistant to censorship, corruption, and single points of failure.

Trust is a big deal in the world of finance, and blockchain is all about building trust through transparency and immutability.

Because every transaction is recorded on the blockchain and can be viewed by anyone, there's a high level of transparency. Plus, once a

transaction is recorded, it can't be altered or deleted, ensuring immutability and creating a tamper-proof record of all transactions.

Smart Contracts: The Future of Transactions.

Smart contracts are like the Swiss Army knives of blockchain -they can do all sorts of cool stuff beyond just handling simple crypto transactions between wallets.

These self-executing contracts automatically enforce the terms of an agreement without the need for intermediaries, saving time and reducing the risk of disputes.

Think of them as digital agreements that can be programmed to execute actions when certain conditions are met.

How To Protect Your Tokens

Storing your crypto assets safely is essential to protecting your assets from theft or loss.

In crypto, you alone are responsible for your money, so be careful when it comes to storing your crypto tokens.

The decentralized and pseudonymous nature of cryptocurrencies makes your crypto assets attractive targets for hackers.

If your crypto gets stolen, or you forget your secret recovery phrase, you can not ask your bank to help you, let alone reimburse you.

A "secret phrase" or “mnemonic seed phrase” is a sequence of 12 to 24

words generated by a cryptocurrency wallet (like Metamask, Rabby, or

Trust wallet) to serve as a backup of the wallet's private key.

This phrase is used to recover access to the wallet in case the original wallet is lost, damaged, or inaccessible. It's crucial to protect your secret phrase, as anyone with access to the phrase can gain control over your crypto funds.

I recommend writing down the secret phrase on a piece of paper and storing the phrase in a secure location, such as a physical safe.

Here are the different ways to store your crypto both online and offline: Online Storage (Hot Wallets):

1. Exchange Wallets: Most cryptocurrency exchanges offer built-in wallets where you can store your crypto assets. While convenient for trading, these wallets are often targeted by hackers, so only keep small amounts for trading purposes.

2. Software Wallets: These are applications or programs installed on your computer or mobile device. They offer more control than exchange wallets but are still vulnerable to hacking if your device is compromised. Popular software wallets include Exodus, Electrum, and Trust Wallet.

3. Web Wallets: Mostly used for DeFi protocols, these wallets are accessible via a web browser and are convenient for accessing your funds from anywhere. However, they are susceptible to phishing attacks and hacking. Examples include Trust Wallet, MyEtherWallet, Rabby, and MetaMask.

Offline Storage (Cold Wallets):

1. Hardware Wallets: Considered the most secure option, hardware wallets are physical devices that store your private keys offline. They're immune to online hacking attempts and are only connected to the internet when making transactions.

Popular hardware wallets include the Ledger Nano series, and Trezor.

2. Paper Wallets: A paper wallet involves printing out your private and public keys on a piece of paper. This method is entirely offline and immune to online hacking. However, it's crucial to keep the paper safe from physical damage, loss, or theft.

3. Offline Computer or Air-Gapped Device: For tech-savvy users, creating an offline computer or air-gapped device solely for storing cryptocurrency keys is an option. This computer should never be connected to the internet, ensuring maximum security against online threats.

Best practices:

- Regardless of the storage method, always create backups of your private keys or seed phrases. Store these backups in multiple secure locations, such as a safe deposit box or encrypted USB drive.

- If you're using software or hardware wallets, regularly update the firmware or software to patch any potential vulnerabilities.

- Consider using multi-signature wallets that require multiple private keys to authorize a transaction. This adds an extra layer of security, as even if one key is compromised, the funds remain safe.

- Be cautious of phishing scams, malware, and social engineering attacks.

Always verify the authenticity of websites and double-check wallet addresses before making transactions.

By following these guidelines and choosing the right online and offline storage methods, you can safeguard your cryptocurrency investments effectively.

Get Started With Crypto Trading

Most people start by invеѕting in Bitcoin, аs the vаluе оf the digitаl сurrеnсу

haѕ constantly going up since it was created.

Despite all the negative news in the popular press, and warnings from traditional bankers and investors, who want to get rid of crypto (they have no control over it as with regular fiat money), I truly believe that the blockchain technology, that powers crypto, is an amazing technology that will not only change the way we use money, but our entire future.

We’re just at the beginning of the digital money revolution. Therefore, it’s a wise decision to start trading crypto.

Cryptocurrency trading has some advantages, compared to traditional trading.

