A sample report on

UK ePharmacy

Market Analysis

Includes Market Size, Market Segmented by Types

and Key Competitors (Data forecasts from 2022 – 2030F) www.insights10.com

This report presents a strategic analysis of the UK ePharmacy Market and a forecast for its development in the medium and long term. It provides a comprehensive overview of the market value, dynamics, segmentation, main players, growth and demand drivers, challenges & future outlook, etc.

This is one of the most comprehensive reports about the UK ePharmacy Market, and offers unmatched value, accuracy, and expert insights

Report Scope

Report Attribute

Details

Number of Pages

70-80

Base Year for Estimation

2022

Forecast Period

2023-2030

Market Overview, Revenue Forecast, Market Segmentation, Growth Factors and Trends, Report Coverage

Competitive Landscape, Key Company Profiles, Government Policies, Regulatory Landscape, Reimbursement Scenario

Quantitative Units

Revenue in USD Million/Billion (Mn/Bn)

Research Approach

Secondary Research (60%), Primary Research (40%)

Click on the icon to know the detailed methodology

A Sample Report on UK ePharmacy Market Analysis I Confidential 3

Table of Content

CONTENT

PG. NO.

1. ePharmacy Overview

12-24

1.1. Overview

1.2. UK Overview

1.3. Economic Overview: UK

1.4. ePharmacy Market in UK

1.5. Healthcare Services Market in UK

1.6. Healthcare Scenario in UK

1.7. Health Insurance Coverage: UK

1.8. Budget of the Government for Public Insurance

1.9. Mergers and Acquisitions

2. Market Size and Forecasting

25-29

2.1 Market size and forecasts (Excel and Methodology)

A Sample Report on UK ePharmacy Market Analysis I Confidential 4

Table of Content

CONTENT

PG. NO.

2.2. Market Segmentation

2.2.1. By Product Type

2.2.2. By Type

3. Market Dynamics

30-34

3.1. Market Growth Drivers

3.1.1. Increasing User Penetration of ePharmacy

3.1.2. Accessibility and Convenience

3.1.3. Increasing e-commerce Platform

3.2. Market Restraints

3.2.1. Data Breaches and Cyberthreats

3.2.2. Lack of Specific Legislative Framework

3.2.2. Prescription Verification

A Sample Report on UK ePharmacy Market Analysis I Confidential 5

Table of Content

CONTENT

PG. NO.

4. Competitive Landscape

35-45

4.1. Major Market Share

4.2. Key Company Profile

4.2.1. Pharmacy2u

4.2.1.1. Overview

4.2.1.2. Product Applications & Services

4.2.1.3. Recent Developments

4.2.1.4. Partnerships Ecosystem

4.2.1.5. Financials (Based on Availability)

4.2.2. LloydsPharmacy

4.2.2.1. Overview

4.2.2.2. Product Applications & Services

A Sample Report on UK ePharmacy Market Analysis I Confidential 6

Table of Content

CONTENT

PG. NO.

4.2.2.3. Recent Developments

4.2.2.4. Partnerships Ecosystem

4.2.2.5. Financials (Based on Availability)

4.2.3. Chemist4U

4.2.3.1. Overview

4.2.3.2. Product Applications & Services

4.2.3.3. Recent Developments

4.2.3.4. Partnerships Ecosystem

4.2.3.5. Financials (Based on Availability)

4.2.4. The Independent Pharmacy

4.2.4.1. Overview

4.2.4.2. Product Applications & Services

A Sample Report on UK ePharmacy Market Analysis I Confidential 7

Table of Content

CONTENT

PG. NO.

4.2.4.3. Recent Developments

4.2.4.4. Partnerships Ecosystem

4.2.4.5. Financials (Based on Availability)

4.2.5. AYP Healthcare

4.2.5.1. Overview

4.2.5.2. Product Applications & Services

4.2.5.3. Recent Developments

4.2.5.4. Partnerships Ecosystem

4.2.5.5. Financials (Based on Availability)

4.2.6. Well Pharmacy

4.2.6.1. Overview

4.2.6.2. Product Applications & Services

A Sample Report on UK ePharmacy Market Analysis I Confidential 8

Table of Content

CONTENT

PG. NO.

4.2.6.3. Recent Developments

4.2.6.4. Partnerships Ecosystem

4.2.6.5. Financials (Based on Availability)

4.2.7. Superdrug Online Doctor

4.2.7.1. Overview

4.2.7.2. Product Applications & Services

4.2.7.3. Recent Developments

4.2.7.4. Partnerships Ecosystem

4.2.7.5. Financials (Based on Availability)

4.2.8. e-Surgery

4.2.8.1. Overview

4.2.8.2. Product Applications & Services

A Sample Report on UK ePharmacy Market Analysis I Confidential 9

Table of Content

CONTENT

PG. NO.

4.2.8.3. Recent Developments

4.2.8.4. Partnerships Ecosystem

4.2.8.5. Financials (Based on Availability)

4.2.9. Simple Online Pharmacy

4.2.9.1. Overview

4.2.9.2. Product Applications & Services

4.2.9.3. Recent Developments

4.2.9.4. Partnerships Ecosystem

4.2.9.5. Financials (Based on Availability)

4.2.10. MedExpress

4.2.10.1. Overview

4.2.10.2. Product Applications & Services

A Sample Report on UK ePharmacy Market Analysis I Confidential 10

Table of Content

CONTENT

PG. NO.

4.2.10.3. Recent Developments

4.2.10.4. Partnerships Ecosystem

4.2.10.5. Financials (Based on Availability)

5. Reimbursement Scenario

46-53

5.1. Reimbursement Regulation

5.2. Reimbursement Process for Diagnosis

5.3. Reimbursement Process for Treatment

5.4 Reimbursement Process – Medicare

5.5 Reimbursement Process - Medicaid

6. Methodology & Scope

54-59

A Sample Report on UK ePharmacy Market Analysis I Confidential 11

UK ePharmacy Market Analysis

1. ePharmacy Overview

Overview of Global ePharmacy Trends

Top 10 ePharmacy Trends

▪

Please be aware that this sample report is

intended to provide you with a brief

Increased Online Presence

Prescription Delivery Services

overview of the kind of information and

Increased online presence of

Offering prescription delivery services

analysis that will be presented in the final

traditional and digital-only e-

for convenience and accessibility

report

pharmacies

▪

In this section you will get an

Mobile Applications

Expanded Product Range

understanding of the topic, which includes

Growing focus on mobile applications

Diversifying product range beyond

the prevalence of the disease, the

for convenient access to e-pharmacy

medications to include health and

application of medical devices, new

services.

