Appendix 2

Income/Expense Analysis

It is important to know where our money goes to ensure that we are not overspending. Below are two simple tables for the purpose of illustrating how to keep track of income and outgo and how to avoid unnecessary debt.

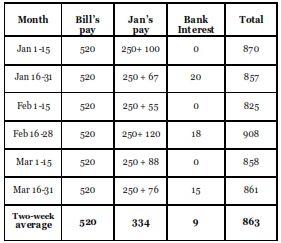

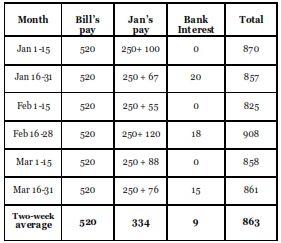

Income Analysis

Bill receives a fixed salary every fortnight, while Jan works in a restaurant and her pay varies each pay period as a part of it comes in tips. The figures are just by way of example and for easy maths.

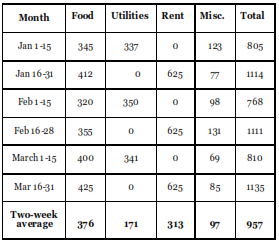

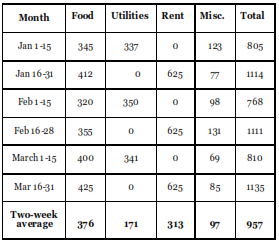

Expense Analysis

In the following example, again actual numbers are not important and will vary from household to household and location to location. All we are doing is illustrating the principles.

Note that upon comparing the income totals with the expense totals, the expenses exceed the income by about 10%. In such a case, adjustments should be made so as not to keep overspending and increasing credit card debt – which, to add insult to injury, accrues high interest.