Australia in a Global Economy

People can buy products and communicate with others from overall the world. Investors can trade investments like stocks over the world. Australia was effected by the crash of the US housing bubble in 2008. All of this is possible due to globalisation. Globalisation involves removing trade barriers between nations, faster global communication and the integration of economies. Globalisation has allowed many things to be possible such as international organisations and businesses and it has improved the global economy as a whole. Despite this, globalisation does makes the global economy more vulnerable to downturns. Individual economies are now more dependent on each other. Globalisation was the reason the US housing crisis in 2008 caused the world economy to go into a downturn.

A Chain Reaction

Another example the impact globalisation has is when Thailand unpegged the Thai baht, which started a chain reaction that brought Long Term Capital Management (LTCM) to its knees. The unpegging of the Thai baht caused the 1997 Asian financial crisis and then the 1998 Russian Financial Crisis and Default that caused Long Term Capital Management to meltdown. LTCM was a company that traded in options (a type of derivative) and thought that their trading methods carried little to no risks. However their risk calculations were off and their mistake almost caused the global financial system to freeze up.

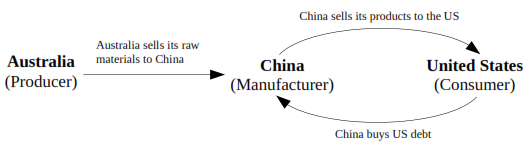

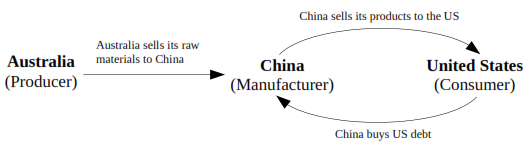

Australia (Provider), China (Manufacturer) and the United States (Consumer)

The way globalisation integrates economies can be seen with Australia, China and the United States with these countries having a close economic relationship. Australia as the producer sells its raw materials such as iron ore and coal to China, who then manufacturers this into consumer goods, which are then sold on to the US. China buys US debt to depreciate the Chinese Yuan to make exporting their goods cheaper. Around a third of Australian exports go to China and so where China goes, Australia follows suit, which was why Australia went into recession after China went into recession. This relationship between these nations will be discussed in further detail latter in this book.

A Global Economy

As globalisation has reshaped the world economy, one can't study economics by just looking at one country. They have to look at the whole economy. No longer can a nation stay completely in isolation and be unaffected by foreign events. An economist will not only have to look at local economic events and policies, but also foreign ones in order to make conclusions about the state of a particular economy.

History of Globalisation

In ancient and medieval times the Europeans, Chinese and American natives were all almost in isolation. The economic conditions in Europe did not impact the economic conditions in the Americas. They all could live in their own little world. At this stage in history, globalisation was almost nonexistent and it would take centuries before it really started to develop.

For most of history, the development of globalisation was slow until nations started exploring and setting up colonies around the world. This was the first stage of globalisation. This stage saw the expansion of the empires like the Spanish and British Empires and the increase of international trade. Now, events in Europe would impact America such as the Thirty Years' War of 1618-1648 causing war in the Americas.

The second stage of globalisation occurred during the 19thand early 20th centuries. The world was becoming more interconnected with countries over the world engaging in trade and diplomatic relations with each other and international investment was now easier.

But World War One (WWI) and World War Two (WWII) put the brakes on globalisation. In WWI, the British closed their stock exchange for a year and liquidity (ability to meet obligations, borrow money and sell assets in the short-term.) dried up. The development of globalisation wouldn't be back on track until the 1960's.

From the 1960's onwards, the track to globalisation just exploded with the deregulation of markets, removal of trade barriers, rise of international organisations and more frequent and faster trading of financial instruments like stocks. This third stage of globalisation also saw the rise of a global monetary system. Globalisation at this point caused international trade and economic growth to boom, but also increased the frequency of economic downturns. Now, the world has become one giant interconnected economy and if humans do start colonising other planets, we would see globalisation on an interplanetary scale.