Economic Terminology

Supply and Demand

This is a fairly basic principle. The supply and demand of goods, services, assets and money is the foundation of economics. Supply and demand effects prices. More demand then supply means higher prices and less demand then supply means lower prices.

The Business Cycle

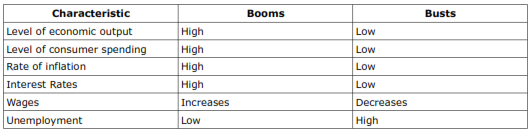

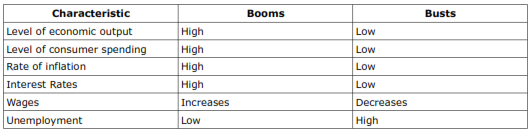

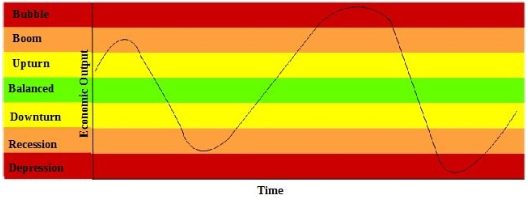

The business cycle is the booms and busts in an economy. The economy fluctuates between booms and busts from the change in economic activity. Below is a table that displays the common characteristics of booms and busts.

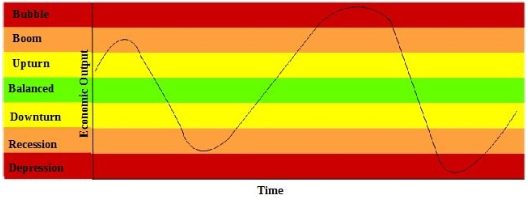

The fundamentals of supply and demand results in busts having lower inflation and booms having higher inflation, but this doesn't always happen. A bust can be inflationary or deflationary. An inflationary bust is a result of excessive currency creation (expanding the currency supply causes inflation) and can lead to a hyperinflation like the one in Weimar Germany. The inflation will erode away one's debt obligations. A deflationary bust occurs when there is too much cheap credit. This credit (or debt) goes away via repayments or defaults and the currency supply contracts causing a deflation. A deflation like the Great Depression leads to lower prices and a smaller GDP and those in debt are wiped out. This chart below shows the business cycle. The further a nation goes to a boom, the further they will have to go into a bust.

The Business Cycle

Bulls and Bears

A bull is a raise in an asset class and a bear is a drop in an asset class. For example, if the stock market went from 800 to 1,200, it's a bull market and if the stock market went from 1,200 to 800, it's then a bear market.

The Monetary System

The monetary system is how the government of a nation provides money to its economy. This includes the type of money used and how it is managed. Most countries like the United States have a debtbased monetary system that uses a fiat currency. The banking structure involves a central bank and commercial bank. Money is created by the central bank and that money flows from the central bank to the commercial banks to individuals and businesses. Australia's monetary system is also like this with the Australian Dollar being its fiat currency and the Reserve Bank of Australia being its central bank.

Currency vs Money

Money like gold and silver are a store of value and currency like banknotes or cheap metal coins aren't a store of value. Money retains its value and currencies lose value overtime. A Weimar Germany banknote is worthless and a gold coin from Ancient Greece still retains its value. A fiat currency is a currency backed by confidence, which loses its value over time.

Currency Supply Measures

The following are different measures used to calculate the size of a currency supply. The more broader measures tend to be higher value and more long-term assets that are harder to liquidise (turn into cash and be used in transactions).

M0: This is the most liquid type of currency, like cash and assets that can be easily converted to cash.

M1: This includes M0 and currency that can be easily converted to cash.

M2: Includes M1 and currency that is harder to liquidise like short-term deposits.

M3: Includes M2 and currency that is really hard to liquidise like long-term deposits. This is the most broadest measure used by most nations, but some nations like the United Kingdom use M4, which is the most broadest measure used.

Gross Domestic Products (GDP) This is the total value of a country's economy. This includes production and consumption of goods and services, trade, investment and government expenditure.

