Part two – for those with defined benefit (DB) schemes

Here we will set out exactly what options are available to you if you have a defined benefit (DB) pension and are considering moving abroad. There are essentially three main options:

1. Leave the pension in the UK in its existing DB arrangement

2. Move the pension into a self invested personal pension

3. Move the pension outside of the UK into a QROPS

1. Leave the DB scheme where it is

Defined benefit schemes can be very generous and offer people a guaranteed income for the rest of their lives. If you are very close to your retirement date and are not keen on investing your money, it may be best to leave your money where it is. In order to understand whether this is the best option you need to make sure you fully understand how your pension works.

Here are some questions you can ask your DB pension provider to help you decide:

-

How much is my income?

-

At what age do benefits commence?

-

What are the spousal or civil partner benefits?

-

Are there any dependents benefits?

-

Can I take a pension commencement lump sum?

-

How is the income indexed?

-

What is the current funding level?

-

What is the cash equivalent transfer value?

Once you know the answers to these questions, you will be in a much better position to speak with one of our financial advisers who can help you decide which option is right for your retirement.

2. Transfer to a self invested personal pension (SIPP)

By transferring your DB scheme into a SIPP, you will have much more freedom in terms of what you can do with your pension savings, partly because of the new pension flexibility rules introduced in April 2015.

One of the main benefits of using a SIPP is the investment freedom you will have over your money. Because you are free to choose from a wide range of investments, such as shares and investment funds, you can help protect your income from inflation and even continue to build your pension pot once in retirement.

Another attraction of transferring to a SIPP is having greater control over your retirement date. It may be that, due to government changes, your retirement date has been pushed back five or even 10 years. With a SIPP, you can begin taking benefits from age 55. If you do decide to transfer into a SIPP you will then be able to use income drawdown to take your pension benefits. If you were to select this option, you could take an income from your pension, while leaving it invested.

Another major benefit of transferring into a SIPP is the additional death benefits available. Before age 75 – or when a pension is crystallised – the pension benefits can be passed on without tax to anybody. After crystallisation or age 75, benefits can still be passed on, but will be subject to the new beneficiary’s marginal rate of tax.

Most DB schemes will offer some benefits for spouses, but at much reduced rates, usually 50%. Some will also offer dependents pensions but these are very low, usually around 10% or 20% for children up to the age of 23, the minimum age permitted by law - and many schemes’ dependant’s benefits are more restricted.

New pension flexibility – what does it mean?

By transferring into a SIPP, you will also be able to take advantage of the new pension flexibility rules in the UK. This means you can access your entire pension from age 55

The UK has just undergone the biggest shake-up of its pension rules since the pension regime was introduced in 1921, with wide sweeping changes granting people unprecedented access to their pension savings.

From 6 April 2015, UK pension holders can access as much of their fund as they like, as often as they like from age 55.

There transferring into a SIPP, you will also be able to take advantage of the new pension flexibility rules in the UK. This means you can access your entire pension from age 55

The UK has just undergone the biggest shake-up of its pension rules since the pension regime was introduced in 1921, with wide sweeping changes granting people unprecedented access to their pension savings 6 April 2015, UK pension holders can access as much of their fund as they like, as often as they like from age 55. There are are of course some considerations to bear in mind as, while you will be able to access your pension cash much more freely, you will still have to pay tax on any withdrawals.

Under the new rules, you could decide to take your entire pension as a cash lump sum. But if you do this, only the first 25% will be tax free, with the remaining 75% taxed at your highest marginal rate of tax. You are also free to decide how much and how often you would like to receive payments from your pension.

Before you reach the age of 75, or before what is known as a benefit crystallisation event, you will be able to take lump sums out of your pension each year, with the first 25% tax free. After age 75, or a benefit crystallisation event, you will be taxed on each withdrawal at your highest marginal rate as you withdraw the remaining 75%.

The most important thing to remember is that the new pension flexibility rules mean you can decide how much and how often you would like to withdraw cash but that it is still subject to income tax.

The rules also mean you will have more choice in how you invest your money. For example, you could use the money to invest in a buy-to-let property or even start a new business venture.

3. A Qualifying Recognised Overseas Pension Scheme (QROPS)

In some ways a QROPS is similar to a SIPP as it will provide you with much greater investment freedom and the option to move forward your retirement date.