wellness items

technology, and other details related to the

topic

Personalization and

AI-Powered Chatbots

Customization

AI-powered chatbots for real-time

▪

In order to obtain access to all of the

Utilizing customer data for

customer support and healthcare

information that you are seeking, you will

personalized recommendations and

information

need to purchase the final report

tailored healthcare solutions

▪

Final report will be comprehensive and

detailed, and it will include data, analysis,

Telehealth and Remote

Digital Health Records

trends, and other relevant information

Consultations

Integration of digital health records for

related to the topic or subject matter of

Integration of telehealth services for

easy access to medical history and

interest

remote consultations with healthcare

prescriptions

professionals

A Sample Report on UK ePharmacy Market Analysis I Confidential 13

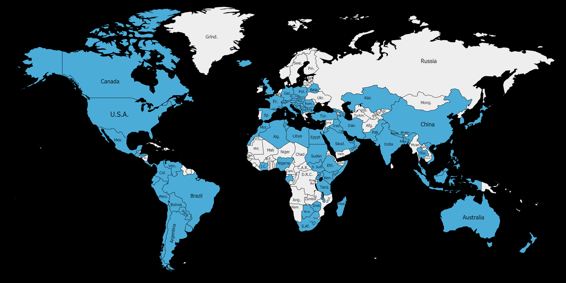

1.1 Statistics at a Glance: The Burden of ePharmacy in the World (continued) Europe

~Revenue to reach

$XX Bn by 2027

North America

~ Market Size of

Asia

$XX Bn

-Fastest CAGR

UK

~Market Size of

UK Market

$XX Bn

~$XX Bn Market

A Sample Report on UK ePharmacy Market Analysis I Confidential 14

1.2 UK Overview

▪

Please be aware that this sample report is

intended to provide you with a brief

overview of the kind of information and

analysis that will be presented in the final

report

▪

In this section you will get an

understanding of the demographics of the

country/region, which includes the

6.73 crores

$31.3 Mn

population, GDP, healthcare expenditure

and other details related to the topic

Is the total

Gross domestic

population of UK in

product (GDP) of UK

▪

In order to obtain access to all of the

2021

information that you are seeking, you will

need to purchase the final report

▪

Final report will be comprehensive and

40.7

$46,510.28

detailed, and it will include data, analysis,

Is the median age

GDP per capita

trends, and other relevant information

in UK

of UK

related to the topic or subject matter of

interest

A Sample Report on UK ePharmacy Market Analysis I Confidential 15

1.3 Economic Overview: UK

Population of UK, (2020-2030)

GDP of UK, (2020-2030)

XX

XX

XX

XX

2020

2021

2022 2023F 2024F 2025F 2026F 2027F 2028F 2029F 2023F

2020

2021

2022 2023F 2024F 2025F 2026F 2027F 2028F 2029F 2023F

Population Split (2023)

▪

In this section you will get an understanding of the demographics of the country/region, which includes the population, GDP, By Gender

By Age Group

healthcare expenditure and other details related to the topic

▪

In order to obtain access to all of the information that you are 0-14

seeking, you will need to purchase the final report

15-24

Female

Male

▪

Final report will be comprehensive and detailed, and it will 51%

49%

25-54

include data, analysis, trends, and other relevant information 55-64

related to the topic or subject matter of interest

65+

A Sample Report on UK ePharmacy Market Analysis I Confidential 16

1.4 Overview of ePharmacy in UK

Highlights of ePharmacy in UK

▪

Please be aware that this sample report

is intended to provide you with a brief

overview of the kind of information and

analysis that will be presented in the

final report

US$0.89 Bn

39.35%

Is projected online

Is the user

▪

In this section you will get an

pharmacy revenue

penetration of e

understanding of the topic, which

in UK in 2023

Pharmacies in 2023

includes the prevalence of the disease,

in UK

the application of medical devices, new

technology, and other details related to

the topic in UK

47.14%

US$33.07

Is the expected user

Is the expected

▪

In order to obtain access to all of the

penetration of

average revenue per

information that you are seeking, you

ePharmacy in UK by

user (ARPU) of

will need to purchase the final report

2027

ePharmacy in UK

▪

Final report will be comprehensive and

detailed, and it will include data,

analysis, trends, and other relevant

information related to the topic or

subject matter of interest

A Sample Report on UK ePharmacy Market Analysis I Confidential 17

1.5 Healthcare Services in UK

UK Healthcare Services Market Forecast, 2022-2030 (in $Bn) XX

XX

XX

XX

XX

XX

XX

XX

XX

2022

2023F

2024F

2025F

2026F

2027F

2028F

2029F

2030F

▪

Please be aware that this sample report is intended to provide you with a brief overview of the kind of information and analysis that will be presented in the final report

▪

In this section you will get an understanding of the overall healthcare services market in UK, which includes the market size, current trends and other details related to the topic

▪

In order to obtain access to all of the information that you are seeking, you will need to purchase the final report

▪

Final report will be comprehensive and detailed, and it will include data, analysis, trends, and other relevant information related to the topic or subject matter of interest

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 18

1.6 Healthcare Scenario in UK

ePharmacy Development Process: The process of developing a ePharmacy drug is complex and involves many stages, from preclinical research to clinical trials to regulatory approval. Here is a simplified diagram of the ePharmacy drug development process: o Preclinical Research: Researchers identify potential drug candidates and test them in the lab o Phase 1 Clinical Trials: Small studies are conducted to test the safety and dosage of the drug in humans o Phase 2 Clinical Trials: Larger studies are conducted to test the effectiveness of the drug in treating ePharmacy o Phase 3 Clinical Trials: Even larger studies are conducted to compare the new drug to standard treatments and evaluate its safety and effectiveness

o Regulatory Approval: The drug is reviewed by regulatory agencies such as the FDA and approved for use in the US market FDA has developed several approaches to making drugs available as quickly as possible, while still ensuring their safety and effectiveness. Here are four of these approaches:

▪

Fast track is a process designed to facilitate the development, and expedite the review of drugs to treat Fast Track

serious conditions and fill an unmet medical need

Breakthrough

▪

A process designed to expedite the development and review of drugs which may demonstrate substantial Therapy

improvement over available therapy

Accelerated

▪

These regulations allowed drugs for serious conditions that filled an unmet medical need to be approved Approval

based on a surrogate endpoint

Priority Review

▪

A Priority Review designation means FDA’s goal is to take action on an application within 6 months Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 19

