Chapter 8

Paper Profits and Investment Fantasies

I Got Sick and Tired of Being Sick and Tired.

I got tired of being whacked down every time I started

getting ahead. I was feeling like I was a little pawn in a giant chess game,

and the big guys were just using all of us in their economic games. I finally

had enough. Plus, I was running out of time. After all, how many 40% to 50%

hits can you take to your life savings and still be able to retire as you had

planned?

Did you know that it takes a 100% gain to recover from a 50%

loss? It’s true. Also, a 50% loss will wipe out a 100% gain. How long do you

think it takes most people to recover from a 50% loss? As I am writing this

(Summer of 2014), it has taken from July of 2009, until now, for the DJIA (Dow

Jones Industrial Average) to climb back up approximately 100% to where it was

in July of 2009. That’s almost 5 years, and that was during a good stock market

time period. And that’s just to break even and be in the same place you were

about 5 years ago.

Plus, you can never get those years back nor their lost

earning potential. My investment friend who lost 65% would have only recently

gotten back to where he was almost 6 years ago if he stayed in the markets. Who

wants to delay retirement plans that long? Playing catch up all the time just

plain stinks.

What About Inflation?

Yep, let’s not forget about our old friend inflation. If you

go to:

www.usinflationcalculator.com you can see that we’ve had over 10% inflation since 2009.

Plus, we’ve had a whopping 37.2% inflation since the year

2000. That takes a huge bite out of your dollars’ purchasing power!

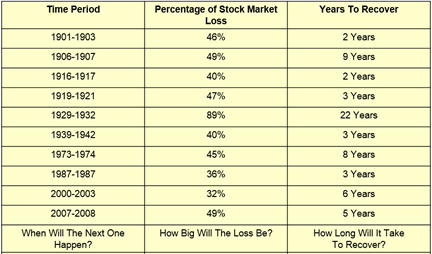

Nothing Goes Up Forever

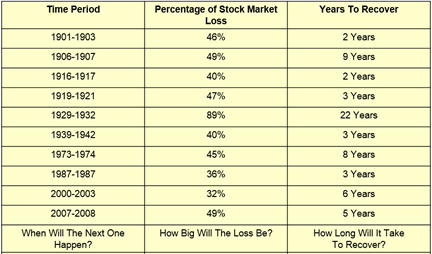

When you’re planning your retirement, timing is everything.

Take a look at the chart below. We know for sure that every so often, the

financial markets crash. They then take years to recover. If you’re young, time

is on your side. If you’re nearing retirement, a loss such as the ones shown

below can be devastating, and can turn your retirement dreams into a nightmare,

overnight.

Based on the market data above, the market loses 47% every 11 years!

Losing money stinks!

Losing 47% every 11 years, is downright stupid.

And, these kinds of losses will keep you from having the

retirement you want and deserve.

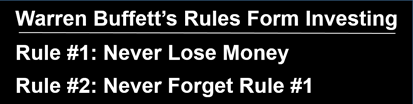

The best single thing we can all do to preserve our wealth

and, best prepare for retirement is to faithfully follow Warren Buffett's #1

rule for investing success.

Seriously, if you’re trying to plan for something as serious

as your retirement in an environment like this, how can you succeed?

The truth is, you can’t.

If you’re an average person playing by the mainstream rules

that Wall Street, and the major investment firms are encouraging you to play

by, you won’t win, and you can’t win.

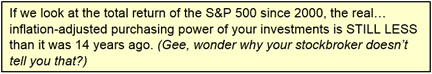

Doesn’t The “Smart Money” Invest Their Money in the S&P 500?

This is often true. Many wise investors know, according to

the Standard & Poor’s, over 99% of mutual funds consistently under perform

the S&P 500 Index. That’s why a lot of smart investors put their funds into

something like a Vanguard S&P 500 Index Fund. It has a low expense ratio,

and simply follows the S&P 500 index, which outperforms 99% of the managed

mutual funds.

How SAFE are you feeling about being in the

markets now?