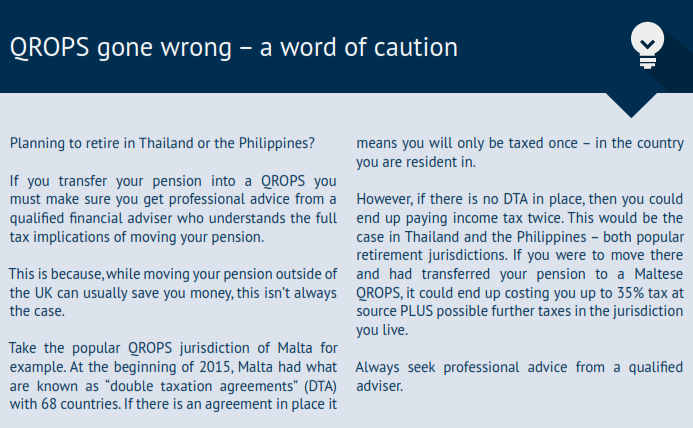

However, as well as these two very clear benefits, by using a QROPS, you will move your money outside of the UK for tax purposes which could be very beneficial, particularly if you are living or going to live in a low tax environment.

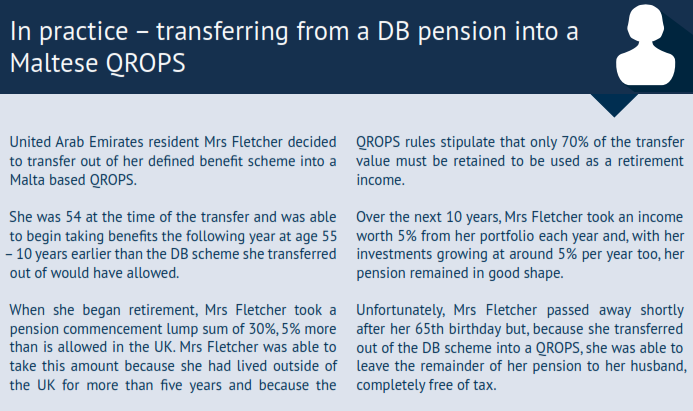

It is really important to note that QROPS are only suitable for those who intend to leave the UK permanently and who are also prepared to completely cut financial ties with the UK. Indeed, for some wishing to change domicile by cutting all UK ties, it may be essential to transfer revenue benefits out of the UK

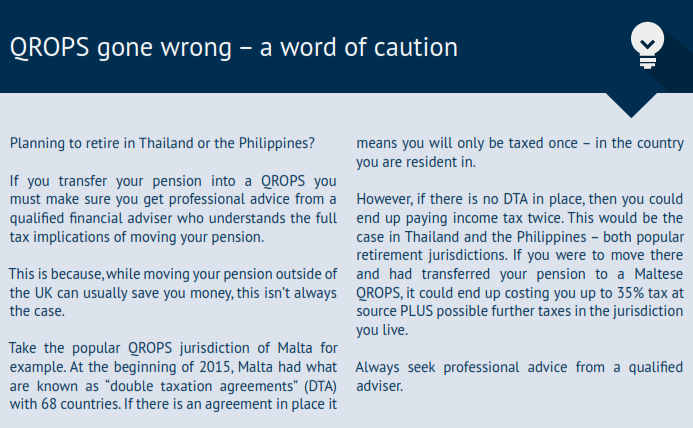

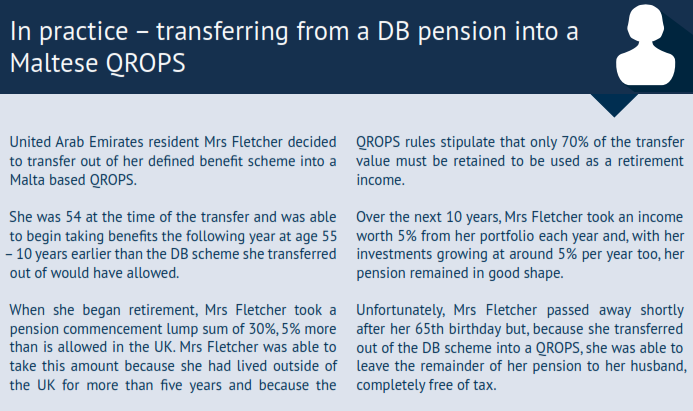

There are a very wide choice of QROPS available, with trustees based in a number of different jurisdictions. Each jurisdiction has different tax levels and rules which will impact the amount of tax you pay on your pension and how this is managed. At the end of this chapter we give an example of how transferring your DB scheme into a QROPS could work in practice.

There are a number reasons why moving your pension into a QROPS could make financial sense. One of the biggest reasons is because you could pay much lower rates of tax.

Here are three big tax advantages a QROPS can offer: 1. Income is not subject to UK tax at source therefore allowing low/no taxation depending on jurisdiction and country of residence

2. For those with larger pensions, a QROPS transfer is a benefit crystallisation event and can ring -fence monies against taxation as/when exceeding lifetime allowance

3. No tax on passing on benefits post age 75, which is significant considering current life expectancy rates.

In addition, QROPS will usually allow a slightly wider range of investments than those available within a SIPP. One popular investment made by people through their QROPS is into residential property, something not permitted within UK pensions. At retirement, you are still able to take a tax free lump sum – the amount of which depends on the scheme you use.