1.7 Health Insurance Coverage: US

% of People by Type of Health Insurance Coverage

Number of People By Health Insurance Coverage

(2021)

Coverage Type

2020

2021

Change %

Uninsured

8.3

Total

327,521

328,074

With health insurance

91.7

Any health plan

299,230

300,887

0.4

Any private plan

217,896

216,366

–0.6

Any private plan

66.0

Employment-based

178,737

178,285

–0.2

Employment-based

54.3

Direct-purchase

10.2

Direct-purchase

33,869

33,555

–0.1

Marketplace

3.5

Marketplace coverage

10,924

11,389

0.1

TRICARE

2.5

TRICARE

9,165

8,299

–0.3

Any public plan

112,925

117,095

1.2

Any public plan

35.7

Medicare

58,541

60,226

0.5

Medicare

18.4

Medicaid

58,778

61,940

0.9

Medicaid

18.9

VA and CHAMPVA

2,967

3,151

0.1

VA and CHAMPVA

1.0

Uninsured

28,291

27,187

–0.4

▪

In 2021, most people (91.7%) had health insurance coverage at some point during 2021 and 8.3 % of people were uninsured for the entire calendar year

▪

More people had private health insurance (66%) than public coverage (35.7%)

▪

Employer-based insurance was the most common subtype of health insurance in the civilian, noninstitutionalized population (54.3%), followed by Medicaid (18.9%), Medicare (18.4%), direct-purchase insurance (10.2%), TRICARE (2.5%), and VA and CHAMPVA health care (1%)

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 20

1.8 Budget of UK Government for Public Insurance

Proposed Budget By Category

Outlays

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2022-31

Medicare

$769

$709

$766

$841

$840

$947

$1,014

$1,085

$1,227

$1,178

$1,325

$1,412

$10,633

In Billions Of Dollars

Medicaid

$458

$521

$571

$582

$616

$645

$674

$698

$734

$768

$801

$837

$6,926

Medicare

3.7%

3.2%

3.3%

3.4%

3.3%

3.6%

3.7%

3.8%

4.1%

3.8%

4.1%

4.2%

3.7%

As % Of GDP

Medicaid

2.2%

2.4%

2.4%

2.4%

2.4%

2.4%

2.4%

2.4%

2.5%

2.5%

2.5%

2.5%

2.4%

▪

National Health Expenditures (NHE) grew 2.7% to $4.3 trillion in 2021, or $12,914 per person, and accounted for 18.3% of Gross Domestic Product (GDP)

▪

Medicare spending grew 8.4% to $900.8 billion in 2021, or 21% of total NHE

▪

Medicaid spending grew 9.2% to $734.0 billion in 2021, or 17% of total NHE

▪

Private health insurance spending grew 5.8% to $1,211.4 billion in 2021, or 28% of total NHE

▪

Out of pocket spending grew 10.4% to $433.2 billion in 2021, or 10% of total NHE

▪

Other Third Party Payers and Programs and Public Health Activity spending declined 20.7% in 2021 to $596.6 billion, or 14% of total NHE

▪

Hospital expenditures grew 4.4% to $1,323.9 billion in 2021, slower than the 6.2% growth in 2020

▪

Physician and clinical services expenditures grew 5.6% to $864.6 billion in 2021, slower growth than the 6.6% in 2020

▪

Prescription drug spending increased 7.8% to $378.0 billion in 2021, faster than the 3.7% growth in 2020

▪

Largest shares of total health spending were sponsored by the federal government (34%) and the households (27%). The private business share of health spending accounted for 17% of total health care spending, state and local governments accounted for 15%, and other private revenues accounted for 7%

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 21

1.9 Mergers and Acquisitions

RCM M&A Deal Value Trend ($Bn)

RCM M&A Deal Volume Trend

$16.7

112

107

107

110

89

$11.7

82

$10.5

$7.7

$6.8

$6.0

1H 2020

2H 2020

1H 2021

2H 2021

1H 2022

2H 2022

1H 2020

2H 2020

1H 2021

2H 2021

1H 2022

2H 2022

Buyer Composition: Strategic Vs Financial (2020)

Buyer Type by Deal Size

41%

41%

42%

39%

($Mn)

59%

59%

58%

61%

Strategic Buyers

Financial Buyers

$0- $25

$25-$50

$50-$100

$100+

57% of the total deal volume are done by strategic buyers and the rest 43% are done by financial buyers in 2020

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 22

1.9 Mergers and Acquisitions (continued)

Latest Deals In UK

Amount /

Company Name

Type

Year

Key Pointers

Duration

▪

Zur Rose Group announced that the group had completed the Merger

-

2022

operational integration of the Medpex brand at the Heerlen facility Zur Rose partnership

with Medpex

▪

BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, announced today it has acquired MedKeeper, a provider of modern, cloud-based

pharmacy management applications

Acquisition

-

July 2022

▪

MedKeeper strategically complements BD's existing presence in BD (Becton, Dickinson

the pharmacy – where the company has pioneered solutions in and Company)

compounding, logistics workflow, controlled substance

acquired MedKeeper

management and inventory optimization.tion

A Sample Report on UK ePharmacy Market Analysis I Confidential 23

1.9 Mergers and Acquisitions(continued)

Latest Deals In UK

Amount /

Company Name

Type

Year

Key Pointers

Duration

Merger

-

Acquisition

-

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 24

UK ePharmacy Market Analysis

2. Market Size and Forecasting

2.1 Market size and forecasts (Excel and Methodology) Click on the icon to know the

UK ePharmacy Market Forecast, 2022-2030 (in $Bn)

methodology and assumption

▪

Please be aware that this sample report

XX

is intended to provide you with a brief

XX

overview of the kind of information and

analysis that will be presented in the

final report

▪

In this section you will get an

understanding of the overall Healthcare

Insurance market in Malaysia, which

includes the market size, current trends

2022

2023F

2024F

2025F

2026F

2027F

2028F

2029F

2030F

and other details related to the topic

2023

2024

2025

2026

2027

2028

2029

2030

▪

In order to obtain access to all of the

Major Markets Patient

2.74

2.82

2.90

2.94

2.98

3.02

3.07

3.12

information that you are seeking, you

(Mn)

will need to purchase the final report

UK Patient Size (Bn)

0.51

0.61

0.68

0.69

0.70

0.71

0.72

0.73

▪

Final report will be comprehensive and

% of US Patients

18.75% 21.70% 23.56% 23.45% 23.42% 23.39% 23.34% 23.45%

detailed, and it will include data,

analysis, trends, and other relevant

Global Market Size (Bn $)

