How much do you pay for an offshore investment bond?

In the world of investment, of course, nobody knows for a fact if and by how much your money will grow. The only certainty is the charges you pay.

In my 12 years as an international financial adviser, I have reviewed hundreds of products, each with a different charging structure and fees ranging from overpriced to downright exorbitant. A disturbing number were towards the upper end of the spectrum. Most people are paying way too much for a perceived benefit they may never receive.

How much is too much?

Based on my experience, a typical investment bond investor could be paying:

• 0.5%-1.5% annual charge to the pension or bond provider

• £400+ fixed annual fee to the bond provider

• 1.5% a year establishment charge for the first 5-10 years

• 3-8% initial commission on the investments held in the bond

• 1%-3% annual charge on investments (this could be much more, and more opaque, if you are invested in structured products)

This can add up to annual charges in the region of 6% with initial charges of up to 8%, although, as I said, these can sometimes be much higher. You would need staggering performance year after year just to cover all the charges. What is worse, those charges are often hidden, so only those with degrees in maths can work out their total costs in real terms.

The following examples should help bring this to life.

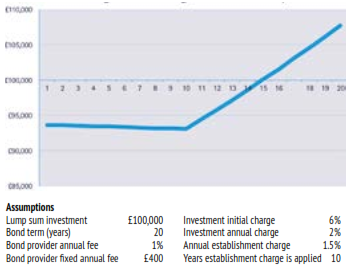

Consider someone who invests £100,000 for 20 years. How much would their investment be worth at the end? How much would they have paid in charges?

In the first example, we shall assume the investment grows by an average of 5% a year (this is the midrate for projections recommended by the FCA, the UK Financial Conduct Authority)

Value of £100,000 investment after charges and 5% growth over 20 years (smoothed)

As the graph shows, the investor in question would only start making money after 15 years. By the end of the 20 years, their £100,000 investment would be worth £107,768 – that means an abysmal effective return of just 0.08%, despite the steady rise in the stock market. This is because of the £88,698 paid out in total in charges.

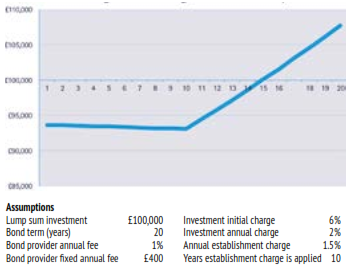

But what if the investments perform really well? What happens to the graph if the same investmentenjoys average annual growth of 15%? To put thingsin context, in the period from 1900 to 2013, developedmarkets have enjoyed an average annual growth of8.3%, whilst emerging markets a growth of 7.4% .

Value of £100,000 investment after charges and 15% growth over 20 years (smoothed)

With an average annual growth of 15%, the graph looks remarkably less scary than the previous one. Or does it?

It is true the investor starts making money in the first year and by the end his £100,000 has turned into £695,318. However, they will have paid £226,259 in charges (a higher amount than the previous example because of the higher fund value). Moreover, despite the prolonged market rally, because of the charges, they will have experienced an effective average return of just 5.95% a year. Charges have swallowed up nearly two thirds of the market growth.

It is like swimming with weights. You need a lot of effort and energy just to stay afloat, and when you move forward, you do so much more slowly and painfully than you would otherwise.

So where does your money go?

A significant chunk is used to fund the adviser’s commission. The rest goes to the product provider and the investment manager.

When the adviser sells the bond to the client, at the outset they receive in the region of 7% upfront from the bond provider. The 1.5% annual establishment charge you pay for the first 5-10 years funds this and can add up to 15% over time. If you leave the offshore bond before paying off all these charges, they will be clawed back from you, resulting in either horrible penalties or a lack of flexibility.

When the adviser recommends the investments, they can also receive a large proportion, if not the whole, of the investment initial charge. This is typically 4%-8% but on some investments, such as structured products and hedge funds, it could be much more. This is either directly deducted from your original investment or ‘back-end loaded’, so you cannot see it – just like the bond itself (thereby accentuating the lack of flexibility).

After selling the product, the broker or ‘adviser’ is unlikely to receive any further commission. For instance, they do not normally receive any part of the annual investment charge. This means they will not benefit if your investments grow in value and conversely will not suffer if they fall. Quite simply, their interests are not aligned with yours.

Why such crippling charges?

Such shocking charges are the result of the way these types of financial product are sold, combined with lack of competition and lax regulation. The international financial services industry today bears a striking resemblance to the UK financial services industry 30 years ago.

Most products are sold through international brokerages and their direct sales teams who masquerade (but are nothing of the sort) as ‘financial advisers’. They need to be paid, and so do the product providers. As all the main protagonists use the same business model and make money the same way, it is in nobody’s interest to apply fairer prices. Nor is there any regulation that prescribes what a fair price should be.