Markets

A market is where buyers and sellers exchange goods and services. However in economics you will find that the term market is used to refer to certain areas like stocks. This is where the market just relates to that area like the stock market is the buying and selling of stocks. When just referring to the markets this is a reference to the entire economy.

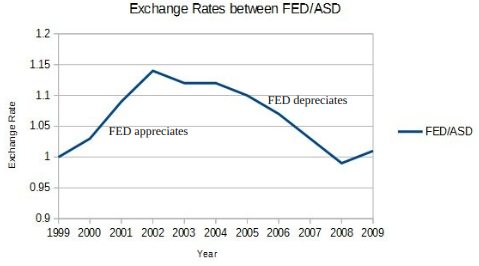

The Exchange Rates

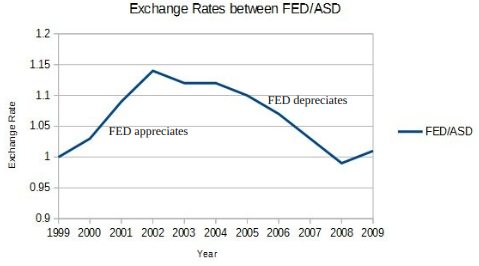

These are the rates of exchange between the currencies around the world, which are often called the foreign exchange rates. These measure the value of one currency to another, such as a rate of USD$0.72 per AUD$1, which means you can get 72 US cents for 1 Australian Dollar and USD$1 for AUD$1.39. When a currency such as the AUD increases against another like the USD, it is appreciating and when it loses value, the currency is depreciating. Below is a visual example of two fictional currencies.

When a currency appreciates imports are cheaper and exports are more expensive and when a currency depreciates, imports are more expensive and exports are cheaper.

Important People, Organisations and Facts

Governor Phillip: Governor of the first British penal colony (Sydney) on Australia. He came to Australia on the First Fleet in 1788.

Reserve Bank of Australia (RBA): This is the central bank of Australia and is responsible for controlling Australia's interest rates and currency supply. A central bank is a private entity separate from a government and is owned by private individuals. The Federal Reserve in the United States for example is owned by shareholders that it pays a dividend of 6%, as outlined in the Federal Reserve Act on their website, “In General. After all necessary expenses of a Federal reserve bank have been paid or provided for, the stockholders of the bank shall be entitled to receive an annual dividend of 6 percent on paid-in capital stock.” 1

The RBA is owned by the Commonwealth of Australia as outlined on their website, “The Bank is a body corporate wholly owned by the Commonwealth of Australia.” 2 Elizabeth II is known to be the head of the Commonwealth and this would apply to other monarchs. In a video, AussieMatters, states on how these monarchs are funded by banks and rich individuals and so, the RBA is indirectly owned by these banks and rich individuals. 3 Also, some of the RBA's profits are paid to the Commonwealth as stated on their website under the Reserve Bank Act 1959, ”The net profits of the Bank in each year shall be dealt with as follows: ...the remainder shall be paid to the Commonwealth.” 4The other share of the profits is saved or put into a fund. Therefore, the RBA is linked to rich individuals and a share of its profits go to them.

Federal Reserve Bank: This is the central bank of the United States.

Bernie Fraser: Governor of the RBA from 1989 to 1996.

Ian Macfarlane: Governor of the RBA from 1996 to 2006.

Glenn Stevens: Current Governor of the RBA.

Some Prime Ministers (PMs) of Australia: a Robert Menzies (1939-1941, 1949-1966), Harold Holt (1966-1967), Bob Hawke (1983-1991), John Howard (1996-2007), Julia Gillard (2010-2013), Kevin Rudd (2007-2010, 2013), Tony Abbott (2013-2015), Malcolm Turnbull (2015-present)

Fiat Currency: As stated later in this book, the Australian Dollar was removed from the gold standard in 1933 and became a fiat currency. This means the Australian Dollar is no longer backed by gold, but by confidence.