You don’t need to buy/hire any special trading software or pay expensive broker fees/commissions to be active on the market. You can begin trading from home, using a PC, laptop, or mobile device, whenever you feel like it.

You are not limited by strict trading hours as crypto exchanges operate 24/7, even on the weekends.

Be prepared that not all will go as you would like…

Market prices fluctuate, especially in crypto. The value of a cryptocurrency is unpredictable. The Bitcoin price can go up 15% today, and tomorrow it can drop 20%.

This is perfectly normal in an adjusting new market like crypto. Get used to the volatility, keep your cool, and be patient. There’s no get-rich-quick method when it comes down to trading crypto.

Every trader will sooner or later be confronted with loss. Don’t take it personally. You didn’t fail.

Learn from your mistakes instead, and consider losses as “learning money”.

That being said, if you are ready to take the plunge and start trading coins, but don’t have a clue where to get started, look no further, here’s help.

Basic Trading Advice

A very important question to ask yourself is, do you have enough “extra”

money to start trading/investing?

Rule number one in trading is: “Only invest money that you can afford to lose.”

Don’t quit your job. Don’t empty your bank account, or ask family or friends to lend you a sum of money to put in a trade that you believe will make you a millionaire overnight. It won’t happen!

Use “risk capital” only!

It’s okay if you don’t have a lot of cash. You can start trading with little money, like $100 or $500, and slowly build a portfolio by making small profits.

Starting to trade crypto can be an exciting venture, but it's essential to approach it with caution to minimize the risk of losing money.

Here are some tips to follow:

- Educate yourself before diving into crypto trading. Take the time to learn the fundamentals of blockchain technology, different cryptocurrencies, and trading terminology. Understanding the market dynamics and the factors influencing crypto prices will help you make informed decisions.

- Choose a reliable exchange with robust security measures and a user-friendly interface. If you sign up for a trading account, complete the necessary verification steps and secure your crypto assets by enabling two-factor authentication (2FA), using strong and unique passwords.

- Consider offline storage options like a hardware wallet (Ledger or Trezor) for storing your long-term crypto holdings.

- Develop a trading strategy and define clear objectives, based on your risk tolerance, investment goals, and market analysis. Consider factors such as entry and exit points, position sizing, and risk management techniques.

- Monitor the market and stay updated on cryptocurrency news, market trends, and price movements. Use technical analysis tools and charting platforms to identify trading opportunities and make informed decisions.

- Practice risk management strategies such as setting stop-loss orders to limit potential losses and diversifying your portfolio to spread risk across different cryptocurrencies.

- Remove your emotions and do not let fear and greed dictate your trading decisions. This can result in impulsive actions and losses. Stick to your trading plan and make decisions based on technical analysis and predefined strategies to guide your trades.

- Stay away from leverage trading, and only trade with money you can afford to lose. Using excessive leverage can lead to significant risks, especially in volatile crypto markets.

- Don’t chase the hype! FOMO (fear of missing out) can tempt traders to invest in overvalued assets, leading to giant losses when prices inevitably correct.

These tips will protect you against a lot of common mistakes that new traders make.

Which Trader Are You?

There are two ways to make money by trading crypto. You can buy and hold crypto for a long time, and store your tokens in a hardware wallet, without the intention to trade or sell your crypto shortly.

If you believe in Bitcoin (like I do), and expect it to become a valuable asset over time, there’s no point in selling the asset with the possibility that you may never be able to repurchase Bitcoin at the price you originally bought it for.

This makes you a HODLER.

- If you plan to store (or HODL) your crypto for a longer period, I highly recommend you buy a Ledger Nano hardware wallet. This secured hardware wallet can store multiple coins offline and will be the best investment you’ll ever make. You can read more about it here.

You can also buy crypto, and keep your tokens in your personal wallet on an exchange to sell them when the price goes up and buy back when the price drops.

This makes you a TRADER.

As a trader, you want to put your coins to work for you, putting you in another league.

The number one rule in trading is simple: “Buy low, sell high.”

Well, that’s a bit easier said than done in the non-rational crypto market.

Problem 1: The market information is not evenly distributed.

We’re trading against each other with partial information, and there are greedy people out there with tons of cash, who “trick” the market all the time.

Problem 2: The market is always right.

Get used to the fact that YOU are always wrong when a trade goes bad.

Not the market.

No matter how attached you may feel to a certain coin, and despite the people on Twitter/Telegram/Discord who are saying that it will be the next Bitcoin, the time will come when the coin turns against you.

It happens. Get over it. Don’t believe what people say. Nobody can tell the future.