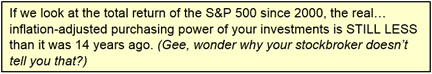

Take a look at the chart below. It shows the performance of

the S&P 500 from the year 2000, up until summer of 2014. Around the year

2000, the S&P 500 began a decline which ended in a 48% drop. Around 2008,

the index began a decline which ended in a 56% drop. (Some people call these

drops, retirement killers.) Take a look at where it is now. It certainty

looks like the S&P 500 could begin another huge drop, at any time now.

Don't you think?

Here’s the problem. People have been saying the same

thing every day, since 2011. Since that time, a lot of “experts” have

been telling people to get out of the market NOW, before it falls off a

cliff again. Had you taken their advice, and gotten out back then, you would

have missed a huge up-side gain. Most of us are the same. We don’t want to miss

the up-side gains, but we are also scared to death, that it’s going to crash

again, and we will lose another 50% of our portfolio. Who can afford to go

through that again?

I’m here to tell you there is a better way. A MUCH better way. The Barefoot Retirement Plan allows to you participate in most of

the up-side gains… and TOTALLY eliminates any and all losses due to market

declines. With our program, you don’t have to watch the financial channels

24/7, and worry about when the next crash will really happen. You just relax

and live your life. If the markets go up, your account will go up. If the

markets crash, you are completely safe due to market downturns.

Caution. Please don’t wait too long to get

your Barefoot Retirement Plan set up, and in place! You don’t have to be a

financial guru to look at the chart below, and tell we’re way overdue for

another big correction, and/or crash.

Jeremy Grantham, co-founder and chief investment strategist

of GMO, a Boston-based firm with $117 billion in assets under management, was

recently quoted as saying, “Another horrific stock market crash is

coming, and the next bust will be “unlike any other” we have seen. We have

never had this before. It’s going to be very painful for investors.”

You can choose not to participate in the next big crash.

When you finish reading this book, you’ll have more

information than about 99% of other Americans have, on how to protect yourself,

your family and your retirement. Don’t wait until it’s too late. Give us a call

today, and let’s take the first step to getting you protected.

“If I had to give advice, it would be keep out of Wall

Street”

John D. Rockefeller

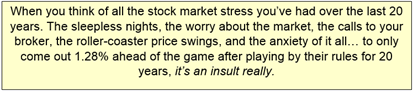

Let’s Take a Look at the Returns AVERAGE Investors Are Earning

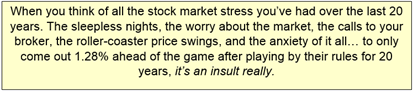

According to Dalbar, Inc., the nation's leading financial

services market research firm, over the last 20 years the average equity

mutual fund investor has only earned 4.25% per year. (Asset allocation

funds and fixed-income funds performed dramatically worse over this same time

period.) That is less than half the return that the S&P 500 returned over

the same time period. Plus, that 4.25% return only beats inflation by a puny

1.28% a year.

Morningstar conducted a similar study, and the results were

even worse. A 12.01% mutual fund return over 6 years, resulted into an actual return of just 2.2% for investors.

If you find this interesting, I found a great little

website, I think you will like. You simply enter any date range you want, and

it will show you the AVERAGE returns versus the ACTUAL returns of the S&P

500. Plus, if you check the little box that says, “Adjust for Inflation,” it

will make you want to cry. Most of us don’t want to really think about our

actual returns because it makes us feel like a looser. Like a failure. If you

want to build wealth, you just can’t do it with the puny actual returns that

average investors achieve. To check out the site, go to:

moneychimp.com/features/market_cagr.htm

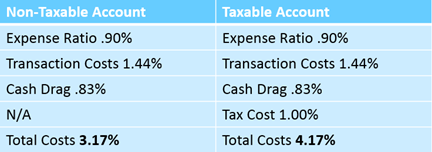

What About All of Those Investment Fees?

Let’s not forget about all the fees that are charged by the

various mutual funds and financial institutions. Some financial analyst

estimate that over 90% of all financial advisers and planners can't even beat

the S&P 500. In spite of that, you still get to pay all the relentless fees

they charge for such poor performance.

Most people don’t even realize this is going on. Forbes.com

featured an article by Ty A. Bernicke, CFP where he did an in-depth analysis of

mutual fund fees. The article was titled: The Real Costs of Owning a Mutual

Fund. His findings are summarized below, and I think they speak for

themselves.

