PART 12 Future of the U.S. Dollar & Our Economy

The future of the U.S. Economy looks pretty bleak for the next 10 years or so. When I hear some of the doomsday predictions put forth by some of these prominent economists, I can't help but want to help others prepare.

Economist Marc Faber has made some pretty negative statements about the future of the U.S. economy. Here is a quote directly from Marc Faber.

"The future will be a total disaster, with a collapse of our capitalistic system as we know it today, wars, massive government debt defaults and the impoverishment of large sections of Western society."

Source: The Gloom, Boom, and Doom Report (9/09)

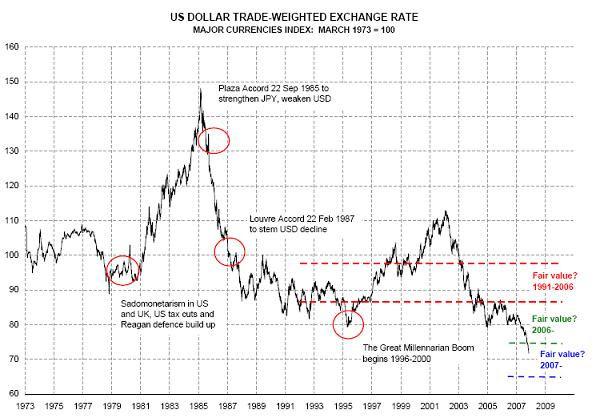

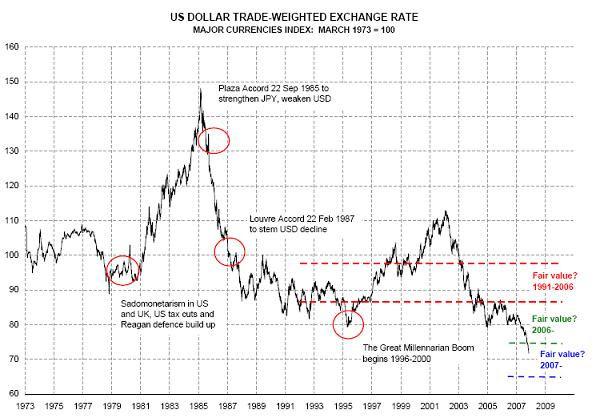

The U.S. Dollar is in serious trouble, and signs of

improvement don't look good at all. The USDX (U.S. Dollar Index) started in 1973 after the U.S. was taken off the gold standard.

The USDX is a weighted average of the U.S. Dollar against six other currencies. At

www.goldsilver123.com

at

58 its start, the value of the U.S. Dollar Index was 100.00, but has recently fallen to a value of 71.

What does this mean? It means that since 1973, the beginning of the USDX, the dollar is only worth 71% of what it was. Some economists are expecting the USDX to go to 40 or lower. This would mean disaster for you if you are holding dollars.

The following chart shows the

gruesome details of the fall of the dollar.

The U.S. has borrowed trillions of dollars from countries, notably China, to fund our addiction to credit. Citizens in the U.S. are in debt up to their eyeballs and the only thing that has enabled people to keep borrowing money is the credit extended to the U.S. lending institutions by other countries.

China has now pulled back from purchasing Treasury Notes from the U.S. and are buying gold instead. The Chinese are not the only countries increasing their gold reserves. India recently purchased 200 metric tons of gold from the IMF.

Countries around the world are aware that the dollar's reserve status as the world's currency is going to end soon. That's why they are scrambling to get out before it's too late.

The U.S. government will try to inflate their way out of this mess, but will ultimately fail just like other governments in history who have tried the same thing. One stimulus package will lead to the next one and it will end with

the collapse of our once great

nation.

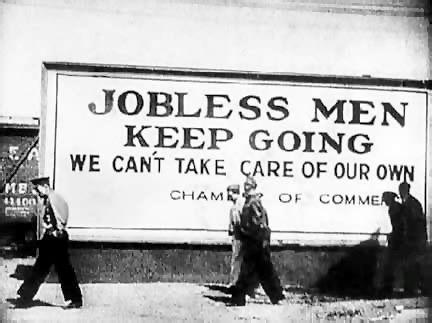

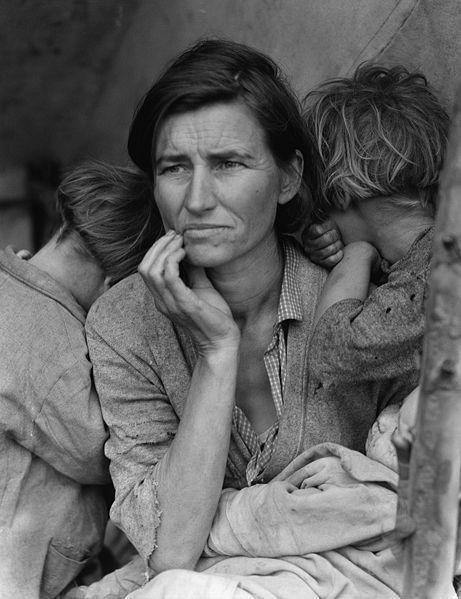

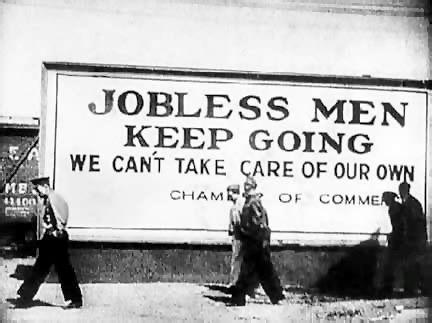

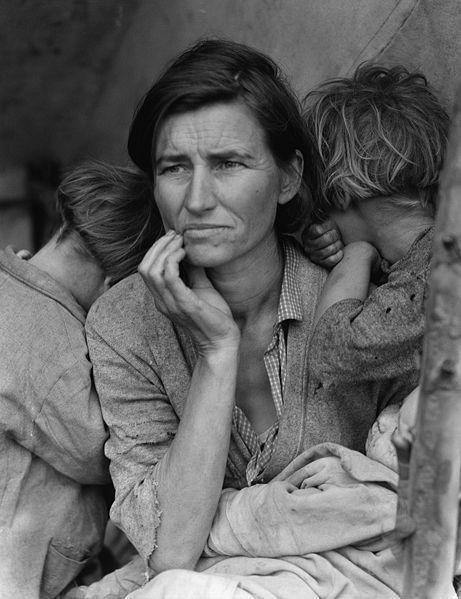

Let's not forget most people

in this country have never

experienced an economic

collapse like that of the Great

Depression. Most people are

not prepared for what is

coming and they will soon

find out what real poverty is all about.

Before I conclude I would like to make a note that I believe along with many experts, that all commodities will go up over the next 10 years. People don't want to hold paper when it's being inflated. You will see the price of crude oil go up as well as the price of food.

It would be a good idea to research these markets and invest in them as well because we could see

$500 a barrel oil in our future.

To learn more about investing in oil,

click here.

If you think that claim is outrageous, what do you think people were saying in 2000 when some experts said gold would go above $1,000/ounce? They called them crazy, but who's laughing NOW!?!?

at

at