I've wasted enough time in Telegram groups, where “experts” share their wisdom. All they want is to make you buy their pump-and-dump shitcoins.

Problem 3: Crypto markets are moving at lightning speed.

Crypto trading happens at “warp speed”, so be prepared to make fast decisions. Trading is not for the weak-hearted.

Many crypto traders are young and grew up with high-end computers and flashy games. They can act fast and possess the skill to react to a problematic situation instantly.

Cryptos are the computer generation’s stock market.

If you want to beat them, you need a profitable strategy… and I will show you one in a moment.

Pump-And-Dump Scams Explained

You may have heard about “pump and dump” groups, set up by big money investors who place millions of sell orders at a time with the only purpose of increasing the price, causing panic on the market, and making people buy their coins.

A P&D is a manipulative tactic commonly in crypto. It involves artificially inflating the price of a particular asset (the "pump") through coordinated buying, followed by selling off the asset at a profit (the "dump"), leaving unsuspecting investors with losses.

There’s no business to do in a P&D scam, so stay away from them.

Here's how a pump and dump mechanism works:

1. The scam begins with a group of manipulators (I call them scammers), often referred to as "pump groups" or "whales," accumulating a significant amount of a low-volume or low-priced cryptocurrency with a small market capitalization, making it easier to manipulate.

2. Once the scammers have accumulated a sufficient amount of tokens, they begin coordinating their buying efforts, which creates artificial demand for the crypto, causing its price to surge rapidly within a short period.

3. To attract more investors, scammers create hype by spreading misleading information through social media platforms, online forums, or chat groups, exaggerating the potential for significant price gains.

4. As more investors start buying into the hype and driving up the price further, the pump reaches its peak value. At this point, the manipulators begin selling off their holdings, capitalizing on the artificially inflated price.

5. Once they have offloaded their holdings and secured their profits, they initiate the "dump" phase by selling off large quantities of the crypto in a coordinated manner. This massive sell-off causes the price to plummet sharply.

6. As the price crashes, investors who buy into the hype at inflated prices are left holding a depreciating asset, suffering significant losses as the value of the cryptocurrency rapidly declines.

7. After executing the P&D, the scammers move on to repeat the cycle with different assets, leaving behind a trail of investors.

P&D schemes are illegal in regulated financial markets and are considered fraudulent activities. But in crypto, with less stringent regulations, P&D

schemes are unfortunately more prevalent, making it crucial for investors to exercise caution before investing in any crypto.

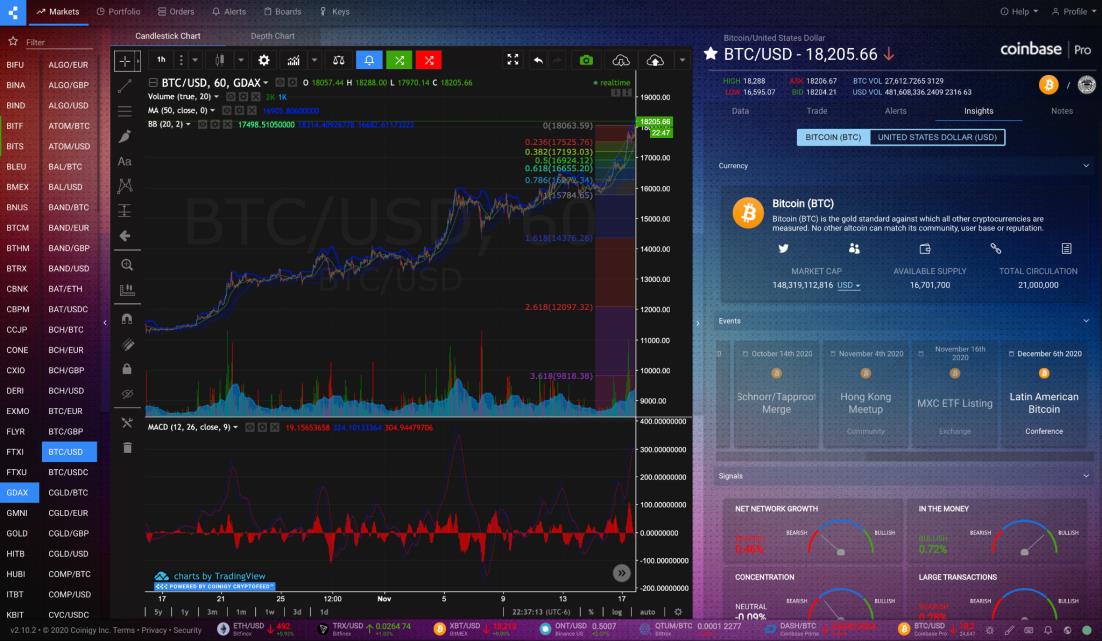

It’s easy to spot a manipulated market. When I see a chart like the one below, an alert goes off:

This chart pattern behavior should be an indication to immediately leave the market. Don’t try to outsmart the whales, because you will never win.