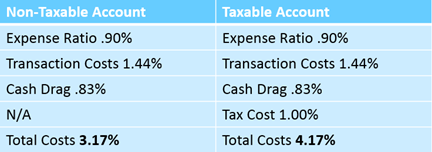

Average Mutual Fund Cost Summary

Below is a summary of quantifiable costs and fees of the

average mutual fund. The advisor costs and soft dollar costs are not included

below due to the wide range in advisory fees and the difficulty of quantifying

the soft dollar costs. If you work with a financial advisor, it is most

important to add the advisory fees to the costs listed below to get an accurate

view of your total potential costs.

Over your life time, fees like this can absolutely kill your

retirement. When you look at the average real returns investors are earning and

the fees that are charged, it’s enough to make you sick.

Demos, a public policy organization recently estimated that

over a lifetime, a median-income two-earner family will pay nearly $155,000 in

401(k), and IRA fees. This amount consumes nearly 1/3 of their

ENTIRE investment returns. Higher-income dual-earner families pay as much

as $277,969 in these types of fees. No wonder if feels like the deck is stacked

against you.

Here are some startling facts recently presented in the PBS Frontline

documentary, “The Retirement Gamble.”

• 50% of Americans can’t afford to save money for retirement

• 1/3rd have ZERO saved!

• 63% of your wealth is eaten up in fees over 5 decades.

• Average family will pay $155,000 in FEES to a 401k plan.

• 79% of mutual funds don’t even beat the S&P 500.

John Bogle is the founder of Vanguard, the largest mutual

fund company in the world. He is on record for saying, “Fund investors do

not earn the full market return… because fund investors incur costs, and costs

are subtracted directly from the gross returns funds earn.” Bogle also said

this about the 1990s bull market, “The 6.5% annual return earned by fund

investors was 3.3% behind the 9.8% annual return reported by the funds

themselves.” Funny that they don’t advertise the fact that investors made

1/3 less than what the funds show as their earnings.

Heck, just last month CBS 60 Minutes featured a story

titled: Is Wall Street a Rigged Game? Michael Lewis thinks so. In the

financial writer's new book titled Flash Boys, he blasts the so-called

high-frequency traders he says are gaming the market. It’s always the same-old

story. The big guys win and screw over the little guys.

The story revealed how the big banks, stock exchanges and

high-frequency traders have spent billions to game the system by using a

technique called front running. They have sophisticated systems in place that

can sniff out slower trades, jump in front of them, and make additional profits

on the trades you are placing. These systems insure they win on every trade.

These front running trades happen 100 times faster than the blink of an eye.

Believe it or not, this is all perfectly legal. They went on to say that human

beings have now been completely removed from the market place.

Wall Street is starting to look more like professional

wrestling these days. You know it’s fake. You know it’s rigged, but some are

still drawn to it. How can any average person, with average intelligence, and

average information win in a rigged game like this? The truth is, they can’t.

Many of my friends now call this rigged stock market, The Wall Street Casino,

and I agree with them.

Low Interest Rate Trap

Even though we are currently in one of the longest and strongest

bull markets in history, US stock ownership is at a record low. Although less

than half of Americans trust banks and financial services, many are forced to

turn to fixed income options. Due to the government's low interest rate policy,

fixed investments like money markets, CDs, etc. that used to pay solid

guaranteed returns, NOW only pay a tiny 1% to 2% or so in returns.

Everyone knows itty-bitty returns like this, just won’t cut

it, and they certainly won’t help you reach your retirement goals. Plus, after

you factor inflation into the mix, you’re really going backwards. And if you’re

just fed up with it all and decide to leave your money in a bank savings

account, they’re currently only averaging 0.06% interest, according to CNN

Money. Over the last 24 years, our program has produced an average annual

return of 9.28%. That means our program has produced 154 times more than

the banks are now paying you!

Money Jail

If you choose to put your funds into a qualified plan like

an IRA, or a 401(k), you are voluntarily choosing to subject yourself to an

unending amount of restrictions, limitations, penalties, and requirements. They

offer you the “cheese,” in the form of being able to put before taxed

dollars into your retirement accounts. After you take the cheese, the door

slams shut, and you are then locked in to all the requirements and restrictions

imposed by these programs.

