WHO PAYS THE PIPER?

INCOME TAX CONTRIBUTION

“In South Africa, about 1.7 million people (roughly 3% of the population) pay about 80% of income tax,” Ernst Roets of AfriForum tweeted. At the time of publishing, the tweet had been retweeted close to 200 times and liked 155 times.

One of AfriForum’s readers asked that they verify the figure.

SARS and treasury officials, together with consulted experts, directed *Africa Check to annual tax statistics and budget review data as the best tax-related information. But both data sources have limitations.

While the latest tax statistics fall close to Roets of Afriforum’s claim, these figures aren’t inclusive of all taxpayers.

Treasury budget review data for 2016/2017 is in the same ballpark (1.7 million taxpayers contribute 78% of income tax) and takes into account all taxpayers, but these figures are estimates. The latest treasury estimates show 1.9 million individuals are expected to contribute an estimated 80% of income tax.

Given that claim requires clarification, we rate it mostly correct.

Researched by Gopolang Makou, *Africa Check, a non-partisan organisation which promotes accuracy in public debate and the media. Twitter @AfricaCheck and www.africacheck.org

INCOME TAX AS A PROPORTION OF ALL TAXATION

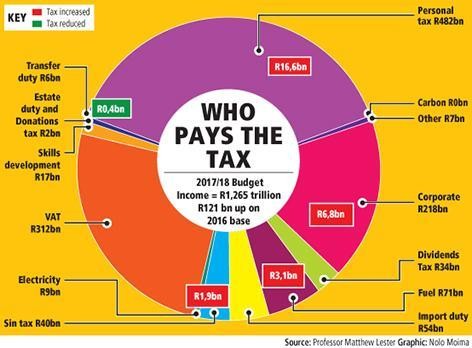

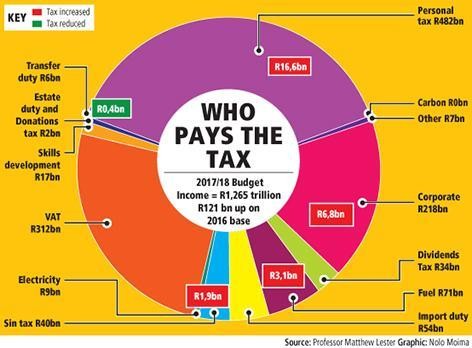

The 2017/18 South African Budget anticipated collecting R482bn in Personal Taxes out of an anticipated R1, 265 trillion for all taxes to be collected. VAT for collection amounted to R312bn, Corporate Taxes R218bn and Dividends Tax R34bn. All other forms of taxation amounted to R219bn.

Personal Taxation amounts to 38% of all taxes to be collected.

Additional research by Bryan Britton former SARS Tax Practitioner