However, at the time of publishing this guide, only QROPS based within the EU will be able to offer clients access to 100% of their pension as with the new flexibility rules in the UK. Most QROPS will still stipulate that at least 70% of the fund’s value must be used to provide an income for the life of the beneficiary.

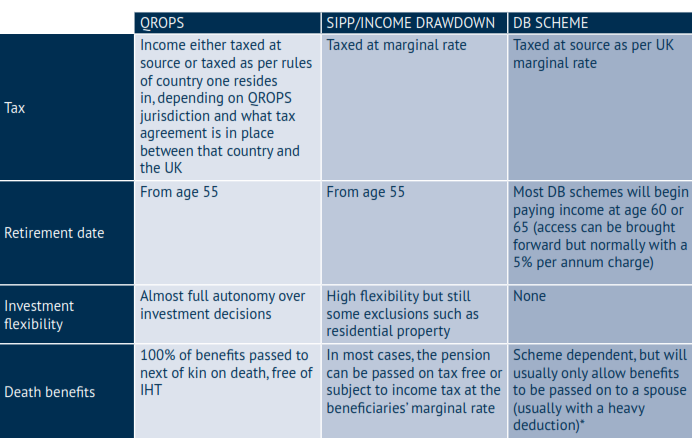

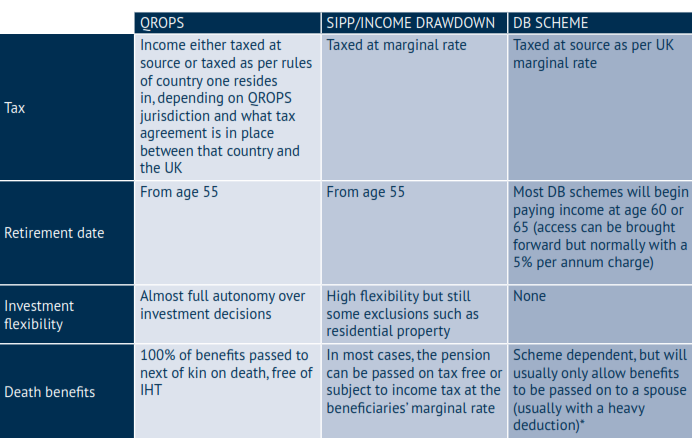

At a glance: QROPS vs. SIPP vs. DB scheme

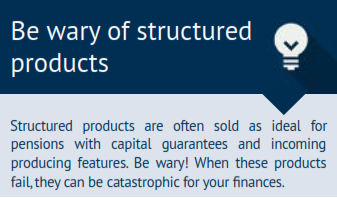

One of the most important things to remember is that your retirement savings have taken you a lifetime to build and, while you will still want to invest, you cannot afford to lose significant sums of money. You will not get another chance to build your pension savings.

There are unscrupulous advisers out there who are more than happy to take your cash and to invest it into high risk, high commission funds, which often fail. The only winners in these cases are the advisers who are paid vast commissions and will then disappear as soon as there is trouble.

Before you begin planning your pension investment portfolio make sure you discuss your attitude to risk with your financial planner.

There are three big considerations you must take into account when setting up your portfolio for retirement:

1. Income – Generating enough income for your desired lifestyle

2. Longevity – Making sure your money lasts through your retirement

3. Inflation – Stopping your capital from being eroded by inflation

1. Income

There are two main ways that you can generate some income in retirement. One traditional method is to invest in an income paying equity fund. These funds will invest into dividend paying companies. These dividends are then paid into the fund which is then able to produce an income.

Another method of generating income in retirement is through investing in a bond fund. These operate in a similar manner as an equity fund, except rather than owning shares in the company, the fund owns debt issued by the company. The issuing company will then pay the fund a set rate for lending it money.

2. Longevity

Clearly, if your investment strategy is no good, your money is going to run out. It could be particularly damaging if you lose a substantial sum of money through a stock market crash or other unexpected event, as there is no way to get your money back quickly.

This is why the asset mix within your portfolio is important. As well as generating the required amount of income, you also want to ensure you do not have too much risk.

Consider allocating some of your portfolio to very highly rated government bonds – UK and German government bonds are two of the best – or very strong so-called “blue chip” companies.

By purchasing bonds from these companies, or investing in funds which do, you will offer your portfolio some stock market protection, while also growing your capital.

In practice – when an investment fails

Mr and Mrs Smith, moved to Spain around six years ago with £152,858 in savings to see them through to retirement. They bought a property and set up a small B&B business.

In addition to their savings, Mr Smith had a UK pension worth around £425,637, with which he planned to fund their income in retirement. While in Spain, they were contacted by a financial adviser and took his advice to transfer Mr Smith’s pension into a QROPS to allow more “investment freedom”.