Using Crypto Trading Platforms

When it comes to trading crypto, having the right tools isn't just a luxury, it's a necessity.

If you are going to trade regularly and don’t want to be logged into your crypto exchange for security reasons, I recommend using an online trading platform with API integration to your exchange.

These online services offer a variety of tools, charts, and indicators to help you trade across multiple exchanges from one unified interface.

Below are 2 of my favorites:

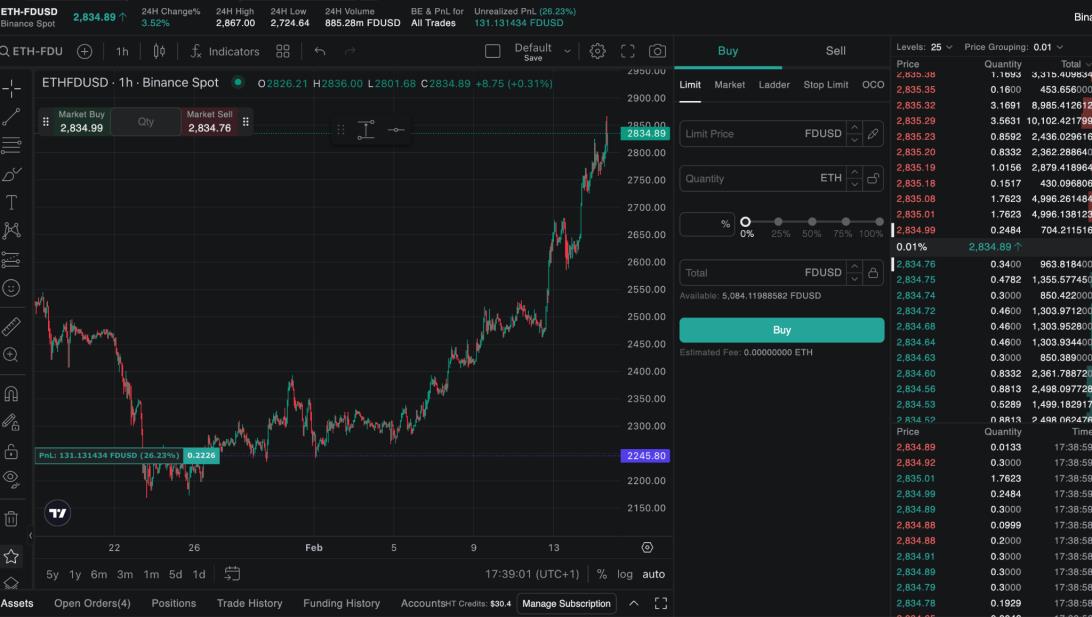

1: HyperTrader

HyperTrader is a fast and sleek trading platform where you can organize, analyze, and trade your crypto.

The interface has been simplified as much as possible. Orders can be placed in real-time via the chart, and changing/canceling orders is also implemented

by dragging and dropping a button.

HyperTrader also allows you to place OCO orders. OCO, short for "Order Cancels Order," is a conditional order type that links two market orders. In this setup, the execution of one order automatically leads to the cancellation of the other.

This mechanism allows traders to set predefined entry and exit points for their trades.

Let me give you an example.

Consider you have bought Bitcoin at $20,000. To secure your profits and limit losses, you set an OCO order with a sell limit order at $25,000 and a sell stop order at $18,000.

If Bitcoin hits $25,000, your sell limit order gets executed, securing your profit, and the stop order at $18,000 is canceled.

Conversely, if Bitcoin drops to $18,000, your stop order triggers to minimize losses, and the limit order at $25,000 is withdrawn.

This is a unique feature that most other trading platforms don’t offer.