After all, have you actually read all the rules,

regulations, requirements, restrictions, and legalese about these programs?

They are similar to the tax code, in that they just go on, and on, and on, with

a seemingly unending amount of rules, regulations and restrictions.

Putting your money into traditional qualified plans is

somewhat like voluntarily locking your money up in money jail. Once they are

locked up, they are then subject to these rules. You lose a good deal of your

freedom-to-choose, and to make your own financial moves, based on your

individual and unique needs. When you choose to put your money into these

qualified plans, you are basically putting the Government in charge of your

retirement.

When you voluntarily lock up your money in the usual

qualified plans, you are subjecting them to a great deal of limitations and

restrictions such as:

• Limited contribution amounts

• Limited investment options

• Early withdrawal penalties

• Limited, to no loan options

• Forced distributions

When you choose to put your funds into the Barefoot

Retirement Plan, you are basically giving your money, and your access to it, FREEDOM.

As you will discover shortly, our plan offers:

• Unlimited contribution amounts

• Unlimited investment options

• No early withdrawal penalties

• Unlimited loan options

• No forced distributions

We will show you how to “legally” break your money

out of money jail, and give your money, and yourself, the freedom you deserve!

Our program, gives the control to YOU.

Good News/Bad News… Retirees Are Living Longer

The average life expectancy for someone entering retirement

today is currently 84 years of age. This age is just an average. Over half will

live beyond that — some will live into their 90s and even into their 100s. In

fact, the Social Security Administration states that 25% of people turning 65

today will live past 90 years old and one out of 10 will live past 95.

While living longer is a wonderful thing and much better

than the alternative, it’s also causing retirees to try to figure out creative

ways to make their retirement savings last an extra 10, 15, and 20 years.

That’s a tall order, especially at a time when health care costs are rising so

rapidly. Even if you have the health and desire to work, jobs for the elderly

are very scarce indeed.

My Sarasota Story

A few years ago, I was in Sarasota, Florida having lunch

with clients. Sarasota is a big retirement area, and it’s packed with retirees.

It’s a beautiful area. Lots of sun, gorgeous beaches, great restaurants, and a

slower pace of life.

During lunch, we were talking about life in Sarasota, and

one of my clients said, “Yep, many of them retire at 65, and go back to

work at 80.” It was one of those phrases that didn’t register in my

mind when I heard it, until a few moments later, so I said, “Wait, hang on a

moment… and say that again please.”

They said it was a pretty big thing there. Many people

retire at 60 to 65 and move to Sarasota to soak up the sun and enjoy retired

life. However, when some of them get around 80 years old, they find themselves

running out of money. Sadly, many of them have no other options, so they have

to try to find a job just to survive. Yikes! I had just never thought about

that before, but it really weighed heavily on my mind. It used to be that when

you retired, you stayed retired. Now, it’s not necessarily the case.

Let me just say I totally understand the people who “want” to continue working as they get up in age because they love it. It keeps them

sharp and gives them purpose. I get that. However, I can’t imagine that

represents a large percentage of retirees. I bet most of them have worked their

guts out their entire life, and cherish the time to finally stop working, slow

down, and enjoy doing the things “they” want to do.

Can you imagine how sobering it would feel to be 80 years

old and wake up one morning and discover you have to go back to work? Heck,

they probably haven’t worked a job in 15 years. Their work skills are probably

not exactly up to par, so it can’t be easy to even find a job that anyone would

want to do at that age.

I’m a ways from retirement myself, but I know how I feel

some mornings waking up and having to get my body moving. I simply can’t

imagine how it must feel to be 80+ years old and have to wake up early every

day, to go to a job that you don’t want to do, but have to do, just to survive

every day. Plus you’ll likely be bossed around by a boss, who’s a fraction of

your age.

17% of retirees believe they retired too early, and should

have kept working longer. I can’t imagine this scenario is the vision that very

many people have for retirement. But what are you going to do? If you run out

of money, you’ve got to do something. That’s why we’re on a mission to help as

many people as we can, properly set up a Barefoot Retirement Plan, so they will

be able to make choices during their retirement and won’t be forced to go back

to work if they don’t want to.