3,620

3,780

3,950

4,128

4,314

4,508

4,711

4,937

information related to the topic or

subject matter of interest

UK Market Size (Bn $)

61

74

84

87

91

95

99

106

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 26

2.2 Snapshot of ePharmacy Market Segmentation

By Product Type

By Type

Prescription Medicine

Analgesics

Over the Counter Medicine

Skin Care

Dental Care

Cold and Flu

Vitamins and Minerals

Others

▪

In this section you will get an understanding of the segmentations which will cover the UK ePharmacy Market

▪

In order to obtain access to all of the information that you are seeking, you will need to purchase the final report A Sample Report on UK ePharmacy Market Analysis I Confidential 27

2.2.1 Market Segmentation: By Product Type

UK ePharmacy Market Share, By Product Type (2022)

▪

Prescription medication market in UK is

a significant component of the overall

ePharmacy treatment market

▪

Please be aware that this sample report

is intended to provide you with a brief

Over the Counter

overview of the kind of information and

Medications

analysis that will be presented in the

final report

▪

In order to obtain access to all of the

information that you are seeking, you

will need to purchase the final report

▪

Final report will be comprehensive and

Prescription

detailed, and it will include data,

Medications, 65%

analysis, trends, and other relevant

information related to the topic or

subject matter of interest

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 28

2.2.2 Market Segmentation: By Type

UK ePharmacy Market Share, By Type (2022)

▪

Analgesics ePharmacy market in UK is

a significant component of the overall

ePharmacy market

Others, 12%

Vitamins and

▪

Please be aware that this sample report

Minerals, 10%

is intended to provide you with a brief

Analgesics

overview of the kind of information and

analysis that will be presented in the

final report

Clold and Flu, 15%

▪

In order to obtain access to all of the

information that you are seeking, you

will need to purchase the final report

▪

Final report will be comprehensive and

detailed, and it will include data,

Dental Care, 20%

analysis, trends, and other relevant

information related to the topic or

subject matter of interest

Skin Care, 38%

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 29

UK ePharmacy Market Analysis

3. Market Dynamics

3.1 Market growth drivers

3.1.1 In UK the user penetration of ePharmacy will be 39.35% in 2023 and is expected to hit 47.14% by 2027

▪

ePharmacies offer the convenience of ordering medications and ePharmacy Use In UK

healthcare products online from the comfort of one's home. This accessibility appeals to individuals with busy lifestyles, limited mobility, or those living in remote areas

▪

Please be aware that this sample report is intended to provide you with a brief overview of the kind of information and analysis that will be presented in the final report

▪

In order to obtain access to all of the information that you are seeking, you will need to purchase the final report

▪

Final report will be comprehensive and detailed, and it will include data, analysis, trends, and other relevant information related to the topic or subject matter of interest

2010

2022

2030

A Sample Report on UK ePharmacy Market Analysis I Confidential 31

3.1 Market growth drivers

3.1.2 In the UK, ePharmacies play a crucial role in providing secure access to authentic and approved pharmaceuticals at affordable prices, with enhanced convenience through online platforms, home delivery, and improved digital payment infrastructure

▪

E-pharmacies can assist secure the provision of authentic and approved pharmaceuticals (a wide range of drugs that are safe for use) at reasonable rates (by removing intermediaries and giving discounts) and with greater ease of access (online platform, home delivery

& improved digital payment infrastructure)

▪

As a result of the convenience and value they provide, E-Pharmacies are predicted to be generally embraced in UK

▪

Please be aware that this sample report is intended to provide you with a brief overview of the kind of information and analysis that will be presented in the final report

▪

In order to obtain access to all of the information that you are seeking, you will need to purchase the final report

▪

Final report will be comprehensive and detailed, and it will include data, analysis, trends, and other relevant information related to the topic or subject matter of interest

A Sample Report on UK ePharmacy Market Analysis I Confidential 32

3.1 Market growth drivers (continued)

3.1.3 Efficiency of ePharmacies in delivering low-cost medical products, and combined with the increasing penetration of e-commerce is driving the UK ePharmacy market growth. User penetration will be 83.1% in 2023 and is expected to hit 86.3% by 2027

▪

A large patient pool globally prefers doorstep delivery of Penetration rate of e-commerce in UK

healthcare products owing to unavailability of certain medicines in retail pharmacy stores

▪

Additionally, ePharmacies lower the dependency of

chronically ill patients and elderly citizens towards third person for procurement of medicines and healthcare

supplies. Additionally, the increasing penetration and literacy regarding internet resources are projected to boost the market sales.

▪

Please be aware that this sample report is intended to provide you with a brief overview of the kind of information and analysis that will be presented in the final report

▪

In order to obtain access to all of the information that you are seeking, you will need to purchase the final report

▪

Final report will be comprehensive and detailed, and it will include data, analysis, trends, and other relevant information 2010

2022

2030

related to the topic or subject matter of interest

A Sample Report on UK ePharmacy Market Analysis I Confidential 33

3.2 Market restraints

3.2.1 In the UK, ePharmacies collect

3.2.2 In UK, there is currently no

3.2.3 In UK, implementing robust

and process user data, this user

unique or specific legislative

prescription verification systems

data also make ePharmacies

framework that solely governs the

while maintaining privacy can be

vulnerable to data breaches and

operations and practices of

a complex task

cyberthreats

ePharmacies

▪

To provide a flawless consumer

▪

Owing to there is no unique

▪

Validating prescriptions and

experience, these online

regime for these players, the

ensuring they are genuine poses

platforms rely substantially on

legal system that governs the

a challenge for ePharmacies

useful insights obtained from

offline sale of pharmacies

▪

Verifying prescriptions online is

user data (personal details,

equally applies to E-Pharmacy

crucial to prevent misuse or

purchasing habits, etc.)

▪

To safeguard the interests of

illegal distribution of medications.