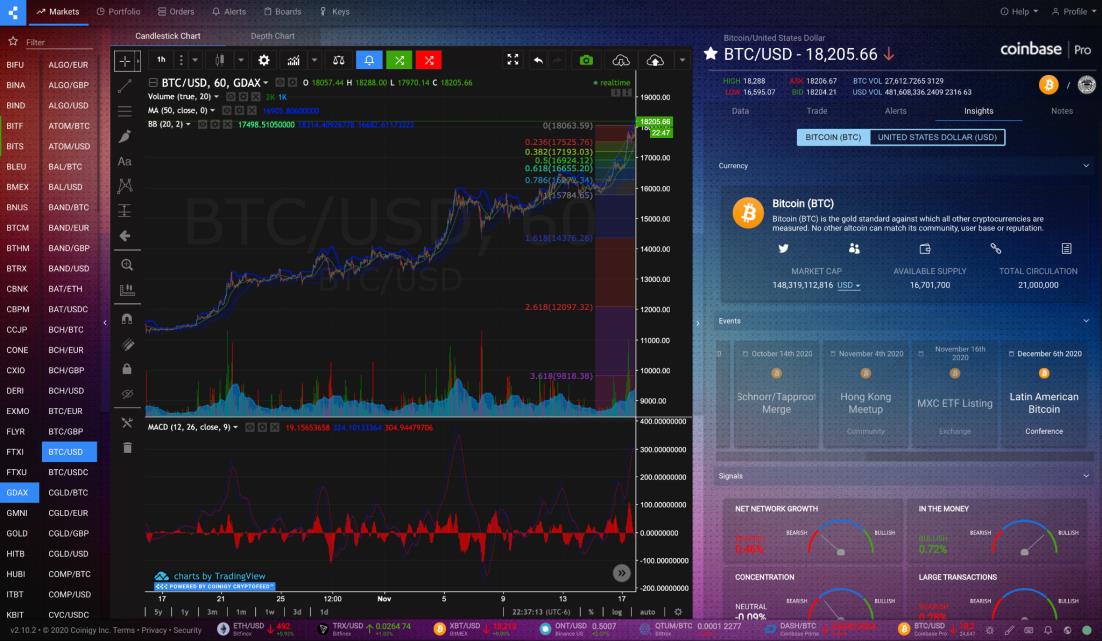

2: Coinigy.com

Coinigy is another crypto trading platform that’s been around for a long time. It allows users to access and trade on multiple cryptocurrency exchanges through a single platform.

This eliminates the need to switch between different exchange websites, streamlining the trading process.

Coinigy offers advanced charting tools and technical analysis indicators to help traders analyze market trends, and identify trading opportunities. The portfolio tracking tools allow you to monitor the performance of cryptocurrencies across various exchanges.

You can set up custom trading alerts based on price movements, volume changes, and other criteria to stay informed about market developments and potential trading opportunities.

Coinigy offers API integration with numerous cryptocurrency exchanges, allowing you to execute trades, access market data, and manage your accounts through automated trading bots or custom apps.

There is a mobile application for both iOS and Android devices, allowing traders to access their accounts and trade on the go.

Check out which platform suits you best.

You can not buy crypto on Hypertrader or Coinigy. Both platforms function as an independent tool where you connect your exchange account to, and trade with money from your exchange.

Everything happens from within your exchange, and you connect to Coinigy or HT by simply adding your API key.

Both trading tools are easy to grasp, but I prefer Hypertrader, as the software also allows me to place OCO orders, which Coinigy doesn’t.

Trading cryptocurrency happens on a crypto exchange, where you buy, sell, and store your coins.

Start trading with a little sum, or do some paper trades first, to see how the market reacts to your positions.

How To Practice With Paper Trading Paper trading is like a flight simulator for traders. It allows you to practice trading without risking real money. You use virtual funds to execute trades in a simulated market environment.

The beauty of this kind of trading is that you can make mistakes and learn from them without any financial consequences.

Whether you're into day trading, swing trading, or long-term investing, you can experiment and fine-tune your approach.

Paper trading platforms simulate real market conditions, including price fluctuations and order execution. It's as close to the real thing as it gets.

I recommend you keep a record of your paper trades, just like you would with real ones. This allows you to review your performance and identify areas for improvement.

Treat your paper trading as seriously as you would real trading, so avoid taking unnecessary risks or making impulsive decisions.

Once you've built confidence and consistent success in paper trading, consider transitioning to real trading with a small amount of capital.

Start small and scale up as you gain experience.

If you want to find out more information about a peculiar crypto, you can check it out at https://coinmarketcap.com

Here you find all the crypto tokens that are being traded. You’ll see how the coins are performing, their market volume, how much gain or loss they made in the last hours or days, and much more!

There are two options when it comes to buying or selling crypto. There are:

“market orders” and “limit orders”.

If you place a “market order”, your position will be instantly filled at the current market price.