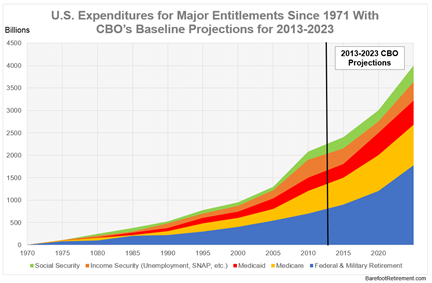

Higher Taxes and Cost of Living – Get Ready!

When making your retirement plans it’s critical to factor in

what your taxes will be, as well as cost of living increases. Some advisors

will tell you that your taxes will go down in retirement because you’ll be earning

less money. This is not necessarily true and the time to figure this out is

when there’s still time to do something about it.

If your home is paid off you’ll lose your mortgage interest

deduction. If your kids have finally moved out on their own or aged out, you

can no longer claim them as dependents, so you’ll lose that deduction. There

are a host of similar factors to consider but by far the biggest one, that’s

staring all of us square in the face, that most people don’t what to talk

about, is the overwhelming indebtedness of America. Let’s see…

Our national debt is over 17 Trillion Dollars and rising

fast

47 million Americans are on food stamps and climbing

Obama Care costs likely to skyrocket out of control

Entitlement programs soaring like never before

49% of Americans (voters) currently receive Government

benefits

Fed is producing 85 billion of new money every month

Social Security, Medicare & Medicaid going broke

Plus, as many as 1/3 of the largest cities in American are

facing possible bankruptcy.

I hate to be Mr. Gloom & Doom here, but this stuff is a

really big deal! Someone has got to pay for all of this. Even if the Government

were to tax all the super-rich fat cats at a 100% tax-rate, that won’t even put

a dent in it. The only way they’re going to be able to pay for all of this is

to raise our taxes. Desperate times call for desperate actions, and you can’t

ignore the transformation that’s happening right in front of us.

We’re in uncharted waters. No country in the world has

experienced debt of this magnitude before. We have the largest government in

the history of the world, and they are manipulating the largest economy in the

world, and twisting the global market in ways that have never been done before.

At some point, something has got to give, and when it does, watch out. Uncle Sam will be forced to raise taxes just to keep the Government Ponzi

scheme going.

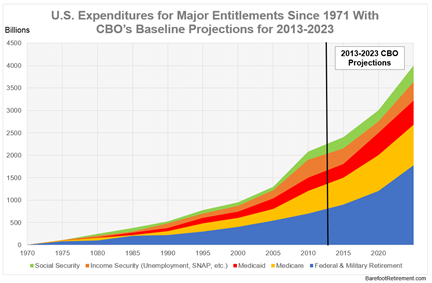

Take a look at the chart below. It was created by using the

CBO (Congressional Budget Office) expenditure estimates. Looking at this chart,

do you really see any way that taxes will EVER be able to go down in our

lifetime? Hardly!

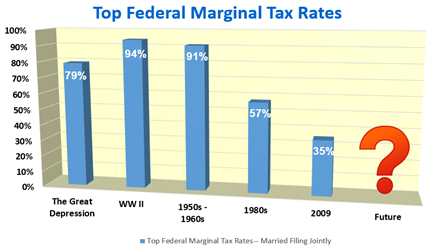

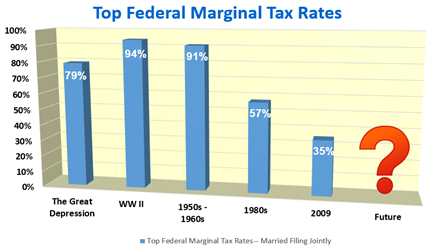

How High Can Tax Rates Go?

Obviously, no one knows just how high tax rates will go in

the future, but we do know a few things. We know that history usually repeats

itself. We also know that most people have very short memories.

Can you believe that the top Federal Marginal Tax Rates in

the 1950s and part of the 1060s was 91%? Could rates ever get that high

again? That’s up to you to answer for yourself.

It seems pretty obvious to me that if our Federal debt is at

an all-time high and considering all the other economic challenges we are

burdened with, at some point the Government will be forced to consider ALL

options. If/when they can look back and say, “We’ve done it before….” Do

you really think they won’t think of this? The past history of rates being that

high could give them precedence they need to do it again.