PART 4 What Is Inflation?

When I first heard about inflation I had no idea what it was. Confused, I researched more about it and found out that most people haven't got a clue what inflation is or what it means.

Most people simply think that inflation means prices are rising. Higher prices are only the result of inflation. But I still have not defined inflation.

In simple terms, think of blowing up a balloon. You are making it larger by increasing the amount of air. Simply put, you are inflating it. So, when a central bank prints large sums of money they are inflating the supply of money in circulation.

Governments try to keep inflation under control by raising interest rates, which stifles borrowing. If it costs more money to take out a loan, then less people will apply for loans thereby controling the amount of money in circulation.

What happens when governments keep interest rates artificially low? Well, the money supply increases and inflation starts rearing its ugly head. That's where many governments are at today.

Many definitions of inflation will say that inflation is simply a rise in prices of consumer goods. Why would the price of something just magically rise over time? Have you ever thought of that?

Why doesn't the price of goods and services remain the same over time. It is so ingrained in our minds that prices are just supposed to rise, without any good explanation why.

Maybe "grandpa" told you about a pair of nice leather boots he bought for just $5.25 in 1945. Now those same boots cost $100, and that's if you get a bargain!

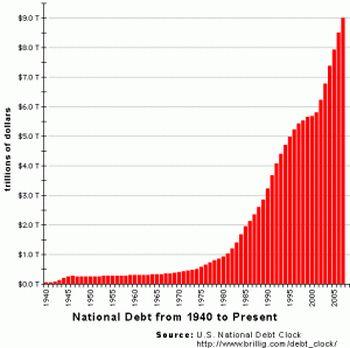

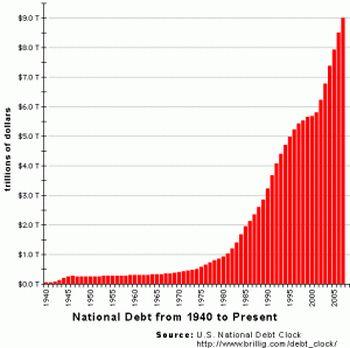

Below is a chart showing the result of money printing over time.

Nobody ever stops and asks why the prices are rising. Simply put, when a central bank like the U.S. Federal Reserve prints MASSIVE amounts of money, and there is not a relative increase in goods and services, the value of the dollar falls. That's what inflation means.

So, your $5.25 that could buy

a nice pair of boots in 1945

will now buy you a gallon of

milk.

Is the loss in purchasing

power all done by accident,

or are there actual people

benefiting from your loss? I

talk more about that in the

chapter on The Federal

Reserve.

Today, most people don't understand inflation because we have a paper currency. Most people can not recognize that the dollar's value is falling, even if they look at some chart showing the details.

Professor "Patrick Harris" explains this well in his book

How To

Protect Your Money From The Coming Obama Inflation Grab.

Many experts believe that the fall of the Roman Empire was attributed to the government inflating their gold coins. The Roman government issued gold coins as currency throughout the empire, but they began inflating the currency at one point.

They debased the currency for the same reason that many other governments in history have debased theirs. Governments do this to fund their operations, whether it's for war, or something else. The Roman government needed more money, so they simply made more while simultaneously devaluing each coin in circulation.

What the Roman Government did was to melt down the gold coins and mix it with other metals like copper, lead, or silver. In response to this, it took more coins to buy the same goods. There were obviously more coins in circulation, which is no different than more dollars in circulation.

The truth is that when governments can no longer tax the citizenry, they use the hidden tax called inflation. It is a hidden tax because most people don’t know their money is losing value.