If you place a “buy limit order”, you can set the price that you want to pay for the token via the order book.

When you place an order that gets filled immediately (as is the case with a market order) you are a “taker” and you will pay a taker fee.

If an order takes a while to fill (a limit order) you are a “maker” and you will pay a reduced fee.

“Takers” generally pay a higher fee and “makers” generally pay a lower fee.

Thus, you should always try to be a “maker.”

So using a limit order is always recommended.

Now it’s time to put up a sell order.

The purpose of crypto trading is to sell the coins that you bought at a higher price and earn more tokens.

Placing a limit selling order is as simple as placing a buying order. You set the price that you want to sell your coins for in the order book, and when the market reaches your target price, the coins will be sold, and you get more tokens in your wallet than you had before.

Your goal should always be to collect more tokens with every trade you make.

Diversifying Your Portfolio

You know the saying: “Don’t put all your eggs in one basket”.

Diversifying your crypto portfolio will save you a lot of money…

Here’s a smart strategy…

(Remember that this is not financial advice! I am not a professional expert.

Always do your own research before you invest in crypto or any other opportunity, and don’t use money that you can’t afford to lose!) Use 40% of your portfolio to trade the top 5 cryptos like Bitcoin, Ether, Litecoin. These coins have a lot of value, are constantly traded, and are considered “standard coins” by traders.

Use 40% of your portfolio to trade the top 10 altcoins like XRP, SOL, BNB, XMR, ADA. These are well-performing coins, with a strong growing potential, and a steady trading volume.

Use 20% of your portfolio to trade small caps. These are new cryptos that sell for little money and trade at low volume but can grow out and become big over time.

Trading cryptocurrency is fun, but prepare to deal with losses now and then.

You can win many trades with my method, but some trades that you don’t make can also save you money.

One of the fundamentals of trading is “not losing money”.

You know the saying: “Buy the rumor. Sell the news.” This saying happens in most financial markets and particularly the crypto market.

Traders buy and sell, based on what they believe will occur in a given economic event (the rumor).

Once the event is released (the news), they dump their positions, and the market moves.

You should NEVER blindly follow someone’s trading advice, but you can connect with influential crypto and blockchain people on Twitter, YouTube, Telegram, or Facebook groups where traders share their knowledge and ideas to find answers to some of your questions.

The internet is a great place to find out important news and inside information… just don’t be a sheep.

Do your own thing and stay away from people who try to get you into their investment opportunity. They would not share their “secret” with you if it worked out so well for them :)

Reddit is also a useful source with hot news about the crypto industry.

Search for “crypto”, and you will find plenty of groups.

Don’t chase for big gains. If you’re extremely lucky, you can ride a pump for a short while, and sell before the dump takes place. But most of the time, you will get burned.

Be okay with small profits. Several small profits will build a big one in the end.

Your primary mission is to buy low-priced coins and sell them for more.

This is the right path to follow. If you keep to this trading strategy, you will be able to build an extra income.

Technical Analysis

Hypertrader and Coinigy will give you a whole list of technical analysis (TA) indicators. TA tools can help you to decide when to step into a trade, or get out, but don’t rely on TA too much.

One indicator that you can use to decide if you want to get into a trade is the Moving Average Exponential (MAE) tool.

As you can see in the screenshot, there are 2 MAE lines. One is in purple, that is the MAE nr 1. The other one is in blue, that is the MAE nr 2. Now, what do these lines mean?

Well, simple. These indicators will tell you if it’s a good moment to buy or sell.

The rule is: when the purple line is below the blue line: BUY ONLY.

When the blue line is below the purple line: SELL ONLY.

A descending purple line shows a downtrend. It indicates that people are selling, and when others sell, you should buy.

When the purple line is ascending, people are buying, and that’s when you should sell. That’s it.

In this YouTube video, I will show you how to add the two MAE indicators on a Coinigy chart, and how to configure them right:

https://youtu.be/1mMFK_0qEZE

Another handy TA tool is the relative strength indicator. This indicator can be used to find out if the price of a coin is oversold, or undersold.

When the line is above the 70 mark, it is time to sell. When the indicator is below the 20 mark, it is a good time to buy.

TIP: In my “5% Crypto Trading Strategy guide, you will find more unique trading strategies to maximize your profits. This is not a boring tutorial on technical analysis, but a step-by-step guide with practical tips, written in a clear, accessible language.

If you want to find out more about TA, you can explore specialized websites like Investopedia.com and Tradingview.com

Recap