▪

As a result, this data is

customers and to act as a

Implementing robust prescription

vulnerable to data breaches and

backbone in encouraging growth

verification systems while

other cyberthreats.

in this sector, the government

maintaining privacy can be

must establish a separate

complex

legislative framework for E-

Pharmacies in the near future

Our analysis will thoroughly investigate the key restraints that may significantly impact business operations and growth

A Sample Report on UK ePharmacy Market Analysis I Confidential 34

UK ePharmacy Market Analysis

4. Competitive Landscape

4.1 Major Market Share

▪

UK ePharmacy market is a highly

Revenue of Major players in UK ePharmacy Market ($ Mn) competitive space, with many companies

developing and marketing ePharmacy

Company10

treatments

Company 9

▪

Some of the top companies in UK

ePharmacy market based on revenue and

Company 8

market share include

Company 7

▪

In order to obtain access to all of the

information that you are seeking, you will

Company 6

need to purchase the final report

Company 5

▪

Final report will be comprehensive and

Company 4

detailed, and it will include data, analysis,

trends, and other relevant information

Company 3

related to the topic or subject matter of

interest

Company 2

Company 1

XX

A Sample Report on UK ePharmacy Market Analysis I Confidential 36

4.2 Key Company Profile

Key Note:

1

▪

Here is the list of top 10 companies which

Pharmacy2u

will cover in the final report

2

LloydsPharmacy

▪

Each company will have slides for

o Overview

3

Chemist4U

o Key details

4

The Independent

o Offerings

Pharmacy

o Name of products

5

AYP Healthcare

o Recent activities/ Press Coverage

o Distribution and Vendor Partners

6

Well Pharmacy

o Mergers, Acquisitions and

Collaboration

7

Superdrug Online Doctor

o Financials

8

▪

If there are specific companies that you

e-Surgery

would like to be included in the report,

please let us know via email

9

Simple Online Pharmacy

▪

In order to obtain access to all of the

information that you are seeking, you will

10

MedExpress

need to purchase the final report

A Sample Report on UK ePharmacy Market Analysis I Confidential 37

4.2.1 Pharmacy2U

Solutions offered by Roche

▪ Pharmacy2U is one of the largest online pharmacies in the UK

Founded in: 1999

▪ It operates as an online platform that provides a range of

➢ Mark Livingstone - Chief

HQ: Leeds, United Kingdom

healthcare services and products

Executive Officer (CEO)

▪ Pharmacy2U's primary focus is on providing convenient access to

➢ Daniel Lee - Chief Financial

Type: Private

prescription medications and healthcare advice to customers Officer (CFO)

across the country

Revenue: $150 Mn

➢ Julian Harrison - Chief

▪ They operate under the supervision of the General

Commercial Officer (CCO)

Pharmaceutical Council (GPhC) and follow guidelines set by the Website: www.pharmacy2u.co.uk

Medicines and Healthcare products Regulatory Agency (MHRA)

➢ Andy Hornby - Chairman

ePharmacy

Recent Activity / Press Coverage

Services Offered by Pharmacr2U

April 2023, Pharmacy2U, the leading online pharmacy in the UK, Online Prescription Ordering

Medication Reminder Service

announced that they will be leveraging RingCentral’s UCaaS and Repeat Prescription

CCaaS services through the cloud, to offer next-level customer service Online Doctor Consultations

Management

in the age of digital transformation

NHS Prescription Service

Health Information and Advice

November 2022, Pharmacy2U Voted UK Number One Brand for Online Doctor Service

NHS Prescriptions

Customer Experience By Pharmacy2U

Medication Delivery

A Sample Report on UK ePharmacy Market Analysis I Confidential 38

4.2.1 Pharmacy2U (continued)

Partnerships Ecosystem

Current Corporate Partners

Current Clinical Trail Partners

A Sample Report on UK ePharmacy Market Analysis I Confidential 39

4.2.1 Pharmacy2U (continued)

Latest Deals - Mergers and Acquisitions

Amount /

Company Name

Type

Year

Key Pointers

Duration

▪

Pharmacy2U announced new partnership with Diabetes UK

▪

This partnership aims to help support people currently living with diabetes, as well as those at increased risk of type 2 diabetes October

across the UK

Merger

-

2021

▪

With 4.9 Mn people living in the UK with diabetes and an Pharmacy2U

estimated 13.6 million people at increased risk of developing type partnership with

2 diabetes, providing clear information and accessible guidance Diabetes UK

is crucial

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 40

4.2.1 Pharmacy2U (continued)

Revenues ($Bn), 2020-2030

▪

Pharmacy2U annual revenue for 2022 was

$150 Mn, a xx% increase from 2021.

Pharmacy2U annual revenue for 2021 was

$xx, a xx% increase from 2020.

70.9

70.3

▪

Revenue generated by Pharmacy2U in

63.3

2022 reflects the company's continued

growth and success in the healthcare

industry

2020

2021

2022

2023F

2024F

2025F

2026F

2027F

2028F

2029F

2030F

▪

In order to obtain access to all of the

information that you are seeking, you will

need to purchase the final report

Breakdown of Net Revenue by Segment, 2022

▪

In order to obtain access to all of the

information that you are seeking, you will

need to purchase the final report

1

2

3

4

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 41

4.2.2 Company 2

Solutions offered by Company

Founded in:

HQ:

Type:

Revenue:

Website:

Drugs for

Recent Activity / Press Coverage

ePharmacy

Drugs

Indications

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 42

4.2.2 Company 2 (continued)

Partnerships Ecosystem

Major Distribution Partners

Major Vendor Partners

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 43

4.2.2 Company 2 (continued)

Latest Deals - Mergers and Acquisitions

Amount /

Company Name

Type

Year

Key Pointers

Duration

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 44

4.2.2 Company 2 (continued)

Revenues ($Bn), 2020-2030

▪

Please be aware that this sample report is

intended to provide you with a brief

overview of the kind of information and

analysis that will be presented in the final

xx

xx

xx

report

▪

In this section you will the understating of

financial overview of the company, which

includes revenue forecasting, segment

revenue and other key details as per

2020

2021

2022

2023F

2024F

2025F

2026F

2027F

2028F

2029F

2030F

availability

▪

In order to obtain access to all of the

Breakdown of Net Revenue by Segment, 2022

information that you are seeking, you will

need to purchase the final report

▪

Final report will be comprehensive and

detailed, and it will include data, analysis,

trends, and other relevant information

related to the topic or subject matter of

interest

1

2

3

4

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 45

UK ePharmacy Market Analysis

5. Reimbursement Scenario

5.1 Reimbursement Regulation

Medicare and Medicaid together provide

The reimbursement scenario in the US ePharmacy market is complex and can health insurance coverage for more than

vary depending on the specific treatment, setting of care, and insurance coverage. Here are some key points to consider:

4 in 10 Americans

▪

Medicare:

o Medicare is a federal health insurance program for people aged 65 and Other Public

older, as well as people with certain disabilities or health conditions 1%

o Medicare covers many ePharmacy treatments, including chemotherapy, Other Private

radiation therapy, and some immunotherapies

3%

Uninsured

o

9%

However, coverage can be subject to strict guidelines and restrictions, Medicare

17%

such as the requirement for prior authorization

▪

Medicaid:

o Medicaid is a joint federal-state program that provides health insurance for people with low incomes

o Medicaid coverage for ePharmacy treatments can vary by state, and Medicaid

and CHIP

may be subject to limits on the amount and type of treatment covered 21%

▪

Private Insurance:

o Private insurance coverage for ePharmacy treatments can also vary widely depending on the insurer and the specific policy Employer-Sponsored