They were in a strong position, with enough to comfortably retire on. Their pension commencement lump sum would have been enough to clear the business mortgage on the property. With minimal ongoing costs, they would only need an income of around £15,000 per year to live a comfortable retirement, which the remaining pension pot would have easily provided.

Their financial adviser had his own retirement in mind however. He found it easy to persuade them that a series of structured products was the right way to invest their money.

Headline features like ‘capital protection’ and ‘quarterly income paying’ on these products make them sound low risk, as does the fact that they’re underwritten by large well-known banks.

The structured products performed badly. Some of them were linked to individual stocks which plummeted in value, while others were linked to assets such as gold which also fell significantly in value.

Despite the adviser’s promise of capital protection and income payments, the Smiths lost 60% of the value of their pension savings.

As a result, their dreams are in tatters and they have had to push their retirement plans back several years as they return to work in the UK to replenish their savings.

3. Inflation

One factor often not considered by retirees is the impact of inflation on their income. Over the course of your 10, 15 or even 30 year retirement, the value of each pound in real terms will fall. This is because the price of most goods and services will rise.

For example, factoring an average rate of inflation of 3%, after just 10 years a £500,000 portfolio would be worth £375,000 – 25% less than at retirement. Factoring inflation is therefore crucial when looking at pension portfolio investing.

Growth is going to be critical to ensure your portfolio remains of sufficient size to produce the yield require, as you will also likely be taking an income from this portfolio.

We would suggest therefore that a pension portfolio focuses on strategies with low, smooth volatility (stock market ups and downs) to soften the impact of capital reduction.

This would typically include a wide mix of investments,some more risky than others, which should hopefullyprovide income, preservation and growth.

In practice – the effect of inflation

Mr Jones is a self-made businessman with an independent retail store and has always besensible and saved hard. He sold his business at the age of 55 and, after repaying his mortgage and other outstanding debts, has a pension pot of £500,000.

He is afraid of investing his money and losing it, so he leaves it in cash.

As he wants to use his pension pot as an income, he decides not to take a 25% tax free lump sum, leaving the entire £500,000 available for an income. He decides then to take an annual income of £17,500.

However, assuming a 3% rate of inflation, after just five years he will have eaten away £100,000 worth of his pension. At this rate, he will have used up his entire pension pot before his 80th birthday and will certainly leave nothing for his family after he dies. If he were to have taken his 25% tax free lump sum, as most people do, he would use up his pension well before his 75th birthday.

If he invested his money, even cautiously, it would mean he could have helped to protect his pension from the effects of inflation, as a 4% return would have seen him comfortably passed his 85th birthday.

In practice – investing for income

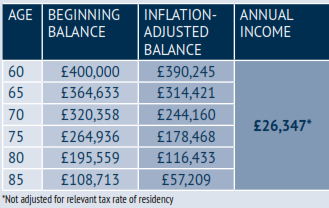

Mr Heath is 59 and is planning to retire next year, with a pension pot of £500,000. He plans to use £100,000 to complete a property purchase abroad.

Having been sensible with money, Mr Heath has cleared his mortgage in the UK and has no other outstanding debts. He plans to let his property in the UK and intends to sell if he ever needs the capital. By combining his savings and his pension lump sum he has enough to purchase his dream retirement home outright.

However, he still needs to protect his money from inflation, provide an income and ensure it lasts. To do this we would recommend:

► Investing between 60%-65% of his portfolio into in a mixed asset income producing strategy to generate the income and preservation.

► Investing the remaining 30%-35% into a balanced strategy, pushing the overall risk level up slightly but with aim of keeping volatility under 4%.

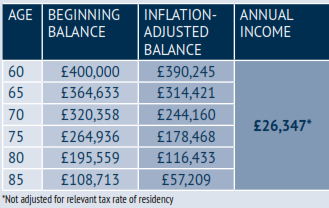

This gives him a balance of income, preservation and growth, with a long term targeted yield of 5%. The table to the right shows how his pension fund would reduce, taking him through to age 85 (assuming inflation of 2.5%).

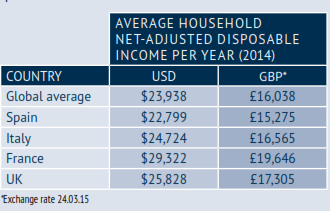

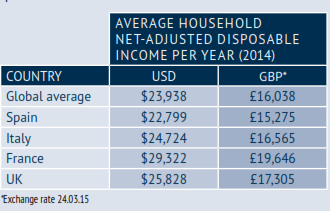

If this is compared to some average income figures for common retirement locations, it leaves Mr Heath quite well off:

Mr Heath is in quite a common position, having cleared his major expenses and needing a modest income to be comfortable in retirement. Using his pension savings in this way allows him to generatthe required income, and be confident that portfolio will stand the test of time.