Chapter 19

The Barefoot Retirement Calculator

Putting It All Together -- The Real Power Of Leverage

We realize that some of these concepts and programs can be a

little hard to understand in the beginning. There are quite a few moving parts

and variables, and if you are new to this, it can sometimes be a challenge. To

help our clients understand and visualize this better, we created a customized

Barefoot Retirement Calculator.

There’s no other calculator in the world like this one. Its

custom made and one-of-a-kind. I have to tell you, our clients absolutely love

it! Caution: This calculator can become addicting.

The Barefoot Retirement Calculator is super easy to use, and

it gives you an excellent visual representation of the programs you are

considering. There are three core components to it.

The first component is for seeing how your current

retirement program will perform in the future. You simply plug in some simple

numbers and assumptions, and it will visually show you how your money will grow

and hold out before and during retirement.

The second component visually shows you how your IUL can

perform based on the variables you select.

The third component is the best! It visually shows you the

amazing power of leverage. This section combines your IUL and your outside

investments together, and visually shows you just how powerful this combination

can be.

To help you better understand how it works, let’s take a

look at two different examples.

Example 1:

In this example, we have a 46-year-old who makes $100,000 a

year. He has accumulated $250,000 in his portfolio, and puts this amount into

an IUL. That’s it. He makes NO further contributions to his policy. He

retires at age 65, and is then able to borrow $125,000 a year from his account,

each and every single year, until age 120.

Wow. He was only making 100k a year while he was

working. Now by only putting in 250k, he will be able to have a higher annual

income during retirement, than he did while working. Plus… the 100k he made

while working was taxable. The $125,000 a year he borrows from his policy each

year is TAX-FREE. If he was in the 28% tax bracket while working, he was only

netting out around $72,000 a year.

Who says that you have to downsize your lifestyle when you

retire? That’s what the Barefoot Retirement Plan is all about.

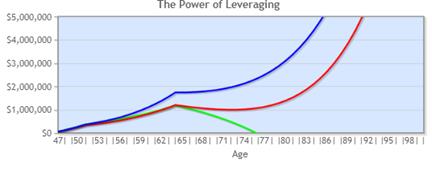

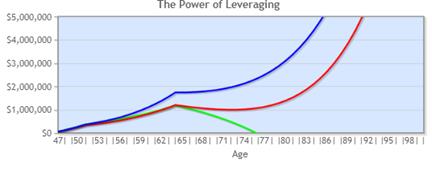

Red Line: The red line (GIA Asset), shows what

your gains would have been if you ONLY invested in the IUL, the

market index returns for the IUL averaged a 9% overall gain, over the years

shown; you did not borrow against your policy, and you did not make any

alternative investments into bucket B. You can see around age 77; the cash

value of this account is over 1 million dollars, and you never run out of

retirement funds.

Green Line: The green line (Alternative

asset), shows what your gains would have been if you had ONLY invested

in an alternative investment that averaged a 10% return over the years shown.

The alternative investment could represent your IRA, 401(k) or any other

investment you would have made. On this chart, you can see that the green line crashes

below zero around age 77. That means, if that’s your only retirement

income, you are now 77 years old and out of money. Ouch! Can you say, “Welcome

to….?”

Blue Line: The blue line (Combined Leverage

asset), shows the power of leverage. It shows what the total value of your

account would be if you put 250k into an IUL, and then made no further

contributions to your policy, AND you borrowed a loan against your

policy, put the funds in bucket B, and averaged a 10% return on your bucket B

investments. At age 77, your cash value is over 2 million dollars, and you never run out of retirement funds.

As you can clearly see, the power of leverage is amazing and

life-changing for most people. It can make all the difference in the world to

your retirement. It can make the difference between you being able to live the

barefoot retirement lifestyle of your dreams, or having to work into your

golden years, just to survive.

Example 2:

In this example, we have a 40 year-old, who makes $75,000 a

year. He does a good job managing his money, and manages to save approximately

13% of his gross income, or $833 a month, which he puts into his IUL each

month. We are using a 9% return on his IUL, which has been the historical

average for over 24 years. Plus, he borrows against his policy and achieves a

10% return per year, in outside investments, (in his bucket B).

He decides to retire at 65 years of age. When he retires, he

will be able to borrow a retirement income out of his policy of $125,000 a

year, for the rest of his life! Again, it’s pretty amazing that someone who

only made 75k a year while working, can achieve a lifetime retirement income of

125k a year, for life.

Plus, remember, the 125k per year is tax-free money. He gets

to keep it ALL, and give none of it to Uncle Sam. He is making 67% MORE in retirement, than he was making while working.

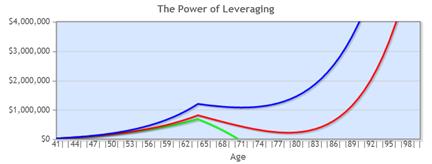

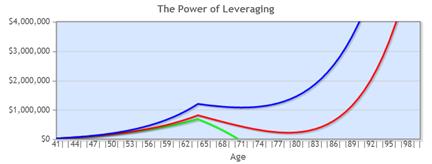

Now, to make this even more interesting, let’s take a look

at the lines on the chart below.

Red Line: The red line (GIA Asset), shows what

his gains would have been if he ONLY invested in the IUL, the

market index returns for the IUL averaged a 9% overall gain, over the years

shown; if he did NOT borrow against your policy, and he did not make any

alternative investments into bucket B. You can see, around age 80, is the low

point. The cash value of his account at this low point is only around $200,000.

However, here is the key takeaway. The red line never touches zero. That

means he NEVER runs out of money during retirement. If he lives to 90, his cash

value goes up to about 1.3 million.