49%

o Some policies may have high out-of-pocket costs, such as deductibles and co-pays, while others may have more comprehensive coverage Health Insurance Coverage, 2022

A Sample Report on UK ePharmacy Market Analysis I Confidential 47

5.1 Reimbursement Regulation (continued)

▪

Affordable Care Act:

o Affordable Care Act (ACA) includes provisions to help improve access to ePharmacy treatments by requiring insurers to cover certain preventive services, including ePharmacy screenings, without co-pays or deductibles o It also includes protections for people with pre-existing conditions, such as ePharmacy

▪

Reimbursement for New Treatments:

o Reimbursement for new ePharmacy treatments can be a complex and lengthy process, as insurers and government programs often require evidence of safety and effectiveness before providing coverage o This can create challenges for companies developing and marketing new treatments

▪

Value-Based Care:

o There is a growing trend towards value-based care, which aims to improve outcomes and lower costs by focusing on the value of treatments rather than simply the volume of treatments o Value-based care models can include payment models that tie reimbursement to outcomes or performance metrics In order to obtain access to all of the information that you are seeking, you will need to purchase the final report Final report will be comprehensive and detailed, and it will include data, analysis, trends, and other relevant information related to the topic or subject matter of interest

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 48

5.1 Reimbursement Regulation (continued)

Coverage Penetration (% Total Population)

Source of Funding

Spend on Healthcare (%of Current Health Expenditure) 100%

100%

100%

100%

100%

0%

Government Expenditure

0%

xx

xx

xx

xx

xx

7%

Public Healthcare

44.

0%

8%

46.

47.

51.

51.

Private Health Insurance

Coverage

Out of Pocket

Private Coverage

9%

1%

6%

5%

5%

38.

37.

35.

32.

31.

Other

NA

NA

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Public healthcare coverage is provided by the government and includes programs like Medicare and Medicaid

6.3%

4.08%

5.1%

3.8%

2.2%

2.4%

3.6%

GDP Growth (yoy)

Medicare is a federal program that provides healthcare coverage to individuals who are 65 years of age or older, as well as certain younger people with disabilities 14.7%

11.3%

15.5%

7.5%

4.2%

NA

NA

HC Spend Growth (yoy)

Medicaid is a joint federal-state program that provides healthcare coverage to individuals with low income and limited resources

Reimbursement Market Trends

▪ Shift towards value-based care has been a significant trend in the US healthcare system, with payers and providers increasingly focused on improving patient outcomes and reducing costs

▪ This has led to the development of alternative payment models such as accountable care organizations (ACOs) and bundled payment arrangements, which incentivize providers to deliver high-quality, cost-effective care Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 49

5.2 Reimbursement Process

The reimbursement process in the US healthcare system can be complex and can vary depending on the type of healthcare service, the healthcare provider, and the insurance coverage. Here are the general steps involved in the reimbursement process:

▪

Service or Treatment Provided: The healthcare provider performs a service or treatment for the patient

▪

Billing: The healthcare provider submits a claim to the insurance company or other payer, requesting reimbursement for the service provided

▪

Adjudication: The insurance company or other payer reviews the claim to determine whether it meets the criteria for reimbursement. This can involve verifying the patient's eligibility, reviewing the treatment provided, and checking for any potential errors or fraud

▪

Payment: If the claim is approved, the insurance company or other payer reimburses the healthcare provider for the service provided, based on the negotiated payment rates or fee schedule

▪

Patient Responsibility: Depending on the patient's insurance coverage, they may be responsible for paying a portion of the cost of the service, such as deductibles, co-payments, or co-insurance In order to obtain access to all of the information that you are seeking, you will need to purchase the final report Final report will be comprehensive and detailed, and it will include data, analysis, trends, and other relevant information related to the topic or subject matter of interest

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 50

5.3 Reimbursement Process

The reimbursement process in the US healthcare system can be complex and can vary depending on the type of healthcare service, the healthcare FDA

provider, and the insurance coverage. Here are the general steps involved in the reimbursement process:

▪

Service or Treatment Provided: The healthcare provider performs a Market Authorization

service or treatment for the patient

▪

Billing: The healthcare provider submits a claim to the insurance company or other payer, requesting reimbursement for the service Private Payers

Public Payers

provided

▪

Adjudication: The insurance company or other payer reviews the claim to determine whether it meets the criteria for reimbursement. This can involve verifying the patient's eligibility, reviewing the treatment Health Technology Assessment

provided, and checking for any potential errors or fraud

▪

Payment: If the claim is approved, the insurance company or other 1

2

3

payer reimburses the healthcare provider for the service provided, Coding

Coverage

Payment

based on the negotiated payment rates or fee schedule

Coding depends on availability code while coverage and payment process decisions are made through an HTA.

Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 51

5.4 Reimbursement Process - Medicare

Medicare

▪ 100% population is covered under this scheme

Population Covered

▪ Citizen’s contribute to this scheme which then earns an interest. There is Basic Healthcare Sum (BHS) cap which limits the maximum contribution to an individuals Medicare account

Provider Restrictions/

Services can be claimed from Medicare-approved institutions only (14 public hospitals, 10 private hospitals, 7 public community centers, 1 private community Selection

center and over 100 surgery centers, ePharmacy centers, colonoscopy centers and screening centers)

▪ Medicines under SDL and MAF Plus can be bought from the money saved in this account

▪ Money can be also be claimed for antiretroviral drugs for HIV, Desferrioxamine drug for treatment of thalassemia and immuno-suppressant drugs for organ transplant

▪ Money from this account can be used to pay Medishield premiums and Integrated Shield Plan premiums, subject to withdrawal limits Services Covered

▪ Patients above 65 years of age can claim under Flexi-Medicare and further reduce their out-of-pocket expenses by using up to $200 per patient per year from their Medicare account

▪ Excluded: Traditional drugs such as Herbal and Ayurveda cannot be claimed from Medicare account; Drugs used for cosmetic purposes such as slimming pills and hair loss pills cannot be claimed from this account

▪ Approved chronic conditions and vaccinations, health screenings as outpatient treatments can be paid with Medicare up to $500 per account per year, however a cash copayment of 15% is applicable

