Chapter 6

The Retirement Crisis in America

Our Government and the main street media don’t want to talk

about the retirement crises that’s unfolding right before our eyes. They don’t

want to shine a spotlight of truth on the looming retirement train-wreck in

America.

Why you ask? They don’t want to scare everyone to death.

Make no mistake about it. It’s out there. If you listen quietly and pay

attention, you’ll hear it. It’s coming. And coming fast. It’s like an

out-of-control freight train. And it’s headed right for us. And if you don’t

prepare for it, it’s going to slam right into you.

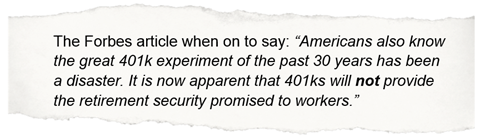

Forbes.com ran an article on 3-20-13 called “The

Greatest Retirement Crisis in American History.” The article

stated, “We will witness millions of elderly Americans, the Baby Boomers and

others, slipping into poverty. Too frail to work, too poor to retire, will

become the ‘new normal’ for many elderly Americans.”

The average 401(k) balance for 65 year olds is

estimated at $25,000 by independent experts, (or $100,000 if you believe the

retirement planning industry). Economics Professor Teresa Ghilarducci estimates

that 75% of Americans nearing retirement in 2010 had less than $30,000 in their

retirement accounts.

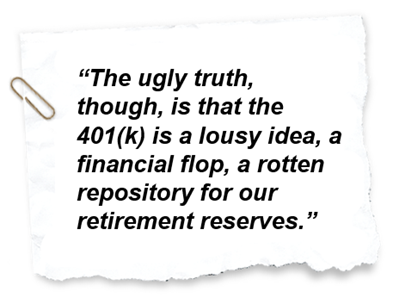

Did you see the TIME Magazine cover, “Why It’s Time to

Retire the 401(k).” In the article it said;

In this eye-opening article, they also spoke of what they

thought was the solution. We agree with their recommended solution, but more on

that in a bit.

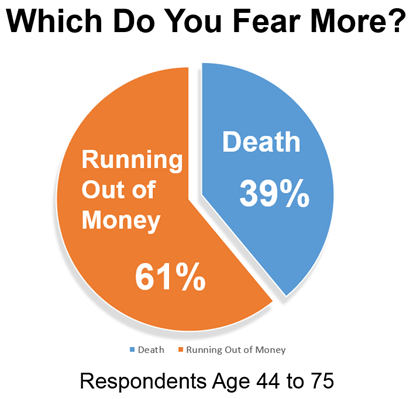

I know this is some seriously scary stuff. Most Americans

are vastly unprepared for retirement and for some, they’re literally scared to

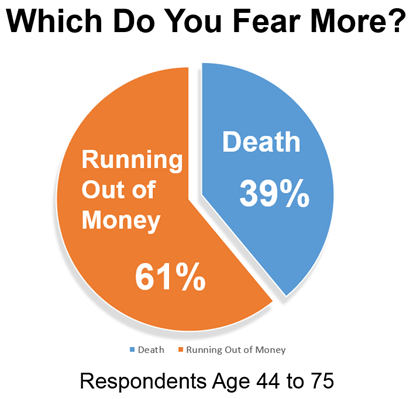

death. In fact, check out this recent survey. It found that 61% of Americans

FEAR running out of money when they retire MORE than they fear death

itself! Wow. Is that a sobering statistic or what?

The 60 Minutes Story About Retirement Being Broken In America.

60 Minutes ran an eye-popping story about what a huge

disappointment 401(k)s have been and how they have failed so many Americans.

I encourage you to take a few minutes and what this shocking

60 Minutes story. You can view it by going to: www.BarefootRetirement.com/60minutes

A massive 28% of the American population are baby boomers.

Some reached retirement age a few years ago. Now 10,000 baby boomers are

retiring every single and every day. Even so, the vast majority of boomers are

not yet there. There are 88 million more boomers on the way. That’s a good

thing because most of them are nowhere near ready for retirement.

Heck, over half of all Baby Boomers are still supporting

their adult children. Others are supporting their elderly parents. How are they

supposed to adequately save for their retirement when they’re still supporting

others and trying to survive themselves?

Make no mistake about it. There IS a retirement crises in

America. As it plays out over the next few decades, people are going to be

shocked at how dramatically this is going to change our way of life.

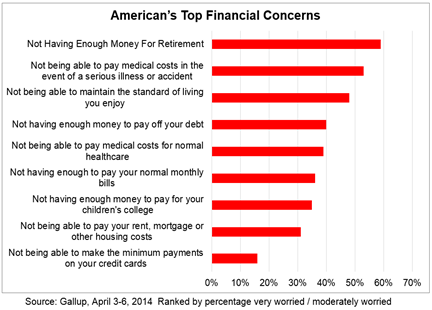

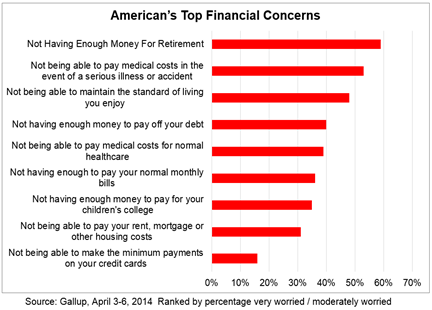

Here’s another survey by Gallup that shows you how the fear

of running out of money during retirement stacks up against the other fears out

there:

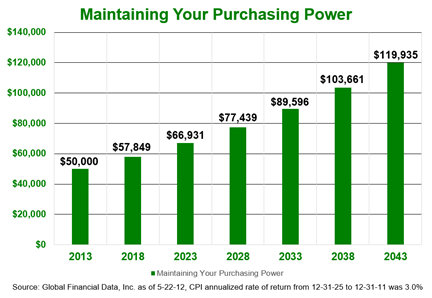

Maintaining Your Purchasing Power During Retirement

Another challenge we all face is inflation. Too many people

don’t stop and seriously consider the longer-term effects of inflation.

Especially if you’re on a fixed income. Since 1925, inflation has averaged

3% a year. (Source: Global Financial Data, Inc.)

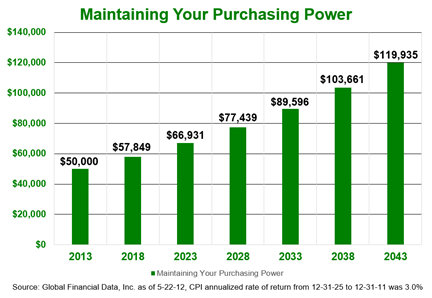

As you can see in the chart below, if you had an income of

$50,000 per year in 2013, you would need to have an income of $89,596 to

maintain the same purchasing power just 20 years later. When planning your

needs during retirement, be sure to factor in inflation.

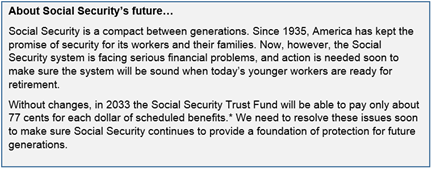

Yes, But What About My Social Security Benefits?

As I’m sure you know, many financial and economic experts

both inside and outside of our Government have expressed doubt about the Social

Security program and its ability to survive long term. If you are counting on

Social Security as one of your main sources of retirement funds, it may be wise

to seek some other options just in case these experts are right.

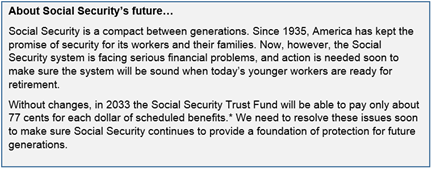

In fact, most people never even notice this, but this is the

exact statement you will find on the very first page of your 2014 Social

Security statement:

Two points on this. First, if this is what the actual agency

is saying about their own financial health, it leads one to wonder just how

accurate this is. The Government seems to be handing out the “Free

Government Cheese” as fast as they possibly can, to everyone they can,

regardless if they are legal US citizens or not. So at the rate they are

burning through all of that Government money, it makes you wonder how long the

Social Security Trust Fund will really last.

Second, it stinks that the Government promised you this

benefit and will, in all likelihood, not be able to come through with it. You

have done what was required of you and paid a lot of money into the Social

Security system. You upheld your end of the bargain. Now you get the short end

of the stick. This is especially bad for younger people. They will have to

continue paying their full amount into the system knowing full well that they

may not receive anything back in return for it. So if you are relying on Social

Security for your “Retirement Program," you may want to take matters into

your own hands and develop a Plan-B, just in case.

Yes, But What About My Pension Plan?

You’ve probably heard about all the pension fund problems

there are with Government pensions as well as some corporate pension programs.

Hopefully, they will survive and thrive but their future is looking dim.

Pension plans are similar to Social Security in that they

are nothing more than promises that can be broken.

During the years from 1996 through 2007, 25% of all the

Fortune 500 company pension plans have been terminated, closed or frozen.

That’s a staggering number.

In a study conducted by Hewitt Consulting (now Aon Hewitt) it

was found that if the same rate of decline in pension funds that occurred from

2002 through 2008 continues, (something the company considers unlikely), there

will be no more open-plan pension funds in the Fortune 500 by the year 2019.

I sat beside a guy on a flight years ago, who was one of the

top Federal officials in charge of the Federal Pension Benefit Guarantee

Corporation (PBGC).

A lot of people feel a great sense of security knowing that

the PBGC is there to back them up in case their employer’s pension fund goes

belly up. I remember how shocked I was when this fellow told me about the tiny

fraction of pensions that they could bail out if there were large numbers of

pension failures. It would be like trying to bail out the ocean with a thimble.

If the problem is small, they can handle it. If it becomes widespread, you had

better have another plan.

Can You Relate To This?

Most middle and upper-middle-class Americans are pretty much

in the same boat and have been down the same pathway. We’ve been faithfully

following the rules and doing what all of the “experts” have been

telling us.

Things like: “Contribute to your IRA, invest in your

company 401(k), invest in solid mutual funds, stay the course, buy and hold,

hang in there, keep the faith, just keep on investing and over time, the stock

market will deliver the best return, and you’ll be able to retire comfortably

and enjoy your retirement years the way you deserve to.”

I’ve got a question for you.

How’s all that “expert” financial advice working out for you so far?