Foreword

On one of the darkest days in recent financial history, I had to talk my best friend out of jumping from the balcony of his penthouse apartment and plummeting to his death in the streets of downtown Toronto, Canada. Yes there was the 2008 Global Financial Meltdown yet before 2008 there have been many financial cycles and there will be many more. He wasn't the only one contemplating suicide the night of October 19, 1987. During the global financial ruin of Black Monday, people who worked their entire lives to create a life of wealth and financial security lost everything when the stock market plummeted. For many who worked in the stock market, the realization that they had wasted years of their lives working for something that could simply vanish at the whim of a stock ticker welcomed a devastating blow from which they would never recover.

For my friend, taking his own life was the only logical solution.

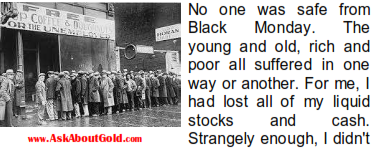

feel the same frustration as others. While I certainly wasn't happy about it, in my positive mindset I was still grateful that my most valuable asset was unaffected by Black Monday - my loving family. Plus, it also helped that I still had my houses, cars, and other material assets.

My friend did not share my outlook and took it considerably harder. He was coming apart at the seams. That was apparent from the frantic way he talked on the phone. He never seemed like the type to take his own life, yet people do extreme things after losing millions of dollars.

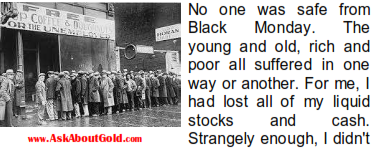

Black Monday

Without hesitation, I jumped in my car and sped down the highway for an hour and a half to watch over him while I tried to convince him that there was still hope. As we talked all night he started to realize that Black Monday was just a learning experience for both of us - a very expensive learning experience, yet a learning experience nonetheless. I fell asleep on his couch that night, and as the sun began to rise on the Toronto skyline, so did the sun rise on my friend's life.

The next day, he was off of the suicide watch list and saw the little light at the end of the tunnel - he was still young enough to rebuild and could rebuild.

1986 and 1987 were headline years for the stock market, a continuation of an extremely beefy, bull market that had started mid-1982. Low-interest rates, leveraged buyouts, hostile takeovers and merger mania were prevalent in these defining years. The market was on a high and some believed it could never fail. However, historically, all booms must end in a bust.

October 19, 1987 is referred to as Black Monday and October 20 as Black Tuesday—to account for time zone differences. This is the infamous day that stock markets around the world crashed heavily, devaluing immensely in an incredibly short period of time. On that day alone the market fell 22.61% -- or about $500 billion, setting a record yet to be broken for the highest recorded slump on a single day. News headlines reported mass hysteria; people who had lost millions of dollars went barging into investment offices with guns blazing, killing brokers who had little or no control over the circumstances that caused the money loss.

Mid-October had brought a black cloud of events that undermined investor confidence. Markets began incurring large daily losses. A larger than life federal trade deficit was announced and the dollar value slumped. The markets began to unravel in Hong Kong. They wreaked havoc all through Europe and came to rest in the United States.

Black Monday

By the time the ruckus had died down in late October, stock markets in Hong Kong, Australia, Spain, the United Kingdom and North America had fallen 45.5%, 41.8%, 31%, 26.45%, 22.68% and 22.5% respectively. New Zealand's market was hit particularly hard. Their numbers recorded a decline of 60% from its 1987 peak and it took several years to regain their footing.

Many factors were involved in the intricacies of the stock market fluctuation, yet U.S. Congressman Edward J. Markey, who had predicted the impending storm, touted program trading as the main culprit. This is the practice of simultaneous buying and selling of many different stocks, or of stocks and related futures contracts, with the use of a computer program to exploit price differences in different markets. Many criticized people engaging in program trading for blindly selling stocks as the markets fell, exacerbating the decline.

Edward J. Markey

The majority of investors did not even understand why they were selling, and were simply following the frantic pack mentality. This emotion-based, decision-making was what caused a dramatic downward spiral to occur. However, the flip side of the coin, as some economists explained, was that the speculative boom leading up to the crash was actually the issue caused by program trading and that the crash was merely a return to normalcy.

The Federal Reserve intervened quickly to prevent the economic disease from becoming fatal, encouraging banks to continue lending at very low-interest rates, even though this caused them to operate at a loss. Remarkably, not only did the market stabilize very quickly, it bounced back to embark on a second bull run that was fueled by companies buying back their stocks, which were considered undervalued in the aftermath of the market meltdown.

Panic in the media

After Black Monday, regulators overhauled the system, putting into place "trading curbs" or “circuit breakers” to electronically halt stocks from trading if they plummeted too quickly. These constant, intense market fluctuations were a red flag to investing one’s wealth in paper money.

Gold is the one currency that floats through these global disasters, in fact, gaining value in times of crisis.