▪ Inpatient hospitalization, up to $450 per day + surgical limits according to Table of Surgical Procedures

▪ Approved day surgeries up to $300 per day + surgical limits according to Table of Surgical Procedures Level of Coverage/ Assurance

▪ Outpatient scans/ diagnostics for ePharmacy up to $600 per year per patient, and up to $300 for other medical conditions

▪ Chemotherapy (includes analgesic medication and suppressive treatments such as neuroendocrine and nuclear medicine treatments) up to $1,200 per month per patient

▪ Renal ePharmacy up to $450 per patient per month

▪ Other treatments are also approved with various sub-limits for withdrawal

▪ DRG with Activity Based Funding for public providers Mechanism of Coverage

▪ Block funding with DRG for providers not covered under ABF

Financial Feasibility

▪ The Basic Healthcare sum has been increased by more than 4.4% in 2017 on account of increasing costs of healthcare. This is an individual account Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 52

5.5 Reimbursement Process - Medicaid

Medicaid

▪ 38% population is covered under this scheme

Population Covered

▪ Medicare covers individuals who are aged 65 and older, as well as those with certain disabilities or end-stage renal disease Provider Restrictions/

Services can be claimed from Medicaid-approved institutions only (14 public hospitals, 10 private hospitals, 7 public community centers, 1 private community Selection

center and over 100 surgery centers, ePharmacy centers, colonoscopy centers and screening centers)

▪ Medicines under SDL and MAF Plus can be bought from the money saved in this account

▪ Money can be also be claimed for antiretroviral drugs for HIV, Desferrioxamine drug for treatment of thalassemia and immuno-suppressant drugs for organ transplant

▪ Money from this account can be used to pay Medishield premiums and Integrated Shield Plan premiums, subject to withdrawal limits Services Covered

▪ Patients above 65 years of age can claim under Flexi-Medicaid and further reduce their out-of-pocket expenses by using up to $200 per patient per year from their Medicaid account

▪ Excluded: Traditional drugs such as Herbal and Ayurveda cannot be claimed from Medicaid account; Drugs used for cosmetic purposes such as slimming pills and hair loss pills cannot be claimed from this account

▪ Approved chronic conditions and vaccinations, health screenings as outpatient treatments can be paid with Medicaid up to $500 per account per year, however a cash copayment of 15% is applicable

▪ Inpatient hospitalization, up to $450 per day + surgical limits according to Table of Surgical Procedures

▪ Approved day surgeries up to $300 per day + surgical limits according to Table of Surgical Procedures Level of Coverage/ Assurance

▪ Outpatient scans/ diagnostics for ePharmacy up to $600 per year per patient, and up to $300 for other medical conditions

▪ Chemotherapy (includes analgesic medication and suppressive treatments such as neuroendocrine and nuclear medicine treatments) up to $1,200 per month per patient

▪ Renal ePharmacy up to $450 per patient per month

▪ Other treatments are also approved with various sub-limits for withdrawal

▪ DRG with Activity Based Funding for public providers Mechanism of Coverage

▪ Block funding with DRG for providers not covered under ABF

Financial Feasibility

▪ The Basic Healthcare sum has been increased by more than 4.4% in 2017 on account of increasing costs of healthcare. This is an individual account Illustrative

A Sample Report on UK ePharmacy Market Analysis I Confidential 53

UK ePharmacy Market Analysis

6. Methodology & Scope

Research Methodology

▪

Insights 10’s research methodology delves deeper into the market, covering the macro and micro aspects of the industry. We identify the key growth drivers, opportunities, and restraints that might promote or hinder the future industry growth along with an expansive overview of the competitive landscape to help our clients make informed strategic decisions

▪

We implement a mix of primary and secondary research for our market estimate and forecast. The secondary research forms the initial phase of our study where we conduct extensive data mining, referring to verified data sources such as independent studies, government and regulatory published material, technical journals, trade magazines, and paid data sources

▪

For forecasting, the following parameters are considered:

❑

Market drivers and restraints along with their current and expected impacts

❑

Technological scenario and expected developments

❑

End use industry trends and dynamics

❑

Trends in the consumer behavior

❑

Regulatory scenario and expected developments

❑

Current capacity and expected capacity additions up to 2030

▪

We assign weights to these parameters and quantify their market impacts using the weighted average analysis to derive the expected market growth rate

▪

We appoint data triangulation strategies to explore different areas of the market. Our qualitative and quantitative assessments are time-sensitive, reflecting the most recent value and volume of the market across regions

▪

All our estimates and forecasts are verified through exhaustive primary research with the Key Industry Participants (KIPs)

▪

Currency used in the report is the US dollar (USD), with the market size indicated in USD million/billion (Mn/Bn)

Analysis Methodology

Our Analysis Methodology involves three critical stages: Data

Market Data Analysis

Interpretation &

Collection

& Statistical Model

Presentation

Secondary

Analysis &

Market Trends

Research

Interpretation

Primary

Market Sizing &

Insights

Research

Analysis

Proprietary

Data Triangulation &

Presentation &

Database

Validation

Reporting

Data Triangulation & Data Validation

Top Down Approach

Final

Final Market size break up to

Market

rest of segmentation

Size

Validation from

Arriving at market size

Primary Interview

of each segment

Summarization of revenue

generated from companies

Validation from

to arrive at total market size

Primary Interview

Revenue generated by products &

Final

services offered by companies

Summary

Bottom Up Approach

Key Benefits for Stakeholders from this Report Study provides an in-depth analysis of the market with current trends and future estimations to elucidate the imminent investment pockets

Our tools provides stakeholders with a cohesive understanding of the industry outlook, considering the qualitative and quantitative industry variables

Comprehensive analysis of factors that drive and restrict the market growth is provided Comprehensive quantitative analysis of the industry from 2022 to 2030F is provided to enable the stakeholders to capitalize on the prevailing market opportunities

Extensive analysis of the key segments of the industry helps understand the applications and technologies used globally Our rigorous data collection, thorough statistical analysis and specialist assessments ensure that our clientele has a greater understanding of the industry space, supply chain, price fluctuations, competitive landscape, and other vital factors

Time Frame

Report Attribute

Details

Quantitative Units

Revenue in USD Million/Billion (Mn/Bn)