Green Line: The green line (Alternative

asset), shows what his gains would have been if he had ONLY invested in

an alternative investment that averaged a 10% return over the years shown. The

alternative investment could represent his IRA, 401(k) or any other investment

he would have made. On this chart, you can see that the green line crashes

below zero around age 71. That means, if this is his only source of

retirement income, he is completely and out of money, at the no-so-old age of 71. Then what? Unfortunately, there are no good options at this point.

Blue Line: The blue line (Combined Leverage

asset), shows the power of leverage. It shows what the total value of his

account would be if he put $833 a month into his IUL until age 65. AND he borrowed a loan against his policy, put the funds to work in bucket B, and

averaged a 10% return on his bucket B investments. Around age 71, his cash

value is at its low point of over 1 million dollars. Since the blue line never

touches zero, he will never run out of retirement funds, for the

rest of his life.

The interesting thing here is the difference between the

green, and blue line at age 71. By not using this program, he is out of money,

and flat busted at the age of 71. However, if he follows the Barefoot

Retirement Plan, (and if our return assumptions at least meet the return

percentages we used for this analysis), instead of being broke at age 71, he

would have a cash value net worth of over a million dollars, and a $125,000

annual, tax-free income, for as long as he lives. Talk about two different

lifestyles, this is a pretty huge difference.

Some of you reading this may not have $833 a month to put

into an IUL. Here’s the thing. What if you cut this in half? What if you only

put in half as much, and if you only received half as much in retirement?

That’s still pretty amazing. Or, what if you had two or three times more, to

put into your IUL. Imagine what your retirement numbers would look like? Well,

you don’t have to imagine. We’ll be happy to run those numbers for you for

free. Just contact us and request your free analysis, and we will be happy to

show it to you in vivid detail.

The two main variables in these examples are the percentage

of return that the blended index will deliver in the years to come, and the

percentage of return you can achieve with your outside investments in your

bucket B. The blended index we most often use, has averaged a 9.24% return over

the last 24 years. As you know, those have been some pretty crazy years. How

will it perform in the next 25 or so years? No one knows. If it performs

better, you plan will do better. If it performs worse, your plan will not

perform as well. There are no guarantees of what the future holds, nor how the

markets perform.

Additionally, no one knows how your outside investments will

perform. You could have a low performance with your investment choices, or you

could even lose all of your money. If that happens, your plan obviously would

not perform as well. On the other hand, it’s possible that you could make some

excellent investment choices that have outstanding returns. This would cause

your plan to perform even better.

If you find that these risks are more than you would be

comfortable with, perhaps this program is not for you. It’s not for everybody.

Fourth Quarter Playbook

The majority of Americans are not even close to being

financially prepared for retirement. They are so far behind where they need to

be; it’s depressing. If they keep doing what they’ve been doing, and keep

getting the same results they’ve been getting, it’s a mathematical certainty

that they will not reach their retirement goals, and will not have enough funds

to retire the way they plan to.

Here’s a great analogy for this. You’re sitting in your

favorite chair, in your den, watching your favorite football team, play on a

Sunday afternoon. They just reached the fourth quarter. Your team is behind by

27 points. Yikes. The coach has been calling running plays, for most of

the day. They obviously haven’t been working so hot, against this dominant

defense. You know the feeling you get, as you are screaming at the TV.

You know that if that coach doesn’t do something different,

if he doesn’t change up his game-plan and playbook, if he doesn’t start calling

some down-the-field passing plays, they’re going to lose this game. The clock

is going to run out on them, they won’t have enough time to make up the 27

points, and they’re going to chalk up another loss on the season. You scream

louder at the coach, saying something like this, “Come on man. Call some

passing plays. We can win this one. Let’s get it going. Throw the damn ball,

and let’s score some touchdowns….”

Some people are in a similar spot with their retirement. The

clock is ticking down. There’s not much time left. If you’re going to get it

done, and win the retirement game, you’re going to have to do something

different. You certainly don’t want to panic, and throw caution to the wind.

You don’t want to throw Hail-Mary passes on every play. You need to be

smart about it. But you also need to remember Einstein’s famous quote, “Insanity

is doing the same thing over and over again, and expecting different results.”

Of all of the retirement programs out there that we’ve ever

seen, we’ve never seen one as powerful as this. Not even close. As you can see

by running different scenarios on your Barefoot Retirement Calculator, this

program does have the potential to help you make up for lost ground, win the game,

and be able to retire on your own terms. However, just like the coach has no

guarantees that if he changes his play calling, that he’ll win the game,

neither do we. If the markets don’t perform, or if we make some bad decisions

along the way, they could affect our outcome.

On the other hand, the coach probably knows, or should know,

that if he keeps playing-it-safe, and calling those same running plays that

haven’t worked all day, that he will lose the game. As we have said all along,

retirement planning is serious business, and it should be given a great deal of

thought.

We want to give you a FREE GIFT.

We want to give you our custom built Barefoot Retirement

Calculator. We’ve spent many months as well as thousands of dollars developing

this tool. We want to give it to you as our gift to you, simply for taking the

time to check out the Barefoot Retirement Program.

It will help you take an in-depth look at what your

retirement looks like now… and what it could look like using this amazing

program. It will also demonstrate the Power of LEVERAGE. You’ll be able to plug

in your own numbers, your own investment amounts, your years until retirement

and your own investment return assumptions. We think you’ll love it. It’s fun

to run all kinds of “What If” scenarios. You’ll find it to be an

eye-opener.

To Gain FREE ACCESS To Your Barefoot Retirement

Calculator, Go To:

www.BarefootRetirement.com/calculator

Grab Your Free Calculator Now!