6

Conclusions

Investing for retirement can get very complex, especially if you start getting the idea that you can do better than the major markets indices or target date funds, however it doesn't need to be. The main thing to remember is that not investing at all, and keeping everything in cash, gives you no chance to grow your money. Your money could actually lose value due to inflation if you aren't at least earning interest to keep up. target date funds provide a diversified portfolio, which you can easily further diversify by having multiple target date funds of the same year. There are many resources, such as the Bogleheads.com website, that you can use to learn more about investing, especially if you believe that target date is not the best option for you.

I personally avoid: (1) small, less liquid mutual funds and exchange traded funds, (2) those having a sales load, (3) those having management fees of more than 1% on domestic stock funds or 1.5% for foreign stock funds, and (4) any funds that are not positively reviewed by a legitimate and independent source of investment information. Even the top rated funds have down years due to market swings, so this doesn't eliminate all risk. Before putting money into a fund, you should also see what's going on with the stocks and bonds it owns using these sites. Putting a large lump sum into a fund right before it crashes may require many years to recover from (dollar cost averaging, or gradually investing small amounts, is a lot safer). Bear markets can crash just about any portfolio full of stocks in the near term by 30% or more, even if it has high quality companies, so keep this in mind as you get closer to needing to withdraw your money for living expenses. Retirement Income funds holding low risk US Treasuries are more appropriate for people retiring in a couple years than having a majority in stock funds, unless they're producing consistently reliable dividends.

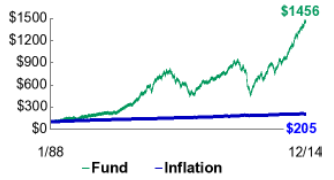

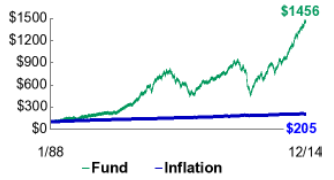

Those whose retirements are still many years away are likely better off ignoring stock market swings and continuing to invest as usual. For example, someone who began putting $300 per month into an S&P 500 fund in 1999 would have grown their $58,000 investment to about $116,000 by 2015. Had they sold their stock in 2009 as the market crashed, they would not have been as fortunate. The chart below shows that even $100 invested in an S&P 500 fund in 1988 would have grown to almost $1500 by 2015.

As long as nothing has fundamentally changed about a fund's underlying investments, or their future potential, then downturns aren't necessarily a reason to sell a fund. If you've invested money into a narrow sector of companies now in trouble, or into a particular foreign market that's piled up too much debt, then there may be more reason to rethink your investment. Broad based stock funds, such as those tracking the S&P 500, seem to bounce back eventually. Sometimes its best to ignore what they're saying on TV about the markets, rather than attempt to “Time the market”, buy low and sell high. To quote billionaire investor Warren Buffett:

"The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”