Base Year for

2022

Estimation

Market Overview, Revenue Forecast, Market

Segmentation, Growth Factors and Trends,

Report Coverage

Company Profiles, Competitive Landscape,

Regulatory Landscape, Future Opportunities

Report Customization (3 to 5 working days)

with purchase. We will provide you with data

Customized Report

that is currently not a part of our scope as a

2023-

Forecast

part of customization

2030

Period

Pricing and purchase

Avail customized purchase options to meet

options

your exact research needs

A division of

Lifesciences Market

Research Reports you

can trust

Insights10 is a healthcare focused market

research firm founded with an aim of being an

insights driven company in the data driven world

and delivering actionable insights that can drive

decision and strategy making process for

businesses

www.insights10.com

Get actionable insights to

take informed business

decisions

A large database of over 30,000 syndicated

market research reports in Healthcare Services

and healthcare sector at global, regional as well as

country level. We also provide customized

research reports tailor made to suit your needs

www.insights10.com

Elevate your business plans

with in-depth market analysis

and industry intelligence

Our qualitative, acute, and result-oriented market

research reports provide a comprehensive

understanding of the business scenario and the

latest trends related to the life sciences market

www.insights10.com

Gain a competitive edge with

Insights10's customized

healthcare research solutions

Whether you are looking to expand into new

areas, develop new products, or take advantage

of new opportunities we have reports to help you

accelerate and improve your plans by identifying

unique growth prospects.

www.insights10.com

Market Research Reports

across various categories

Healthcare Services

Digital

Medical

Healthcare

OTC &

Clinical

(Diseases & Drugs)

Health

Devices

Services

Nutraceuticals

Trials

FEATURED REPORTS

FREE SAMPLE REPORTS

TRENDING TOPICS

What makes us different?

30000+

22000+

2000+

1200+

Life science

Country

Rare & orphan

Reports

Market Research

Specific

Disease

Published

Reports

Reports

Reports

Annually

Table of Contents

Market Overview

Competitive Landscape

1

6

Growth Drivers &

Key Company Profiles

2

7

Growth Restraints

Epidemiology &

Policy & Regulatory

3

8

Disease type

Landscape

insights on

which our

reports are

Market Segmentation

based

4

9

Reimbursement Scenario

Market Share

5

10

Factors Driving Future Growth

Our Services

Market Research

Customized

Primary

Reports

Reports

Research

Database

Full-Time

Conference

Service

Engagement

Coverage

Competitive

Regulatory

Subscription

Intelligence

Compliance

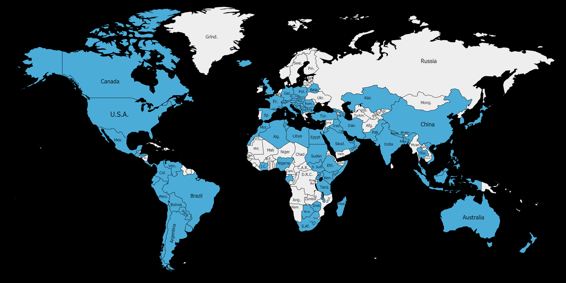

Over the years, we have developed an in-depth experience of executing market analysis at global, regional & country specific level in life sciences.

Our team has

conducted market

research across 62+

global markets in

America, Europe,

Middle East, UK and

Asia Pacific regions

Research Projects Done

Our Research Process

01

02

03

04

05

Identification of

Market

Collection of

Collaboration

Verification &

Data

Dynamics

Data

of Data

Analysis

Statistical Databases

Company Websites/Annual Reports

Data

Sources

Trade Publications

We have access to multiple highly

Online Databases

reliable free and subscription data

sources. We have many years of

experience to understand which

Published Research Reports

sources are more dependable for what

and which to prefer for the reliable and

Whitepapers

latest information.

Press Releases of Key Market Players

What kind of data is presented

in our reports?

Our reports present data, which is:

Reliable

Expert-verified

Real

Comprehensive

Easy to read

The report is

The data is prepared

Allowing you to

Covers everything

You do not have to

prepared using a

by a team of highly

confidently make

you would need to

be a market expert

proven methodology

qualified &

smarter business

know about the

to understand what

and insightful

experienced research

and strategic

market including

really is happening

research

analysts & vetted by

decisions

market size,

on the market and

our local associates

competitive analysis

how it works

& much more

The team

“The business decision-making process is no longer as straightforward as it used to be. It requires insights generated at the right time, based on reliable data interpreted in a nuanced manner for each market.

We at Insights10 are building the future of market research and are committed to providing our clients with the right intelligence and insights to make business decisions quickly and efficiently.

Insighs10 is a unique platform that combines deep

domain expertise, nuanced data at a country and

functional area level, and years of experience working with some of the best organizations in the world,

generating insights that provides substantial competitive advantage.”

Dr. Purav Gandhi

Founder & CEO

Leadership Team

Dr. Purav Gandhi

Anish Swaminathan

Mukesh Nayak

Ritu Baliya

Founder & CEO

Director

Head – Marketing & Research

Engagement Manager

Purav is a physician and an entrepreneur

Anish has 15+ years of experience

Mukesh is an engineering graduate with

Ritu has over 6 years of experience in

with 12+ years of experience in Healthcare

in management consulting in the

an MBA in Marketing. He is a seasoned

strategy building, market assessments,

& Life Sciences industry spanning across

Life Sciences sector, and has

healthcare market research & marketing

market sizing, and RWE for global MNC

strategy, market access, health informatics

worked with diverse multinational

professional with a progressive

healthcare & biopharma clients across diff.

and RWE, digital health, analytics and data

firms in the US, India, Middle East

experience of over 20 years in Life

markets (America, Europe, UK, APAC and

science. Purav studied medicine from

and APAC regions. His primary

Sciences, Pharma and Medical Device

Middle East). Her areas of expertise include:

Gujarat University and also completed his

area of interest is Customer and

sectors. With an in-depth understanding

Indentifying emerging trends in life sciences

MBA from IIM-Kozhikode. Purav started

Market Strategy, Market Access,

of primary research, he has conducted

industry, Competitor landscape assessment,

his career with Deloitte working on strategy

and Digital Health with special

hundreds of interviews of various

Disease opportunity assessments etc. She

consulting engagements and also co-

focus on emerging markets like

stakeholders in pharma & healthcare &

is a pro in secondary and primary research

founded ConvergeHealth by Deloitte.

UK, Middle East and APAC.

completed several research projects

with a deep domain expertise in healthcare

across life sciences industry.

sector.

Our Team

Our Clients

Our Clients

… and many more

Do you have

any questions?

We would be happy to help.

Web: www.insights10.com

Email: insights@insights10.com

Call: (+91) 931 639 7935

WhatsApp: (+91) 931 639 7935

Thank you

We truly appreciate your business and

look forward to serving you.

www.insights10.com